Hi, it's Paul here.

Apologies for the delay. Somewhat later than usual, here is Tuesday's SCVR.

Let's start with the biggest percentage faller of the day, which must be a profit warning.

Luceco (LON:LUCE)

Share price: 50p (down 35.7% today, at market close)

No. shares: 160.8m

Market cap: £80.4m

Trading update (profit warning)

Luceco, the manufacturer and distributor of high quality and innovative LED lighting products, wiring accessories and portable power products, is today issuing the following update.

I am not familiar with this company. Thankfully, Graham wrote about it 3 times last year, so I'll get up to speed first by reading his 3 articles. I'll summarise them below;

Oct 2016 - floated by Numis on the full UK stock market, at 130p per share. Selling shareholders cashed out £67.1m-worth of existing shares (before costs). The link to the left is to its prospectus. A further £22m (net of costs) was raised to reduce existing borrowings.

3 Apr 2017 - very strong results for 2016 were announced. Adjusted operating profit up 53% to £17.6m. Strong outlook statement too.

11 Sep 2017 - strong interim results, with operating profit up 25% to £9.0m. Full year outlook in line with market expectations. Net debt £26m.

15 Dec 2017 - this is when things started going wrong - a profit warning. Gross margin weakness is blamed, and the financial controller resigned over the apparent error of not spotting it sooner. Forex & commodity prices are the underlying causes. Profit guidance for 2017 reduced by 21% to £13.2m (profit after tax). CEO sold 2m shares a few weeks before this profit warning!

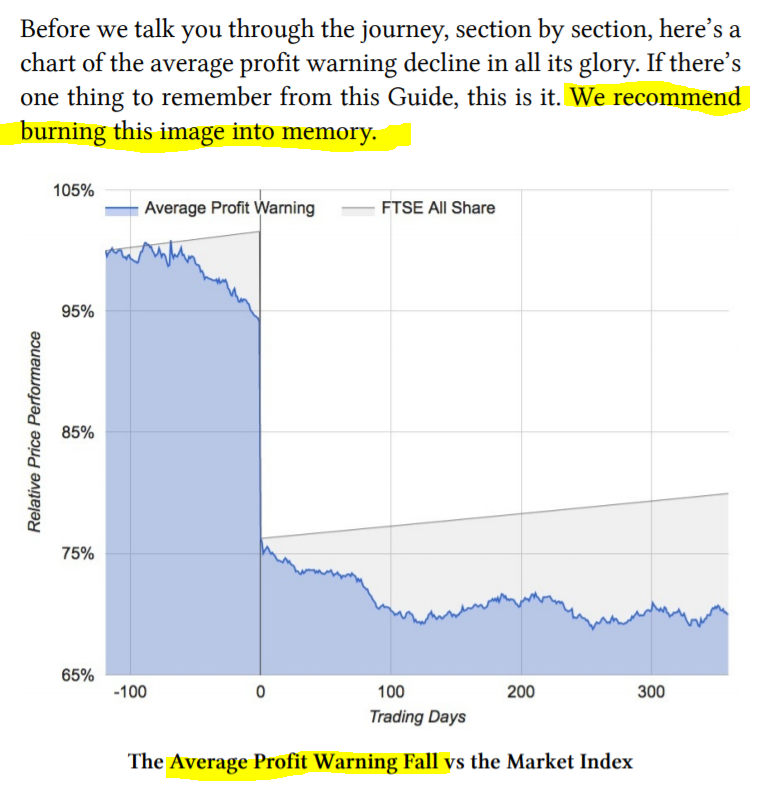

It's interesting to look at the chart, and see that the best strategy in this case, would have been to sell immediately on the first profit warning. We've discussed that a lot in the past, and I am having a quick re-read (highly recommended) of Stockopedia's brilliant 2016 study of 245 small cap profit warnings.

The overwhelming conclusion of this data-driven study, was that selling immediately on a profit warning, has been statistically the right thing to do, on average. This chart says it all;

Emotionally, I think we probably all find it quite difficult to embrace this strategy of selling on a profit warning. However, I am warming to the idea. Let's not forget though, that there are some cases, where profit warnings lead to irrational & excessive selling, creating bargains. So every case is unique.

