Good morning, it's Paul here.

My apologies that yesterday's article, a car dealerships special, was anything but special - actually it blew its head gasket immediately after leaving the showroom. Sorry about that, I got writer's block & there was nothing forthcoming unfortunately. So some time today has been allocated for me to go back & finish it.

Firstly I'll rattle through the handful of trading updates today from small caps.

Water Intelligence (LON:WATR)

Share price: 200p (up 11.4% at 08:10)

No. shares: 12.07m

Market cap: £24.1m

Q4 trading update & corporate development

Water Intelligence plc (AIM: WATR.L), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water is pleased to provide a trading statement for the year ended 31 December 2017.

We are also including an update on our corporate development as we expand our offerings to become a "one-stop" platform with a variety of cross-selling opportunities....

My first job is to look up "potable" in the dictionary! For anyone else who hasn't heard that term before, it means drinkable.

Key points;

- Strong revenue growth - up 45% to $17.7m (note that this is a mainly USA business - 88% of H1 revenues came from USA)

- Growth mainly came from corporate (i.e. own-operated), rather than franchisees.

- Insurance channel looks an interesting growth area - revenues rising from $0.66m in 2016, to $2.5m in 2017;

Insurance channel momentum: first national account implemented; second account signed and in process of implementation; pipeline developing

- Adjusted PBT rose 21% to $1.7m

- Tax cuts - in USA should increase PAT in 2018 & beyond

- Water loss is an increasingly important issue, globally (e.g. forest fires, Cape Town apparently close to running out of water)

- Net debt $1.2m

Outlook - rather long-winded, but this is the key bit;

Global market demand for our solutions is increasing given climate issues and natural resource constraints. The wind is at our back, and we hope to make a difference. We believe that 2018 will bring significant additional revenue growth, both organically and through selected re-acquisition of our franchises.

Profits should also be further enhanced by recent tax legislation in the US, which is expected to materially reduce the Company's tax rate during 2018 and beyond.

Broker update - these days (post the disastrously inept MiFID II) we can only get hold of commissioned research, and notes from the house broker (as this is deemed to be sponsored research). There's an update today from the house broker (available on Research Tree). Its forecast EPS (in US currency, which I have converted into sterling at £1 = $1.39) are as follows;

2017 forecast EPS 8.7c = 6.26p PER of 31.9

2018 forecast EPS 11.3c = 8.13p PER of 24.6

2019 forecast EPS 13.3c = 9.57p PER of 20.9

Personally, I wouldn't buy this share based on those figures - the valuation looks very full, for such a small company. However, I wonder if the house broker might possibly be rather too cautious in its forecasts? It seems to have included little benefit from reduced tax in the forecasts, and is also basing these numbers on revenue growth slowing down considerably from what has been achieved in 2017.

So, the valuation might make more sense if you think the house broker forecasts are too low.

Dividends - nothing historically, and nothing forecast. So this share is for growth investors, not value investors.

My opinion - overall, I think this looks an interesting little company. It's growing strongly, and operates in an area (fixing water leaks) which is very relevant. So I can see why some readers will like this share.

For me, the price looks up with events for now. Mind you, if the company beats forecasts, then that could propel it higher.

Another key point is that I'm trying to avoid opening new positions in very small, illiquid shares. If there's another (maybe worse?) market sell-off, then I generally want to at least have the option of being able to sell, which is often not the case with things this small. So buyers of tiny company shares like this need to remind yourselves that selling could be impossible in another market downturn. That's not a problem if you're only buying a small scrap of shares, or are happy to ride out market sell-offs, but for larger positions, we can be left high & dry in a market sell-off. That's worth considering, in the context of your own tolerance for risk.

So far, so good though - what a smashing chart (see below);

HSS Hire (LON:HSS)

Share price: 25.0p (up 3.1% today)

No. shares: 170.2m

Market cap: £42.6m

Trading update (and strategy progress)

This is a chain of equipment & tool hire shops - operating from around 230 locations in the UK & Ireland. Its website is here. Today's update covers the 52 weeks to 30 Dec 2017.

