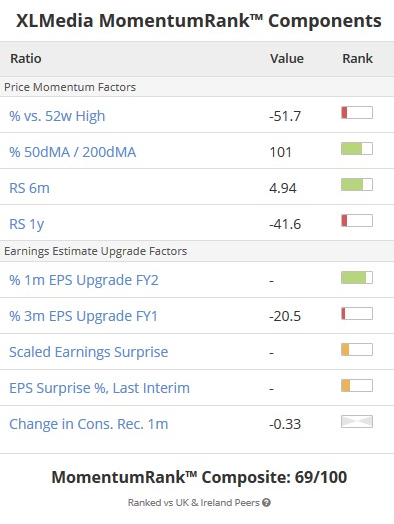

My thoughts on XLMedia. Has a stock rank of 93.

Could XLM be a good contrarian investment?

XLMedia is a performance marketing company. The company owns over 2,300 websites, mainly within the online gambling, personal finance and cyber security niches.

Is the company profitable?

Since their IPO on AIM in 2014 the company has been profitable with rising revenue and growing net profits.

Key metrics include –

Operating margin averaging 28%

Return on capital employed averaging 27%

Return on equity averaging 22%

However in 2018 the revenue and resulting profits took a dip as one of their biggest websites lost organic traffic when Google updated their algorithms.

This resulted in the share price dropping from over 200p to a price, at time of writing, of 46p. Quite a fall by anyone’s standards. This of course was in the background of a general negative market for whole UK stock exchange.

2018 also saw a fall in free cash flow too.

Is the company at a fair valuation?

The company is currently being valued at £107 million. It has £40 million cash in the bank and no debt. Dividend is currently at 10%. XLMedia Plc have historically paid dividends and intends to continue doing so. The Board’s policy is to pay out at least 50 per cent of retained earnings by way of dividend.

With a current PE of 5, I think this represents extremely good value.

My hypothesis on why XLMedia could be a contrarian play

Since its IPO on the AIM stock exchange in 2014 XLMedia has been on a spree of acquisitions and building a big portfolio of affiliate websites. One of its biggest buys was the personal finance website moneyunder30.com for $7million.

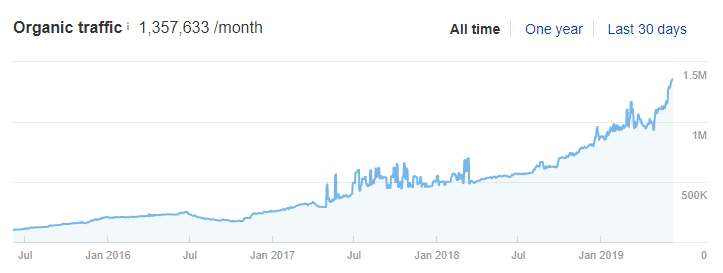

I am presuming this website is the companies biggest earner. If you look at the chart below you can see the organic traffic of this website has grown tremendously since they purchased it.

stats from ahrefs.com

This suggest two things to me –

1) They have a team in place who knows how to grow website traffic

2) I presume the increase in traffic has resulted in more conversions and more revenue for the company

Coming from a digital marketing background I can testify how difficult search engine optimisation (getting lots of organic traffic from Google search engine) has become. This is due to increased competition and multiple changes with googles ranking algorithm.

…