Good morning, it's Paul here!

Yesterday's report was very late, my apologies. In case you didn't spot it, it's here. I covered the debacle with Provident Financial (LON:PFG) in some detail, and have this morning further updated that article with new information which has come to me from broker notes. Also covered was the fiasco that is Sphere Medical Holding (LON:SPHR) , plus a reassuring update from Proactis Holdings (LON:PHD) . Sorry I didn't get round to looking at Empresaria (LON:EMR) but there didn't seem to be anything particularly interesting to write about with that one.

On to today's results & trading updates.

GAME Digital (LON:GMD)

Share price: 32.0p (up 30% today, at 09:11)

No. shares: 170.9m

Market cap: £54.7m

(at the time of writing, I hold a long position in this share)

Year end trading & business update - this company operates retail and online stores for computer game consoles, games, and accessories. It operates in the UK and Spain.

By way of background, Graham wrote an excellent report here on 30 Jun 2017. In that article, he flagged that GMD could be a value opportunity, since its UK store estate had an average lease length of only 1.2 years.

Two weeks later, the company announced that Mike Ashley's Sports Direct had acquired 25.75% of Game Digital. The company said it looked forward to working collaboratively with Sports Direct.

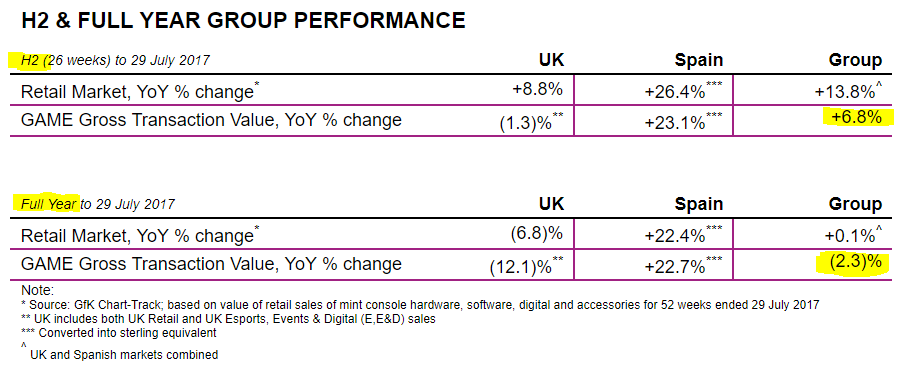

Improved H2 performance - at the end of Jun 2017, the company stated that it expected to report an improvement in trading in H2, of 5-6% growth in gross transaction value. Today's announcement reports +6.8% GTV, which is reassuring. Forex conversion helped the Spanish business, when converted into sterling.

Here is the table of sales performance published today. NB. The "Retail Market" figures are industry benchmarks, and not the performance of Game Digital. I read that incorrectly first thing, so it's important to scrutinise RNSs carefully!

Anyway, the key points are that the H2 performance did indeed improve, and a bit more than expected.

Cash position - this sounds particularly encouraging, in my view;

The Group has continued to maintain a highly-disciplined approach to both working capital and cash management and given the recent improved sales performance expects to report an increased year end cash position (net of overdrafts) of approximately £47 million (2016: £43.1 million).

In addition to this positive net cash balance, as at the year end the Group had access to combined facilities across the UK and Spain of over £77 million.

Some investors seem to think that Game might go bust again. However, if you check out its balance sheet and cashflows, they look healthy to me at the moment. Remember that the end July cash figure is not flattered by seasonality. It's actually H1 which is the busier half year.

Leases - this is what particularly interests me. Retailers usually fail because their shop leases drag them down - due to fixed rents, with upward-only rent reviews every 5 years, and a usual term of 15 years. Internet disruption is killing lots of retailers, when they're locked into uncompetitive leases.

GMD is in a virtually unique position of having 220 of its 306 UK stores coming up for either break clauses, or lease renewals. This means that GMD can renegotiate, or just walk away from those shops, without penalty (usually - there can sometimes be costs for dilapidations, but I doubt that would be material).

