From your full 6 year history have any Super Stocks remained Super Stocks from the beginning?

I'm going to guess the answer is "no".

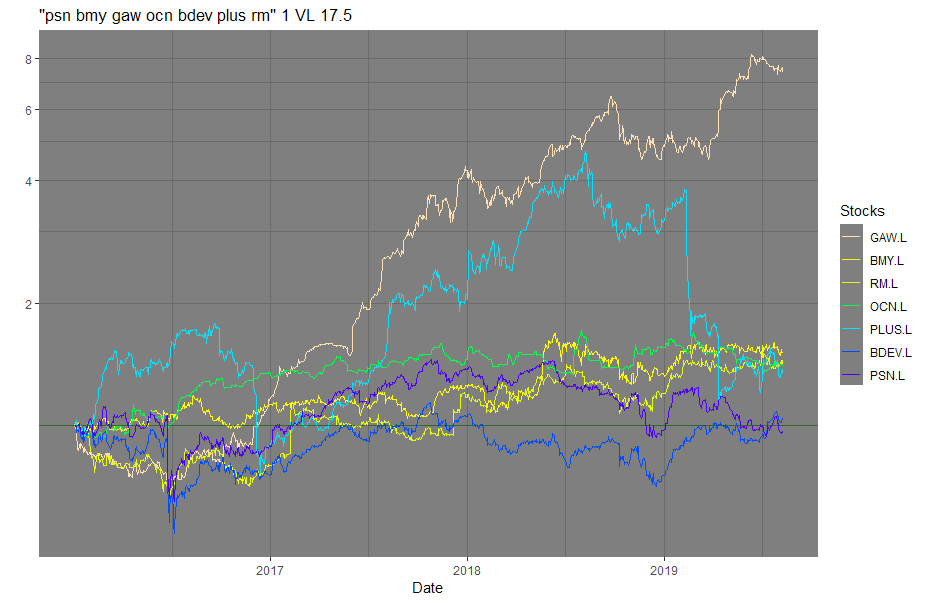

I have data on some stocks back to 2016. So if you are curious my list of the best performers in terms of maintaining a high stock rank seem to be these:

Persimmon (LON:PSN)

Bloomsbury Publishing (LON:BMY)

Games Workshop (LON:GAW)

Ocean Wilsons Holdings (LON:OCN)

Barratt Developments (LON:BDEV)

Plus500 (LON:PLUS)

RM (LON:RM.)

I don't track the smaller caps and I have only sorted using Stock Rank (rather than requiring high Q V M) for this list. So it is just a flavour.

Overall performance since 2016 is reasonably good - but it should be. We are selecting for stocks which have had consistently high Stock Rank so we are forcing them to have at least reasonable historical Momentum.