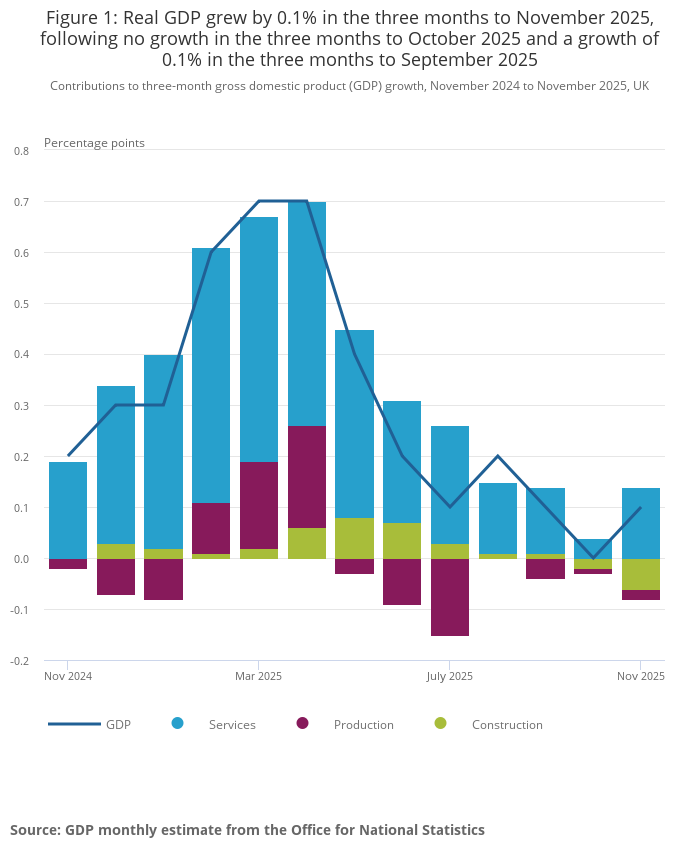

Welcome to The Week Ahead. On Thursday, we learned that the UK economy itself beat expectations in November, printing GDP growth of 0.3%. That beat forecasts of 0.1% and erased the 0.1% decline seen in October.

Perhaps more significantly, we also learned that the German economy grew by 0.2% in 2025, after two straight years of recession.

This data is backward-looking, of course, and neither the UK nor German economies seem likely to deliver vigorous growth in 2026. But modest growth is certainly better than the alternative.

Source: Office for National Statistics

Company news so far this year has suggested that companies operating in economically-sensitive sectors such as retail and hospitality are enjoying mixed fortunes.

While post-Christmas updates from pub chains Mitchells & Butlers and Fuller, Smith & Turner have been relatively upbeat, reports from retailers have been a little more mixed.

The housing market is another area where commentary has remained cautious. FTSE 100 builders Persimmon and Taylor Wimpey both managed to sell more homes last year, despite uncertainty around the impact of November’s Budget. However, social housing and build-to-rent specialist Vistry suffered a fall in output as its partners waited for clarity on government plans (and funding).

Turning to secondhand homes and lettings, London-focused small-cap estate agency M Winkworth warned on profits on Wednesday, blaming a "temporary slowdown in activity". This was followed on Thursday by a cut to broker forecasts for Winkworth’s larger London rival Foxtons.

My overall impression is that homebuyer activity may be stabilising, but is not exactly on fire.

During the coming week, UK economic data is expected to include house prices, inflation and unemployment. These could provide further colour on whether the economy is heating up, cooling down or simply stagnating.

Turning to company news, next week will see a raft of post-Christmas updates from major high street operators.

Retailers B&M, JD Sports Fashion, Currys and Primark owner ABF (which has already warned on profits) are all due to report.

In the adjacent sector of hospitality, pub chain JD Wetherspoon is also due to issue a trading statement, as is travel caterer SSP Group.

Spoon’s chairman Tim Martin rarely misses a chance to lobby for his industry to be treated more fairly on tax…