Good morning! Very quiet for results today, and the FTSE 100 is set to open roughly flat, at 6,524. Toy company Character (LON:CCT) has issued a trading update this morning. It looks pretty good. They indicate that trading in H2 has been "satisfactory" (they have a 31 August year end), and results will be in line with market expectations. I can't find any current market forecasts, but a little while back they were only for around breakeven, which looks consistent with last year's H2 profit (assuming a similar profit this year), and this year's H1 loss offsetting each other.

Checking our archive here, here is the link for my comments on Character's H1 profit warning on 31 Jan 2013. What is interesting, is that they said then that a strong H2 was anticipated, to reverse the H1 loss, and that is exactly what has since happened. So it appears that this is a company whose outlook statements can be relied upon, in the recent past anyway.

I then reported on their interims on 2 May 2013 here, and wasn't impressed with a very poor performance. However one year's poor results are the following year's soft comparatives, and in today's statement CCT give a positive outlook as follows (my bolding):

Although we are only at the start of the new financial year, we are encouraged to report that the Group's forecasted sales remain on track for the 2013 calendar year, which should lead to a substantially better result for the 2014 financial year.

Remember that they have reasonably good visibility, from trade shows, and forward orders from retailers. So it looks like this could be a good time to buy their shares, providing one accepts the high risk of profit warnings. This is because, being subject to the vagaries of fashion amongst children, their products may or may not appeal to the target market from one year to the next.

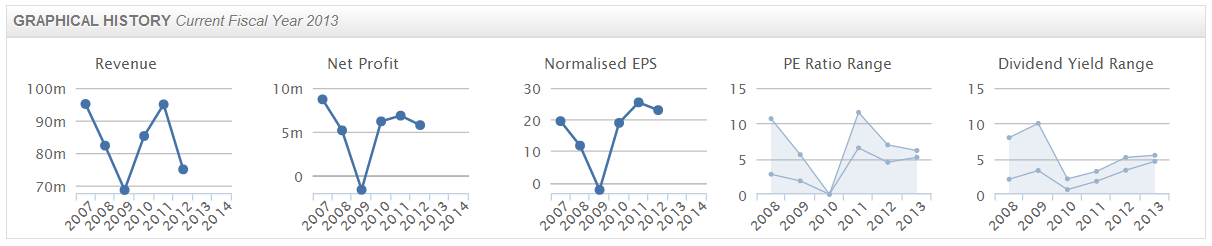

At 140p the market cap is £32.3m, and aside from (understandably) two bad years in the aftermath of the credit crunch in 2008 and 2009, either side of that period they have tended to make typically around £6-7m p.a. in profit. So the usual level of profit appears to be c. 20-25p EPS. So if we go for the lower figure, that means they are only on a PER of about 7 times trend, or typical long term EPS.

Note the positive trend in dividend yield above, which would be 4.7% if last year's divi is maintained, although given that 2012/13 is going to be a poor year, then I'm not sure whether they will maintain the dividend or not?

The Balance Sheet here is not great, therefore it's marginal for me whether I could invest or not. If I did manage to convince myself the Balance Sheet was acceptable, then the position size in my portfolio would only be small, as to reduce risk, I never take big positions in companies which are reliant on significant levels of Bank debt. Although given that current trading is strong, and the economy improving, that's probably being overly cautious - arguably this is the time to be relaxing concerns about debt somewhat, in a recovery.

There's an excellent article form Allister Heath of CityAM, about soaring Bond yields, which is well worth a read. In my opinion he's probably the best commentator on economic matters, having real insights, and expressing complex subjects in straightforward terms.

I wonder how this will affect equities? Research suggests that rising bond yields in an improving economy are generally consistent with a rising stock market - because although there is a drag on equities from money being withdrawn to invest in bonds that are giving an improved return, at the same time investors become more upbeat about the earnings (and hence dividends) available from equities.

Operational gearing is the key thing to keep in mind with equities - i.e. a typical company with 50% gross margins and a 10% operating profit margin will see its profits rise 50% from just a 10% increase in sales! A lot of people fail to factor in operational gearing, and are hence surprised by how quickly profits rise in a recovering economy. Hence why I'm focussed at the moment on finding companies which are likely to out-perform forecasts, which will turn out to be cheap when people see the higher profits reported in due course. There are still bargains out there, it's just that you have to look harder to find them!

So an apparently high PER may not actually be a high PER at all, if the company is likely to smash forecasts. Broker forecasts tend to lag behind reality both on the upside and the downside, so repeat increases in broker forecasts are a good thing to watch out for. Vislink (LON:VLK) is a good example of this, where I reckon broker consensus is now well behind reality, and the PER of 16 is probably going to turn out to actually have been a PER of about 10 (in my opinion). That makes a massive difference to what the share price should be.

I saw another report (flagged up by another outstanding commentator, Merryn Somerset Webb) which said that the magic number for benchmark Govt bonds is 5%. When rates go above that level, then historically the stock market has performed poorly. We're nowhere near that level yet, but it's something to keep in the back of one's mind in future.

A couple of significant Director deals to report on - firstly, I'm amazed to see that Staffline (LON:STAF) shares are up 4% today, given that they announced their CEO has sold 600,000 shares at 540p. That's a material reduction in his stake, being about 2.4% of the company sold, although he retains 5.8%. The usual "in response to institutional demand" line has been trotted out, which as we all know is nonsense. A sale is a sale, and it's generally bearish, except where unavoidable (e.g. divorce settlement).

That said, I like Staffline a lot, and think the shares will do well long term. Short term though, it's difficult to see a lot of upside, especially after this big Director sale.

Secondly, Directors of Clean Air Power (LON:CAP) have stumped up £103k to buy shares at 9.625p. Fair enough that they were not able to participate in the recent Placing a few days ago, as they were in a close period pending results which have since been issued.

However, the Placing was done at a small premium, and the share price has now risen significantly to 11.88p, so it does raise an eyebrow that Directors are now buying new shares with an instant 23% paper profit. Apparently it did say in the original Placing announcement that Directors could not buy shares due to the close period. So perhaps it also said that they intended buying shares on the same terms once the close period finished? I'll check when time permits.

There's a very bullish-sounding trading statement from Synety (LON:SNTY). However, closer inspection of the last set of figures shows that they are a very long way from having a viable business - turnover is still tiny, and it's loss-making. Although some of the narrative in today's statement has sparked my interest, so might look at this in more detail when time permits?

That's it for today. A very quiet day for announcements. So have a smashing weekend, and see you bright-eyed & bushy-tailed on Monday morning from 8 a.m.!

Cheers, Paul.

(of the companies mentioned today, Paul has long positions in VLK & CAP)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.