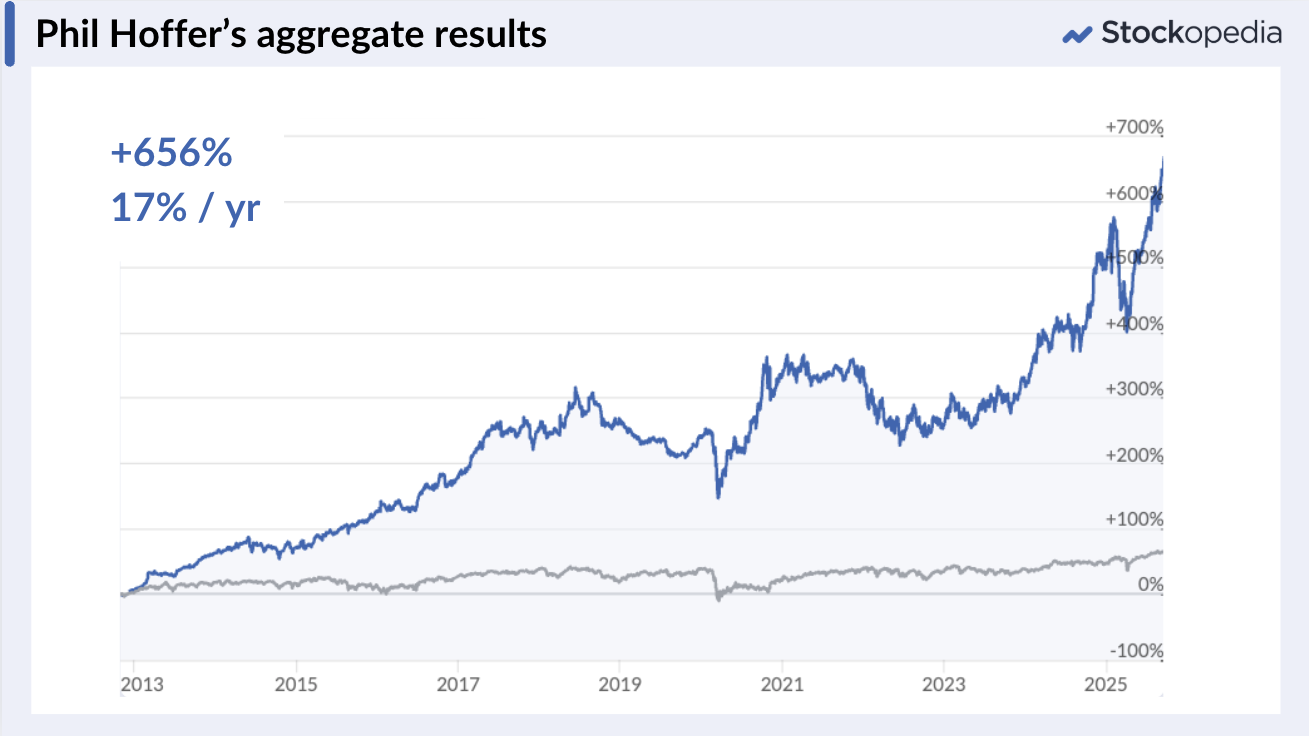

Last night, we hosted our first-ever “subscriber special” webinar with Phil Hoffer - one of Stockopedia’s earliest members - who has compounded his investment portfolios to a 656% gain over 13 years.

Phil’s story mirrors the journey many investors go through. He started out buying share tips in hot sectors, but over time discovered that crafting his own consistent, repeatable process was more reliable.

Once he started letting quality, earnings revisions, and price momentum do their work - his results improved dramatically.

I thought I'd start a thread to let subscribers share their comments, and perhaps Phil will contribute.

You can watch the webinar replay here.

