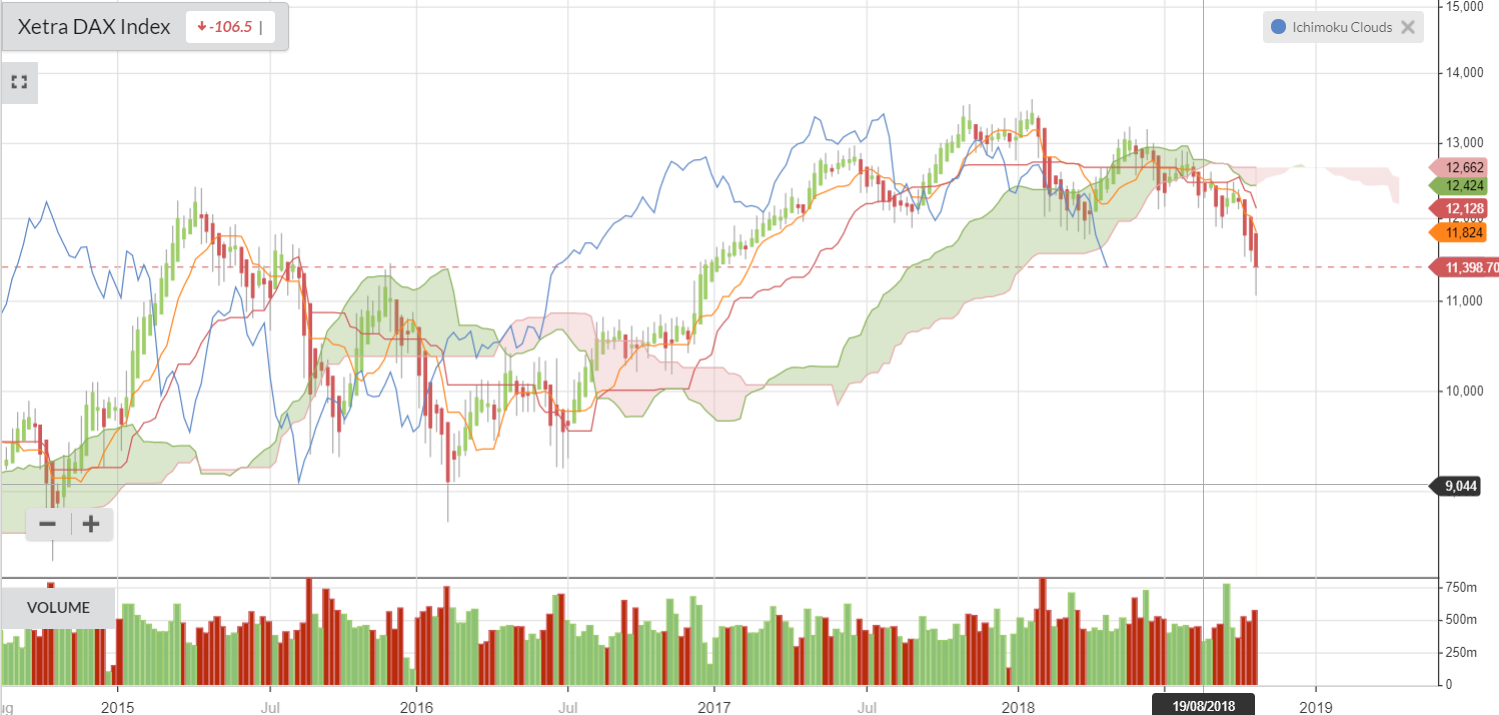

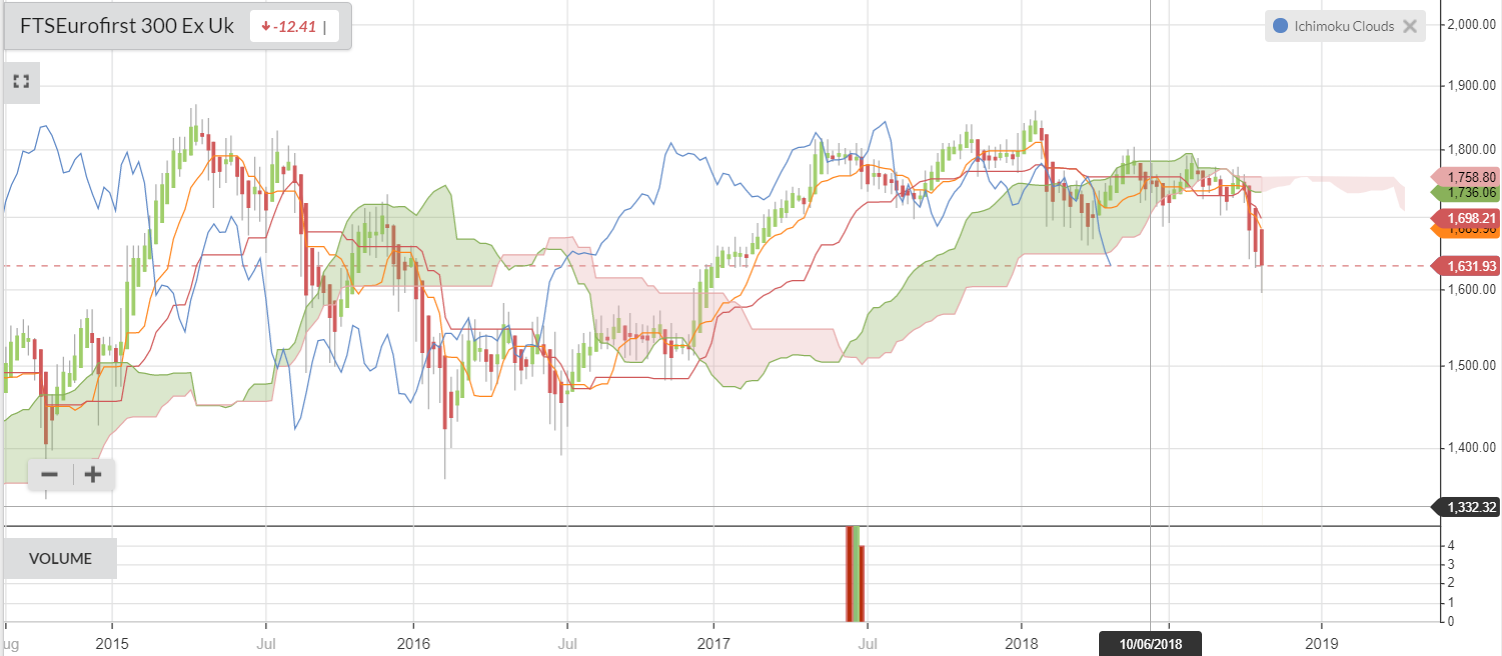

Share prices have fallen across the board in October, and it’s a reminder of just how quickly fear spreads when stocks start tumbling. My colleague Jack wrote this week about the sense of foreboding that’s hanging in the air at the moment. There’s almost a sense of inevitability that some kind of correction is past due. Knowing how to react to that kind of prospect is difficult.

