It’s the end of another month, so it’s time to review stocks which have been in my SIF fantasy fund for nine months or longer.

Three companies are in the spotlight this week:

- Big data software group D4T4 Solutions (LON:D4T4)

- Agricultural and engineering group Carr’s (LON:CARR)

- Packaging group Macfarlane (LON:MACF)

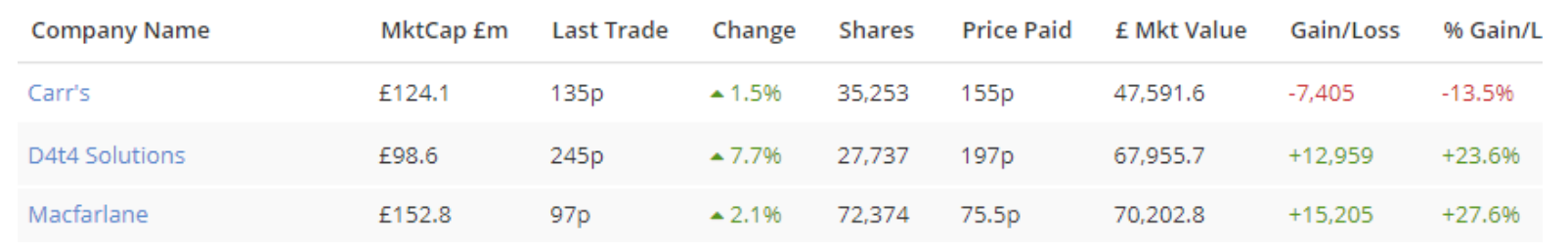

Here’s how these stocks have performed during their time in the portfolio:

I’ll come back to them in a moment, but first I want to take a slight diversion to a topic that’s close to my heart: dividend income.

Dividends add 29 percent

Stockopedia’s Fantasy Fund system doesn’t currently recognise dividend income. However, I do track the income generated by my picks.

I can tell you that the (virtual) income received since I launched the portfolio in April 2016 has had a big impact on my total return to date.

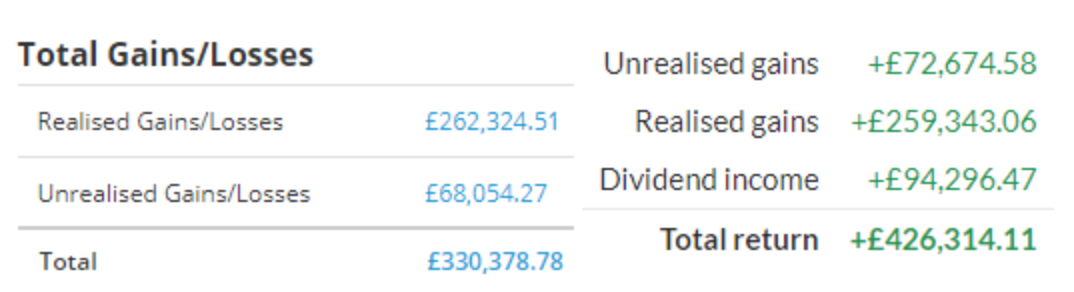

Below on the left is a screenshot from the SIF fantasy fund page. This shows total return to date on the nominal £1m starting value, excluding dividends.

On the right is a screen capture from the excellent new Stockopedia Folio system, which automatically breaks out dividend income to show the contribution it makes to total returns:

(The initial value of the portfolio was £1m)

At the time of writing, the portfolio is worth £1,426,314.11 with dividends, and £1,330,378.78 without dividends.

Dividends have added 9.6 percent to my total return over 3.5 years. That won’t be too surprising -- it’s just under 3 percent each year.

What’s more surprising is to realise that this dividend income has increased my total return to date by 29 percent.

I think these numbers are a useful reminder of the power of dividends, which can of course be reinvested or withdrawn to suit your requirements. That’s not true of capital gains, which must always be traded to be realised.

Diversion over. Let’s get back to this month’s threesome under review.

D4T4 Solutions (LON:D4T4)

(Original coverage 04/12/2018)

Shares in this ‘big data’ software company got off to a flying start when they joined the SIF folio last December. Progress has cooled since April, however. Note that the stock’s gradual decline is also starting to be…