Markets

The FTSE100 is largely flat this week as lower financials were a drag, despite support from commodity producers. U.S. indices fell earlier in the week as the market priced in higher global risks. However, it rebounded midweek as US rate-cut expectations increased.

Here's what we can look forward to next week:

Economic Calendar

Monday 8 Dec |

||

03:00 |

China |

Balance of Trade |

Tuesday 9 Dec |

||

07:00 |

UK |

Retail Sales |

07:00 |

Germany |

Balance of Trade |

15:00 |

United States |

Job Openings |

Wednesday 10 Dec |

||

01:30 |

China |

Inflation Rate |

12:00 |

United States |

Mortgage Approvals |

19:00 |

United States |

Fed Interest Rate Decision |

Thursday 11 Dec |

||

00:01 |

UK |

RICS House Price Balance |

Friday 12 Dec |

||

07:00 |

UK |

Industrial Production |

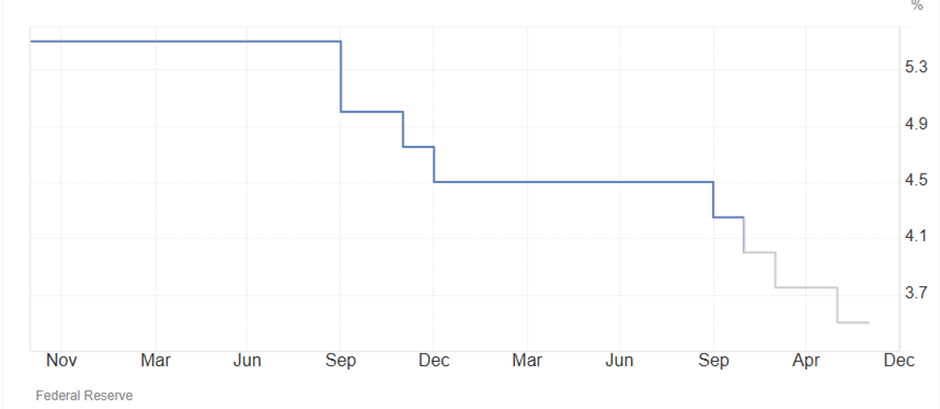

US Interest Rates

The US Federal Funds Rate is forecast to be cut by a further 25bps to 3.75% on Wednesday:

[All charts in this section: Trading Economics]

However, due to the recent government shutdown, the October 2025 CPI report was cancelled, and CPI data for November is scheduled for 18th December. This means up-to-date inflation data will not be available to base this decision on, and the Fed will instead have to rely on other indicators, such as jobs data released over the last week. The uncertainty means there is a wider scope than usual for a surprise decision, and markets may react more strongly to any shock.

UK Figures

It is a fairly quiet week for UK economic data. However, with the recent Budget adding to the economic uncertainty for many companies and individuals, a few data points may indicate how this is being perceived and reflected in economic activity.

The RICS house price balance, released on Thursday, is a survey-based indicator from the Royal Institution of Chartered Surveyors that shows whether more surveyors reported a rise or a fall in house prices in their area. It is considered a leading indicator for house prices because it includes forward-looking sentiment on price and sales volume…

.JPG)