Good morning! There is a mild profit warning from Braemar Shipping Services (LON:BMS) this morning. These shares have doubled from the low point in Sep 2011, and now stand at 580p, for a market cap of £125.6m. Today's IMS states that;

...slower than expected contract awards at Braemar Casbarian in the US ... is expected to result in Group profits for the year being modestly below management expectations.

This factor has offset steady or good performances in their other divisions. Checking the archive here, I haven't reported on this company before, so I'm not familiar with the relative importance of its various divisions. On a simplistic level though one assumes that shipping is likely to be a positive area to be in, as economies generally improve, generating more import/export activity.

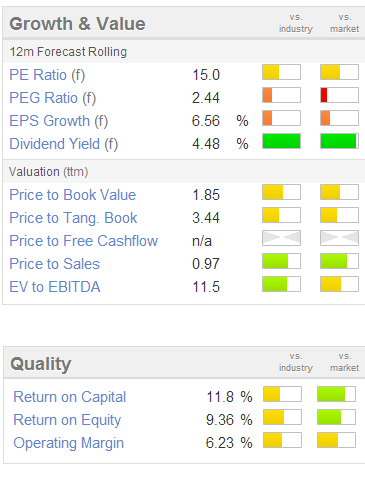

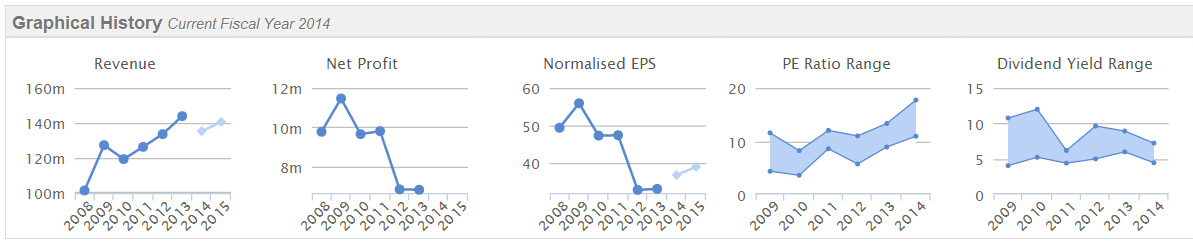

Having a cursory glance at the Stockopedia page for this share, I note that their profitability has been in steady decline since 2008/9 (it's a 28 Feb year-end), the company has (declining) net cash, and has consistently paid a 26p dividend (yielding a solid 4.5%). It doesn't look cheap on a PER basis, especially as they are now going to miss forecast slightly for 2013/14. It will be interesting to see how the shares react today, I suspect a drop of about 5-10% is on the cards. If they fall more than that, then I might research the company in a bit more detail.

Having a cursory glance at the Stockopedia page for this share, I note that their profitability has been in steady decline since 2008/9 (it's a 28 Feb year-end), the company has (declining) net cash, and has consistently paid a 26p dividend (yielding a solid 4.5%). It doesn't look cheap on a PER basis, especially as they are now going to miss forecast slightly for 2013/14. It will be interesting to see how the shares react today, I suspect a drop of about 5-10% is on the cards. If they fall more than that, then I might research the company in a bit more detail.

As you can see from the graphics below, profitability has been in decline, whilst the valuation on a PER basis has been steadily getting more expensive, which doesn't really make sense! The consistently strong dividend yield could provide the clue though, in that income seekers might have been buying the stock - although 5%+ yields are available with plenty of large caps at the moment, so I personally wouldn't chase a small cap just for a not very well covered dividend of 4.5%.

Unusually, I'm seeing more value in large caps at the moment than small caps, so might even need to reverse my investing polarity, and start looking more at the opposite end of the size spectrum! Although there are always overlooked bargains to be found in the small caps space, even if most stocks are now fully valued (or over-priced). It just takes more work to uncover the bargains.

The opportunities now in small caps are coming from companies that are out-performing, so it's a question of scrutinising trading statements more carefully, and calculating your own forecasts rather than relying on broker forecasts, which can be too pessimistic in an economic recovery. Operational gearing means that profits can move dramatically upwards (or downwards!) where a company has high gross margins, and sees a big change in sales. Yet brokers rarely forecast dramatic movement in profits, so this is where the opportunities lie in my view.

