Good morning!

I am back from a fine holiday in Athens - should have gone there a long time ago!

The economy and general state of economic progress did not seem to be doing particularly well on the ground, although that did not detract from a fantastic experience of Greek culture, cuisine, architecture and history. Did I mention the food?

The experience of Greece within the EU has been, let’s be diplomatic, somewhat mixed. And today is apparently going to be the voting day for MPs when it comes to Mrs May’s EU Withdrawal Agreement. It is natural that questions of politics will be on our minds.

This being the SCVR, I will be covering company news first, referring to macro developments only if they have a major impact on the markets.

Best,

Graham

Today we are covering:

- Flybe (LON:FLYB)

- Frontier Developments (LON:FDEV)

- Elegant Hotels (LON:EHG)

- GYM (LON:GYM)

- Cloudcall (LON:CALL) (by Paul Scott)

- Games Workshop (LON:GAW)

- Boohoo (LON:BOO)

- Kape Technologies (LON:KAPE)

- Dignity (LON:DTY)

Flybe (LON:FLYB)

- Share price: 2.6p (-37%)

- No. of shares: 217 million

- Market cap: £6 million

This looks like very bad news for those who were hoping for an improved offer for Flybe.

The consortium, Connect Airways (Virgin Atlantic/Stobart), is lending Flybe's main operating company £20 million, under revised conditions. Flybe wasn't able to satisfy the original conditions.

£10 million of the funds will be released today - implying that it is needed to keep the lights on?

An agreed sale of Flybe's main trading companies to the consortium for £2.8 million will proceed without shareholder approval, since Flybe now has a standard listing on the LSE, rather than a premium listing.

The rationale for switching to the standard listing was presented as follows in Flybe's interim report last year:

This would have the benefit of allowing the Company greater flexibility when considering divestments, particularly to recycle cash, as the current low market capitalisation places restraints and complexity on such disposals for companies with a Premium listing.

A standard listing does offer greater flexibility, but I wonder if the lack of a shareholder vote requirement might have been of greater concern than any issues around recycling cash?

Flybe's recommendation of the offer, published on Jan 11, stated that it was "an attractive option for Flybe's employees, pension scheme members and creditors" - no mention of shareholders.

Today's deals are described as "preserving the interests of [Flybe's] stakeholders, customers, employees, partners and pension members".

If I'm reading it correctly, shareholders will still end up with 1p if the Recommended Offer is accepted by shareholders.

If it's not accepted, then shareholders will have a PLC with c. £2.8 million in cash and nothing else (1.3p/share).

I could be reading it wrong, that's just my interpretation.

It looks like it's over, either way. FLYB shareholders will no longer own an airline.

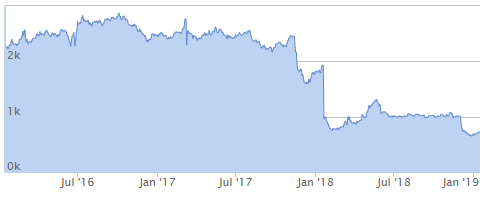

Frontier Developments (LON:FDEV)

- Share price: 911p (unch.)

- No. of shares: 39 million

- Market cap: £353 million

Notice of results and trading update

Plaudits must go to those who wrote this update. We get transparent expectations:

Frontier expects to report revenue of approximately £64 million for the period compared to £19 million recorded in the interim results last year.

Based on trading performance in the first six months of the financial year, combined with sales over the Christmas holiday period, the Board remain comfortable with the analyst revenue projections of £75 million to £88 million for FY19 (the year ending 31 May 2019) and anticipate that revenue should exceed the mid-point of this range.

Frontier is a video game developer and publisher with three franchises under its belt.

The latest one, Jurassic World Evolution (JWE), is by far its biggest achievement to date, but all three continue to make sales.

Note the heavy revenue weighting to H1: £64 million in H1 sales, versus £75 million to £88 million for the year as a whole. JWE was launched around the beginning of H1.

