This week I had an email from a long-term subscriber whose SIPP has grown by 82% year to date. He’s very much a “quality and momentum” investor, who expanded his horizons to North American markets a number of years ago when he felt the growth prospects were poor for UK stocks. It’s been tremendously successful for him, with his biggest SIPP winner year to date being Celestica (NYQ:CLS) - a Canadian provider of Cloud Infrastructure for Google and Facebook - returning 743%. “I would never have found those companies without Stockopedia”.

I have to admit I have as much home bias as anyone, and haven’t participated enough in the US market gains. Knowing the UK markets well, and how to craft returns from them has worked, and I am cautious with the high valuations inherent in US stocks. Nonetheless, I do keep kicking myself when I hear of growth company stories like this. What our companies struggle to achieve in a decade, it seems like American companies can achieve in a year.

So I thought I’d finish up this triptych of articles on Trended Momentum with a look at the USA.

How have the May list of 20 US stocks performed?

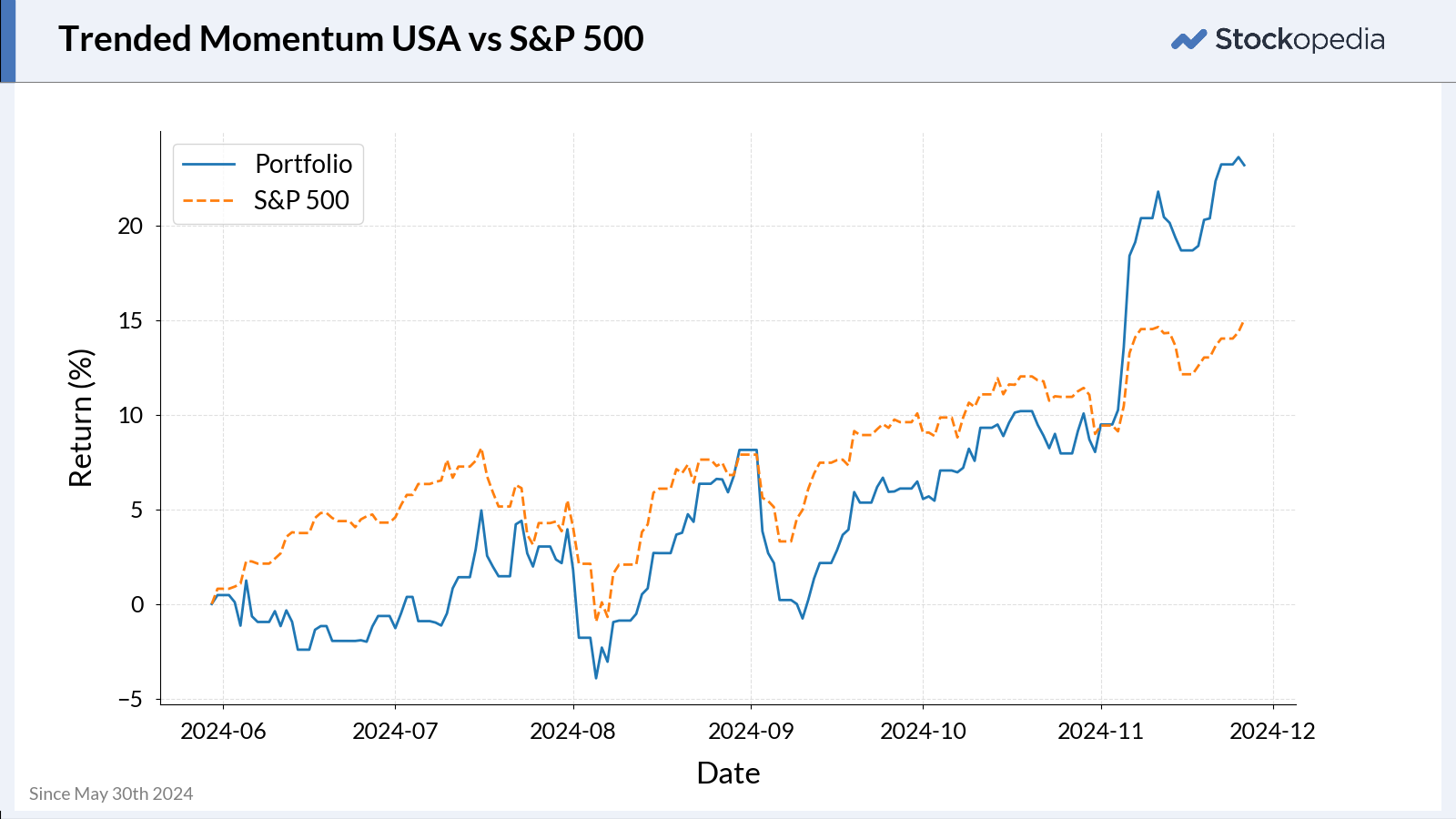

Back in the “Didn’t buy Warpaint?” article published on May 30th, a few asked me to run the same process that I’d run on UK stocks, on the USA. The list was shared in the original comments. Since that date, the S&P 500 has appreciated 15%, but the US Trended Momentum list has significantly outperformed with a 23% gain - and this was a list that included General Motors not Tesla!

Since that date, there have only been 3 losers in the list, with 17 winners. The biggest winner +93% has been the $12bn Sprout’s Farmers Market, which appears to have been a classic Peter Lynch style multibagger, followed by the airline SkyWest +60% and Interactive Brokers +51%. It’s not all been about Artificial Intelligence and Cloud Computing in US markets.

This is past performance over an extremely limited timeframe of course, and the near future may not see such strong results - but who knows. Momentum breeds momentum, and the broad Russell 2000 Index has just broken out to a new all-time high.

Reviewing the history

I’ve backtested a similar process to the one…