Regulars here might recall that I've been consistently negative about this share, since it floated with a full listing, in Feb 2015. The main reason for my negativity is that the ship was holed below the waterline from day 1 - specifically its terrible balance sheet, laden with far too much debt, and negative net tangible assets. There have also been operational problems, and trading losses. Clearly the business was in no fit state to have listed on the stock market at all.

It was clear to anyone who checked the Admission Document, on page 149, that the pro forma balance sheet had negative net assets at the time of floating, in early 2015. That has remained the case since. So the big issue here has always been its very weak balance sheet.

People occasionally ask me why we write about companies with serious flaws (such as HSS) in these reports? The reasons are that it's important to warn readers about companies with financial problems, to help you avoid investment losses. Also, occasionally, these can be interesting turnaround situations. Although it pays to set the bar high, when assessing whether a turnaround is real or not, because many turnarounds don't actually work out as hoped for.

Competitor Speedy Hire (LON:SDY) also ran into operational problems at a similar time to HSS. However, with its very much stronger balance sheet, SDY has managed to sort itself out. That's very much in contrast to the massive shareholder value destruction at HSS, as you can see from the chart below. The main green & red candlesticks are the price of HSS shares. The (rather feint, sorry it's not possible to change the colour) comparator line is the share price of SDY. Note how HSS has destroyed nearly all its shareholders' value over 3 years, whereas SDY has only lost about 20% of shareholder value (excluding divis):

For that reason, I'm always inclined to favour companies with stronger balance sheets. Crucially, a strong balance sheet gives management time to sort out operational problems. Whereas a weak balance sheet can plunge a company into crisis, consume management time, and the shares into a tailspin, when problems emerge.

Anyway, let's see what the company says today;

Current trading - it's profitable at the operating profit (i.e. EBITA) level;

Since HSS last updated the market on 29th November 2017, trading has been positive with the Group maintaining solid momentum.

The Board is pleased to reaffirm that full year performance is in line with guidance given in August, of H2 adjusted EBITA of between 8m and 11m.

Ah, I just spotted that this refers only to H2. I didn't spot that on first (quick) reading, assuming that it was the full year figure. So on checking the H1 results, it's clear why the company is coy about giving the full year figure - because H1 adj. EBITA was negative, at -£7.3m. Put that together, and we're looking at full year EBITA of only £0.7m to £3.7m.

To me, this feels a bit misleading, so my hackles are up a bit - this announcement looks to have been over-PR'd, in an attempt to polish the proverbial.

Revolving credit facility - extended, but the company admits that it needs to be refinanced this year;

HSS also announces that it has successfully agreed with its lenders to extend the 80m revolving credit facility (RCF), which will now mature in July 2019.

Management continues to make good progress towards refinancing the Group and expects to complete this during 2018.

The bank debt isn't a particular problem here. It's the additional loan notes which look unsustainably high to me - which expire on 1 Aug 2019. Therefore the company faces a debt brick wall in July 2019. Both the bank facility, and its loan notes, will need to be refinanced by then, otherwise the company goes bust.

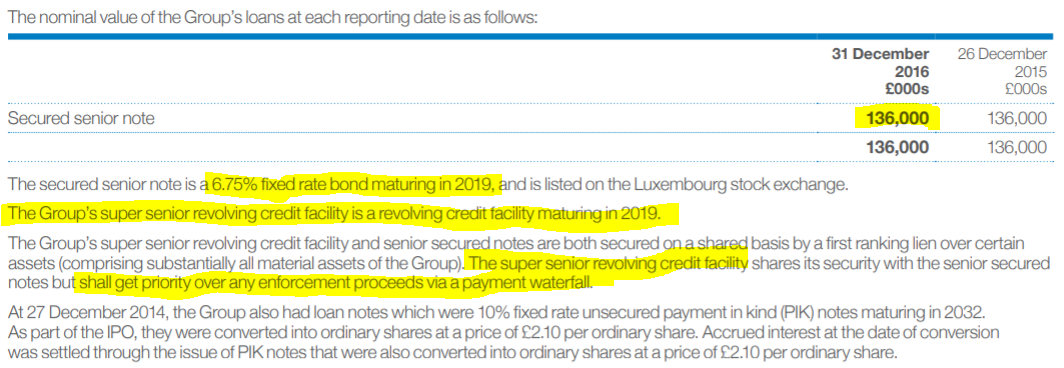

Curiosity got the better of me, so I've had a dig into the most recent (2016) Annual Report. It contains some fascinating information on the debt structure, as follows;

I've not come across senior, and super-senior debt structure before. It's quite straightforward though, reading the explanation above (note 17, on page 101 of the 2016 HSS Annual Report). The bank effectively ranks ahead of the loan note holders. That explains why the bank is prepared to extend its RCF until just before the bonds mature - because it's first in line to be paid off from asset disposals (well, after any preferential creditors anyway) in a winding up.

