Good morning, I'm expecting another large set of updates today!

That will do it for today, cheers!

Spreadsheet accompanying this report: link (updated to 16th December)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Schroders (LON:SDR) (£6.73bn | SR83) | Annual results for 2025 are expected to be ahead of market expectations on adjusted operating profit. AOP of at least £745 million (FY24: £603.1 million). Group AUM of c. £825 billion including joint ventures and associates (FY24: £778.7 billion). | ||

Lion Finance (LON:BGEO) (£4.16bn | SR84) | CFO has decided to step down after 20 years with the company. His successor was CEO of Moldova’s largest bank, maib. | ||

DCC (LON:DCC) (£3.8bn | SR96) | Agreement to acquire UGI International LLC's liquid gas businesses in Poland, Hungary, Czechia and Slovakia. Enterprise value €48m. | ||

Taylor Wimpey (LON:TW.) (£3.68bn | SR83) | UK home completions excluding joint ventures in the middle of guidance range. Revenue £3.8bn (2024: £3.4bn), operating profit c. £420m (2024: £416.2m). Outlook: uncertainty ahead of the late Autumn Budget impacted sales in H2 2025 and order book coming into 2026. “We are experiencing a good level of enquiries consistent with last year.” | ||

Dunelm (LON:DNLM) (£2.36bn | SR83) | H1 PBT expected to be approximately £112m - £114m. FY26 PBT now expected to be at the lower end of consensus expectations (£214 - 227m). | BLACK (AMBER =) (Mark) [no section below] | |

Rathbones (LON:RAT) (£2.18bn | SR74) | Funds under management and administration increased 2.3% in Q4 to £115.6 billion. Net outflows £0.5 billion. | ||

Safestore Holdings (LON:SAFE) (£1.68bn | SR91) | Revenue +5% (constant exchange rates). 3.1% LfL growth. Operating profit down 62.6% to £159.3m due to lower property revaluation gains. Net assets £2.3bn. FY 2026 outlook: cautiously optimistic with a return to earnings growth. | ||

Mitchells & Butlers (LON:MAB) (£1.65bn | SR96) | LfL growth 7.7% over core 3-week festive period. Quarterly LfL sales +4.5%, “well ahead of the market”. “… we remain confident in our ability to manage the c.£130m of year-on-year cost headwinds we expect to face this financial year, driven primarily by increased labour costs and food cost inflation.” | ||

Savills (LON:SVS) (£1.49bn | SR61) | 2025 growth at least in line with expectations. “…While market uncertainty is expected to remain elevated in 2026, the Board believes that strong pipelines and strengthening investor and occupier sentiment will support recovery across our core transactional markets.” | ||

Great Portland Estates (LON:GPE) (£1.33bn | SR27) | Another strong quarter of leasing, with market lettings 9.1% ahead of the March 2025 ERV. “We head into the final quarter with positive momentum… With a robust financial position and best-in-class team, GPE is well placed to drive attractive shareholder returns." | ||

Ashmore (LON:ASHM) (£1.3bn | SR57) | AuM increased by US$3.8 billion (+8%) over the period (Q2), comprising net inflows of US$2.6 billion and positive investment performance of US$1.2 billion. | ||

Oxford Instruments (LON:OXIG) (£1.24bn | SR73) | Reconfirms its full-year outlook, with reported adjusted operating profit anticipated to be in line with market expectations. Consensus for FY26 reported adjusted operating profit ranges from £70.2m to £73.0m, with a mean of £71.8m. Year-to-date book-to-bill ratio 1.2. | ||

Glenveagh Properties (LON:GLV) (£870m | SR79) | 2025 revenue +7%, operating profit +9%. EPS +18% (20 cent). For 2026, the Group is guiding EPS of up to 21 cent, reflecting continued growth in completions, the ongoing contribution from Partnerships and disciplined cost control. Forward order book of approximately €1.1 billion (2024: €0.95 billion). | ||

Raspberry PI Holdings (LON:RPI) (£558m | SR21) | The Raspberry Pi AI HAT+ 2 is an add-on board for Raspberry Pi 5, expanding the Company's on-device AI capabilities. | This is a Reach announcement, i.e. a non-regulatory press release. | |