Phil's track record

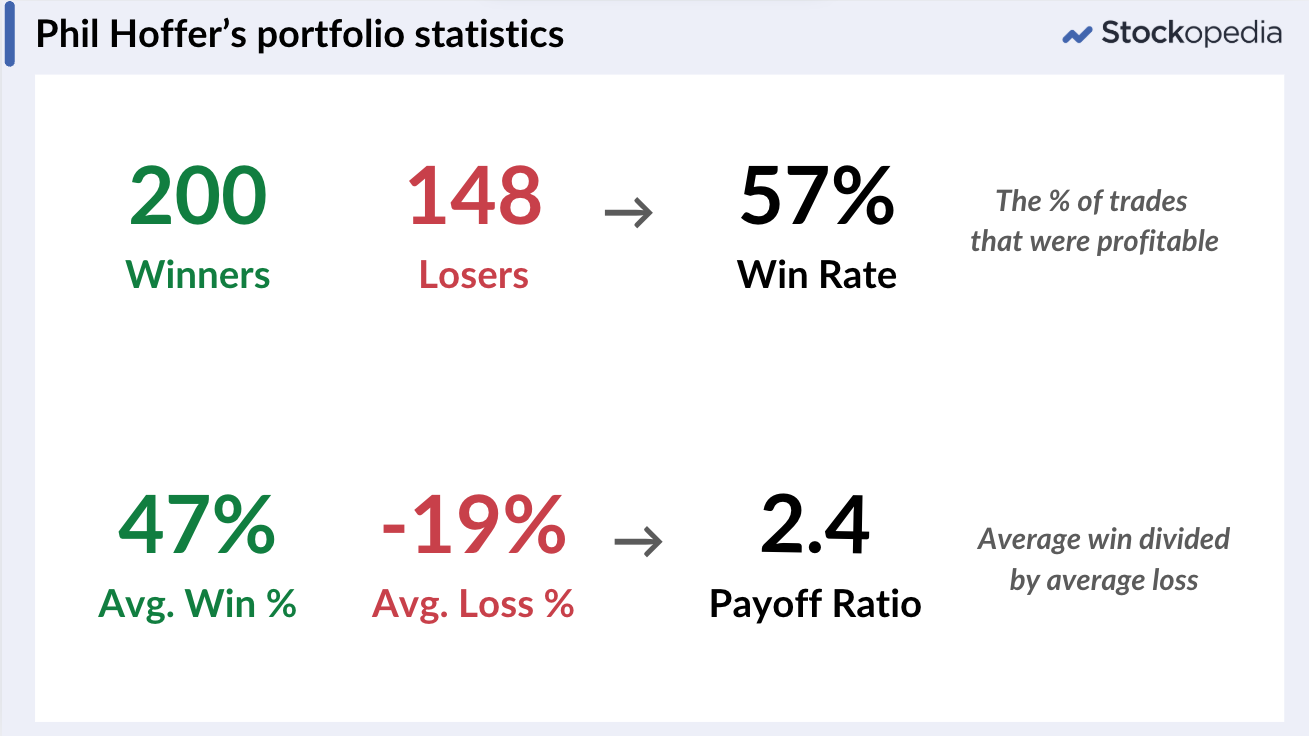

Phil was kind enough to share his historic records with us, so we pulled out his performance history and portfolio statistics. We will put the slides on the event page soon, but here are a few of the highlights.

A few of Phil's portfolio statistics tell the story - a consistently high win rate at 57% and far higher returns from his winners than his losers. As Peter Lynch once said "if you get six out of ten correct in this game you are good".

What Phil buys

Phil’s sweet spot is high-quality companies with strong price and earnings trends - what we’d call high QM stocks, or High Flyers at Stockopedia. He's quite value agnostic - usually he pays a premium P/E for great companies, while occasionally he finds bargains.

In practice, that means (in brief!):

-

QM Rank ≥ 90, Quality > 80

-

Profitable, cash-generative, with ok balance sheets.

