We are heading towards a very painful market crash, there are few things of which I am more certain.

The trouble is that I have no idea whether it will be next week, next month, next year or next decade. I also have no idea how far the market may rise in the meantime nor how many ‘wobbles’ we may experience before the big event.

But I can be sure there will be a major meltdown sometime ,it is what markets do. At this point we will see the anointment of a new batch of economic gurus who “told us so” (irrespective of how long before they had been telling us so!)

This leads me to ponder (in part of course because I am nervous that such an event might not be that far off) – What should I do about it?

For those investing “for the long term”, the answer might be :

Do Nothing

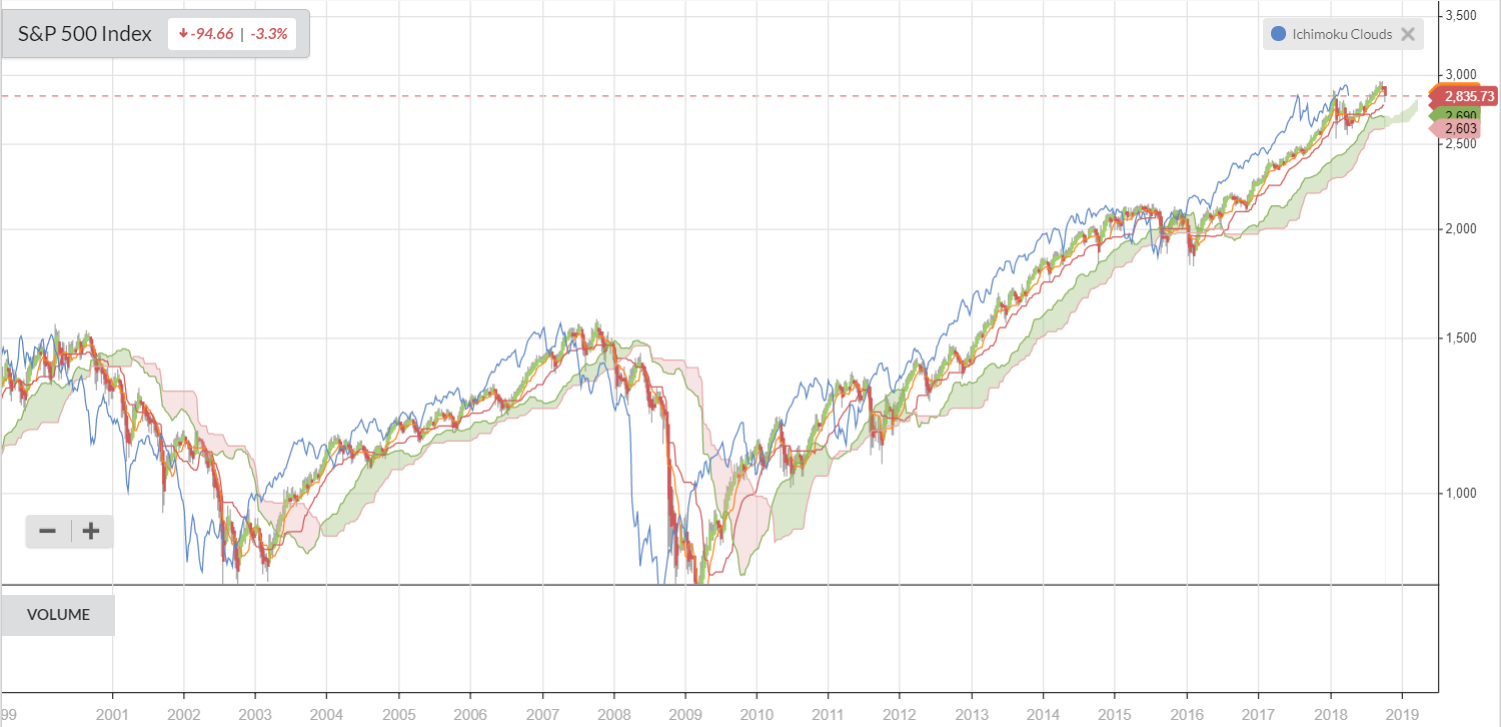

The underlying basis of this position is that over the long run the stock market is just such a great place to be invested that rather than risk value judgements about “short term” swings, the best bet is just to remain in the market.

This is not without merits, and indeed some of the things I found while researching this article sway me a little more towards this view than I had expected.