Advanced Medical Solutions (LON:AMS) (£487m | SR53) | Full year 2025 revenues of approximately £228.5 million (2024: £177.5 million), EBITDA of £49.5 - £50.0 million (2024: £40.2 million), and the Board is confident of meeting market expectations. | ||

Caledonia Mining (LON:CMCL) (£466m | SR83) | $100m notes to be offered in a private placement, plus an optional $20m. Using a capped call to hedge the associated risk. | ||

Fuller Smith & Turner (LON:FSTA) (£381m | SR95) | Trading statement for 41 weeks to 10th Jan 2026. Like for like sales for the year to date up 5.3%. There was “an excellent Christmas trading period”. As the previous buyback programme completes, the Board has approved a buyback for up to an additional one million “A” shares. | ||

DeFi Development UK (LON:DFDV) (£375m | SR4) | Non-Exec Chair and a new CFO have been appointed. | ||

VAALCO Energy (LON:EGY) (£324m | SR89) | 2025 sales 22,100 WI BOEPD, at the top of its guidance range of 20,800 to 22,200 WI BOEPD. Increased cash at bank by nearly $35 million to $58.8 million. | ||

Anglo Asian Mining (LON:AAZ) (£318m | SR56) | Q4 Copper production +94% Q-o-Q to 4,439 tonnes, due to increased production from both Gedabek and Demirli. FY Copper production of 7,915 tonnes was lower than the revised guidance of 8,100 to 9,000 tonnes. Gold production of 25,061 at the lower end of the revised guidance of 25,000 to 28,000oz. Net cash inflow in Q4 2025 of $16.7m. Net cash $2.5m. | ||

Ab Dynamics (LON:ABDP) (£308m | SR54) | Expects to deliver FY26 adjusted operating profit in line with current expectations (of £24.5m). Net cash £35.5m. "Whilst mindful of any short-term macroeconomic disruption driven by geopolitical events, the Board remains confident that the Group will make further financial and strategic progress this year..." | AMBER = (Graham) [no section below] | |

Essentra (LON:ESNT) (£275m | SR39) | FY Revenue flat (+2.5% CCY LFL), expects adj. Op profit for FY25 to be in line with market expectations (of £32.0m to £32.4m). FY25 pre-IFRS 16 net debt leverage guidance is unchanged and is expected to close within the targeted leverage range of <1.5x. | ||

Serabi Gold (LON:SRB) (£261m | SR99) | Q4 production 11,534 ounces, +15% on Q4-2024. Net cash 31 Dec $42.1m (Q3: $33m). Annual production of 44,169 ounces, representing a 18% increase vs FY2024 2026 consolidated production guidance of 53,000 – 57,000 ounces gold. | AMBER/GREEN = (Mark) | |

Brooks Macdonald (LON:BRK) (£257m | SR55) | 26Q2 FUMA +3% to £20.1bn, Net inflows £50m, market performance £0.5bn. | ||

Mkango Resources (LON:MKA) (£190m | SR21) | Official launch of the rare earth magnet facility today at Tyseley Energy Park. | ||

Foxtons (LON:FOXT) (£168m | SR56) | Revenue +5% to £172m, Adj. Op Profit flat at £22m, Net debt £17m (FY24: £12.7m). Acquires Cauldwell, a leading independent agent in Milton Keynes, for a total enterprise value of £6.5m on a cash and debt-free basis. “The Group expects to deliver revenue and profit growth in the year, underpinned by non‑cyclical and recurring Lettings revenue.” | BLACK (AMBER ↓ ) (Graham) The broker note from Panmure Liberum confirms that the FY26 profit forecast has been cut by 3%, and FY27 cut by 14%. I will cautiously take a neutral stance on this stock today. The valuation is not expensive, but I would be nervous if it was. Rather than valuation, the bigger concern here is just the lack of growth and the uncertain outlook for London property. I have an open mind on this one and would be happy to upgrade our stance again in due course. But given that this is a profit warning (although the RNS didn’t explicitly say so), I’m neutral for now. | |

Cab Payments Holdings (LON:CABP) (£168m | SR39) | FY Total Income expected to be c£119 million, Adj. EBITDA expected to be slightly above the range of consensus estimates (of £33.8m). | ||

