Anyone invested in UK-focused cyclical stocks has done well since December’s general election. Indeed, we might speculate that if Neil Woodford had maintained his focus on FTSE 350 dividend stocks, he’d now be enjoying the adulation due to a successful contrarian.

Mr Woodford ran out of time, but the main reason this happened is that he didn’t stay true to his system. If he had, I’d be willing to bet that investors would have continued to trust his stock-picking instincts.

The Stockopedia ethos is all about focusing on quantitative factors that are proven to work. Not every stock with good stats will be a winner. But in aggregate, a balanced selection should perform well, as Ed Croft’s NAPS portfolio has demonstrated.

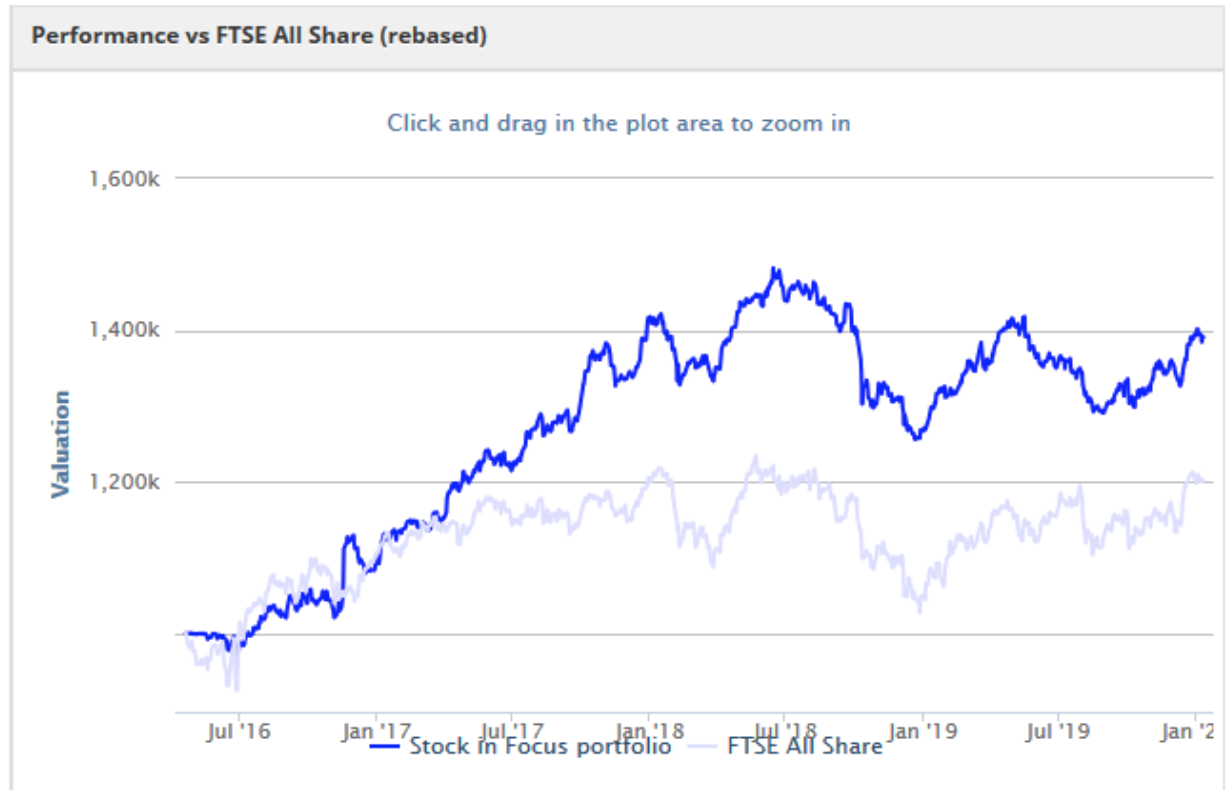

Staying true to my system has been a key goal for me since I launched the Stock in Focus (SIF) folio in April 2016 (this link will only work on the old Stockopedia site). The challenge I agreed with Ed at that time was to see if I could beat the market with a portfolio where the stocks are selected using a screen. So far, I’ve succeeded:

But sticking to the rules isn’t always easy. Sometimes the stocks which qualify for my screen just seem like poor businesses. Other times, I like the business, but it feels like the wrong time to buy.

Right stock, wrong time?

This week’s stock is a good example of this dilemma. I admire car supermarket Motorpoint Group (LON: MOTR) as a business. But buying now seems like an all-or-nothing bet on the UK economy.

To give you a bit of history, the SIF folio has previously owned this stock, from December 2017 to January 2019. My timing was poor. I bought too late to enjoy the 2017 gains, watched the 2018 gains slip away and then sold before the rise seen in the second half of 2019!

C’est la vie - the holding did at least log a small profit above its costs.

In my view, it’s not hard to imagine the same thing happening again in 2020. Motorpoint shares have risen on Brexit/election euphoria, but of course nothing has actually changed in the real economy. And the hard work on Brexit must still be…