A good recent example of a profit warning creating a bargain opportunity was the crash in share price of Revolution Bars (LON:RBG) (in which I hold a long position) in May 2017. This created a lovely buying opportunity where investors were able to double our money in the next 4 months, when Stonegate launched a 203p cash takeover bid for the company. Shareholders rejected the bid, but the opportunity was there to cash out, in the market, if people wanted to).

The other to consider is liquidity. You might want to sell after a profit warning, but if you hold a large position in an illiquid stock, it can be impossible to get out. So there's the risk that large shareholders might end up drip-feeding shares into the market over a sustained period, after a profit warning. So it's a problematic area, for sure. Sometimes, I find that whatever you do, re a profit warning, the opposite would have been the better course of action!

Anyway, getting back to the latest RNS, what does this say?

Profit warning 6 Mar 2018 - it's a warning on calendar 2018 profits now. I do like the way this company gives us precise guidance in its trading updates. In a MiFID II world, this is very helpful, as otherwise private investors would be left in the dark, due to lack of access to research notes;

Trading conditions since the Group's trading update on 15 December 2017 have remained difficult in our UK consumer facing business, which is approximately 25% of Group revenue, as a result of well publicised weak consumer confidence and a weaker dollar.

These factors have caused us to revise our estimates for the outturn for the year to December 2018.

We now anticipate reporting 2018 profit after tax in the range of 12.0-14.5m, on revenue growth on 2017 of 5-10% at current exchange rates.

I'm not sure why Luceco gives guidance on profit after tax, when profit before tax is the more usual benchmark. Anyway, the fact that the company is using best practice, of providing the market with a clear range of profit outcomes, is fantastic. How long will it take, before so many other companies catch up, and report to us in a similarly helpful style? We need this information direct from companies now, as MiFID II has restricted our access to broker research so badly.

2017 results - the full numbers have not yet been published. Guidance is revised down again. It's great when companies give profit guidance, providing the results fall within the guided range. Unfortunately, the 2017 results are being guided down again today. As mentioned above, on 15 Dec 2017 the company guided to PAT of £13.2m. This has now come down again, to £11.0m. The explanation today is as follows;

The shortfall relates primarily to continued margin pressure and the treatment of certain costs which had been earmarked for capitalisation but are now being taken through the profit and loss account. Revenue is expected to be 168.6m and net debt at 31 December 2017 was 36.9m.

This is seemingly due to the new CFO taking a more prudent view. It reinforces my feeling that the finance function at this company seems to have been very poor in the past. Or, that's perhaps being used as an excuse? It makes me wonder if there are any more skeletons in the cupboard, yet to be revealed?

Other points in today's update;

- UK retailers have de-stocked, after a weaker than expected Christmas

- "Continued strong growth among higher margin trade, projects and international customers"

- "Our previously outlined improvement actions remain on track to return margins to long term expectations during H2 2018"

Balance sheet - I'm a bit concerned that the net debt is reported at having risen to £36.9m at 31 Dec 2017. That's getting close to, or even into dangerous territory in my view. This seems to be due to a debt-funded acquisition, announced here on 18 Sep 2017 of Kingfisher Lighting, for £9.75m.

Aside from its bank debt, the rest of the balance sheet looks OK.

Bank facilities - this is the main issue for further research. Note 11 in the last interim results discloses that most (£20.4m) of the bank debt relates to invoice discounting arrangements. The receivables book was £29.3m at the time. So I imagine the bank is probably reasonably comfortable with borrowings which are supported by receivables, as there shouldn't be any issue with the bank getting its money back, in the worst case scenario.

I've done a search (CTRL+F) on the 2016 Annual Report, on the word "covenant". It's mentioned 8 times, including these bits;

The Group has committed borrowing facilities in place in the UK comprising a £12m revolving credit facility (“RCF”), which was drawn down in full at the year end, and a maximum £30m invoice discounting facility with HSBC.

Bear in mind that this is rather historic now, so might have since changed.

This excerpt below suggests that the company has a net debt: EBITDA bank covenant, which is normal;

Net debt at 31 December 2016 stood at £29.4m, (2015: £46.1m), representing 1.4 x 2016 adjusted EBITDA and the Group continues to enjoy considerable headroom against its covenant requirements.

