International Business Times Video

Can anyone solve the UK's growing housing crisis? The new Mayor of London, Sadiq Khan, has a huge challenge on his hands now that he is settled at City Hall. He promised during his election to make 50% of all new homes in London "genuinely affordable".

This is how bad matters have become in London: according to estate agents Savills, first-time homebuyers in the capital now require a deposit equalling 131% of their annual salary.

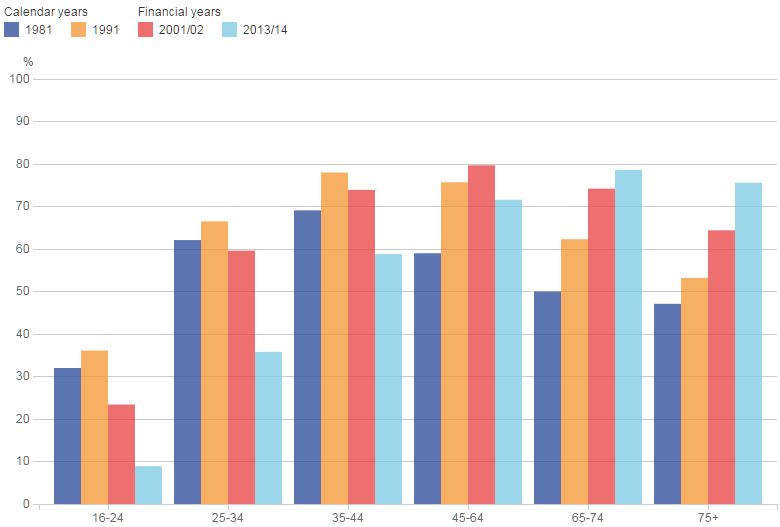

Only 36% of 25-34 year olds owned their own homes in 2013/14, compared with a massive 66% in 1991 (Chart 1).Just look at the way that adults aged up to 34 have seen home ownership fall as a result of increasingly unaffordable housing – just 9% of 16-24 year olds owned their own homes in 2013/14, compared with 36% in 1991.

To this end, Mayor Khan will use the £400m ($580m, €519m) that remains of the London Mayor's affordable homes budget to support housing associations to build more London homes.

1. The 16-34 age group have seen a collapse in home ownership, ONS

1. The 16-34 age group have seen a collapse in home ownership, ONSThis is not, however, exclusively a London problem. Indeed, back in 2004 the Barker Review concluded that the UK would need to build 250,000 new homes per year just to keep pace with the growing population.

But of course, this has not been achieved.

Matters are now so extreme that housing charity Shelter reported last year that a quarter of all adults under the age of 35 in the UK were still living in their childhood bedroom with their parents.

How big is the UK's housing shortage today?

Estimates vary, and the 2014 Lyons report estimated a shortfall of around 1 million homes.

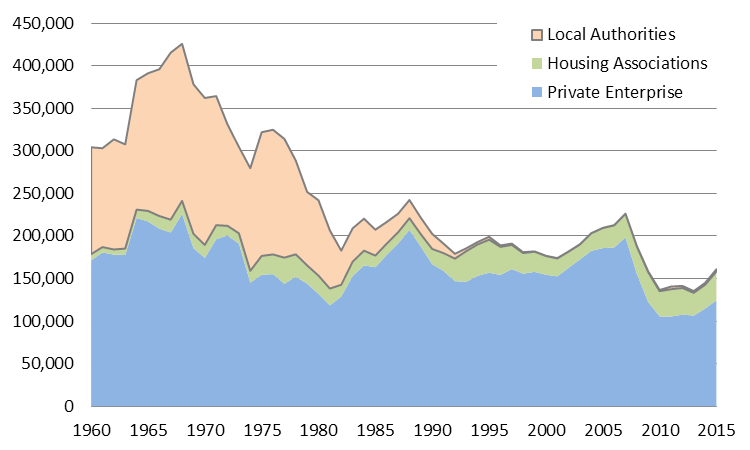

Just look at the number of homes built per year since 2004, the year of the Barker Review. The National Housing Federation (NHF) assesses the need for new homes at 245,000 across the UK each year. But, in the last 11 years there has not even been one year where that many homes have been built.

2. Steady decline in house building volumes since the 1960s

2. Steady decline in house building volumes since the 1960sDepartment of Communities and Local Government

If…