On Thursday evening DX Group was ranked amongst the top 1% of stocks in the UK according to the Stockopedia StockRanks. Unfortunately for holders, the company announced a profit warning on Friday morning and was brutally punished by the market. It fell 73% from 85p to 23p on the day. As usual, Paul Scott was very quick off the mark with his analysis in a post which has drawn a wave of more than 60 responses from the community since.

Catching up this morning I discovered many, often rather angry, comments about the fact that DX Group had a 99 StockRank before the profit warning. For those who don’t know, the StockRanks grade all UK and international shares from zero (worst) to 100 (best) across a range of fundamental and technical factors, so when one of the top rated stocks falls out of bed it tends to cause a stir.

As one of the architects of the system, some of these comments were pointed in my personal direction, so I feel I have a duty to respond. While I’ve written extensively on how to think about high StockRank stocks before, there was one comment in particular that has prodded me to pick up the quill. Be warned - my response won’t be comfortable reading for some but I do hope though it will clear up some of the misinformation that has been shared on the discussion boards.

Have lots of high StockRank stocks really been “disasters”?

Whenever there’s a profit warning in one of our highly ranked stocks I often see this kind of comment:

Quite a number of high StockRank rated stocks have disappeared, gone bust or become disasters lately.

This is a very normal response to a painful situation such as a profit warning, but it is an observation driven by software bugs in the human brain rather than from rational investigation.

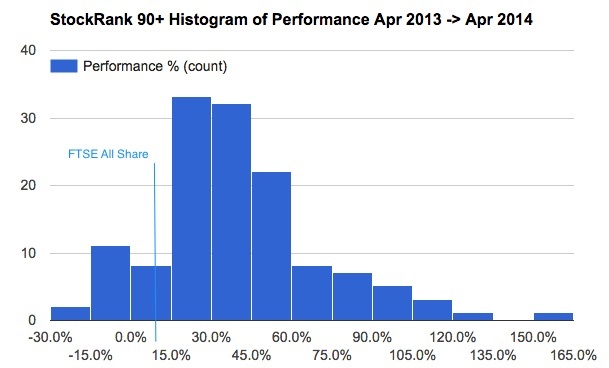

In order to analyse whether lots of high StockRank stocks have indeed ‘disappeared, gone bust or become disasters’ I have taken a closer look at the performance of the 142 shares that had a StockRank of 90+ on 31st March 2015.

- Performance In just over 7 months, the average performance of these 143 stocks has been a gain of 11.4%. For comparison the FTSE All Share has fallen by 8% in the same period. i.e. these 142 high ranked stocks have beaten the All…