Most stock market watchers could be forgiven for thinking that 2015 has been a bit of a damp squib. Some promising early gains for the FTSE 100 have been all but given up, Greece worries have weighed hard and the dour Scot failed again to regain his Wimbledon crown. But beyond the headlines stock markets have been treating sensible small cap investors to quite a bounty.

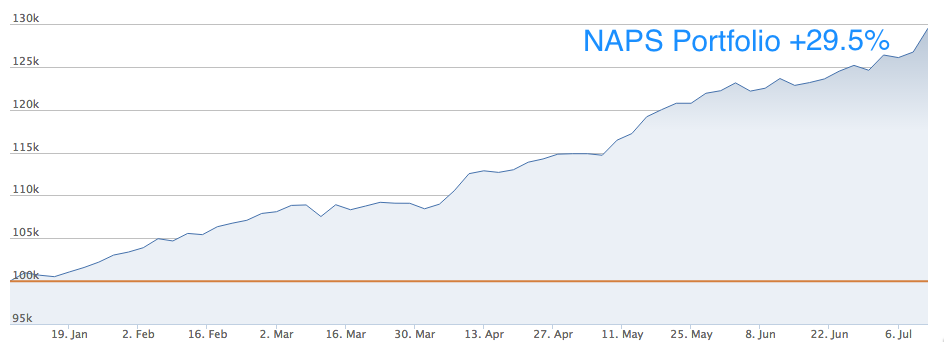

The FTSE Small Cap Index is up over 7% year to date while the FTSE Fledgling Index has rallied 17%. Closer to home my own 20 stock “New Year NAPS” list has stormed to a 29.5% return in just over 6 months. In the light of this recent good fortune, I felt it time to dust off my quill and pen a few words to reflect on what’s gone right, what’s gone wrong and what on earth should be done now… if anything at all.

From NAPS to SNAPS…

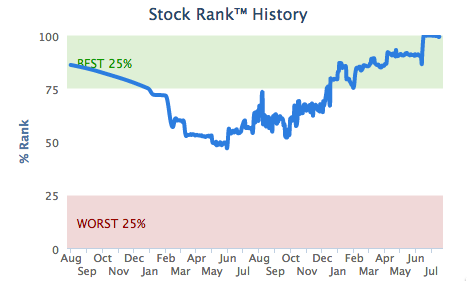

Newcomers to the site might want a quick refresher of how the NAPS were selected. We’re a DIY research site and we don’t do ‘tips’, so rather than hand pick some stocks for the year like you might find in newsletters or magazines, we thought we’d just throw the task at our core algorithm - the Stockopedia StockRanks. With a few simple filters to avoid tiny and hard to trade stocks we named the 2 highest ranking stocks across each of our 10 ‘economic sectors’… from Energy to Telecoms…. and threw them in a portfolio. You can check out all the original rules here.

Genuinely, I didn’t have vast hopes for this set of stocks as many were selected across sectors (e.g. Utilities) not exactly renowned for market beating returns. But they’ve absolutely trounced the market, beating the FTSE 100 by 22% in six months. Only Idox has fallen into negative territory while every other stock has returned 10% or more. The best, International Greetings, has more than doubled.

All this good fortune has started to make me nervous. After all, this was essentially a systematic portfolio and one of the most important parts of any good system is sound risk management and rebalancing. The portfolio positions have now drifted substantially leaving greater exposures to some stocks and smaller exposures to others. Should we just let our…