Opinions are divided on how Britain’s Brexit-inspired political rollercoaster will play out in the the stock market. But one thing’s for sure, the active fund management industry is already feeling the effects. Risk-wary investors have been pulling their cash from active funds at a rapid rate this summer... but not everyone is feeling the effects.

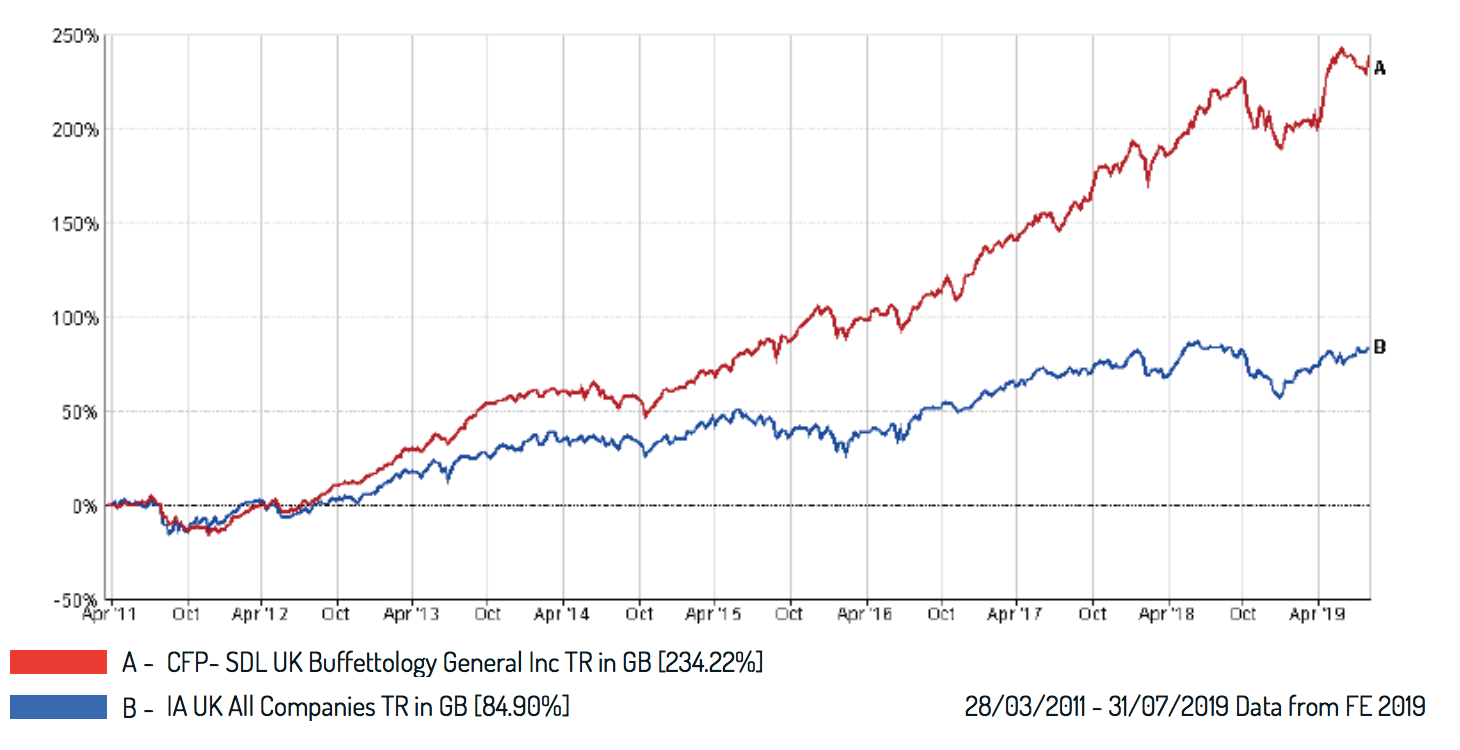

Over the past six months Keith Ashworth-Lord has seen the size of his Sanford Deland UK Buffettology Fund nearly double to £1.13 billion. In that time, the number of holdings in the fund has risen from 30 stocks to just 34. That’s a big clue about the careful stock selection and high conviction that lies behind Ashworth-Lord’s strategy.

When I interviewed him three years ago, the fund had just crossed the £50 million mark - and then, just as now, he was insisting that 30-or-so stocks was adequate diversification.

As the name suggests, Ashworth-Lord’s Buffettology Fund takes its cues from the investing approach of the legendary investor, Warren Buffett. And while it’s easy to see why Buffett’s multi-billion dollar fortune is enviable, a big part of his appeal is his consistent common-sense approach to the stock market. His attitude to buying and holding stocks seems perfectly logical - so it’s understandable that others try to copy it.

