Bioventix 2700p

A good set of results today. Revs rose 31%, the business showed good operational gearing and EPS rose 39%. The business has £6.2m of net cash and is very cash generative. Graham N covers the results in some detail in his thread today here.

I wanted to add a few thoughts from my point of view as i have covered this company in some detail before in my initiation article (interestingly no comments at all !)

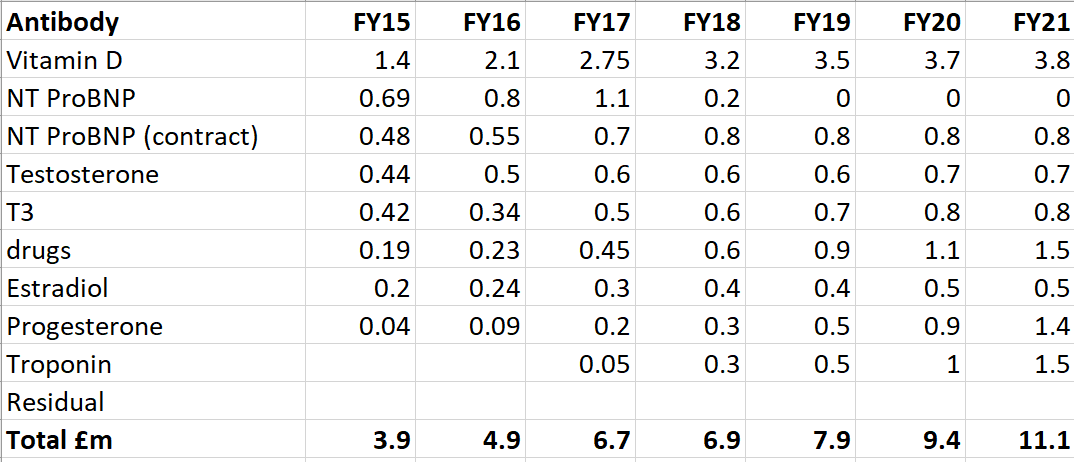

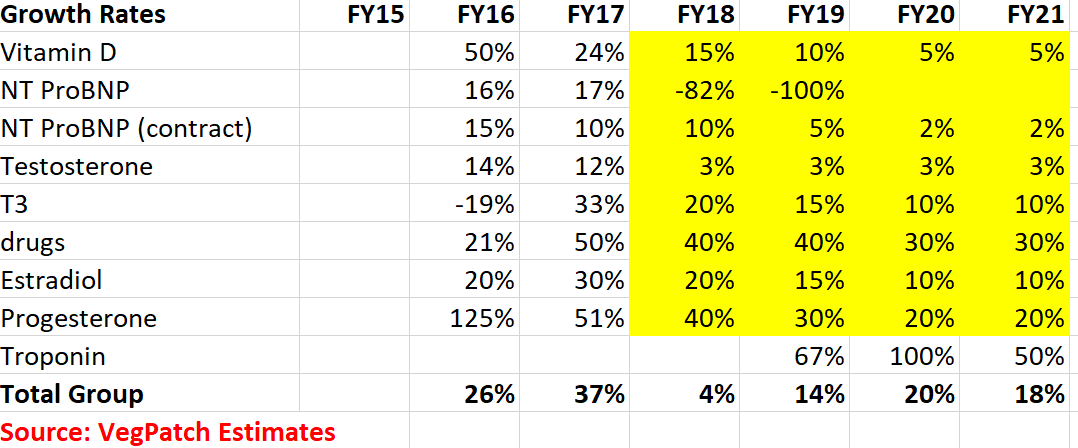

Revenue growth was driven by 1) growth in numbers of blood tests using BVXP antibodies and 2) the tail end of Sterling weakness vs Euro and vs USD. A major driver of revenue growth recently has been the huge growth of the Vitamin D test. Cracking this test was pretty demanding for BVXP and so management realised it could charge a premium for the test as it was v difficult for others to develop a competitive antibody. Usually BVXP earns a 2% royalty on the value of a blood test, but with Vit D they charge 4%. Hence that has been driving much of the revenue growth and now accounts for 38% of Group sales. What’s positive for me is that the Vit D test grew by 24%, implying the other 62% of sales grew by 36%

The Group does have its challenges ahead as a very profitable antibody called NT ProBNP, which had a finite commercial life, went off royalty in August. Originally this was supposed to be £700k looking back through my notes. But it has clearly been growing and Sterling has weakened so the hole to be filled is now larger at £1m. Counteracting this is the new high senstivity Troponin test for Siemens, used to detect heart attacks. Like all BVXP antibodies, BVXP has little visibility as it may send the antibody months (or even years) in advance. It gets a royalty in arrears each time the antibody is used in a test. So while the new Troponin test is really exciting BVXP doesnt know how well the test is faring against more standard tests. Also hospital clinicians may take time to get familiar with the Troponin test. So while the royalty stream from the NT ProBNP test has dropped off a cliff, its replacement in the portfolio will take time to ramp up. BVXP has low visibility, hence management is hedging its bets…