Shares in retailers might come under a bit of pressure today after George Osborne's surprising announcement yesterday of his backing an increase in Minimum Wage, indicating that £7 per hour (up from £6.31 per hour) was needed to restore the purchasing power of Min Wage to pre-Recession levels, and that the country can afford it. This is of course completely unrelated to the fact that we have a General Election in just over a year!

This is an excellent move in my opinion - at the moment we have a ludicrous situation where the taxpayer subsidises businesses (through Housing Benefit, Tax Credits, etc) to pay wages that are below living costs, especially in the South East. There is also no incentive for the economically inactive to seek work, as they are better off claiming Benefits. The businesses that are belly-aching about this should not be in business, if they can't generate enough cashflow to pay their staff enough to live on. As for losing jobs abroad, frankly so what if a relatively small number of unskilled jobs move to low wage economies - in the main they already have done anyway.

I recall when Min Wage was originally introduced, and at the time I was the CFO for a clothing retailer with about 120 shops. I was worried that it would hit our P&L hard, but in fact it made negligible difference, as only a small top-up was needed to some staff, and the rotas were reorganised to trim back on hours worked. So arguably it made us more efficient. Low wages make employers lazy, because they don't need to seek efficiencies.

It might hurt shares in the supermarkets a bit though, and agencies that supply blue collar workers (e.g. Staffline) as investors digest the implications?

Packaging manufacturer, Robinson (LON:RBN) has issued a trading update for the year ended 31 Dec 2013. I last reported on this company on 21 Aug 2013 and used its figures to give a mini tutorial on how to read and interpret a Balance Sheet. So for anyone who would like to revisit that, please click here.

Revenues for 2013 were up 11% to £23.4m, and profits are in line with expectations, and "will show further improved profitability". I'm a bit confused by the figures here. The historic EPS is shown on Stockopedia as 12.5p for 2012, yet the broker consensus forecast for 2013 shows a drop to 11.0p, and a further drop to 10.3p in 2014. That doesn't look right to me, so I've double-checked on another website, and they also have these same forecasts.

The only reason I can think of is that perhaps more shares were issued in 2013, causing to future EPS dilution? I shall have a quick check on investegate. Incidentally, I understand that Stockopedia are hoping to move to a live news feed too, later this year. At the moment they are 24 hours delayed here. That said, it's easy enough to check on investegate, so not a problem in my view. Personally I would love to have click-through links to RNS statemens appear on each company's chart, so that I can see what impact the announcement had on the share price. That would add a lot more value than having live news, in my view.

Right, well I can't see any RNS statements that indicate a large increase in the number of shares in issue, other than some Options being exercised, which increased the issued shares by 1.2%. So the forecasts remain a bit of a mystery here. Perhaps any readers can enlighten me? Anyway, based on the broker consensus, this share doesn't look cheap, on a forward PER of 18.3, but they also have substantial property assets, which could explain the high rating (that, and my suspicion that the EPS forecasts might not be correct). So at the moment, confusion reigns on this one, although there's no reason for the share price to move particularly, as they have today reported in line with expectations results for 2013.

Bioquell (LON:BQE) has issued an update on trading for the year ended 31 Dec 2013. They say that;

Trading remained broadly consistent with that disclosed in the Interim Management Statement on 15 November, 2013

So checking back in our archive here, my comments on 15 Nov 2013 were that their trading statement was too vague to be of any use, as it didn't give any indication of how profit was panning out against expectations. So today's vague statement is just refering back to previous vague statement! Whoever is writing these things needs to up their game - shareholders mainly need to know how profit is progressing. Turnover is for vanity, profit is sanity, so not mentioning profit in a trading update makes the whole thing fairly pointless!

Revenue for 2013 is reported as £44.6m, up 9% against 2012. Stockopedia shows broker consensus forecast at £44.9m, so they are a whisker below, and as they're so coy about mentioning profitability, I can only assume that must also be a bit below expectations?

