Hi everyone, this is my first post on Stockopedia so thanks for taking the time to read it.

I've been investing, on and off, for around 10 years and the one technique that has appealed to me more than most has been Ben Graham's value investing. I discovered Graham's method via Warren Buffet after trying to understand how he sought to buy stocks. I know Bufett's wealth has come mainly in his later life and thanks to the float Geico produces, but his record still stands none the less.

I have recently started using Graham's method alongside my growth and momentum plans, mainly to appease my own curiosity, but also because I believe there are a lot of stocks that are being overlooked in the wake of the current AI / automation bubble / renewable energy surge. By this I mean more emphasis being put into looking at potential in the future rather than detailed research on fundamentals in the hear and now.

My question is do you think there is still a place for value investing as a main strategy, and has the market changed since the days of Graham and Buffett's early successes to reward the more forward thinking investor.

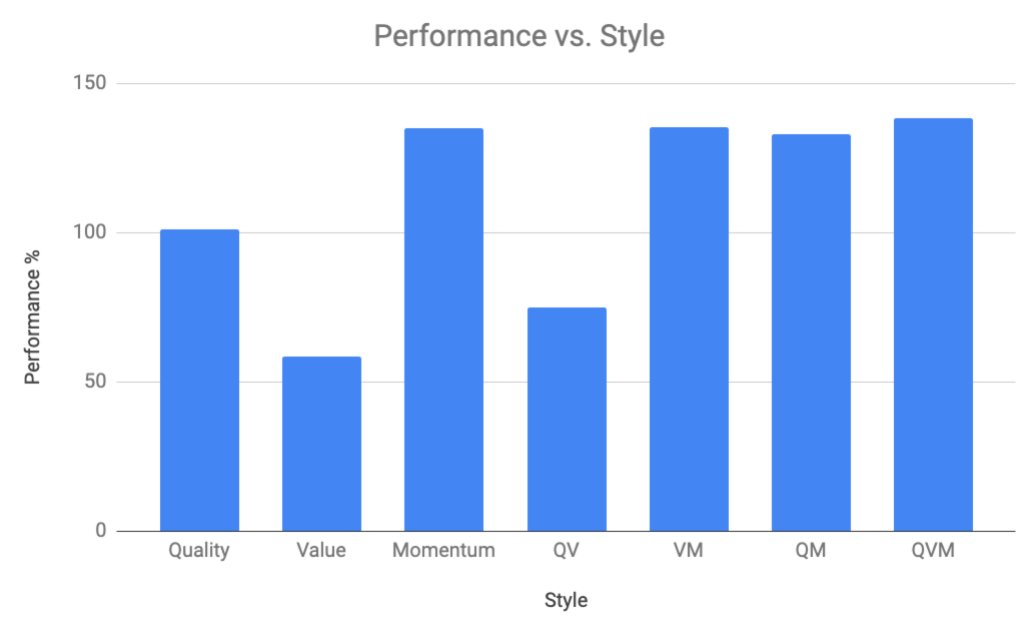

For some people value investing will be a great strategy, for others not. No strategy works all the time and not everyone can live with the strategy, whether that be growth, momentum, quality etc. For example value will often require you to sit through large falls in the share price before Mr Market recognises what you've already seen. That's hard for many people. Momentum means sitting out of the market for extended periods while value investors are seeing their bets come good.

What is important is finding what you are comfortable with and sticking to it - be that deep value investing or high momentum swing trading and everything in between. A huge amount will be determined by your own interests, knowledge and temperament.

The "greats" in their respective fields from Buffett to Minervini all stress this - otherwise people risk flip flopping, switching when one has done well and the market is going to rotate to favouring others.

Woodford is a fine example of the need to stick to what you know - he went from buying big cap quality dividend payers to thinking he could pick small growth stocks. He couldn't, totally different skill set he just doesn't have.