Market conditions have remained uncertain in recent weeks, with profit warnings and poor trading updates punished severely. We’ve also seen shareholder wealth permanently destroyed at Conviviality and (I suspect) Mothercare, as Graham discussed on Monday.

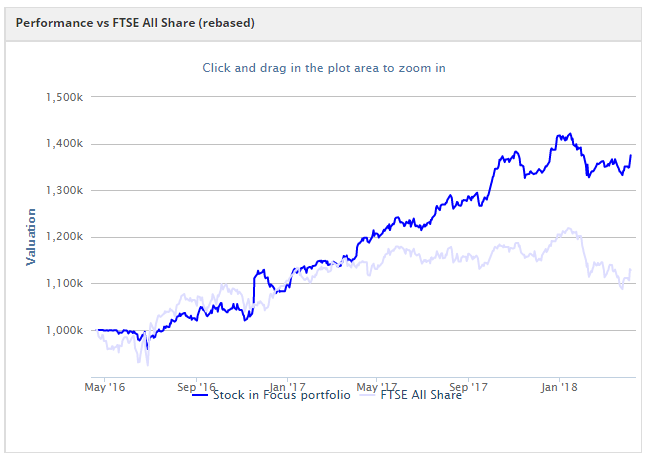

The SIF portfolio has managed to avoid this kind of distressed situation so far. Performance against the FTSE All Share benchmark has remained satisfactory, in my opinion:

However, I haven’t felt able to add many new stocks recently. Although companies have continued to qualify for my own Stock in Focus screen, very few of these are new. And many are in sectors already covered by existing portfolio stocks.

Here’s a list of the companies which currently qualify for the screen. I’ve highlighted them using the colour code below so you can see how few new stocks are available for consideration at the moment.

Already in SIF (green)

Previous SIF stock that has qualified again for the screen (blue)

Direct overlap with a SIF stock or not eligible for some other reason (red)

The graphic above shows that there are seven stocks I could consider adding to the portfolio:

- Russian oil and gas group NK Lukoil

- US-focused plumbing and heating supplier Ferguson

- German commercial property firm Sirius Real Estate

- Specialist insurance and employee benefits group Jardine Lloyd Thompson

- UK motor and home insurer Hastings

- Investment manager Charles Stanley

My rules specify that I should consider stocks with the highest StockRanks first.

Starting at the top, I’m going to rule out NK Lukoil despite a StockRank of 99. My previous experiment with Russian stocks delivered mixed results. The imposition of US sanctions against a number of oligarchs makes me even less keen on investing in such firms.

The next qualifying stock on the list is FTSE 100 plumbing and heating supplier Ferguson. Although this is a UK-listed company, about 90% of trading profit now comes from the USA. A further 5% or so comes from Canada and Central Europe. The UK accounts for the remainder.

I think it’s fair to view Ferguson as a play on the US economy. In contrast, the portfolio’s other property-related stocks (Redrow, Norcros and Costain) are mainly focused on the UK. So I don’t think there’s too much overlap with…