Good Morning Monday,

Top list of positions which are showing signs of advancing in price in the next *50 days.

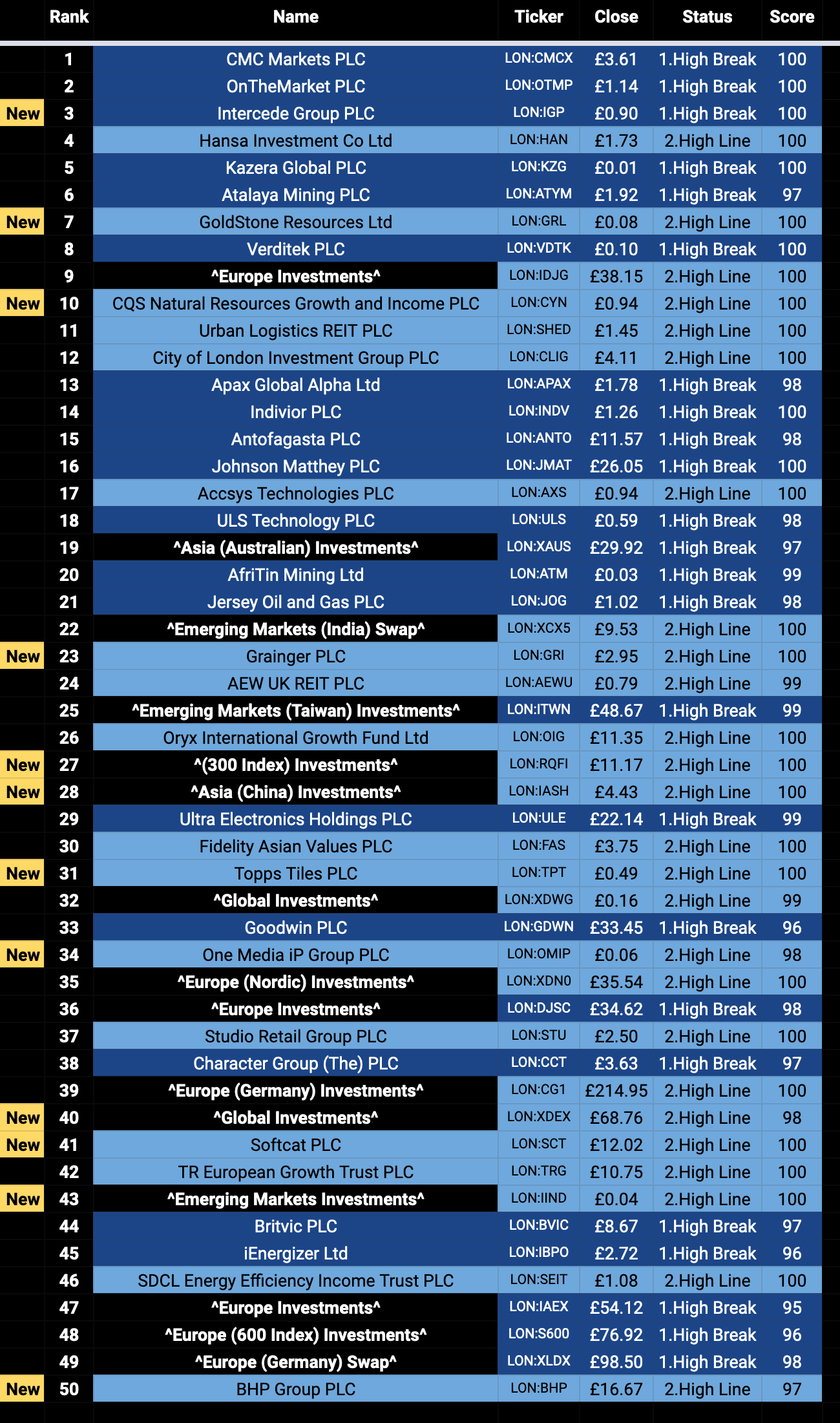

********************** Published on Thursday 19 November ***********************

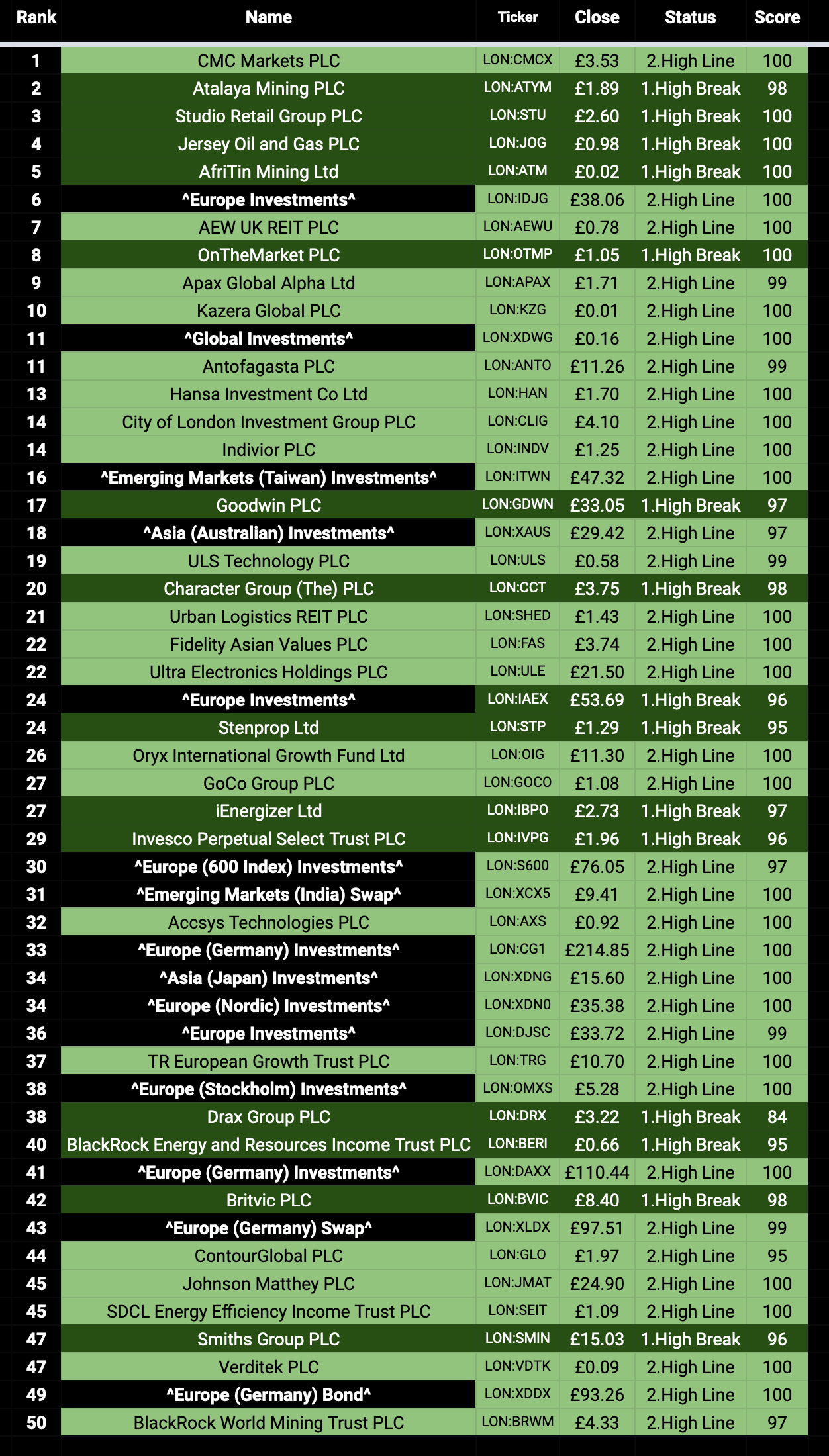

********************** Published on Wednesday 18 November ***********************

********************** Published on Tuesday 17 November ***********************

********************** Published on Monday 16 November ***********************

Hoping for brilliant things to happen, so join me in the comments!

Hi Stockopedia, its Dan here.

You may be familiar with my screen name as been the first comment of the day on the SCVR; trying to capture the most recent RNS snippets and links. They have +1000 combined thumbs up in November, which I would like to cash in to fund the creditably for this project.

As written before on the SCVR, I use automation to make life easier and always drive for simplicity. My previous roles in marketing could be summed up as understanding complex, dynamic, evolving data type problems and organising it down to a linear set of rules to then build it back more efficiently. And as a creature of habit, this is the same approach I have used to understand the stock market.

The automation I have written scans the market for everything possible to buy in an ISA, scores the historic price behaviour via the chart, and produces a ranked list which “the code believes” are most likely to advance in the next 50 trading days.

This framework allows me to daily analyse the top 50 charts from the output with the intension to place a position.

*DYOR - Everything I purchase is intended to be held for 50 trading days, but can range from 1 to 100 days depending on updated price information. I sometimes force trades, do not wait for breakouts and place positions before expected RNS. The list may contain low and high volatile positions - as well as low and high spread positions. Trading is less about knowing what to do and more about knowing what not to do - I accept the risk.

.jpg)