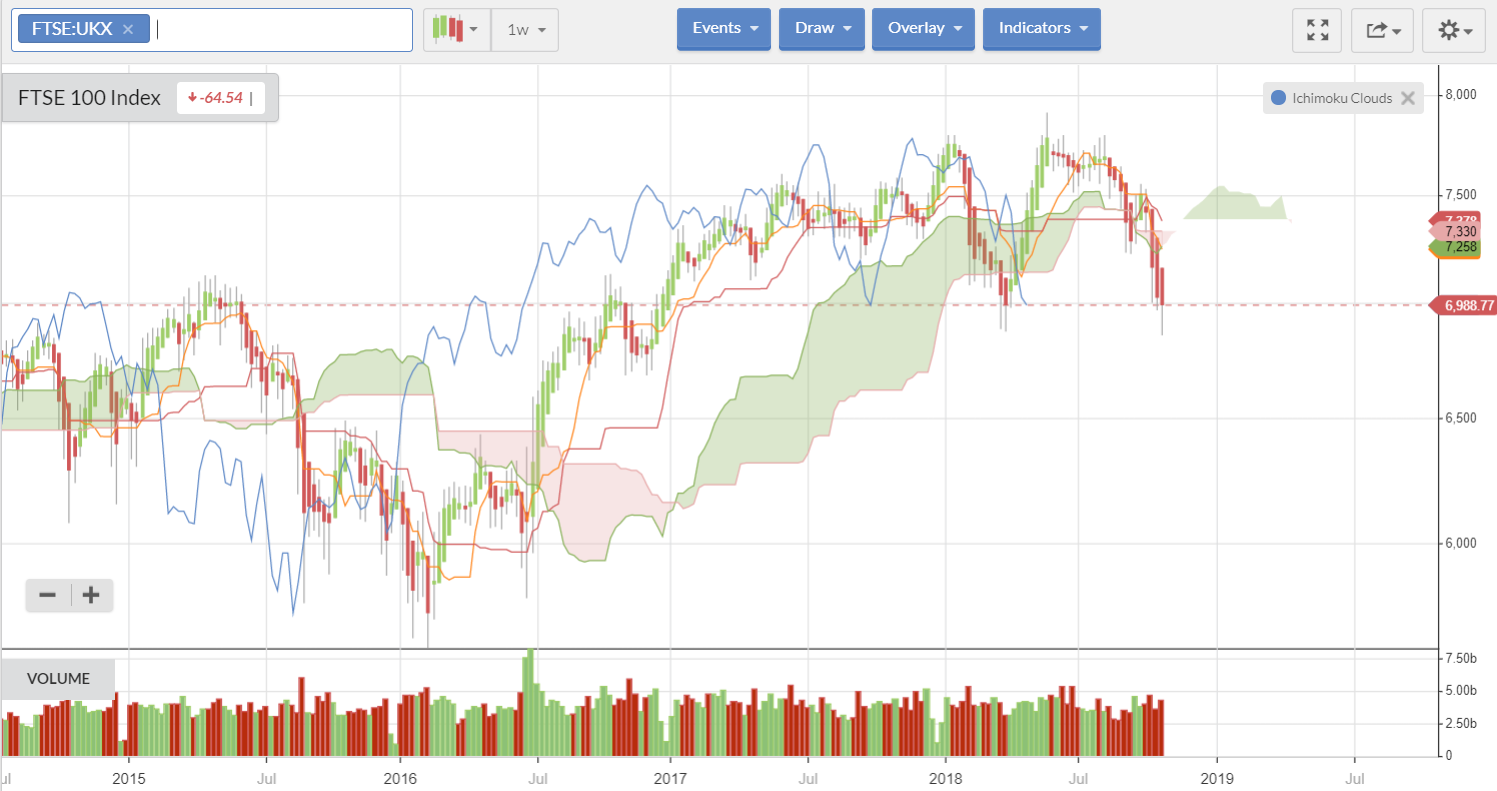

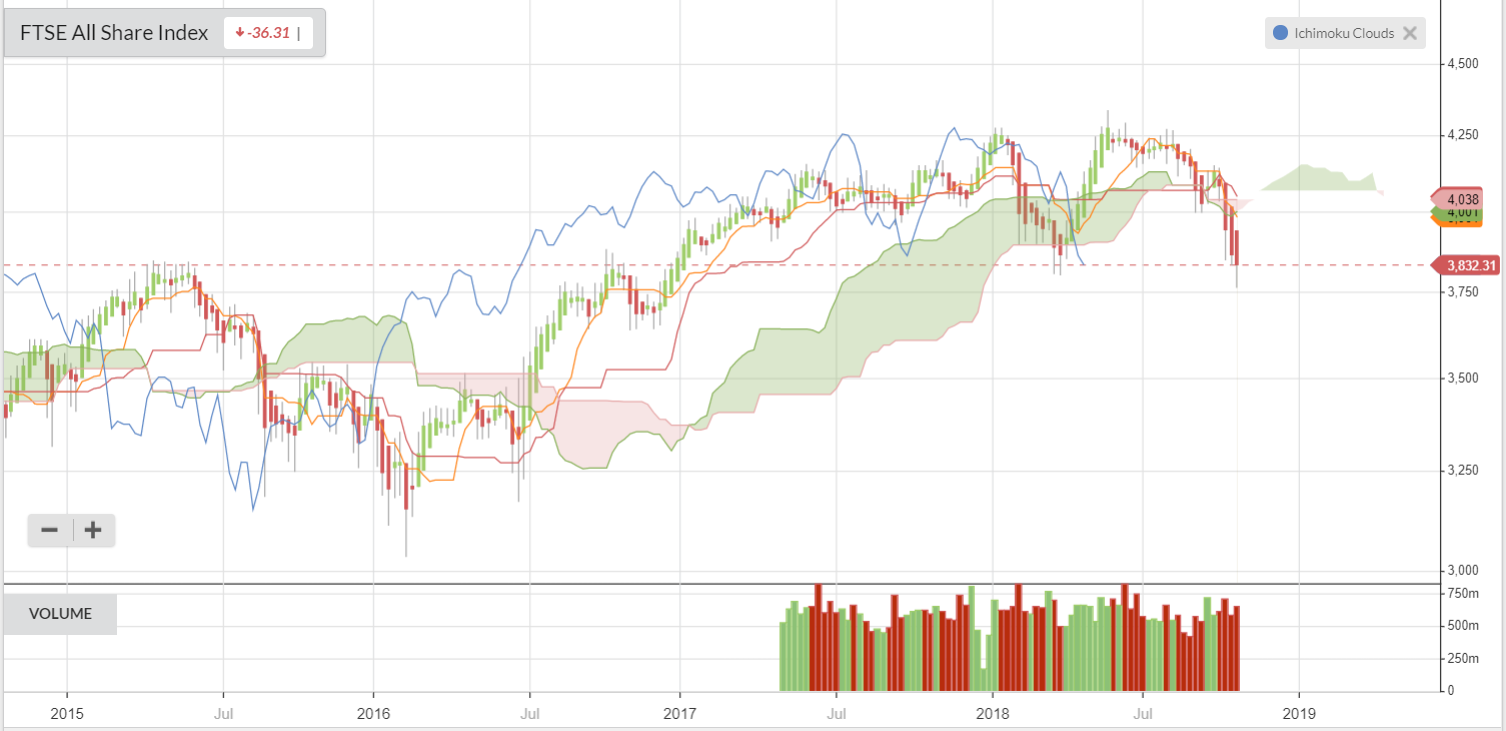

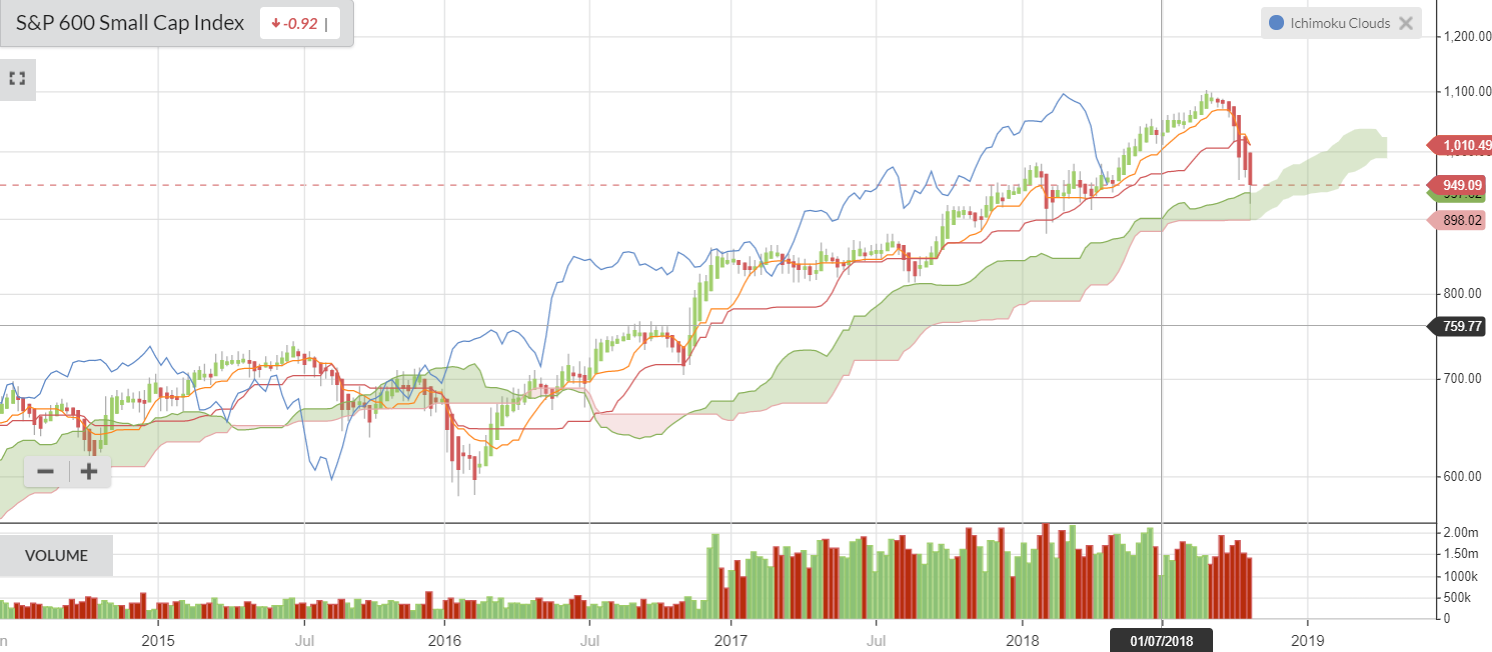

Ten years into a bull run, and faced with various signs of trouble (in various parts of the world), it’s not hard to piece together a pretty gloomy narrative. While October has been unpleasant, some of the main UK indices - certainly the small and mid-caps - have been trending down since early summer. So for some investors, this experience has been less of a suckerpunch correction and more of a protracted beating.

This week the FTSE 250 has been flirting with correction territory, with the index currently down by just over nine percent for the month. As usual, the UK indices are taking at least some of their cues from price action in the United States. That’s been translating into some sharp and unpredictable intraday moves - days that start well but end up finishing on yet another low.

Profit warnings and bad news

In recent weeks the sharpest falls on the FTSE 250 have been exacerbated by bad news and profit warnings. Among the biggest fallers have been stocks like Keller, ConvaTec, Superdry, Indivior, Inchcape and Victrex. In terms of relative price strength, they’ve all undershot the All-Share index by more than 20 percent.

There are similar war stories over on the AIM All-Share, where Fevertree Drinks - a stock that, size-wise, has more in common with the FTSE 100, has seen more than a billion pounds wiped off its value since the end of the summer. It’s down from £4.23bn in early September to £3.18bn currently.

But it isn’t necessarily all bad news. It’s fair to say that some stocks (a minority) are holding up reasonably well under the conditions. But it’s also the case that investors with at least half an eye on value have been crying out for a meaningful correction for several years. For many, what we’ve seen so far won’t be anywhere near enough. As a result, we’ve…