Hostelworld (LON:HSW) (£145m | SR25) | H2 Revenue +7% (+2% bookings, +5% Average Booking Value). FY Revenue +2% to €93.8m, Adj. EBITDAv€19.9m, in line with market consensus. Net debt €1.6m. | GREEN ↑ (Graham - I hold) I'm upgrading my stance on this as I've had a chance to cool down since the announcement of an acquisition in October. I still think this is a very interesting situation and I'm open to idea of adding to my position. It's rare to find successful online platforms trading so cheaply, in my experience. | |

Audioboom (LON:BOOM) (£137m | SR46) | Revenue +10% to $80.4m, Gross Profit +18% to $17m, Adj. EBITDA +54% to $5.1m, ahead of expectations. Cash $4.2m (FY24: $3.9m). | AMBER/RED = (Mark) [no section below] | |

Savannah Resources (LON:SAV) (£123m | SR30) | “Following approval of the State Grant, Savannah expects the formal signing of the related investment contract to take place before the end of next week.” | ||

Diaceutics (LON:DXRX) (£120m | SR48) | Revenue +20% to £38.5m in line with expectations, Adj. EBITDA expected to exceed analyst consensus estimates. Expects +ve profitability. Expects to deliver 25% revenue growth in FY 2026. | ||

Trufin (LON:TRU) (£116m | SR77) | Adj. PBT to be ahead of previously guided expectations, now expected to be more than £7.4m, (FY24: £0.9m). Adj. EBITDA is expected to be in excess of £11.8m (FY24: £7.6m). Group revenue is expected to be approximately £63.0m (FY24: £55.0m). | ||

Robert Walters (LON:RWA) (£98.8m | SR75) | Net Fee Income -14% YoY, Net cash excl leases £26.2m (30 Sep: £26.6m). | ||

MPAC (LON:MPAC) (£97m | SR22) | FY revenues £170m (FY24: £122.4m), U/L PBT in line with market expectations of £13.5m (FY24: £10.5m), Order Book flat, Net debt excl. leases £47.7m (30 Jun: £43.2m). | AMBER = (Mark) | |

Premier Miton (LON:PMI) (£95.4m | SR69) | AUM -7% to £9.6bn, Net outflows £870m, market performance £103m (+1%). | AMBER ↓ (Mark) | |

Distribution Finance Capital Holdings (LON:DFCH) (£91.7m | SR68) | SP +5% Loan book up 27% on the prior year (FY2024: £666m) and ahead of previously guided range of £750m-£800m. Adjusted pre-tax profit of at least £17.5m, up 22% on prior year. Meduim-term targets for 2030, which are additional to the previously announced 2028 targets: loan book >£1.5bn, cost to income ratio 45%-48%, return on required equity c. 20%. Expects to fund growth internally without needing to raise equity. | GREEN = (Graham) [no section below] We've been consistently postive on this one, even in October when the outlook was merely "in line" for 2026, despite 2025 having previously been upgraded. Panmure are now forecasting underlying PBT of £19.4m for 2026, which is slightly higher than the £19.0m they suggested in October. Although profit growth may have paused in the short-term, the overall size of the business continues to take great leaps forward with the loan book up by an enormous 27% year-on-year. Whenever this translates into operating leverage, we should see very significant earnings growth. In the meantime, the shares are still trading below tangible net assets of 75p (latest share price: 59p). | |

Alumasc (LON:ALU) (£89.4m | SR70) | Pamela Bingham appointed Chief Executive Officer. | ||

Pebble (LON:PEBB) (£66.2m | SR92) | Revenue flat at £125m, Adj. EBITDA -5% to £15.8m. Cash of £9.6m (FY24: £16.5m). In line with expectations. | ||

Likewise (LON:LIKE) (£62.7m | SR51) | FY Revenue -8.6% to £163.8m. “The Group is on track to achieve current market expectations of Profit Before Tax for FY25 with further meaningful growth in profitability anticipated in FY26.” | ||

Agronomics (LON:ANIC) (£58.9m | SR40) | Agronomics will invest the AU$3m (c. £1.5m) in All G via convertible notes, to bring their holding up to c5%. | ||

Abingdon Health (LON:ABDX) (£16.3m | SR9) | H1 Revenue +45% to £4.5m, Cash £2.6m (30 Jun: £1.9m) after £3.2m net raise. Maintaining its revenue guidance for FY26, including grant-funded income, in line with market expectations of £12.6m. | ||

