In June last year, I wrote about Indivior in this column.

At the time, the Reckitt Benckiser spinoff was nearing its peak share price of 271p.

The stock enjoyed a perfect StockRank score of 100, despite only having been listed for six months. The market appeared unconcerned about the future, despite the likelihood of serious challenges to the firm’s profits.

How things change. Indivior shares have fallen by 27% since then. The changes I feared in Indivior’s business are starting to materialise. February’s results revealed that sales fell by 9% in 2015, and net profits fell by 43%.

Despite this, a sharp improvement in momentum since the firm’s 2015 results has helped lift Indivior’s StockRank back up to a stellar 99.

A couple of readers have asked me to take a fresh look at the stock, which is also a member of Stockopedia founder Ed Croft’s 2016 NAPS portfolio. With the shares down by 38% from last year’s all-time high, is Indivior a contrarian opportunity, or a value trap?

The big risk?

Before I delve more deeply into Indivior’s valuation and outlook, it’s worth summarising the key risks faced by the business.

Indivior’s only real commercial product is Suboxone, a medicine used to treat patients with opioid (mainly heroin) addiction. Historically, Suboxone has been sold in two forms, a tablet and a film.

The film is seen as having a number of advantages over tablets. As it’s administered by dissolving a piece of medicated film on the tongue, the dispensing pharmacist can be sure the treatment has been taken by the correct person. Tablets can be more easily secreted and sold or swapped for drugs. There is apparently a black market for Suboxone.

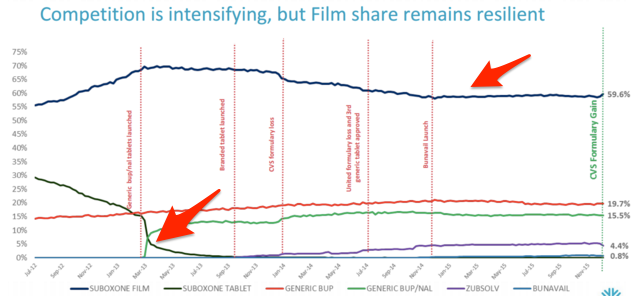

However, market share for Suboxone Tablet has now fallen to less than 1%, thanks to generic competition. This slide from the 2015 results presentation shows how Indivior’s market share has changed since July 2012 (Suboxone Film is the top line, Suboxone Tablet is the green line that drops to the bottom):

(Taken from Indivior 2015 results presentation)

In just one year, Suboxone Tablet went from a c.30% market share to sub-1%. The other coloured lines represent generic tablet competitors. It’s obvious why Indivior is putting a lot of effort into legal challenges to all six of the new drug applications for a competing film products.

An…