Good morning, it's Paul here!

I'm still jet-lagged, so am waking & sleeping at very odd times - no change there, I hear you cry! Anyway, I've been up since 4am today, and have finished yesterday's report , adding a new section on the trading update from Hornby (LON:HRN) . Quite an interesting special situation actually, but not one I'm tempted to buy.

Market comments

Small caps seem to be in a terrible patch at the moment, so my portfolio is really suffering. Still, it's a marathon, not a sprint, and this type of gloomy market is when (selectively) we can find some bargains. Also, I feel that 2017 was so ridiculously good, that many small caps became over-valued. So a correction to more sensible valuations was inevitable at some point.

Graham and I began to sound like a stuck record last year - concluding our reviews on many stocks, with - nice company, but the shares look too expensive. With valuations now generally having corrected downwards, hopefully we can unearth some more sensible buying opportunities this year. After all, the time to catch the bargains is when other people are too fearful to buy on good news.

I don't see any reason at all to expect a sustained bear market. We have good growth in the world economy, in all main regions. UK consumer confidence is fairly weak, but the outlook seems quite encouraging to me - inflation has peaked, and is now falling. We have full employment, wages are rising, and look set to soon overtake inflation - meaning that the pinch on disposable incomes is coming to an end.

Very unusual weather in the UK has also had an impact this year to date. Winter weather carried on through until the end of March. Therefore retailers & hospitality companies have seen lower footfall. There seems to have been a shift from consumer spending away from things, towards experiences - e.g. I read yesterday that holiday bookings are bucking the trend - surprisingly, at a time of weak sterling.

However, I think it's important to remember that, when we buy a share, we're not just buying this year's earnings, we're buying all earnings in perpetuity. So if prices are marked down because this year's earnings have been hit by one-off factors (such as poor weather), then that can, selectively, provide a buying opportunity.

Mind you, we have to be very careful to avoid companies that are in structural decline. I feel, given that retail is my specialist sector, embarrassed that to a certain extent I've been asleep at the wheel - not anticipating the dramatic decline of shares in Debenhams (LON:DEB) , Mothercare (LON:MTC) or Carpetright (LON:CPR) for example. Although I saw enough to realise that all of those (and others) were best avoided.

It seems to me that a wave of CVAs is now the only solution for many old-school High Street (and out of town park) retailers. Something has to give, after their profits have been decimated by high rent & rates, rising import costs, higher wages due to living wage, pensions, etc, plus a certain amount of business leaking away to the internet every year.

There is only one thing that can release the pressure - namely rents, which have to fall dramatically. The only quick way to do that, is via a CVA. So I think retail landlords are going to be the really big losers in the next few years. Hence I would avoid any REIT which owns properties that are let out to retailers. I'm toying with the idea of shorting Land Securities (LON:LAND) , Intu Properties (LON:INTU) , or Capital & Regional (LON:CAL) - which own a lot of shopping centres. Although that ship might have already sailed, as I see all are already trading well below book value. Also the cost of shorting could be prohibitive, due to having to fund the dividends to the other side of the trade.

The other thing to look out for, is the impact of interest rates being too low, for too long. This has led to over-investment in many sectors (i.e. mis-allocated capital). Hospitality has seen a c.40% increase in casual dining outlets in the last 10 years. The sector is now in a disastrous over-capacity situation, where many PE-backed chains are struggling to survive. The only way out from over-rented sites, is a CVA.

There's a similar situation with retailers - there are too many malls, with excessive rents, many of which are white elephants now. All of this is great for consumers of course - bargains abound, with most chains discounting heavily, so look out for the deals - nobody needs to pay full price any more when eating out. That's another reason why we should not fear the return of inflation, in my view. Retailers' pain is the consumer's gain, as customers resist price rises, and shop elsewhere if retailers try to impose price rises.

Equally, with the internet, there are numerous companies battling for our business, cutting prices to the bone. Many are operating at a loss, or at best a negligible profit margin, in order to gain market share. Again, great for consumers. Not so good for long-term choice though, as independent retailers are being squeezed out of existence.

Overall, I think the marvellous stock market conditions of 2017, where we could look forward to almost everything in our portfolios going up almost every day, are now long gone. This is now a much tougher market, where only good stock picks are likely to give decent returns. To my mind, it feels like a long-overdue correction in a bull market, rather than the start of a bear market. But I reserve the right to revise that opinion in future, if the facts change!

Topps Tiles (LON:TPT)

Share price: 72.85p (down 9.5% today, at 10:01)

No. shares: 193.5m

Market cap: £141.0m

Topps Tiles Plc (the "Group"), the UK's largest tile specialist, announces a trading update for the 26 week period ending 31 March 2018. The Board will announce interim results for the period on 22 May 2018.

LFL sales in H1 look pretty sound, at +0.6%.

However, the trend shows a deterioration, since the split is as follows;

Q1 +3.4% LFL sales

Q2 -2.2% LFL sales

Obviously very bad Feb & Mar weather is bound to have had some impact, which the company helpfully tries to estimate;

While we estimate that short term weather factors in late February and March, and the timing of an earlier Easter, account for around 1.6% of the second quarter like-for-like sales reduction, it is also clear that that there has been a softening of the underlying market.

I like these comments - the company is telling it like it is, not trying to sugar-coat the baddish news.

There is additional commentary, within which this caught my eye, as potentially providing good future upside;

Commercial - we are investing in our Parkside business with an ambition to develop this into a leading brand in the commercial tile market. We have launched a new website, parkside.co.uk, and are very encouraged by the response we have received in our drive to build a talented sales team.