Given that net debt has now risen considerably, to £36.9m, and EBITDA will have fallen, then I'm not sure the group will still have "considerable headroom"? This is the key issue, where we need more information (as the company does not state in its Annual Report what the bank covenants actually are).

It's not necessarily a problem, but I'm wary that it might be a problem. The smallish divis might need to be cancelled in future, to focus on reducing debt. So I would work on the basis that divis may not necessarily continue.

Cashflow statement - the business looks nicely cash generative. Note that it capitalised £1.2m of internal development costs in H1 2017.

Broker forecasts - I can't find any updates, unfortunately. However, since the company has very helpfully provided us with profit after tax (PAT) estimates, then it's very simple to work out EPS, by dividing the PAT guidance by 160.8m shares in issue. This arrives at;

2017 latest guidance of £11.0m PAT, divided by 160.8m shares = 6.8p EPS

2018 latest guidance of £12.0 - 14.5m PAT, divided by 160.8m shares = 7.5p to 9.0p.

Does the 2018 guidance make sense, or might there be further slippage on these forecasts as the year goes on? Who knows, but given the recent track record, I think it makes sense to treat the company's forecasts with great caution.

Personally, I think I'd be comfortable using a lower range, of maybe 5-7p EPS for 2018, to value this share. Therefore at 50p, it would be on a PER of between 7.1 and 10.0 . Given that net debt of £36.9m is quite considerable, at 46% of the market cap, then the cash neutral PER would be quite a lot higher, and not looking a particular bargain.

My opinion - this looks a can of worms in some ways - e.g. repeated lowering of guidance, accounting problems, bank debt which could now be tipping into problem territory.

On the other hand, even after the latest downgrades to forecasts, this remains a nicely profitable and cash generative business. I'm just worried if anything else might come out of the woodwork?

Looking at the divisional performance, most of the group profits actually come from its wiring accessories division, BG Electrical. The products don't strike me as being high tech, or particularly special. So it's not clear to me what competitive moat the company has? Maybe its high profit margins could be vulnerable to erosion from competitors also sourcing similar products from China, and under-cutting Luceco on price?

Another question is whether the company's owners possibly floated the company at a high valuation, knowing (or maybe suspecting?) that its growth was not sustainable? That question is bound to be raised when strong growth at flotation time turns into a series of profit warnings and accounting problems.

Overall, I think I've talked myself out of wanting to have a punt on this. I shall read its next set of results with interest though, so it's going on the watch list. I think some comfort on the banking situation is necessary, in particular on how much headroom the company now has on its bank covenants?

With the share price depressed now, that makes it harder to raise fresh equity funding, if needed. Management credibility is also bound to be questioned, after the very poor sequence of events in recent months.

Begbies Traynor (LON:BEG)

Share price: 75p (up 2.9% today, at market close)

No. shares: 138.1m

Market cap: £103.6m

(at the time of writing, I hold a long position in this share)

Begbies Traynor Group plc (the "Group"), thebusiness recovery, financial advisory and property services consultancy, today issues a trading update for its third quarter ended 31 January 2018.

Everything seems to be going to plan;

The Group has traded in line with our expectations in the period, with revenue and profit growth for the year to date, reflecting improved year-on-year performance in business recovery and advisory services.

We remain confident that results will meet our expectations for the year as a whole.

It's interesting to note that corporate insolvencies are still historically low, despite a 9% increase in 2017. This is the continued influence of ultra-low interest rates, which has incentivised banks to hold back on forcing zombie companies into administration. How will it all end? Nobody knows for sure, but it seems obvious that with interest rates likely to rise gradually, then insolvencies will probably rise. We're also seeing over-capacity, and financial problems in some sectors, such as hospitality, and retail.

Acquisition - a small, earnings enhancing acquisition has also been announced today. It's a corporate finance firm called Springboard.

My opinion - I remain a holder of BEG, and see it as something counter-cyclical, which helps balance my other portfolio positions a little, given that almost all other holdings of mine would benefit from an improving UK economy. Begbies benefits from corporate insolvencies, so it works the other way.

On a PER basis, Begbies looks rather expensive now. However, when its workload increases, then there's considerable operational gearing. I think the market is pricing in future increased profit margins, hence why the PER looks high at the moment. For this reason, and the divi yield still being pretty good, at 3.3%, I intend to continue holding this share for the foreseeable future.