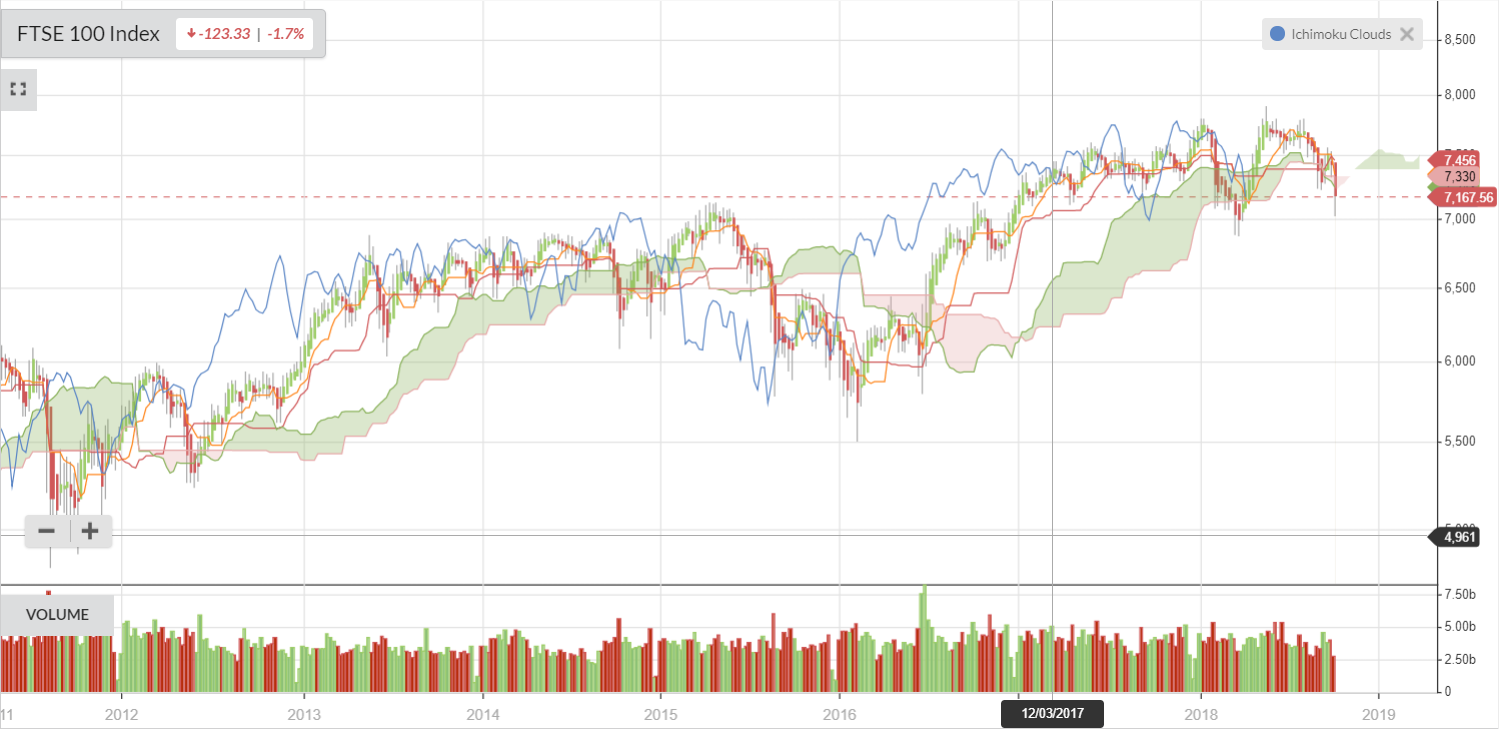

After all; if one had held the FTSE All share from its pre-2008 crash high point of 3,479 ( 15-Jun-07) through to the end of May this year [4,222] you would have seen a 21% increase in value (despite being down 50% in March-2009). This represents a CAGR over nearly 11 years of 1.8%, add maybe 2% pa to that for dividends, whilst that is a pretty meagre return, it is far short of being a disastrous melt-down during such an ‘exceptionally’ turbulent period.

Except that may this period was not so exceptional after all. I recently read an article in the mainstream press encouraging ordinary Joes and Josephines to consider investing in the stock market. It contained a couple of comforting statistics (I cannot validate how they were calculated) from long term analysis of the market :

- Over any 10 year period there is a 90% chance that investing in the market outperforms “cash”.

- Over any 18 year period this chance rises…