The more I look at various share price charts, the more I see March 19th seems to have been when everything got really cheap. Since then, we have actually seen quite an encouraging rally. Is this based on an improving outlook, or are people just tired of worrying?

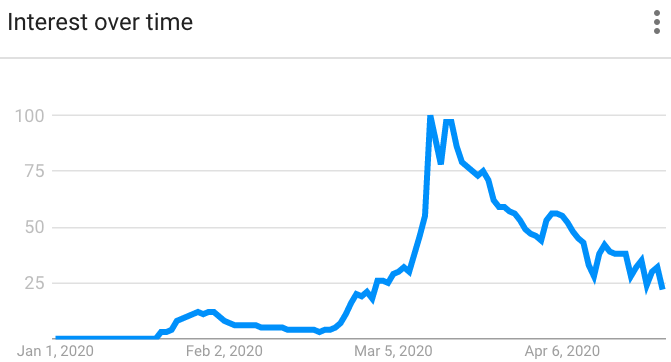

“Panic” is an exhausting state of mind. It can’t be maintained for long because it burns up so much fuel. A quick look at the charts below shows an interesting link between google search terms for “Coronavirus” and the year-to-date FTSE All-Share performance.

Correlation does not equal causation, and I’m not drawing any strong conclusions from the below. It is a surface level comparison, but it does fit the idea that people have got tired of worrying.

Google trends for “Corona”:

FTSE All-Share year-to-date performance:

It does seem like Corona panic and market selling both peaked in mid to late March. That kind of high pressure environment can lead to all kinds of unfortunate behavioural biases. While those conditions have passed for now, it is worth considering your plan of action for when/if another Corona-inspired bout of panic hits the market again.

The longer term your outlook, the easier it becomes to see a path through all of this. In the short term though I wonder if we are being complacent - or at least, betting on quite a favourable outcome. Markets are forward-looking, but are they too forward-looking right now?

The risks still remain, and a lot of economic damage has been wrought during this lockdown. There is more poor economic data to come and a tricky normalisation period which, according to some operators, will be even more treacherous to navigate than a full on lockdown. Millions of people are also out of work.

This aside, I do see companies that should be able to survive and even thrive in current conditions.

My (pretty vague) macro view remains something like “on a 10-year view, I believe stock markets will go up therefore I am overweight equities.” Your own investment horizon is a key consideration, obviously.

However, I also feel that the current market conditions are assuming a quite positive outcome and are undervaluing the downside scenarios. That tells me to be prepared for volatility, and to continue prioritising balance sheet health, liquidity, and companies that…

.jpg)