Frontier's fourth franchise is in the works, release targeted at some point in FY 2020. I suppose it's better to be vague about this in public, rather than committing to a date which can't be met.

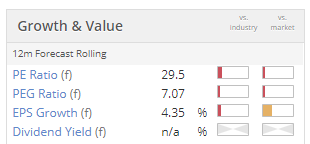

I like this company but I don't know how to predict the success of its future releases and therefore feel unable to value it. I'll be more interested in the shares when the company is more diversified across different franchises and when the share price looks less optimistic.

For what it's worth, though, the forecast P/E ratio shown above might be much too high - if the fourth franchise is released over the next 12 months and is a hit, then earnings might turn out much better than this P/E ratio implies.

As a snippet of industry news for GAME Digital (LON:GMD) investors, I would note that "the majority of [JWE] unit sales on all three platforms (PC, PlayStation 4 and Xbox One) are from digital sales", as physical discs now account for the minority of sales.

Elegant Hotels (LON:EHG)

- Share price: 70p (+3%)

- No. of shares: 89 million

- Market cap: £62 million

Elegant Hotels Group plc ("Elegant Hotels" or the "Company" or the "Group"), the owner and operator of seven upscale freehold hotels and a beachfront restaurant on the island of Barbados, today announces its audited results for the year ended 30 September 2018.

Let's sort through the highlights:

- average daily rate up 2%.

- RevPAR down slightly, suggesting that occupancy is down (RevPAR = avg daily rate * occupancy rate).

- Occupancy is indeed down, 62.3% vs. 63.9%. The company says this is due to its acquired hotel missing the peak tourist season. Without that, occupancy was "largely consistent" (down slightly?) vs. the prior year.

Outlook

Trading is in line with market expectations. Caution over macro conditions and UK consumer discretionary spend.

My opinion

The results look reasonable, and the company's adjustments to the numbers aren't too heavy. The only exceptional costs were $0.8 million of pre-opening costs for its new hotel and some restructuring costs.

I'm also very pleased and impressed that the company has taken the following initiative:

From FY 2018 onwards, the Group no longer excludes non-exceptional share-based payment charges from these measures in line with best practice.

Bravo!

Kudos to Elegant (or should I say κῦδος) for recognising that share-based payments are not exceptional, but are instead a matter of routine for many companies.

This should be a lesson for others, who present adjusted profit measures excluding share-based payments - they aren't exceptional, so don't mislead investors by showing us numbers which don't count them.

Anyway, let's drill into the profit figures a little bit:

- adjusted EBITDA $19.7 million. EBITDA margin the same as last year.

- operating profit $14.2 million (slight reduction in operating profit margin to 22.6%).

- PBT $10.6 million, down compared to last year but up 5.5% on an adjusted basis.

Overall, I view this company as offering decent prospects to investors at the current share price.

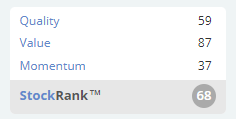

The StockRank agrees:

The company thinks that its net asset value is c. 153p/share, based on GBPUSD at 1.30. This is based on the most recent valuation of the property portfolio by CBRE, and after deducting net debt of $72 million. This property valuation is not reflected on EHG's balance sheet.

I tend not to buy shares in hotel groups, personally, but this one looks more interesting than most. Most of its customers are from the UK - a recovery in GBP will give a big boost to them and therefore to EHG.

GYM (LON:GYM)

- Share price: 211p (-6%)

- No. of shares: 138 million

- Market cap: £291 million

As a prospective investor in GYM (LON:GYM), I'm excited to see that its share price has fallen back - although existing shareholders may have a different emotion!

Let's get up to speed with progress at this gym roll-out that uses the the no-contract, 24/7, low-cost model:

- 158 gyms (up from 128)

- 24.2% market share in the low-cost gym segment (2017: 22.4%)

- revenue misses expectations due to later openings than planned and more weeks of closure due to rebranding of acquired gyms

- 15 to 20 new gyms planned for 2019

It looks to me as if most of GYM's growth in 2018 came from growth in the low-cost segment as a whole, rather than coming from GYM's market share growth within that segement.

