Two years ago, the fashion retailer JD Sports showed all the signs of being a high quality business that was growing popular with investors. In a competitive market, it was carving out a niche for selling activewear at premium prices. The only catch was that its share price was starting to look as premium as its products.

Since then, JD’s high quality and relentless momentum have propelled its shares by an impressive 250%. But only with the benefit of hindsight could you say that JD was ever a bargain in recent years.

This investment profile belongs to a group of companies in the stock market known as High Flyers. They are companies capable of compounding strong returns over many years - but you have to pay up for the privilege of owning them.

A case of style and substance

A key feature of High Flyers is their financial and franchise quality. Often they have strong brands or services that customers love. JD’s business model has deliberately left the “stack ‘em high, sell ‘em cheap” model to competitors like Sports Direct. By focusing on well designed, appealing stores, it’s attracted the best ranges from higher-end brands.

That makes it impressively profitable. JD produced strong operating margins of over 10% last year. Its return on capital - the returns that it gets from investing in store roll-outs - are an eye-catching 37%. And that roll-out programme is now accelerating across Europe.

Profit surprises spur momentum

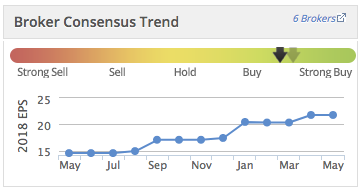

Fast, profitable growth acts like a magnet in the stock market and it causes prices to rise relentlessly. This is exactly what we’ve seen from JD. Over the past year, analysts have continued ratcheting up their 2018 earnings-per-share forecasts for the company - hiking them from 14.6p to 21.8p. That’s a considerable increase in growth expectations for a £4.3bn business. These upside surprises and regular forecast upgrades have underpinned the momentum in JD’s shares.

A premium share price

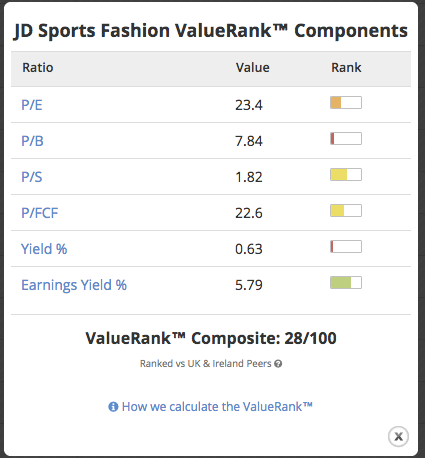

The inevitable catch for buying strong quality and momentum is that the prices of High Flyers risk bringing traditional value investor to their knees. Against Stockopedia’s ValueRank, JD has consistently looked pricey, yet the trade-off can be seen in the price performance.

When it comes to valuation, what one investor sees as expensive, another may well view as a…