As I flagged up in my year-end review, I’m shifting the portfolio’s minimum holding period from six months to nine months. To avoid too long a time without adding new stocks, I’m making this change gradually.

In May I looked at seven-month old stocks. This month it’s time to review the portfolio holdings that are eight months old. Three stocks qualify:

Small-cap fund manager Miton Group

Convenience store chain McColl’s Retail

Logistics firm Wincanton

A quick look at the SIF portfolio suggests that it’s been a successful eight months for all three firms, with an average total return of 29.6% on each stock. Let’s take a closer look.

Miton Group

Miton’s fund management business is headed by small-cap expert Gervais Williams, who also has a 6.9% stake in the firm. Our own Ben Hobson interviewed Williams last year. If you haven’t read the interview, I’d recommend it.

Miton’s share price has risen by 43% since I added it to the portfolio in November. One reason for this is the above-average investment performance of the firm’s funds. Management say that 12 out of the company’s 15 funds have been first or second quartile performers from when their current managers took over, until 30 June 2016.

One of the reasons why I decided to extend the minimum holding period for each stock was to make sure that all companies published at least one set of accounts during their time in the portfolio.

In the case of Miton, this has worked to my advantage. The group’s 2016 results showed that average assets under management rose by 20% to £2,783m last year. Fee margins were maintained, and the group’s adjusted pre-tax profit rose by 70% to £5.1m. Strong cash generation allowed the board to increase the dividend by 49% to 1p per share.

Miton’s 12 July H1 trading statement was also well received by the market. The first half of the year saw average AuM rise by 13.4%, to £3,157m. Net cash was £18.2m at the end of June, despite a £2.6m share buyback.

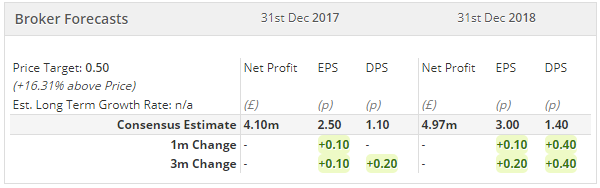

Although Miton’s management don’t seem to have explicitly updated their guidance for the year, consensus forecasts for 2017 and 2018 have risen recently:

Miton now rates as a Super Stock under the StockRank Style system and has…