Titon Holdings (LON:TON) (£11m | SR70) | Revenue +2% to £15.8m, U/L EBITDA £811k (FY24: £5k), U/L operating LBT £40k (FY24: £916k). Cash £3.5m (FY24: £2.3m). Trading in the first quarter of FY26 was in line with the Board's expectations. | ||

Newmark Security (LON:NWT) (£10.6m | SR86) | H1 Revenue +13% to £11.6m, Adj. EBITDA +100% to £1.0m, Operating Profit £0.1m (25H1: £0.3m loss). £4.0m net debt (25H1: £3.8m net debt). “H2 FY26 has started strongly and currently expects both divisions to surpass H2 FY25 revenues and operating profits”. | AMBER/RED (Graham) [no section below] I once owned shares in this, a long time ago, but eventually lost interest. As a group it does look interesting with cloud-based workforce security software and a wide range of physical security products. As an investment, however, it has never managed to convert revenues into profits which it could then reinvest for compounded growth. The stock has been listed for over 20 years at this stage, and it has had the same CEO (the founder/Chairman's daughter) since 2013. Today's outlook statement suggests that the company could make a profit this year to surpass last year's £0.7m, but I'm going to take a moderately negative stance to reflect the very long history attached to present management. |

Graham's Section

Hostelworld (LON:HSW)

Up 1% to 118p (£147m) - Trading Statement - Graham - GREEN ↑

(At the time of writing, Graham has a long position in HSW.)

Yesterday Roland covered Nichols (LON:NICL), which is probably the least exciting share on my annual watchlist (its update was in line with expectations).

Hostelworld is a new entrant to my watchlist, and a share that I own personally.

Thankfully, this is also an “in line” update from the online travel platform.

Let’s extract some key points:

H2 revenue +7%

2% increase in number of bookings, 5% increase in average booking value

Average booking value has been trending downwards in recent years, so this is a nice reversal.

Continuing:

Commission rate on bookings has increased to 16.7%, thanks to the “Elevate” tool which lets hostel operators pay more for increased visibility on the site.

Marketing as % of revenue fell from 48% in H2 2024 to 45% in H2 2025.

As for the full-year numbers, they are slightly less impressive than H2:

Net revenue +2% to €93.8m, which I think is below expectations.

1% reduction in number of bookings, 2% increase in average booking value.

Adjusted EBITDA €19.9m, in line with expectations.

I’m happy enough with these results: hopefully the momentum from H2 continues into H1 of 2026.

Cash: €12.2m cash, net debt €1.6m. They’ve completed most of their £5m share buyback. I accept that buying back their shares is a little aggressive, but I think they can afford it given their current profitability. The StockReport shows an after-tax net income forecast of €16.1m for 2025, rising to €19m for 2026.

At the current valuation, I do think they are getting good value for their buyback activity!

“Growth roadmap”

They reiterate the rationale for their $12m purchase of OccasionGenius:

The acquisition marks an important evolution of the Group's social travel platform, enabling integrated event discovery with its existing social and accommodation offering.

In other news, they now sell access to their social network even for travellers who haven’t made a booking.

Not sure if that will be able to compete with Facebook or other free options, but I guess it can’t hurt!

And they’ve also expanded to accommodation options beyond just hotels (e.g. budget hotels).

So I don’t think it’s fair to say that management has been standing still - there have been plenty of initiatives over the past year. Let’s hope that a few of them are successful!

Management remains confident that the additional capabilities delivered during 2025 - including social monetisation, budget accommodation, and the OccasionGenius integration - will strengthen the platform and support long-term value creation.

Graham’s view

Obviously I’m bullish on these, seeing as I own it personally and I added it to my watchlist. At the moment the stock is only worth 1% of my portfolio, and I’m wondering if I should add to it.

I just think it’s very rare to find an online “platform” business like this, with a well-defined niche in which it is successful, and a well-known consumer brand, which is available at such a low earnings multiple.

Weaknesses? Well, revenue growth hasn’t been as strong as it perhaps could have been.

The $12m acquisition is still up for debate in my view, as to whether it represents good value. The business they bought only had a few employees, but Hostelworld says that it will speed up their progress significantly (connecting travellers with events).

The balance sheet could be a little stronger, too. It’s a balancing act because I also think that buybacks at this valuation are good for shareholders. Hopefully we will see the cash position improve during 2026.

