Well it had to happen eventually didn't it? After a barnstorming 43% return in 2017, the No-Admin-Portfolio-System (NAPS) hit a wall in 2018. My musings on the benefits of ignorance last January led to nearly 100,000 reads over the year but, if private investor sentiment is anything to go by, I've a feeling that this year's more sober reflection may not prove as popular. I think this would be a shame, as it's in the harder times that the best investment insights are learned.

As usual, this is an extensive piece, ruminating on the sources of risk and return since the inception of the NAPS, reviewing the portfolio selection criteria and culminating in the list of 20 stocks for the year.

Yes, these are the "top stocks for 2019" according to my current NAPS criteria, but I have absolutely no crystal ball as to where each stock will go. Up, down, sideways, in circles - I have no idea. I know this is a controversial thought to traditional stock pickers, but the individual stocks don't matter to me. I wouldn’t bet my home on a single one of them. What matters to me is how the stocks have been selected, what traits they bring, and how they synthesise into a portfolio. The NAPS seeks the perfect portfolio, not the perfect stock.

What is the NAPS?

(Long term readers can skip this section.) The NAPS is a process that can be used once or twice per year to generate a stock market portfolio with a good chance of market beating returns. It's based upon a few fundamental principles:

- Behavioural Investing. Many stock market investors (myself included) are plagued by behavioural biases that can lead to investment mistakes. A disciplined, rule-based approach to stock selection helps counter these biases.

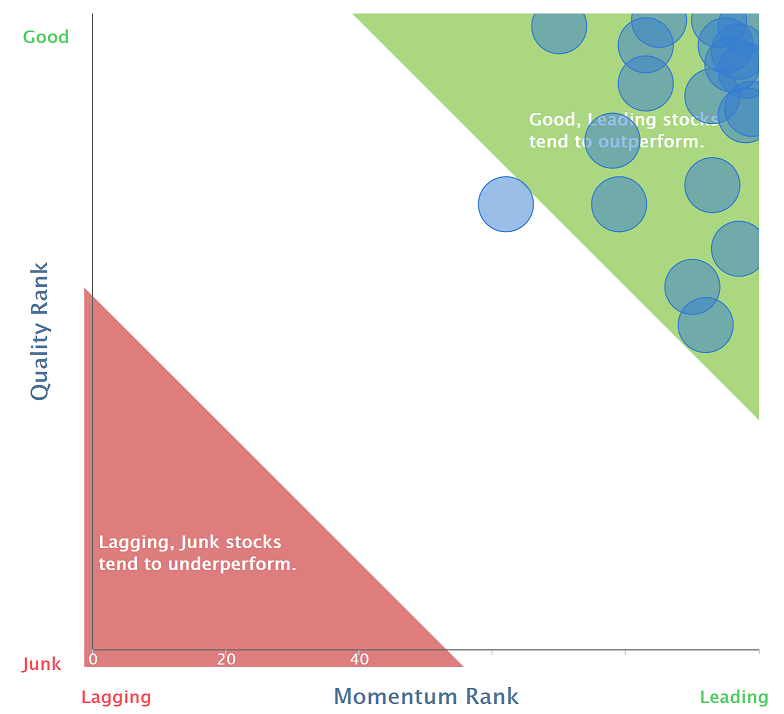

- Factor Investing. Market beating stocks are regularly driven by a common set of factors or traits (such as quality, value & momentum). We can screen the market for stocks with these traits to select potentially, market beating portfolios.

- Diversification. It's the only free lunch in investing. Since most investors either don't diversify or don't know how to, rigorous diversification helps avoid the risk of ruin and maximises the potential of profiting from factors.

In practice, it's a simple, rule based approach that generates a portfolio of 20 high ranking stocks from different market sectors. It's…