Shares in building services contractor Lakehouse are now trading in-line with the firm’s IPO price in March. Is this an opportunity to follow smart investors like Mark Slater into a profitable buy, or is the market right to treat this recent flotation with caution?

The well-used argument against investing in IPOs is that if a firm’s owners want to sell, they are likely to be getting a decent price. This could be at the buyer’s expense. A number of recent IPOs have disappointed investors shortly after their listing, but is it fair to tar all floats with the same brush?

In my view, the real risk for private investors is that the sellers know much more about the business than the buyers. The sellers may also have stripped the business of assets or cash to fund dividends for which the future owners will have to pay.

In this article I’ll ask whether these considerations, or other risks, apply to Lakehouse.

The Lakehouse attraction

Lakehouse was founded in 1988 and now employs 2,400 people through a group of specialist subsidiaries. These include heating, electrical and building firms. The group’s work is a mixture of public sector, commercial and social housing. It’s also an installer for five of the big six energy utilities.

Lakehouse floated at 89p per share in March, before hitting a high of 105p in June. The shares have slipped back since then and currently trade at around 90p.

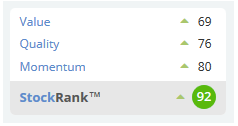

Based on the firm’s latest figures, this stock appears cheap. Stockopedia’s computers certainly like it, with a StockRank of 92 and rising ranks in all categories.

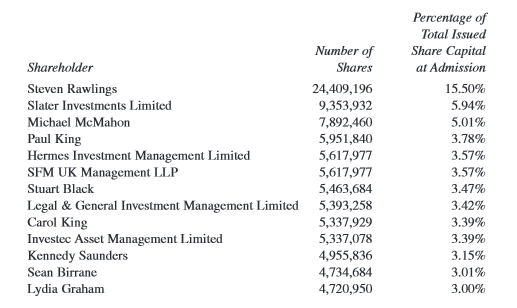

Lakehouse’s post-IPO ownership profile is also quite encouraging. This isn’t simply a case of private equity owners dumping their stock onto an unsuspecting market and walking away.

Eight of the fourteen individuals with stakes of more than 3% in Lakehouse before its IPO remained 3% shareholders after the flotation. This includes several key directors.

Executive chairman Stuart Black is a former chief executive of Mears Group and has considerable experience in this sector. Lakehouse also boasts an impressive list of institutional shareholders, topped by Mark Slater with a 6% stake:

Mark Slater went public with his admiration for Lakehouse at the UK Investor Show back in April.…