Overall, I’m still a strong believer in this one. I’m going to upgrade my stance on this to GREEN from AMBER/GREEN, now that I’ve had a chance to reflect and calm down since October!

The share price has made little gains since 2021-2022, but it's a vastly more attractive proposition now than it was then, in my view.

At the end of 2022, the share price was 115p, only a few pence lower than it is today.

- Year-end 2022: revenues €70m, loss making, net debt €13m.

- Forecast 2026: revenues €107m, adjusted net income €17m-€19m, and it's expected to have net cash.

Foxtons (LON:FOXT)

Down 6% to 53.4p (£157m) - Unaudited Year End Trading Update and Acquisition - Graham - BLACK (AMBER ↓)

Foxtons Group plc (LSE: FOXT).. provides an update on trading for the year ended 31 December 2025, together with the acquisition of Cauldwell Property Services Ltd, expanding its presence into the fast-growing commuter town of Milton Keynes and further advancing the Group's growth strategy.

The market was a bit cold on this announcement:

Revenue +5% versus prior year to c. £172m. (this looks like a miss against £174m expected.)

Adjusted operating profit c. £22m seems approximately in line.

Lettings were 64% of revenue.

HQ relocated, bringing £1.5m of cost savings to offset inflationary pressures.

£5.5m of buybacks and £3.6m of dividends - not to be sniffed at with a market cap of only £160m.

Estimates: thanks to Panmure Liberum for commenting on this today.

The note from Panmure confirms that FY25 revenue missed expectations and FY25 profits were in line.

Looking ahead, they have adjusted their forecasts as follows:

FY26 revenues reduced from £185.7m to £180.2m

FY 26 EBIT reduced from £28.5m to £23.1m.

FY27 revenues reduced from £195.3m to £190m

FY 27 EBIT reduced from £31.4m to £27.1m.

Net debt at December 2025 was £17m and it’s expected to be at a similar level at the end of 2026 (£15m, according to Panmure).

This is largely because of the acquisition announced today:

On 7 January 2026, the Group completed the acquisition of Cauldwell, a leading independent agent in Milton Keynes, for a total enterprise value of £6.5m on a cash and debt-free basis, of which £0.8m is deferred for 12 months and contingent on performance targets being met. Cauldwell's unaudited total revenue and operating profit for the 12 months ended 30 November 2025 was £3.1m and £0.8m, respectively. Approximately two-thirds of total revenue is attributable to Lettings.

Outlook: conditions are difficult.

Sales began 2026 with a lower under-offer pipeline than the previous year, as a result of the significant sales market disruption around the Autumn Budget and a very strong comparative period in Q4 2024 (ahead of the March 2025 stamp duty deadline). Due to the lower under-offer pipeline, Q1 2026 Sales revenues will be lower than those recorded in Q1 2025. When the sales market normalises, we expect a more stable market backdrop, with transaction volumes to benefit from recent mortgage rate reductions and the release of pent-up demand.

Graham’s view

I do wish that forecasts could be included plainly in RNS trading updates, rather than in broker notes - there is no law preventing companies from doing that! But this is how most companies operate.

Based on the Panmure broker note, this update is a profit warning.

The FY26 profit forecast has been cut by 3% and the FY27 profit forecast has been cut by 14%.

The Cauldwell acquisition is interesting but is not really the headline here, in my view. The headline is that the sales market around London has been under some pressure, and that the growth forecast has been greatly diminished as a result.

The FY27 forecast, in particular, has been reset at a significantly lower level.

I will cautiously take a neutral stance on this stock today.

The valuation is not expensive, but I would be nervous if it was:

Rather than valuation, the bigger concern here is just the lack of growth and the uncertain outlook for London property. The acquisition announced today, while not making an enormous difference to the overall picture, does slightly increase the risk - perhaps the sellers have read the tea leaves better than Foxtons are?

I have an open mind on this one and would be happy to upgrade our stance again in due course. But given that this is a profit warning (although the RNS didn’t explicitly say so), I’m neutral for now.

