Managing risk and cutting losses can have a significant positive effect on your portfolio returns. Also below is why tracking your trading results is key to successfully managing risk.

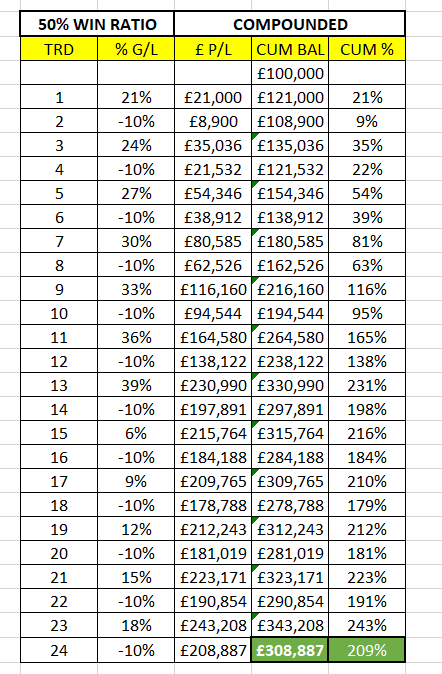

Firstly, hopefully the table above is an eye opener for how losses work geometrically against you - i.e., the more you lose the more required to get back to even.

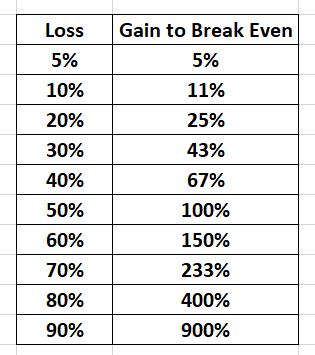

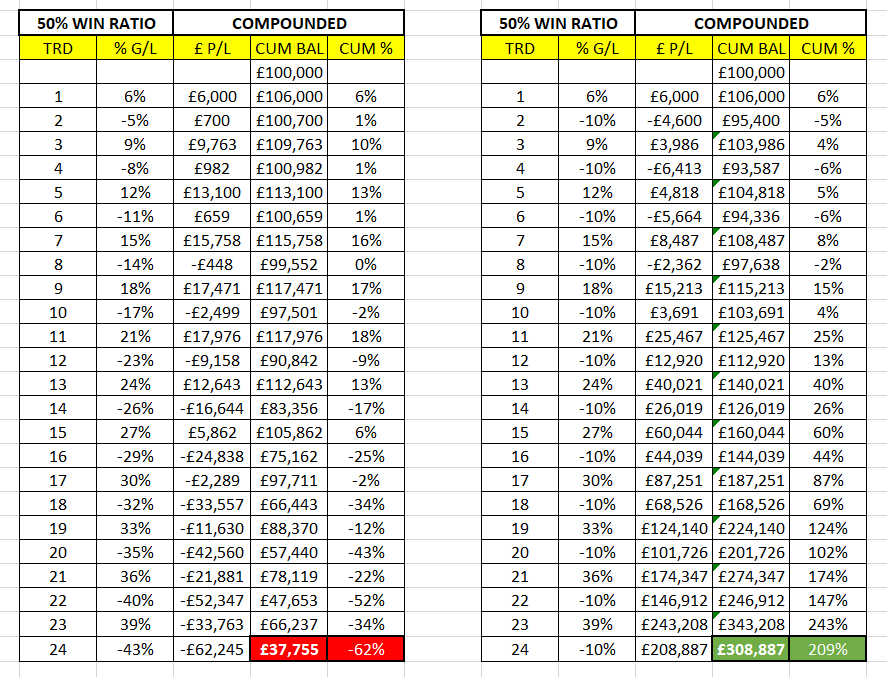

Below is a table showing example trading results and the difference between managing risk (keeping losses small) and not managing risk. The difference is world class performance (+209%) vs losing 62% of your portfolio value.

- The starting values are exactly the same, £100,000.

- The number of trades is exactly the same, 24.

- The ratio of winning trades vs losing trades is exactly the same, 50/50.

- The gains on winning trades are exactly the same.

- The only difference is one set of results caps losing trades at 10%, whilst the other set of results increases each losing trade by 3% (starting from 5%).

At the end of 24 trades one person has managed to lose 62% of the value of their portfolio and is left with £37,775 from their starting £100,000. The other person has achieved a 209% return and now has £308,887. In other words, in the space of 24 trades by managing risk, one person is up £271,112 over the other.

Remember how losses work geometrically against you? The person who lost money now needs to make back circa 2.65 times his £37k just to get back to even.

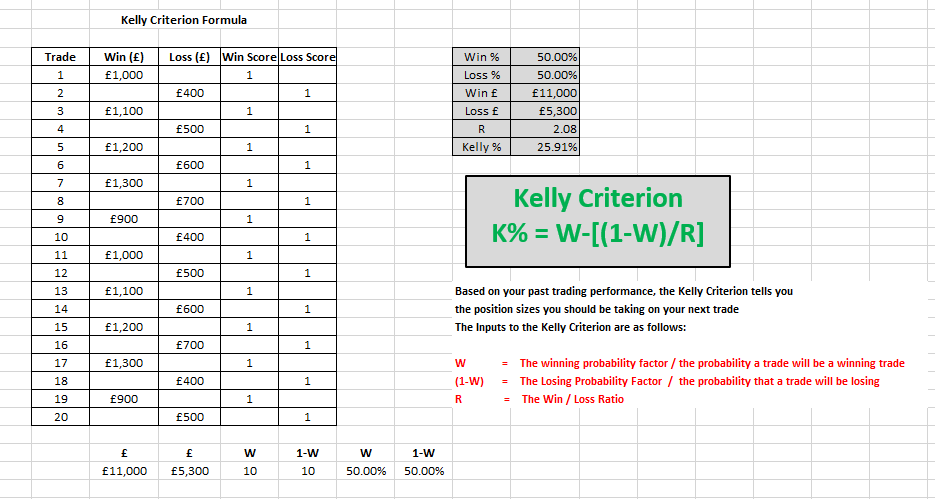

Below is the Kelly Criterion to help you further understand your own returns and your optimal position sizing based on your actual returns.

As shown in the Kelly Criterion table above, by keeping losses small comparatively to gains a speculator can achieve high returns even being wrong half the time - 50/50 win loss ratio.

In the above example the Kelly Criterion is showing, based on actual results, the speculators optimal position size would be 25.91%. This might seem too high, especially when trying to manage risk, so many successful speculators in this situation would apply a half Kelly position - i.e., circa 12.5% of the total portfolio value. However, most would scale into positions so the first position they take might be quarter Kelly.

Cheers,

JC