Time marches on and in business, change is the only real constant.

Given that dynamic environment, I think sensible rules of thumb can outlast highly engineered and complicated models. They feel like more robust and fundamental truths to steer by.

For example:

- Assumption 1: a strong stock price can indicate improving prospects that are not fully priced in by the market.

- Assumption 2: a low price-to-sales ratio indicates a relatively cheap share price (profit margin, business model, and financial health considerations aside).

Pair these two assumptions together and you have a reasonable starting hypothesis that company A is modestly valued with improving or undervalued trading prospects. Maybe you’ll find something to disprove that hypothesis, but it’s a solid place to start.

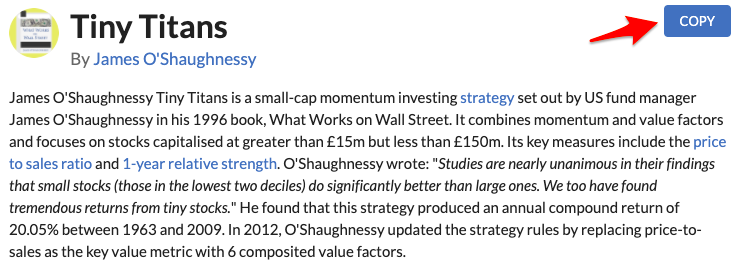

You’ve also just described James O’Shaughnessy’s Tiny Titans (more or less). This screen regularly beats the market with just a couple of simple and intuitive rules that allow it to recruit a deep field of fast-moving stocks.

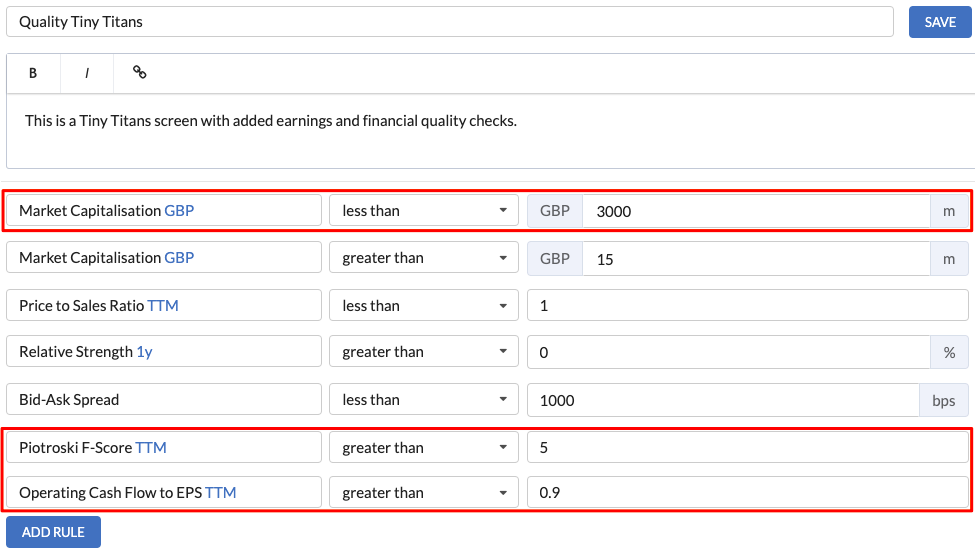

Its minimalist central criteria (of price-to-sales < 1x and relative strength 1y of > 0%) does mean that no thought is given to financial health, cash flows, quality of earnings, or scale of opportunity - but it’s easy to add some of these checks in by copying and customising the screen.

Below I’ve added two additional criteria: an F-Score of > 5 (for financial health) and an operating cash flow to EPS ratio of at least 0.9 (to show accounting earnings are backed up by cold, hard cash).

I’ve also loosened up the market cap limit to look at bigger stocks on the move.

Here’s the screen. There are many promising candidates here including a couple I have covered before such as Premier Foods, Gear4Music, Computacenter, and Volex.

All of these are exciting companies worth revisiting - but for now I’d like to look at two small caps I haven’t covered before: Tandem and MPAC.

Tandem (LON:TND)

Market cap | Spread | Op CF to EPS | F-Score | Price/sales | Relative strength 1y |

£19.4m | 779bps | 2.9 | 8 | 0.5 | +157% |

(I hold)

I’ll start with Tandem (LON:TND) given it released its half-year results yesterday.

This bike and leisure toy developer and retailer comes with a lot of history (and not all of it good).

…

.jpg)