This week saw the quarterly rebalancing of the FTSE indices. A new recruit for the FTSE 100 is satellite operator, Inmarsat. Out goes temporary power supplier Aggreko, which has laboured this year in tough trading conditions. New names in the FTSE 250 include challenger banks Aldermore and Shawbrook, discount retailer B&M and Neil Woodford’s Woodford Patient Capital Trust, among others. Gone for the time being are companies like oil producer Soco, chip maker Imagination Technologies and banknote printer De La Rue. You can see the full list here.

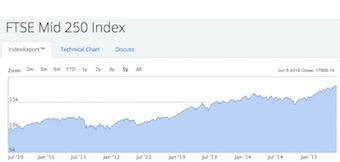

While the loss of a prestige position in the blue chip index might sting for Aggreko, it now finds itself in an index that has powered ahead in recent years. Indeed, while index changes represent the fliers and fallers in the market, there’s little doubt where investors have often been best placed in recent years. The FTSE 100 is more or less flat on where it was one year ago, while the FTSE 250 is up by 10.5%. Over five years the performance has been stark, at 33% and 89% respectively. So while companies chop and change, the performance of the mid-caps has been impressively consistent.

In The Search this week, we had a look at ways of finding Value & Momentum stocks with the potential to soar. Alex Naamani picked up on toymaker Character Group in his review of Guru Screen movers. Roland Head’s Stock in Focus was new FTSE 100 entrant, satellite operator Inmarsat. Meanwhile, with debate still raging about the future of investment platform Plus500, our resident small-cap value expert Paul Scott shared his thoughts on how the battle between bulls and bears had played out. If you want to read more, you can dig through all of the Small Cap Report archives.

Around the web this week, we’ve been reading:

- John Authers, FT - How to judge if stocks are at the top

- Alpha Architect - Did Ben Graham Value Investing Work in the Recent Bull Market?

- Malice For All - The Best Doctor Gives The Least Medicine

- The Value Perspective - Merger mystery –…