In prevailing market conditions, where participants are fixated on downside risk, looking for quality, growing companies with safe balance sheets and margins of safety is more important than ever. Sylvania Platinum (LON:SLP) might be one of those companies - if you believe the current prices of palladium and rhodium can be maintained.

Sylvania is a low-cost South African producer and developer of platinum, palladium and rhodium. Surging platinum group metals (PGM) prices have propelled the group’s shares ever higher in recent weeks. Barring a one day drop last Friday, it has also held up relatively well in the recent risk-off market conditions.

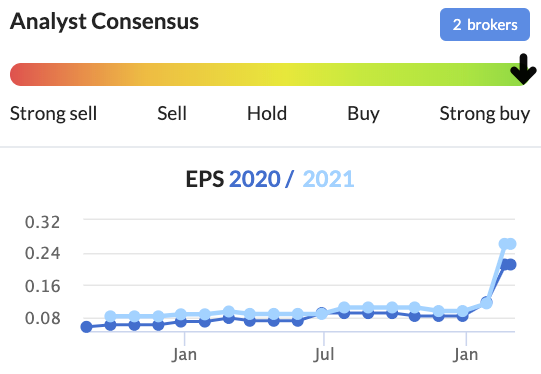

That is probably due to an attractive combination of rocketing profitability, stacks of cash on the balance sheet, and a shareholder-friendly use of prodigious amounts of free cash flow. The group’s shares currently trade on just 2.8 times forecast earnings and brokers have been busy more than doubling their EPS estimates for FY20 and FY21.

Sylvania has a market cap of £135m, but it also has $33m of cash, virtually no debt, and there is every indication the company will have added to this cash pile by the year end. The group also holds untapped mining assets with option value.

So what’s going on? Am I late to the party here or will the market at some point wake up and aggressively rerate this cash-rich South African miner’s shares?

Not without risk…

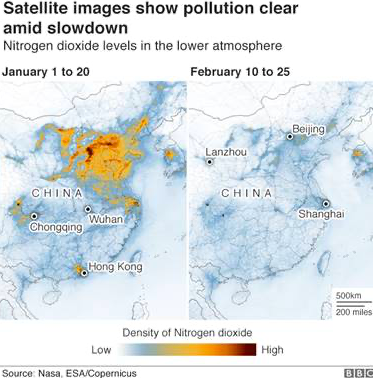

While the PGM metals Sylvania produces are in demand from auto industries for their pollution-reducing properties, it is worth remembering the Sylvania, as a low-cost operator, is operationally geared. That means profits that seemingly materialise out of nowhere can likely evaporate just as fast.

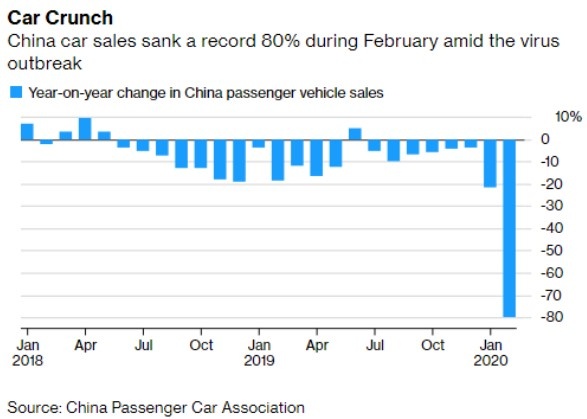

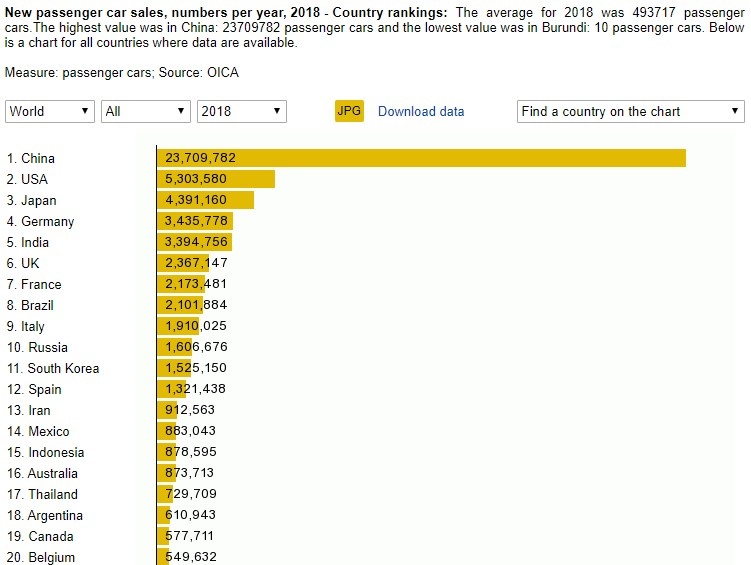

It is impossible to look at stocks without considering the Coronavirus at the moment, and I believe Sylvania could have some exposure to the economic disruption that has occurred so far. It is hard to quantify anything at this stage, but a lot of demand for PGMs comes from China’s automobile market. Assuming that spot prices for these metals can be maintained is central to the thesis that Sylvania shares are cheap.

The group itself flags other risks. In its FY19 results, it notes:

There are clouds on the horizon in automotive markets – China trade wars, Brexit, and such mean that we will remain with our conservative views of metals prices…

.jpg)