Current broker forecasts are for a fall in EPS from 9.5p last year to 7.4p this year, so maybe they might come in around 7p possibly? That's just a guess, based on the cautious tone of the last two trading updates. Therefore at 140p the shares are on a PER of perhaps 20 times 2013 earnings. So this share price clearly already factors in an improvement in earnings for 2014. Forecasts are for a bounce to about 10p, and an increased order book reported today perhaps supports that, but personally I'm not seeing enough evidence to give me comfort that risk/reward is favourable. So I'd rather wait to see the results on 18 Mar 2014, and draw a conclusion then.

There is a trading update for the year ended 31 Dec 2013 from Toumaz (LON:TMZ), an early stage technology company. Their key product is a small wireless device that is worn by patients like a plaster, which constantly transmits their vital signs to a computer, this allowing medical staff to immediately receive alerts when any patient needs urgent help. The company has been brilliant in promoting this device to investors, but not as yet in actually selling it. They do report some trials in America though, and the first commercial shipment is happening right now.

Their turnover seems to come from other activities in digital radio. The figures look grim at this stage - revenue of £21.8m, but an EBITDA loss of £10.2m. Net cash was £21.5m following another fundraising, so they can keep going for another two years at this rate of cash burn.

I like the main product, but at 4p the shares are a £48m market cap gamble that these products will take off in sufficient scale to turn Toumaz into a viable business, which it isn't at the moment. So far these shares have been very poor performers, having fallen from 12p to 4p in the last two years, and with more dilution happening at intervals, the upside might be limited. Also there must be plenty of other companies working on similar technology one would imagine? So it's too speculative for me.

There are more trading updates today from the following, which I only have time to mention briefly, as have to dash for a train for a meeting;

T Clarke (LON:CTO) - a building services group

- Trading update for the year ended 31 Dec 2013

- Trading has continued in line with expectations

- One major contract is in dispute & no profit (or loss) has been recognised on this contract as yet (creates uncertainty)

- Net cash of £1m at end 2013

- Order book "solid" at £250m (end 2012: £230m)

- "More optimism" in UK construction market, contract wins are encouraging

My comments:

- Shares down 8% to 68p

- Very low margin business, so difficult to value on PER basis.

- 4% dividend yield - but divis were much larger (3 times) pre-financial crisis, so scope for recovery?

Brainjuicer (LON:BJU) - online market research company.

Trading update for the year ended 31 Dec 2013 - revenue increased 17% to over £24m - excellent Q4 - PBT will be c.£3.5m (2012: £1.5m, 2011: £2.8m) - substantially beating market expectations - cash generation strong, cash of £6.2m at y/e (2012: £3.8m), no debt - Outlook statement vague but positive.

My comments - a very good statement, that drove a 13.7% rise in share price to 365p on the day, so mkt cap now risen to £45.9m. Earnings should be about £2.7m, so I make that a PER of about 17, which doesn't look outrageously expensive for a growth company that is trading well. Although the sharp setback in 2012 concerns me, as the shares dropped from 356p to a low of 203p in Nov 2012-Jan 2013. So looks a bit accident-prone. Might the same Q4 upset occur in future at some point?

Eclectic Bar (LON:BAR) - as the name implies, it's a bar & nightclub operation. So could be a good stock in a recovering economy perhaps? Seems to have a fair bit of debt, and this is a tough sector to make money in, so probably not something that would interest me. A recent IPO, so probably over-priced, as most are currently.

Their trading statement covers the six months to 31 Dec 2013 and says that sales are in line with expectations. Doesn't say anything about profits, so I shall treat this with caution.

Surgical Innovations (LON:SUN) - their shares fell 7% on the day, to 5p, on the back of a disappointing trading update for the year ended 31 Dec 2013. Although revenues rose 13% to £8.6m, higher costs & adverse exchange rate movements have caused EBITDA to be "significantly below" the £2.9m reported for 2012. I'd rather have profit figures, than EBITDA, so will have to wait for the results to be published, which was very late last year, on 9 April!

24/7 Gaming Group (LON:247) - their shares dropped 27.5% to 10.88p on the back of a pretty disastrous update saying they need to raise more additional funding. So it's a bargepole job for me. They detail cost cutting, etc, but it's not of interest to me, as the first golden rule for an investment is that the company must have adequate financing in place. This one seems to have burned through a lot of cash, and generated no return.

Have a great weekend, and thanks for reading.

See you on Monday morning from 8 am!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.