Mark's Section

Serabi Gold (LON:SRB)

Down 2% at 338p - Reports Q4-2025 Production - Mark - AMBER/GREEN

I never like it when a company puts a lot of promotional text in the RNS headline, it gives the feeling that they are trying too hard to overcome a weakness somewhere. Last year’s RNS title, “Q4-2024 Production Results and Operational Highlights”, becomes “Reports Q4-2025 Production, Record Annual Production, Production Guidance Achieved & Operational Highlights” this time.

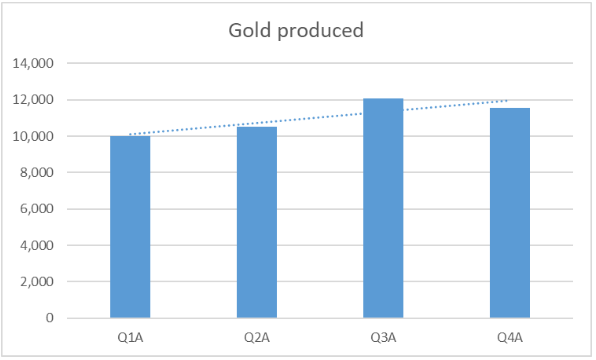

The company is choosing to highlight the record annual production. However, I think shareholders may be a little disappointed with Q4 production. Coringa performed well delivering slightly higher production, but lower grades at Palito meant that production was back to Q1 levels. The net results was that Q4 was below Q3 production, and slightly below recent trends:

They also highlight that they achieved production guidance, which is true. But at 44,169oz, this is very much at the lower end of the guidance range of 44,000 – 47,000oz that they started the year with.

So when they give us 2026 production guidance of “53,000 – 57,000 ounces gold” my assumption would be that they will deliver closer to the bottom end of that. This is still 20% higher than 2025 production, which is a strong performance, if delivered.

There is also good news on the cash front:

The Company had a net cash balance at the end of Q4-2025 (after interest bearing loans and lease liabilities) of $42.1 million (31 December 2024: net cash $16.2 million).

Plus, shipping delays meant they didn’t receive $5.1m of payments until post-period end. Although this is an ops update and such things are not always mentioned, I would have liked to see some commentary on what they will do with this cash. There is a dividend forecast of 12c for when they release final results. However, gold miners are always always spotting something shiny out of the corner of their eyes which they want to buy rather than return cash to shareholders.

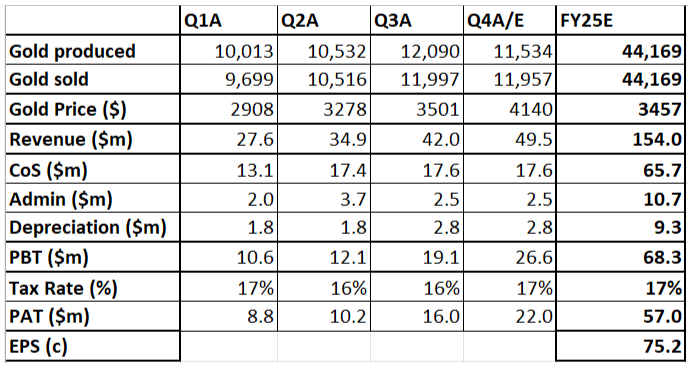

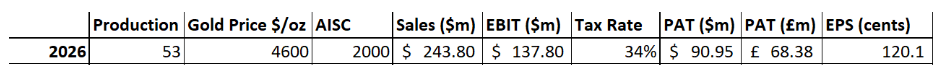

I can model what this production looks like based on the average gold price during the quarter, and keeping costs from Q3 similar:

This still looks to be a handy beat on the $147m revenue and 65c EPS forecast in the StockReport. Although, this is almost entirely down to gold price strength rather than operationally exceeding expectations. Tax is a big unknown as they have been paying less than the headline rate and I have assumed similar rates for Q4. Long-term they will likely transition to paying the full rate of 34%, though.

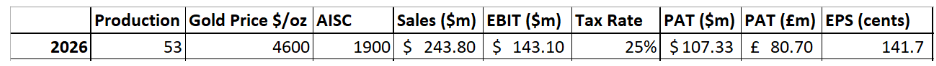

Looking forward, I can model what their production guidance and current spot gold prices mean for future profitability.