Range - we are seeing encouraging signs that we can leverage our buying scale and range advantage into the commercial segment, effectively almost doubling the size of our addressable market while staying within our specialism of tiles.

That phrase "almost doubling the size of our addressable market..." is the sort of thing that you don't see very often, and certainly makes me sit up and take notice. Doubling your market size, on static fixed costs, could prove lucrative, longer term.

Outlook comments from the CEO sound realistic;

Matthew Williams, Chief Executive Officer, said: "After a strong start to the year, market conditions have become more challenging over the second quarter. While the business has responded well with a performance ahead of the overall tile market, we are retaining a cautious view of market conditions for the remainder of the year."

I think this is warming us up to a probable trimming of earnings forecasts for the full year, but it doesn't sound of particular worry - everyone already knew that this year was likely to be tough for all retailers, whatever they're selling.

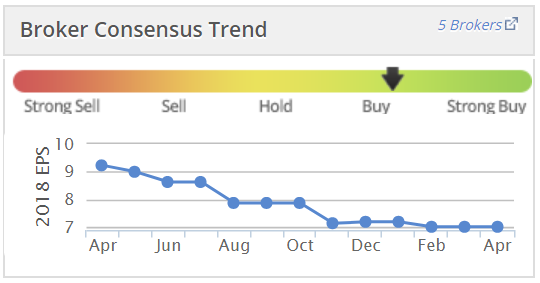

As you can see from the Stockopedia graph on broker forecasts, these have already come down quite a lot in the last year;

My opinion - this is one of the very few retailers that I would consider investing in right now.

I think this company is likely to be a structural winner, in the long term. The trouble is, why buy it now, given that earnings forecasts are steadily falling?

This is a classic glass half full, or half empty share. At some point, the market is likely to become optimistic, anticipating future recovery in earnings & growth from the new addressable market. We just don't know when. So the risk of buying/holding now, is that the market might continue to see things negatively for some time. Nobody knows.

It's on my watchlist already, as I like the company, and took a small opening position a little while ago. However, that didn't survive my recent portfolio pruning. I could definitely see myself buying back into this share at some point. The only question is the timing - which depends on macro factors such as consumer confidence readings, inflation & wage growth figures, which I tend to monitor monthly to drive some decision-making, on at least the timing of buys & sells. It's a fundamentally good company though, in my view.

Looking at the chart, 60p is looking an interesting potential future buy point, maybe?

Conviviality

The final chapter here is that an announcement today from C&C (LON:CCR) that it is buying the best bits of Conviviality group (Matthew Clark, and Bibendum) for a nominal sum, and assuming some or all of the bank debt. That's to be expected, since Conviviality shareholders declined to refinance the business, so are wiped out.

The market has added about £100m to the market cap of CCR today, which indicates the lost opportunity for Conviviality shareholders. This business could & should have been saved, and new management brought in, but it's too late now. Instead the upside goes to CCR.

It's such a pity, as the whole collapse of Conviviality could have been avoided, if it had just raised an additional, say £50m in one of the previous placings to make acquisitions.

This was certainly a shocking example of how weak management, going on a big acquisitions spree, can have calamitous results. I don't think anyone saw this coming, either, in terms of Conviviality actually collapsing to 0p. When I've got time, I'll revisit the numbers, and see if there were any warning signs in the previous figures. But seeing as management couldn't actually count, and the figures were clearly wrong, maybe that would be a pointless exercise?!

Mothercare (LON:MTC)

Change of CEO - Mark Newton-Jones' 4 year tenure as turnaround CEO at this distressed retailer has come to an end. In comes a new turnaround CEO, David Wood, who sounds a credible new pair of hands.

As I reported recently here, it's impossible to value MTC shares. They're probably worth little to nothing, but that depends on what type of restructuring & fundraising the company undertakes. I cannot see why investors would want to pour in more money, just to see it frittered away, paying off landlords to exit loss-making shops.

It's anybody's guess how existing shareholders will be treated, we just don't know. Hence this share is univestable, and only for gamblers right now.

Onthemarket (LON:OTMP)

Share price: 112.5p (up 2.7% today, at 12:12)

No. shares: 60.5m

Market cap: £68.1m

I wouldn't normally comment on this type of announcement, but I'm intrigued by this share, and am watching its progress.

This company is the UK's 3rd-largest online property website, behind Rightmove & Zoopla. I wrote a review of it a couple of months ago, here.

Today it says;

OnTheMarket plc (AIM: OTMP), the agent-backed company which operates the OnTheMarket.com property portal, is pleased to announce that traffic to the OnTheMarket property portal reached c. 12 million visits* during March 2018, the first full month since Admission to AIM. This is more than double the visits compared with February 2018 and compared with March 2017.

While this is only a month of data and is therefore early days post-Admission in the Company's steps to drive site traffic, the Directors consider this growth to be very encouraging and expect momentum to continue over the coming months through a combination of the increase in marketing and the traffic generated by increases in branches signing up and listing properties. The Company will provide a further update on visits in connection with the results for the year ending January 2018....

My opinion - this is basically a second attempt, after the initial business plan didn't work very well. The IPO raised a chunk of new money, to spend on marketing.

On balance, I reckon the chances of success are pretty slim. However, if it does succeed, then the upside on the share price could be considerable. So it's worth keeping on the watchlist, in my view.

I'll leave it there for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.