-

Price near 52-week highs

-

Positive recent broker upgrades for the next 1–2 years

-

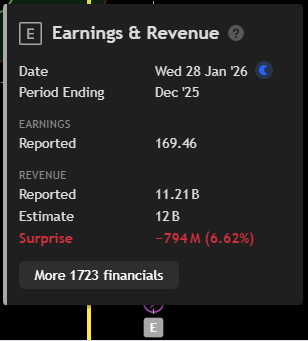

Recent results beating expectations

“The market and the data tell me what’s working. I don’t need to be a sector expert to ride it.”

He has very strict criteria and so has ventured internationally to find more stocks. He buys shares across the UK, Europe, US, Canada, and Asia and Australia - wherever the opportunities line up. He currently has 52% in US stocks.

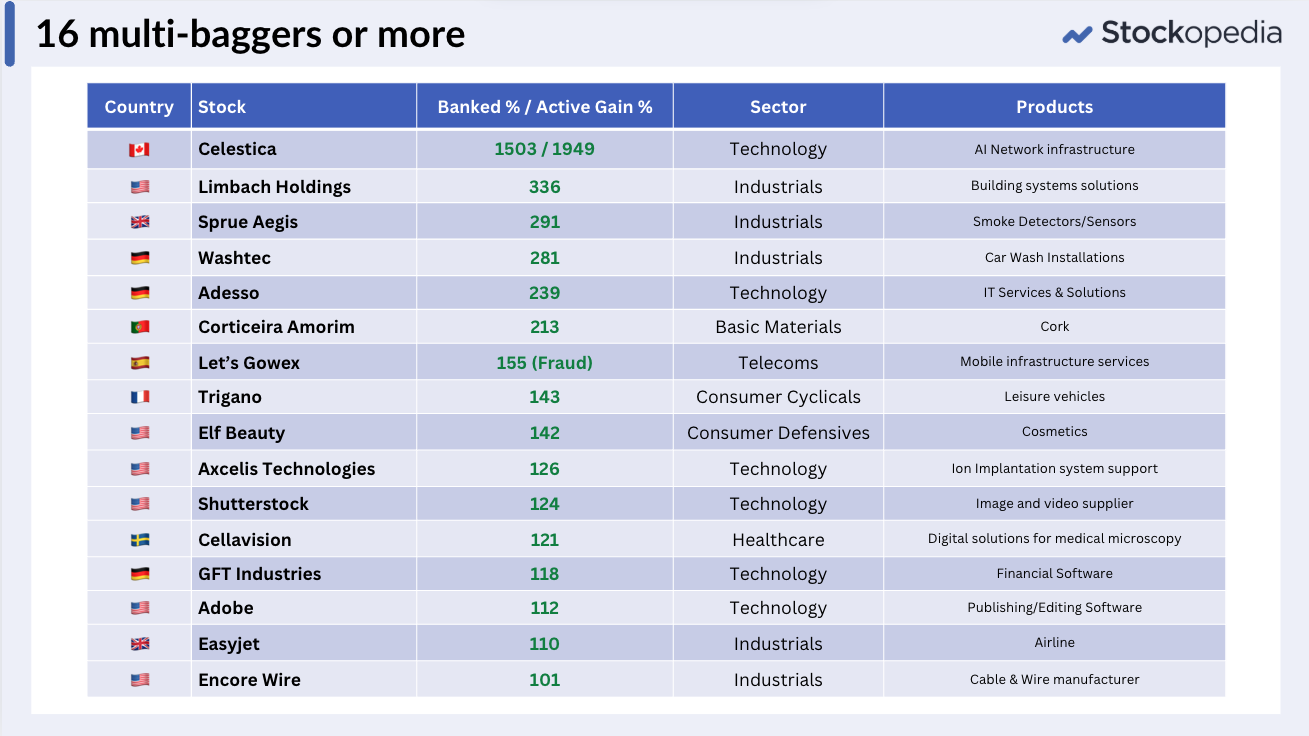

Phil has had 16 multibaggers over the years:

Phil's selling and portfolio rules

Selling is where many investors come unstuck. Phil has clear sell rules.

…