Even if I assume they pull the full Brazilian corporate tax rate in FY26 and have a big jump in AISC, then I still get a figure well in excess of the current forecasts:

Mark’s view

I was a little disappointed with these production figures as they came in at the very bottom of the guidance range and were below recent trends. However, quarterly figures can be lumpy and I’m not reading too much into one weaker quarter in an otherwise upward trend for production. Their 2026 production guidance range looks achievable, although I’d personally assume that they came in at the lower end, similar to this year.

Without seeing how costs have evolved in the quarter it is hard to be certain. However, my expectation is that the gold price strength in the quarter will have led to at least a modest beat on expectations. They look on for an even larger beat for FY26 if the gold price remains at current levels.

This also highlights the biggest risk to the company - if the gold price falls significantly, so will their profitability, and planned production increases won’t overcome this. The good news is that this remains a hedgable risk (at least for more sophisticated investors). However, the company is certainly making hay while the sun shines, and while its rays are still glinting off everything gold it makes sense to keep our mostly positive view of AMBER/GREEN.

Premier Miton (LON:PMI)

Down 9% at 53p - Q1 AuM update - Mark - AMBER

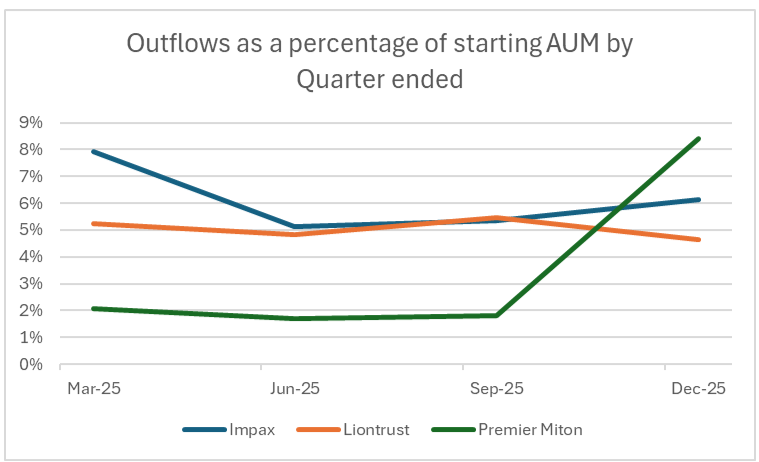

I can see why the market is disappointed with this update this morning. Over the past year, Premier Miton has outperformed a lot of the more UK-focussed asset managers, with around 2% net outflows per quarter. However, in Q4 this jumped to over 8% of their AUM redeemed:

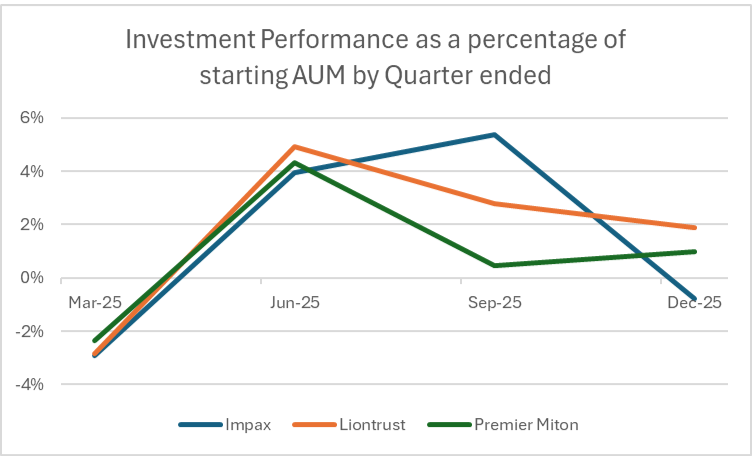

Their recent investment performance has also been nothing to write home about:

Performance data is noisy and no one apart from the tech and US-focussed Polar Capital has been doing well. However, 1% returns in a period when the FTSE 100 has been performing well struggles to make the case for investors to send their capital their way in the short-term.

