Introduction

Zytronic is a company that I first heard about on Paul Scott's blog roughly eighteen months ago. This isn't too surprising given that they're a niche manufacturer of touch screens who supply to industrial clients; hardly a household name. And yet many of us will have seen (or felt) their robust, vandal-proof products in a public space and been impressed by the sheer scale of the displays.

The problem with Zytronic is that they warned very significantly on profits back in May 2013 and the outlook appeared cloudy at the time. In the end it took the best part of a year for the company to demonstrate that this was a one-off blip and, for obvious reasons, the market in the shares remained subdued for perhaps another six months.

Now, though, the shares have reached the level that they were at before the profit warning (although still 20% down on the all-time high point) and the recent full-year results demonstrate real strength. My questions then are: is the Zytronic recovery sustainable; is there more growth left in the tank; and is it reasonable to buy at the current price as a long-term holding?

How do the numbers look?

There's no doubt that Zytronic, as an investment, is of above-average risk. It's small (£45M), listed on AIM (lax regulation), reliant on lumpy orders with limited visibility (customers order on demand) and engaged in an innovation arms race (touch screens are constantly evolving). These are all big red flags for companies with weak management or who supply high-volume, low-margin markets or those without some sort of moat.

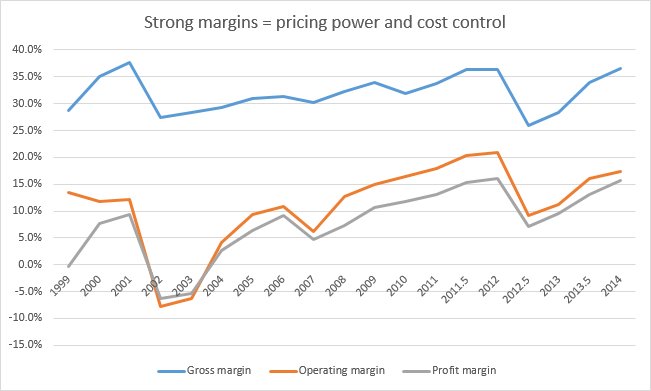

Fortunately Zytronic exhibits none of these problems and the consistently high gross margin demonstrates that they're in a sensible low-volume market. The net profit margins have proved more volatile but I think that there are two key points here: the business was badly impacted by the World Trade Center attack, and the 02/03 years were tough, but since then management have been hot on controlling costs and maintaining focus:

Another aspect of cost control, and clout in the market so that you don't get pushed around by the big-boys, is how effectively you manage outstanding debts. In a small firm like this you might expect to see invoices being paid within a couple of months, on average, and Zytronic…