Good afternoon and welcome back to the Week Ahead.

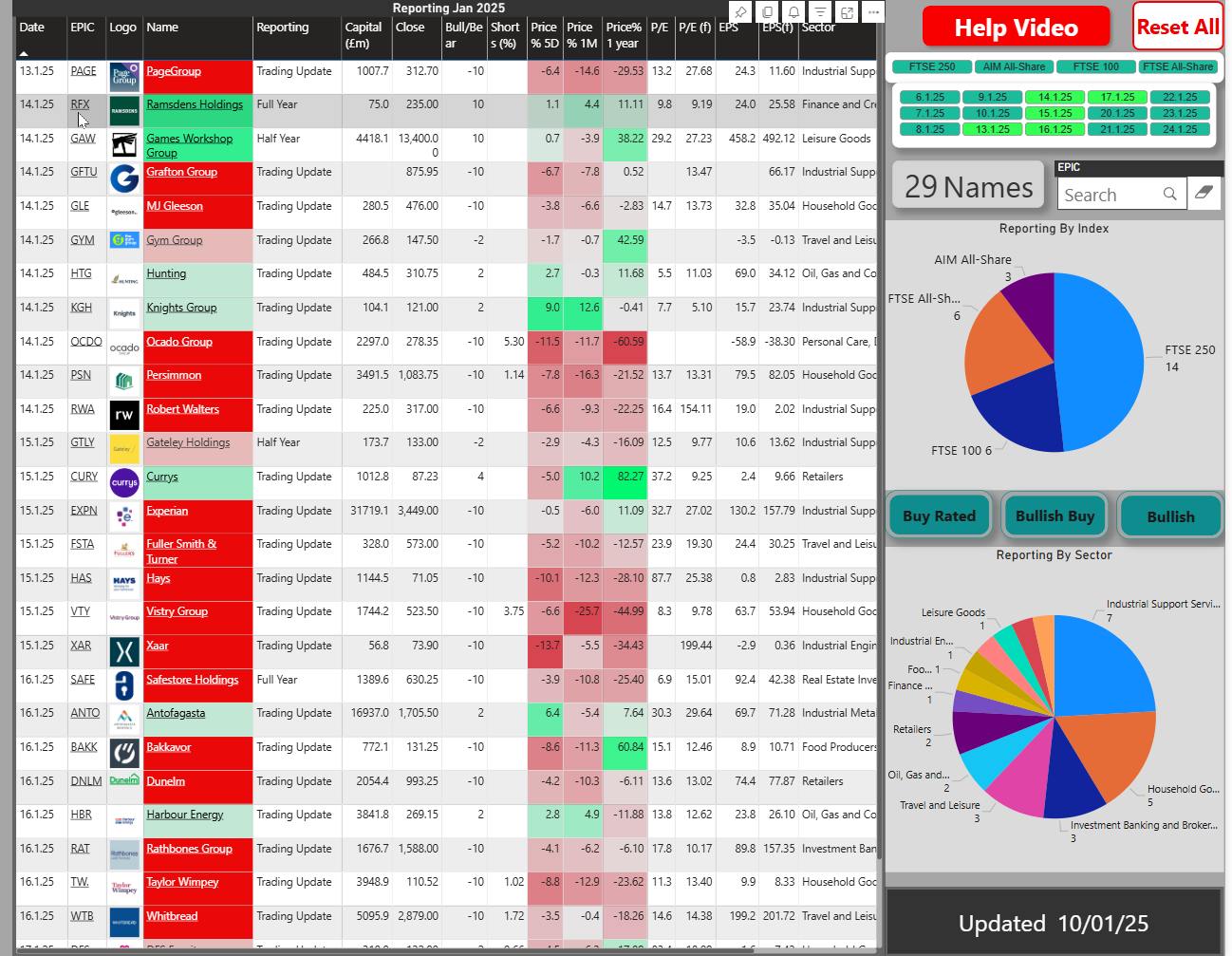

After a quiet start to the week, company newsflow has stepped up a gear in the last couple of days. We’ve had a good scattering of trading updates from retailers and another surge of takeovers (three to talk about this morning).

On Tuesday Keelan wrote about why the outlook for takeovers is worth taking note of. And Mark has compiled a very comprehensive guide for private investors who hold companies which receive a takeover bid. You can read that here.

The week in review

Outside of companies' news, the biggest story of the week has been the movement in bond markets.

Earlier in the week, the UK government sold new 30year bonds at a 5.2% interest rate, which sent the yield on 30year gilts to their highest level since 1998. The yield on 10year bonds has also risen to highs not seen since 2008. On Thursday the yield hit 4.93% while the pound dropped to its lowest level against the dollar for more than a year.