As the CEO says in his comments, this allows GMD to create a new cost base for its UK retail business. This is almost like doing a CVA, but without the costs, hassle, or reputational damage. So this point is absolutely key, in making GMD investable, the way I look at things. If the lease events are handled well, then that could provide a big boost to profitability, and make the business sustainable in its current form.

Strategic update - I can't make any sense of this section in today's RNS. Do any readers understand it? If so, I would appreciate some guidance!

EDIT - I've since read a couple of broker notes, and they reckon this could be about GMD selling its Multiplay business. Apparently this is still loss-making, but being digital, and growing strongly, could command as much as £15m, one broker estimates. So that sounds a sensible move, if it happens.

Outlook comments - sound reassuring - particularly important, as the company will soon be building up to its key Christmas trading period;

"GAME has made further progress in the second half of the year as we continue to focus on developing our strategic initiatives whilst creating a new cost base for our UK retail business to address the challenges in the UK console market.

"We have been encouraged by the recent growth in both the UK and Spanish markets overall and we expect that this momentum will continue into peak trading driven by the benefits of continued customer demand for the Nintendo SwitchTM, the launch of Microsoft's Xbox One X and a strong line up of new games releases.

"GAME has now opened 18 BELONGTM arenas, and we have seen encouraging early performance. We have reviewed our operations and are now accelerating development plans as we seek to fully capitalise on the strong growth potential in our exciting and growing esports activities."

My industry knowledge is negligible, but several friends & contacts have told me that arguably GMD is far from dead. The games companies may want to move to downloads, but customers don't necessarily like those. A gamer told me that he likes to have the software on a physical disc, as he owns it permanently, plus can lend it to friends, or swap/sell it. That's not possible with downloaded software.

Another key aspect is the growth in computer gaming as a spectator sport. As improbable as that sounds, apparently it's becoming quite a big thing. GMD seems to be developing its offering in this interesting growth area.

Profitability - FY17 adjusted EBITDA is forecast in the £7.8m to £8.4m range, by brokers. EBITDA is actually a highly relevant figure (along with others, such as conventional profitability) for retailers, so this shouldn't be dismissed. It's a good proxy for cashflow.

Although given that revenues are substantial, the business is really only running at (or slightly below) breakeven. So there's a lot to be done, and I think the company really needs to make deep cuts in its rental costs on the lease renewals, to return to sustainable profitability.

My opinion - this is a substantial business, with a sound balance sheet, on arguably a dirt cheap valuation. The UK retail division has a terrific opportunity to downsize, and jettison over-rented shops, with the upcoming 220 lease events. If that's handled well, there could be a nice business, with slimmer costs. So due to this opportunity, I doubt whether the retail estate will pull down the whole company, like it did last time.

I think the opportunity for this share, is if investors begin to focus more on the growth areas, such as esports activities. It will be interesting to see what emerges from the Sports Direct relationship - maybe GMD stores within Sports Direct stores, utilising surplus space for esports? As much as anything, Sports Direct eliminated an overhang in GMD shares, which otherwise might have persisted for a long time.

Overall then, I don't see this as a share to hold forever. However, I do think there's a decent chance of a re-rating over the next year or two for the reasons given above. It's a bit of a special situation, which won't appeal to many people probably! That's partly what creates the value opportunity, in my view - extreme negative sentiment, which looks overdone.

Laura Ashley Holdings (LON:ALY)

Share price: 8.23p (down 5.6% today)

No. shares: 727.8m

Market cap: £59.9m

Final results - for the 52 weeks ended 30 Jun 2017.

This is the home & fashion products retailer, operating from UK stores, and international franchisees.

There was a profit warning 8 days ago, which did surprisingly little damage to the share price. So I'm beginning to wonder if this share might be getting close to its lows?