Assuming that the company is not planning to reduce its market share, the company's plans for 2019 bring me to the conclusion that the low-cost gym segment is forecast to grow at a slightly slower pace - c. 10% maybe?

Outlook: full year adjusted EBITDA for 2018 to be £37 million. Not entirely helpful, since prior expectations aren't given and adjusted EBITDA is not the only metric that counts. If I have time, I will listen to the conference call later, to see if more useful comments were made.

My opinion

Worthy of further research and at an interesting entry point in my view, given expectations for a significant increase in net income in 2019/2020. If you believe that the low-cost gym segment is set to keep growing at a healthy clip over the medium-term, then it could be very attractive.

This section by Paul Scott.

Cloudcall (LON:CALL)

- Share price: 95p (+4%)

- No. of shares: 24 million

- Market cap: £23 million

(Please note that Paul has a long position in CALL)

Morning all!

I like this morning's update from £CALL (I have an existing long position, held for many years now).

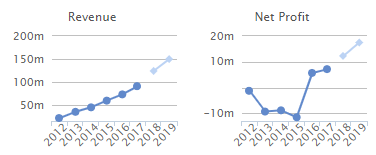

It's been a good example of a jam tomorrow company which has taken far longer, and spent far more money (through repeated placings) to achieve its business plan. That's why the market cap is so bombed out, despite the company operating in a high gross margin, recurring revenue, interesting tech niche.

However, I think the company could now be near that lovely tipping point, where market sentiment suddenly changes from glass half empty, to glass half full.

Growth today is good, and accelerating in both Q3 and Q4, with positive outlook comments too. The company said that sales would accelerate in H2, due to its increase in overheads (primarily developing better product features, and S&M). Sure enough, sales have accelerated in H2 as promised, so mgt credibility should begin to improve.

Cenkos forecast from Sep 2018 (on Research Tree) shows losses being greatly reduced in 2019, from £3.7m in 2018, to £0.7m in 2019), which is driven by a strong increase in gross profit - remember there's huge operational gearing here, as organic revenue growth is strong, and it's achieving an 80% gross margin. So when profits do come, they could really soar after a few years. This is what makes this share so interesting, in my view.

Looking at the Cenkos figures, they show no increase in admin costs in 2019 over 2018, which strikes me as unrealistic. Since costs were cranked up during 2018, then I would expect the total in 2019 to be higher - as it's a full year of increased costs, plus wage inflation, etc.

Therefore, my view is that the Cenkos profit forecast is probably a bit optimistic, but I reckon the company is on track to get fairly close. Again, that's on my list of things to ask at the CMD.

What about cash? It's looking tight again - with only £0.9m remaining at end 2018. There is a £1.85m undrawn bank facility, but in the past the company has preferred to do a top-up placing, rather than going overdrawn. I suspect that might happen again this time. Maybe that's the underlying reason for this Thursday's capital markets day? To generate interest & increase the share price, ahead of another placing? I'll be attending the CMD this week, so will ask that question!

It only needs a top-up, so I reckon a placing of £1-2m would push it over the line, to breakeven & then profit. That's not really a big deal, as only 5-10% dilution, and with positive performance reported today, and a stronger outlook than we've had for a while, I think a small placing could be done fairly easily, if needed, and probably at only a modest discount. So for me, the low cash position is not a deal-breaker. Placings are only a problem when they're (a) big, and (b) from a weak position, e.g. after a profit warning. Neither is the case here.

My opinion - it's been a painful journey, but I think things are coming good here.

I'll report back if anything interesting comes from the CMD later this week.

Back to Graham.

Games Workshop (LON:GAW)

- Share price: £31.85p (+1%)

- No. of shares: 32.5 million

- Market cap: £1,035 million

Another very good six months by Games Workshop, the creator of Warhammer miniatures.