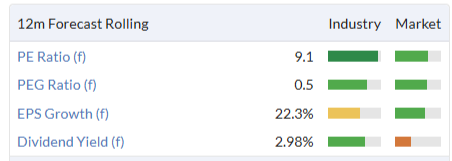

I can’t see any update broker coverage today, but similarly to Impax who reported earlier this week, it would seem to take a pretty big turnaround in fortunes for them to now be able to meet market forecasts for the full year. This means that their current forward P/E doesn’t really stand out amongst peers:

- Impax Asset Management (LON:IPX) 7.4x

- Liontrust Asset Management (LON:LIO) 6.0x

- Premier Miton (LON:PMI) 9.4x

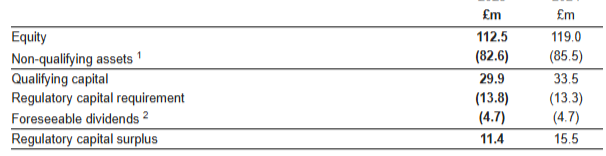

P/E isn’t the only thing, as these companies also have net cash. However, they have to hold that as regulatory capital, making it more like an inventory than distributable capital. I like that Premier Miton clearly tell us what their regulatory surplus is. Something peers don’t always seem as keen to do.

They are forecast to pay a higher dividend yield than the others:

- IPX 8.5%

- LIO 8.3%

- PMI 10.3%

But this is uncovered, so may be at risk of a cut if AUM outflows don’t reverse soon, and that regulatory capital surplus becomes depleted.

The share price has outperformed over the last six months which may also mean that some investors prefer it.

Relative strength:

- IPX -35.3

- LIO -39.2

- PMI -16.5

However, if this isn’t backed up by the underlying business out-performing this may mean it simply hasn’t fallen yet.

Mark’s view

I am sympathetic to the view that the whole sector is cyclical and therefore undervalued on these types of metrics. However, when it comes to Premier Miton specifically, this AUM update worries me. They have seen big outflows in the last quarter and delivered mediocre investment performance. The risk that they miss current EPS forecasts and need to cut back their dividend payout looks to have increased today. However, they still haven’t fallen anywhere near as much as peers recently. Putting all this together means I am going to take a more circumspect view of the near-term outlook here. AMBER

MPAC (LON:MPAC)

Up 2% at 330p - Full Year trading update - Mark - AMBER

The share price has been strangely volatile here on no news, following a big Profits Warning in July:

Today, the shares trade at a similar price level as to when I reviewed their half-year results released in September. I concluded that their FY revenue figure looked achievable, despite the weakening order book, since they only had to do £80.3m in H2 versus £84.7m in H1 to hit Shore’s £165m forecast. Today the announce that:

The Group expects that it will report revenues of c£170m

I was less convinced that they would go from £5.0m in adjusted PBT in H1 to £13.5m for the FY as this relied heavily on them making significant cost savings. However, today they confirm that they are also in line with that figure, which is good news. With Mpac the word “adjusted” often does some heavy lifting, and I expect the same when the results are announced in April. There will be cash costs associated with the restructuring as well as asset write-downs.

Looking forward, the order book has stabilised:

The Group closed 2025 with an order book stabilised at c.£92.0m, in line with the position as of 30 June 2025 (HY25 £91.7m). Original Equipment ("OE") order intake improved c25% in the second half of the year against H1 25, following a slow first half as customers deferred capital investments due to market uncertainty in response to US trade tariffs.

However, Shore maintain their FY26 forecasts with just a 1% rise in revenue to £172m. Adjusted PBT and EPS are expected to rise by 12% to £15.1m and 37.5p, respectively. However, again this is due to cost-cutting, rather than business expansion. This puts them on a forward P/E of around 9 which is relatively modest. However, we also need to include the impact of the large net debt:

Deferrals of anticipated orders in Q4 25 resulted in lower customer deposits and consequently resulted in a higher net debt, excluding leases of £47.7m.

This is up from £43.2m on 30 June, and adds to the risk, with the balance sheet already looking weak at the half-year. Shore calculate an EV/EBITDA of 6.3, which looks about right for this type of business.

Mark’s view

While it is pleasing to see that they hit market forecasts, these are still much lower than they were before the July profits warning. They also will rely heavily on cost-cutting and adjustments in order to hit those bottom-line figures. I don’t think it is crazily valued at 6.3x EV/EBITDA. However, all the Stock Ranks are low:

Which means that the algorithms actually rate this a Sucker Stock. That seems a little harsh to me, but I also struggle to see where the upside comes from here. Relatively lack-lustre growth combined with a weak balance sheet, meaning they can’t afford to pay a dividend, is rarely an exciting prospect. Hence, this update doesn’t change my previously neutral view. AMBER

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.