Today's results are difficult to interpret because the prior year comparatives seem meaningless, being a 74 week period. It's a pity the company didn't also provide pro forma 52 week numbers for the prior year.

However, there's no getting away from the reality that the figures are poor. Pre-exceptional profit has fallen to only £8.4m. Looking back historically, in recent years the company has usually made c.£18-27m operating profit, so this is a big shortfall.

Segmental analysis - in note 5 to today's accounts really concerns me. The retail division has seen profitability collapse to only £3.9m, from £21.6m in the previous 74 week period. This reminds me of French Connection (LON:FCCN) - a badly declining retail division, pulling down the other, more profitable parts of the business.

That was based on LFL retail sales down 3.1%. Note the nasty operational gearing there - a relatively small drop in sales, causing a real crash in profits. I think there is some impact from sterling devaluation too.

The trouble is, there's nothing to stop profits stopping at zero - they can go down into negative territory very easily. Especially when there are multiple cost headwinds, as we already know are affecting the retail sector in the UK. So to my mind, one key worry with ALY shares is whether the UK business could become a big enough drag to pull down the whole group eventually? We need more information on the leases, to see how easily (or not) ALY could exit from loss-making UK shops.

Dividends - there's no final dividend, although a 0.5p interim divi has already been paid. It makes sense to stop divis for now, as the company has historically paid out if anything too much in divis.

Balance sheet - looks reasonably OK to me. There's a very large asset, being the Singapore office block which the company bought, in a bizarre move. So given that the bank lending is asset-backed, I don't see this company being financially distressed at the moment.

Net cash is minus £10.7m, but the freehold office block is worth a lot more than that. So probably not a problem.

Note the pension deficit of £13.8m.

Growth - the company is focusing on international expansion via franchisees, and this is a decently profitably part of the business. The first Indian store is opening soon, and a new Chinese website has started well.

Also, its first tea room in the UK has opened, with the possibility of more. Don't laugh - look at how profitable Patisserie Holdings (LON:CAKE) has become.

Current trading - sounds alright;

Trading for the seven weeks to 19 August 2017 is performing in line with management expectations.

Cashflow - note that inventories rose £6.6m, which dented cashflow.

Stockopedia fires a warning shot, describing this as a "value trap", and a StockRank of only 37. That has made me pause, and re-think, as my finger was starting to hover near the buy button.

My opinion - if this company had a conventional ownership structure, then I would probably buy some at the current valuation, for the speculative upside from expansion in Asia.

However, it is dominated by Malaysian shareholders & management. The problem with this, is that at some point they might simply decide that the UK listing is a waste of time & money. So the disaster scenario would be if we wake up one day, to find the company announcing its intention to de-list. That's exactly what another Malaysian company, Fusionex, did earlier this year.

In fairness to ALY's major shareholders, they don't seem to have done anything to harm UK minority shareholders to date. Quite the opposite - the company has historically paid out extremely generous divis to all shareholders. Last time I looked, management remuneration looked reasonable too.

So who knows what will happen? For me, the de-listing risk is just too high to consider buying any shares in this company.

Robinson (LON:RBN) - I can't see anything appealing about this share. It is a small group of companies making plastic and paperboard packaging. That's a very competitive sector, with customers relentlessly squeezing out profit from their suppliers.

Interims today look rather poor, with profits down on H1 last year. Although the full year outlook sounds reasonable.

The surplus property has been an interesting angle for this share. The company says today that some realisations are expected soon.

It might be worth looking at, as a special situation, if you can get a handle on how much the property upside could be. Personally, I don't see much, if any, prospects for long-term profit growth. So it doesn't interest me. Also the share is hideously illiquid to buy & sell, so the bid/offer spread can take a hefty chunk out of any potential investment gains. Why is it listed on the stock market at all?

I have to leave it there for today, as I'm busy on other stuff for the rest of the morning & afternoon. I'll read the comments this evening, and respond where applicable. As Graham mentioned last week, we do read & take on board all reader comments.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.