Having been too wedded to dividend hunting and convinced I could outguess the shorters, I first missed and then arrogantly ignored the Value Trap warnings about Carillion, and got burned. I licked my wounds and I am now more strongly focused on the Stockopedia Ranks and have adjusted my portfolios to hold almost entirely winning styles with most of those classified as Super Stocks.

My concern now is that I see that the shorters are building positions in some of my shares classified as "winners", namely Barratt, Berkeley, Halfords, Persimmon and Plus500.

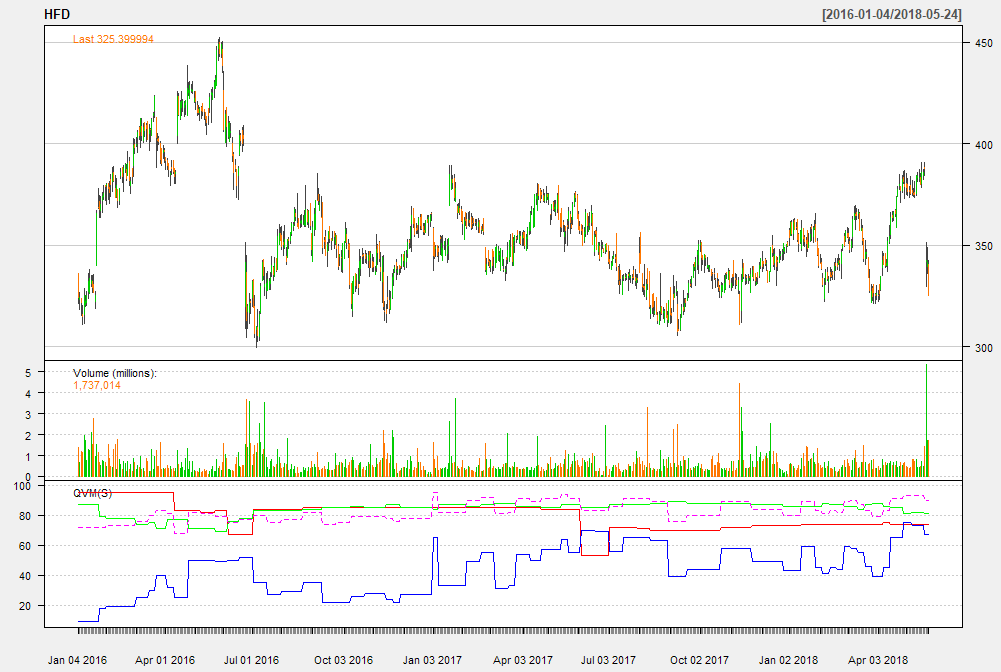

Halfords is a good example. It is still showing as a winner with excellent Quality and Value ranks but because it has tanked over some not really terrible news, the Momentum rank has been slashed and it has flipped from Super Stock to Contrarian. Looking at the trades, almost all of the sells are Automatics which suggests to me that the Momentum investors are heading for the door and perhaps this is a classic over reaction to the news. I read the Halfords report and couldn't see anything really bad. Yes profits were slightly down but credible actions is being taken and it is still a great cash machine servicing a good dividend and capex. As a result, debt is under control and gearing is low. While it isn't a High Flyer, this doesn't look to me like a company on the skids.

My problem is that 2.4% has been shorted over the past couple of days which leads me to believe that there may be something happening to Halfords which I have not recogised.

I rely heavily on the Stockopedia Stock Reports but it looks as though the shorters are using different data or analysis to evaluate these companies. So my question is, how do I find out if there really has been a change which has not yet been picked up by the Stockranks?

Any comments and ideas would be most welcome.

https://shorttracker.co.uk/ should help