It's interesting to see that the chart is still looking bullish, with none of the profit-taking that has been experienced in many other small caps in the last few months;

The Stockopedia scores look pretty good at the moment too;

LoopUp (LON:LOOP)

Share price: 365p (up 9% today, at market close)

No. shares: 42.2m

Market cap: £154.0m

LoopUp Group plc (AIM: LOOP), the premium remote meetings company, today announces its unaudited preliminary results for the year ended 31 December 2017.

I've reported on this company several times before. I've tried out the product (which is good), and met management at their HQ (also all good). So lots of positives.

You can read the results announcement if you want all the detail. My take on it is;

- Revenue growth to £17.5m of 36% is clearly excellent.

- High gross margin (76.7%), recurring revenue product, also very good.

- Operating profit is only £0.7m (up from a -£0.3m loss, on a comparable basis, which excludes some other revenue that was winding down). So how on earth can a market cap of £154m be justified?

The answer is that the market is anticipating strong continued growth, and profits soaring due to operational gearing. My problem with that, is that the operational gearing with this type of company often doesn't produce anything like the expected increase in profits - because management usually reinvest profits in increased overheads. There's nothing necessarily wrong with that - in fact, if you have a big market opportunity, then it makes sense to put short-term profits to one side, and "go for it" in terms of growth. The trouble is though, that makes valuation of the shares very difficult, almost impossible really.

Note that LoopUp receives a substantial tax benefit from its R&D activity, which more than doubles operating profit, and results in profit after tax of £2.0m for 2017. The company would obviously be very vulnerable to any negative changes in Government policy over R&D tax credits. So shareholders here should regularly google on that issue, to keep abreast of any potential risks.

Cashflow statement - a quick look at the cashflow statement reinforces just how ridiculous EBITDA is for software companies. In this case, EBITDA of £3.46m compares with £3.76m of capitalised development spend in the year. So on a cash basis, arguably the business is still actually loss-making.

Balance sheet - absolutely fine, no issues here. I don't think the company will need to raise any more cash, so shareholders should be pretty secure from dilution.

My opinion - it's a smashing company, with an excellent niche product. You need to properly research the product, and its specific features, to understand why customers like it. I did that a while ago, and was very impressed. Never mind what I think, the strong organic growth from customers tells us that the product is good, and in demand. What the long-term potential for the product is, who knows? Something better could come along & wipe it out, longer term.

Strong growth in the USA is interesting, and that region is now 51% of revenue. So that could be another reason why investors are prepared to chase the valuation up to such a high level?

Overall, I can't get my head around the market cap being so high. That could be an emotional response to the fact that I panic-sold my decent-sized position here when Amazon launched a competing product. Since then, the share price here has gone through the roof. So I threw away a big potential gain. I can't bring myself to revisit it at this level now, but good luck to the smart people who continued to hold this stock!

I see that the company has also announced that it is appointing Numis alongside Panmures, as joint corporate broker. Could there be a fundraising/acquisition on the cards, I wonder? Also, I have a hunch that LoopUp itself could become an acquisition target for a larger US tech group, who knows?

Headlam (LON:HEAD)

Share price: 476p (down 10.0p today, at market close)

No. shares: 84.85m

Market cap: £403.9m

Headlam Group plc (LSE: HEAD), Europe's largest distributor of floorcoverings, is pleased to announce its final results for the year ended 31 December 2017.

I was a bit surprised at how many readers asked me to look at this company. My initial skim of the numbers, at 7am, was that they looked resilient. So I wonder why the share price fell 10%?

Thank you to the reader who flagged up this link to the company's results presentation. If there's time, I like to read such presentation slides, as they often contain useful additional information. Although care is needed, as such presentation slides will always be painting the most rosy picture possible.

Thinking about its business model, I don't normally like investing in distributors, because there seems to be a long-term trend to cut out the middlemen, using the internet. However, in the case of floorcoverings, which are very bulky, and come in thousands of options, then it's easier to see why a distributor's business model makes sense. As the company presentation says;

The average customer order value is very small, at only £133. So it seems that independent retailers are using HEAD as their warehouse, and drawing off small orders when required by their own end customers. Price points are low to middle. These factors make me comfortable that this business should be resilient in a downturn, as it's generally not big ticket stuff, but more modest updating of houses, one room at a time, by the end customer.