The only element I'm questioning is the gross margin, which fell from 72% to 67% (still an extraordinarily high level, it must be said).

The report concedes that the company could have done better on gross margin. Operationally, it is a time of transition:

As we move to complete a series of major investment projects, our gross margin and stock levels are not currently where we'd like them to be. We're looking forward to our new Nottingham factory and ERP projects completing, allowing us to fully optimise our Nottingham site. From there, we'll begin to upgrade our warehousing capacity in both Memphis and Nottingham. These further investments will help us maintain our current volumes, increase efficiencies, and give us good scope for sales growth in the future.

The quarterly dividend is 25p, a reduction from the most recently paid 30p.

Return on capital employed is tremendous at 96%, down from 119% a year ago.

Cash levels and overall efficiency were affected by a negative working capital movement of £12 million: inventories and receivables built up, while trade payables were reduced. It's perhaps a slight worry, but management have acknowledged it and are keenly aware.

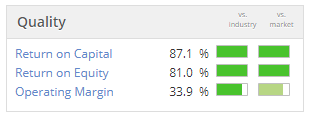

I am a potential purchaser of GAW, though still waiting for that moment when its valuation and my preparation coincide with an opportunity. A unique company with super metrics:

Boohoo (LON:BOO)

- Share price: 177p (-9%)

- No. of shares: 1163 million

- Market cap: £2,058 million

Curious to see the share price fall when the company itself is happy with strong growth over the last four months of 2018.

Group revenue growth expectations for the financial year ending in February have been upgraded to 43%-45%, from the previous range of 38%-43%.

- revenue +43% at constant FX

- gross margin up 170bps to 54.2%

The disparity between bohoo and PrettyLittleThing (PLT) has perhaps left a sour taste in shareholders' mouths, since BOO shareholders only own 66% of PLT:

- boohoo year-to-date revenue +13% at constant FX

- PLT year-to-date revenue +115% at constant FX

Boohoo was founded by Kamani and Kane in 2006, and Kamani then founded PrettyLittleThing in 2012. Amazingly, PLT is now almost the same size as boohoo.

I suppose a concern might be that Kamani can always make a new online brand and, given enough marketing spend, create something that is again around this same size, which BOO shareholders would not own, and would cannibalise the existing brands?

A more obvious concern is that boohoo has reached a natural limit and won't achieve very high growth levels again. If PLT growth were to slow too, as it surpasses boohoo in size, then the growth story would be over.

I'm just thinking out loud here - it's not something I want to get involved with, so I'll leave it up to others to analyse in greater detail. Perhaps I'm being too cautious, and allowing the share price movement to lead my thoughts.

Kape Technologies (LON:KAPE)

- Share price: 106p (-3.6%)

- No. of shares: 142 million

- Market cap: £151 million

I have run out of time but I note that this cyber security company is guiding for adjusted EBITDA "slightly above market consensus" at $10.4 million.

It made an important divestment and has also been active on the acquisition trail. There is too much for me to analyse so I will leave it there. It may be of interest to others.

It has a StockRank of 53, implying average statistical chances - so I wouldn't write it off like I often do for "Sucker Stocks"!

Dignity (LON:DTY)

- Share price: 715p (-0.7%)

- No. of shares: 50 million

- Market cap: £358 million

Many investors have long given up and moved on when it comes to funercalcare provider Dignity.

I note that it is reporting a positive surprise for 2018:

- small growth in market share

- funeral average income higher than anticipated

- overheads lower than expected (marketing spend deferred to 2019)

Underlying operating profits will be approx. £79 million, ahead of current market expectations.

However, there is no change for 2019 expectations - average funeral incomes will be lower, as planned price reductions come into effect.

I would view the small growth in market share as highly encouraging - it says to me that the company's price reductions are working, and that its competitive position has stabilised.

It does have a large debt load to be reckoned with. If you can see it managing its debts, then a P/E ratio of 10x at this bombed out share price might be appealing:

Phew, that was a lot of updates! All done for today.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.