Walker Greenbank (LON:WGB) shares have suffered much as predicted in the Stockopedia anatomy of a profit warning and continue to drift downward. Not helped perhaps by the recent announcement by John Lewis of a dramatic profits fall. I suspect the John Lewis partnership is an important customer for the company. Unfortunately I bought a small position in Walker Greenbank (LON:WGB) on the basis of the improved trading outlined in the AGM statement in late June, only to be floored by the profit warning one month later. I compounded this error by not selling on the profit warning, which I would ordinarily do. My reason for continuing to hold is that Walker Greenbank (LON:WGB) is trading according to broker's notes at a substantial discount to NAV of around 90 pence, with little or no value attributed to the various brands.

I am of the view that brands like Morrison and Sanderson have significant value and would be attractive to companies, such as Colefax (LON:CFX). Added to this Walker Greenbank (LON:WGB) remains profitable and based on current estimates has a dividend yield >6% twice covered by revised earnings. As for balance sheet strength I will defer to Graham Neary's recent commentary from the SCVR on 25th July

"Checking the most recent results statement, the company is in a net debt position after making an acquisition but still had £12.2 million of headroom as of January 2018. The balance sheet is heavy with intangibles but still has NCAV of £13.9 million (i.e. it still has positive net assets even if you write all intangibles and PPE down to zero)."

We hopefully will know more when the interims are released on 10th October.

All views and thoughts welcome.

Jonno

Interesting write up Jonno. It reminded me that I intended to have a scout around “discretionary retailers” in general; I’m bearish about them in the near term but that will pass and I due course there will be an opportunity to sort the wheat from the chaff.

Anyway I hadn’t looked at Walker Greenbank (LON:WGB) for some years, but reading you write up I was thinking to myself this must have “value” trap written all over it. But no, actually it is probably the most extreme example of a “contrarian” play as you could find.

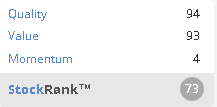

High Quality, high Value and low Momentum, writ large.

So on the one hand you’re going against Stocko by riding out the profits warning, on the other hand you are invested in a winning Stocko style.

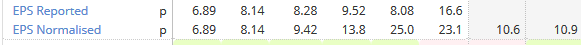

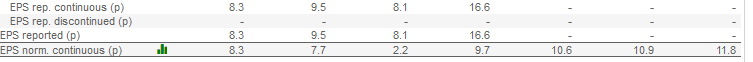

I would caution though that with value being a backwards looking measure and with eps forecast to fall 55%, that value measure may not hold for long.

I can’t recall if Stocko’s value measurements work on a rolling 12 month basis or only on full financial years, if the latter, then the apparent value might still be on show for another seven months, but I would caution that feels like a false signal to me.

On the balance sheet, whilst I can see that there is a healthy discount to Net Asset Value, as Graham says the balance sheet is heavy with intangibles so the Tangible Net Asset Value is only 42p / share. (and the quoted CNAV only 19p)

So I would argue that it’s not really a value case on the balance sheet.

But do the brands have value? When you quoted Morrisons and Sanderson; I thought a grocer and an IT services company, what have they got to do with the price of wallpaper? I think the first one should have been Morris & co, but as you can tell the brands mean nothing to me.

I am not a good judge of the matter as I have a hatred of wallpaper, stemming from a former house of mine having had hideous wallpaper attached by Gorilla glue or some such. Do people really buy wallpaper on the basis of brand? I do not have the first idea, but I would want to be clear it was true before I ascribed any value to the brand names.

So whilst I am attracted to the quality of the business I can’t find anything that would make me want to own them at this time.

The July profits warning aside, retailers are reporting no let up yet to the “challenging” market conditions so I can’t really see any reasons to be cheerful in the short term.

Bear in mind though that I tend to take a much shorter term outlook that I did when is a purer value investor, so I am thinking about reasons for a higher share price in the next 6 or 12 months. Longer term it could be a very different story and it is fair to note that someone might see the opportunity and leap in with a takeover at something above the distressed price in the meantime.

For me that is an opportunity I am prepared to pass up. In the future I might be interested if and when we can see some positive momentum in consumer spending and / or in WGB’s momentum rank.

That is all just my opinion though, so as ever, everyone needs to make their own mind up.

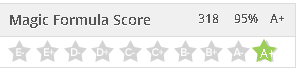

Just taking one more look at the stock report, I see that Walker Greenbank (LON:WGB) have a stellar Magic Formula Score.

So I am effectively arguing against Joel Greenblatt, which might not be too smart!