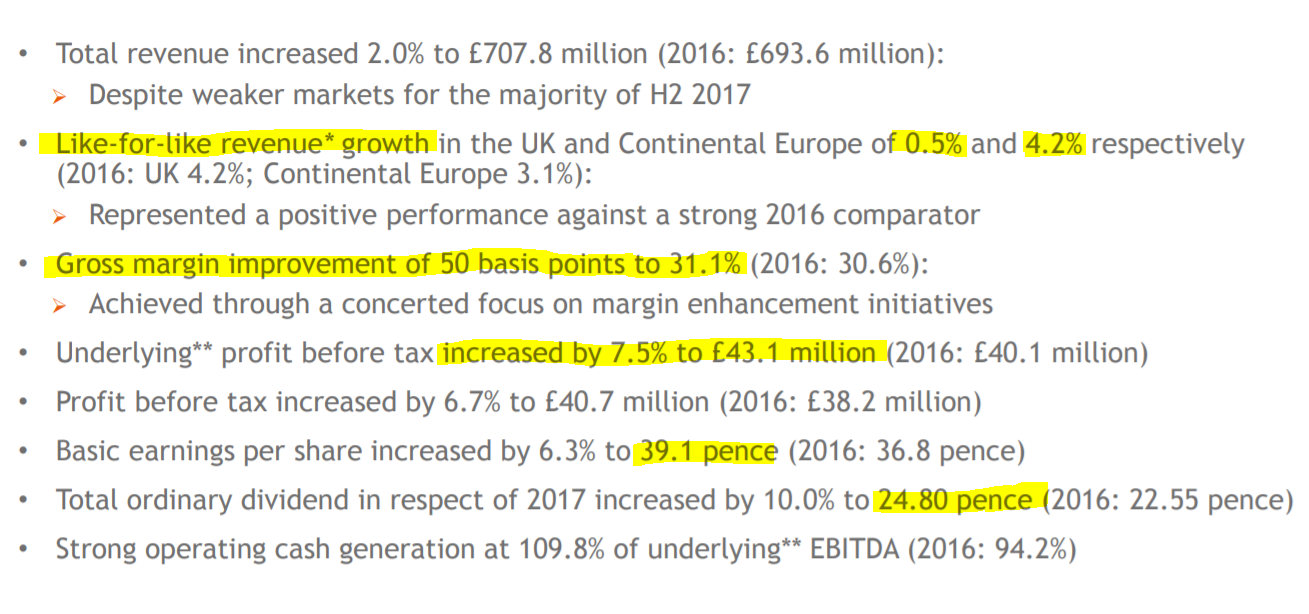

The financial highlights look resilient, if not madly exciting;

I'm starting to form the impression that this looks a pretty decent business. Gross margin of 31.1% isn't bad for a distributor, and it's risen slightly.

Looking at valuation, the share price has fallen slightly to 470p at the time of writing, so that's a (now historic) PER of 12.0 - which looks about right to me, for a basic business model such as a distributor. It depends on the level of net debt though, so I'll look at that next.

I've just noticed that the company reports a higher EPS of 41.7p, after some underlying adjustments. Using this adjusted figure, PER drops to 11.3.

Dividends look to be the main appeal of owning this share, with a lovely yield of 5.3%, based on the 10% increase to 24.8p divis for 2017 mentioned by the company above.

There's been a decent progression in divis every year from 2012, when the payout was 14.9p. I like shares where the divi can be relied upon to increase each year - providing the balance sheet is strong enough to protect the payouts in a downturn.

Note that the company also paid special divis in 2016 & 2017, but had decided against one in 2018, citing capex on a new distribution centre in Ipswich, and acquisitions.

Balance sheet - note that there is a pension deficit, which has dropped from £23.0m a year ago, to £12.7m at 31 Dec 2017. The cashflow statement shows that £2.16m "pension contributions" in 2017, so this looks to be a bit of a drain on cashflow, but not at a material level, given that cashflow generated from operations was £54.5m. If considering a purchase of this share, I would check the last Annual Report notes on the pension schemes, just to be sure that it's not an "iceberg" type situation.

