This week I want to leave the market meltdown to one side and focus on the latest developments in my rules-based Stock in Focus (SIF) portfolio. I’ll also consider another new buy - 8% yielding FTSE 100 stock British American Tobacco.

Before that, I want to look at how SIF has performed versus the market in recent weeks. I also want to consider how the portfolio’s cash balance is influencing my returns.

Beating the market (so far)

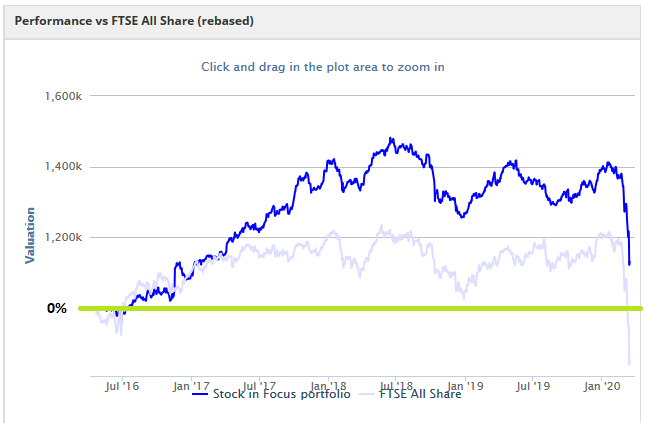

SIF has obviously suffered badly in this market crash. But I’m happy to report that based on its performance since inception in April 2016, SIF is still in positive territory. In contrast, the portfolio’s FTSE All Share benchmark has fallen deep into the red over the same period:

(These figures are complete until 13/3 and don’t include Monday’s sell off)

Even after Monday’s sell-off, SIF is still up by around 5% excluding dividends since April 2016.

I’d like to claim all the credit for this market-beating performance. But in truth I don’t think it’s down to the stocks I own, so much as the stocks I don’t own.

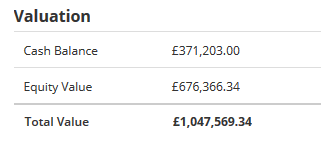

In a market crash, an investor who holds a lot of cash will probably outperform the market. That’s the position SIF has been in over the last few weeks. Even after two recent purchases (Morgan Sindall and Ten Entertainment), cash still accounts for around 35% of the portfolio:

(16 March 2020)

Given the scale of the equity sell off, I’m pretty sure SIF’s outsized cash balance has done me a big favour.

Why does SIF have so much cash? In the months before the market crashed, the SIF stock screen was returning fewer and fewer stocks. This meant I couldn’t replace all of the stocks that were sold. The portfolio shrunk to 14 stocks, well below its target size of 20. I had hoped that this would happen when market conditions became uncertain, but I couldn’t be sure if it would work.

My screen has come back to life! Since the market crash started in late February, my screen has come back to life.

I didn’t expect this to happen so quickly. I thought that my momentum rules would prevent too many new stocks from qualifying.…

.JPG)