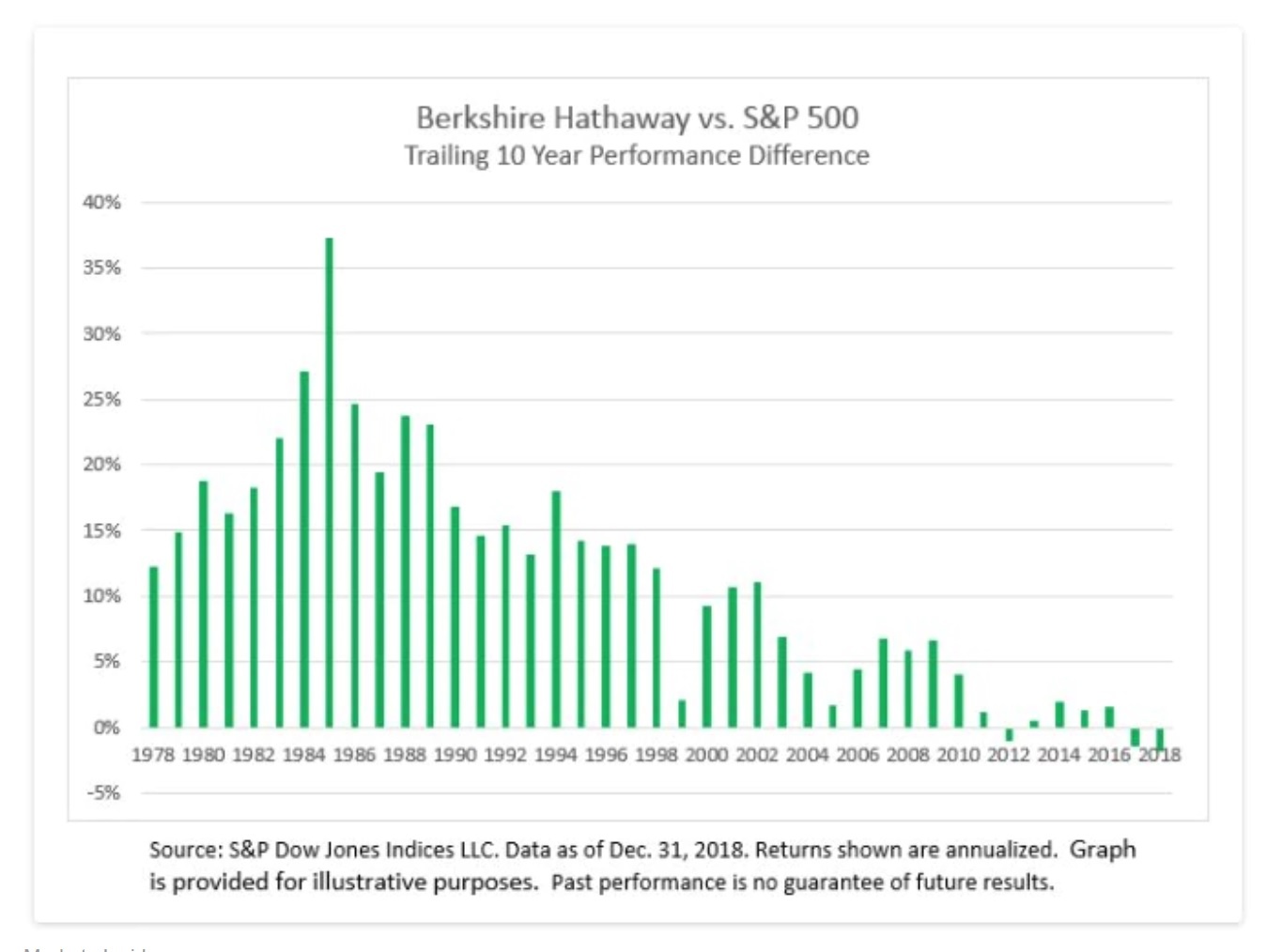

Mimicking the success of a billionaire is perhaps easier said than done. But some of the most important lessons to take from Buffett’s journey as an investor come from how his thinking changed over time.

In his early career, Buffett was (literally) a student of Ben Graham’s deep value investing philosophies. Some of his early money was made in the kind of ‘cigar butt’ stocks that most investors wouldn’t touch. But as he said at the time: "A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the bargain purchase will make that puff all profit."

It was only when he teamed up with business partner Charlie Munger that Buffett’s value focus started to soften. Munger was insistent that it was worth paying a fair price for quality. From there you can see why Buffett arrived at the view that his favourite holding period was “forever”.