Looking at my usual balance sheet tests, here are the numbers;

NAV: £218.6m - which looks strong, given that intangibles are only £44.7m

NTAV: £173.9m - this looks very good, given the size of business, and that it has historically been acquisitive, bolting on other similar companies (a process which can often hollow-out a balance sheet, but not in this case)

Current ratio - this measures the working capital position. The result here is 1.51, which is strong, in my view. There's net cash of £41.8m within current assets.

Long-term creditors are relatively modest, at £30.8m, which includes the bulks of the pension deficit, and a bit of additional bank debt, of £6.5m, plus a few other bits & bobs.

Total net cash is £35.3m - which looks a very healthy position. I'm impressed! It's rather surprising that the strong balance sheet, with net cash, is not mentioned in the highlights section at the start of the RNS - maybe something for Buchanan (the PR firm) to think about when the next results come out?!

Does it own any freehold property? The answer seems to be yes, as the word "freehold" appears 3 times in the 2016 Annual Report. However, note 10 shows "Land and buildings" as having a NBV of £93.2m as at 31 Dec 2016. It's therefore not clear whether this is freehold, long leasehold, or short leasehold, or a mixture of the 3. It would be good to find out what the value of the group's freehold properties are. Do any readers have any info on this?

Overall, I'm pleasantly surprised by this balance sheet - it's strong. Hence divis, plus acquisitions can probably be funded without any dilution to shareholders.

Outlook - expectations unchanged;

Full year expectations remain unchanged for 2018, despite continuation of weaker markets

"We are pleased with our performance during 2017, having exhibited further growth against what was qualitatively viewed as an overall flat market, robustness in the face of a weaker second half of the year, and improved profitability as a consequence of our focus on efficiency initiatives.

The acquisitions of Domus and Dersimo illustrate that we have ample opportunities to grow and broaden our overall leading position in the industry while continuing to invest in the business to support organic growth. I personally wish to thank all our people for their contribution to the 2017 result, and look forward to delivering further improvements in 2018."

I've no idea why that text turned blue, but it's rather nice.

Bear in mind that the bulk of HEAD's business is in the UK. So the uncertain UK economic outlook, Brexit/Corbyn worries, etc, are bound to weigh on the share price here.

My opinion - I didn't expect to like this share, but have to say that my impression has gradually become more positive as I dug into the numbers. Let's summarise;

Positives

- Resilient trading, despite tough markets

- Lovely dividend yield - looks sustainable, plus possible future special divis (not in 2018 though)

- Strong balance sheet

- Acquisition opportunities make obvious sense - bolting on more business and improving its margins through group buying power

- StockRank of 88, although the style is "Neutral"

Negatives

- Headlam is a predominantly UK business, that is finding market conditions tough & consumer confidence not great at the moment

- Investor perception might be that this is a boring company, with limited organic growth potential, so what catalyst is there to trigger a re-rating?

- Chart not looking terribly healthy at the moment - so arguably an opportunity cost of holding this stock (which has overall just gone sideways over several years, in a roaring bull market

- One broker has reduced its 2018 & 2019 profit forecasts by about 3%, given the soft start to 2018. I do wonder if further reductions in forecasts might occur as 2018 progresses?

Overall, I'm probably more sanguine about the UK economy than most commentators, so I'm prepared to look at consumer-related stocks. My feeling is that inflation is likely to gradually reduce, and wages are rising. So we could perhaps see confidence improve later this year? Maybe?

As for Headlam, I like it. However, I'm not entirely convinced that I should rush out and buy shares in it now, but it's certainly going on to my watch list. Maybe the company should step up its acquisition programme? It worked rather well for Victoria (LON:VCP) after all - although that is a group of manufacturing companies, rather than distributors. I wonder if HEAD could acquire some manufacturers too, to vertically integrate (is that the right buzz phrase?!)

Apologies again that this report took longer than usual to gestate, but I got there in the end.

Best wishes, Paul.

P.S. If people leave a thumbs down, because a report is late, do you think that makes me more or less likely to want to finish it off? Have a think about that perhaps. I'm not a machine. Sometimes I can write well, other times nothing happens, so I appreciate it when most people cut me a bit of slack on off-days.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.