The sell-off in the price of bonds (which is what sends yields higher) reflects concerns about the fiscal prospects in the UK. Investors are worried about a rising threat of stagflation (when inflation is high, but the economy is shrinking) in combination with the government’s ongoing heavy borrowing needs.

And this is all before the proposed national insurance changes kick in in April, which could stimulate further price inflation. This week, Next clearly laid out the impact that NI hikes will have on the company’s cost base and said it was likely to push some of those higher costs onto customers. Greggs (which employs over 30,000 staff) also said it would ‘mitigate the NI costs’, while trying to maintain its decent value offering.

The UK is not alone in suffering falling bond prices. In the US, the yield on 10year bonds rose to 4.7% this week. While in Europe, French, German and Italian bonds yields all crept higher.

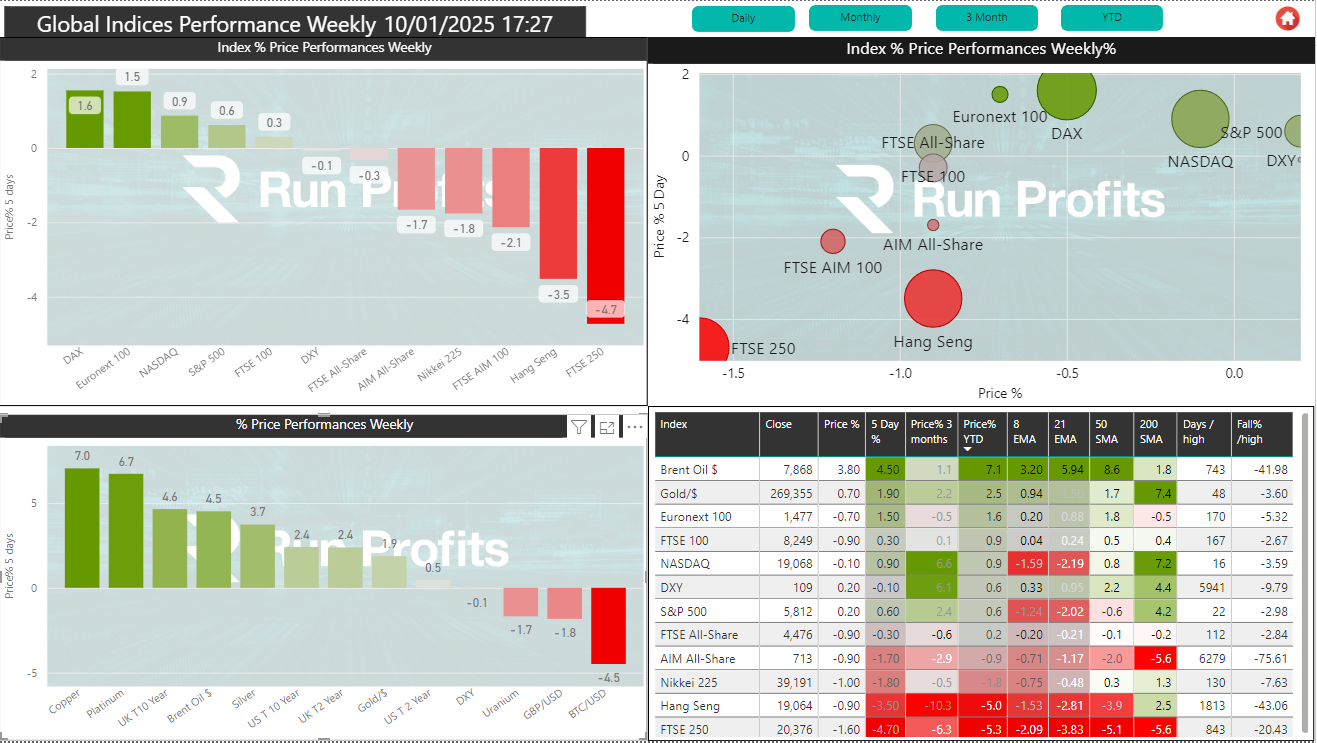

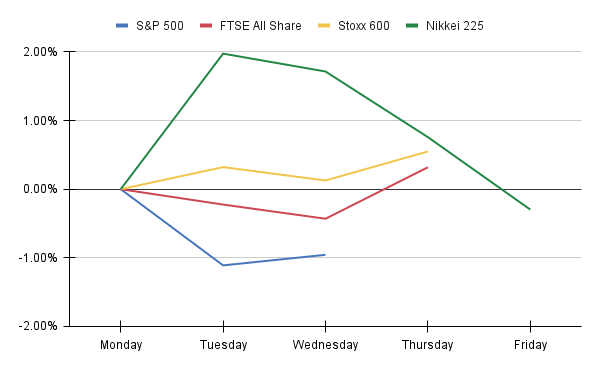

The equity markets have been mixed, although the FTSE All Share looks like it’s on track to end the week moderately higher:

In…