XLMedia (XLM). This stock is showing the chart characteristics that Minervini seeks in his investments. The business appears to be financially sound and to have a "technology moat". Although it was predominantly a betting industry business XLM has expanded into the credit card and cybersecurity industries. This is a strong positive for me as I think that expanding the model into other areas/industries could lead to very significant growth. Their technological expertise is likely to allow them to do this successfully and keep ahead of competitors.

I also like the positive cash position and recent large director purchases. An excellent review of XLM was recently posted on Stockopedia.

https://www.stockopedia.com/content/lsquothere-once-was-an-ugly-ducklingrsquo-ndash-xlmedia-xlm-203107/

I am long in this share and recently topped up during the spurious dip in price caused by the dividend delay (not the fault of XLM and now paid).

XLM has had a good run, I am also a holder, so I am very pleased with how this stock has moved this year.

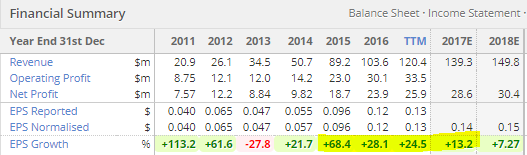

However from what I understand of Minervini it doesn't yet meet his criteria as a super performer, specifically from a fundamentals perspective. Although revenue is moving upwards, margins are not really increasing and EPS growth is reducing. So for the moment I don'y think it would tick all the boxes.