I've put a request in to my stockbroker to get a current price on the bonds. Not because I want to buy any, but to ascertain how much below par they are, which would indicate how negative bondholders feel about the likelihood of them getting their money back.

OK, my broker has just emailed me live prices on the bonds. They're only at a small discount to par, 95.8 Bid, 97.3 Ask. This indicates that the bondholders seem confident of getting their money back, i.e. par value of 100, plus interest between now and 1 Aug 2019. That's assuming that there's liquidity in the bonds, which there might not be, given that it's a small issue of £136m in total. If that's concentrated in the hands of a small number of holders, then the price could be artificial.

Therefore the biggest issue facing HSS is whether, and how to refinance its £136m bonds before 1 Aug 2019. To my mind that looks possible, so it's not necessarily an insurmountable problem. Although I imagine that a fresh equity element to a refinancing package is highly likely - meaning that existing shareholders are highly likely to be diluted, potentially at a deep discount, at some point this year.

For this reason, I would consider this share uninvestable until the refinancing is done. The big danger for private shareholders is that a refinancing might exclude them, if the company decides it has to do a discounted placing. There's no guarantee that an open offer for existing shareholders would be included. So it's just too risky.

Another way of looking at it, for punters, is that the shares could be seen as a call option on the restructuring & refinancing working out. In that case, and with a good dose of luck, there's an outside chance that the shares could recover strongly. Would I want to risk 100% of my money though, just on the off-chance that all the moving parts successfully slot together? Definitely not!

Note also that the bonds attract about £9.2m p.a. in interest expense. It's possible that a refinancing might reduce that rate, but not by much, would be my guess, as it's quite high risk lending. Therefore after taking into account interest expense, the company remains loss-making. No wonder they want to steer us towards EBITA, which ignores interest expense.

There's lots more detail about restructuring the business, which I won't go into here. It sounds extensive though, including this bit;

In the first half of 2018, the testing and repair of all fast-moving products will be completed closer to HSS's customers, using the Group's skilled colleagues across our network of distribution centres and branches. This change will mean far better levels of utilisation and efficiency for the Group, with improved availability for customers as more products will be available for hire in branches.

As part of these changes, the Group will recognise a provision for exceptional costs of approximately 40m, including an impairment of related assets of 7m. This is expected to give rise to a net cash outflow of 2-3m in 2018, followed by net cash inflows of 7-8m annually over the following seven years.

Overall then, I see this share as, at best a special situation, and at worst a punt that could result in a heavy, even 100%, loss. So definitely not one for me, being much too high risk.

Hargreaves Services (LON:HSP)

Share price: 346p (down 3.9% at 12:39)

No. shares: 32.0m

Market cap: £110.7m

Interim results - for the 6 months ended 30 Nov 2017.

Hargreaves Services plc (AIM: HSP), a diversified group delivering key projects and services to the industrial, energy and property sectors...

This business was originally a UK distributor of coal. However, that activity is now winding down, so it has diversified into other areas, and also is property-rich.

In H1 2017/18 the key P&L numbers are;

Revenues down 12.1% to £150.3m

Underlying operating profit of £2.3m up 9.5% on prior year H1.

I'm losing interest already. The interim dividend is held at 2.7p.

This share seems to be more about asset disposals, to release locked-in value;

... the Board remains confident that there is substantial shareholder value to be realised.

Net debt fell by 44% to £20.6m, and is expected to remain at a similar level by year end of 31 May 2018.

There is a nice summary of the group's strategic aims, and progress to date, in today's results;

In April 2016, we announced three key strategic objectives.

First, to report an Underlying Operating Profit from the Distribution & Services business in excess of £10m by the year ending 31 May 2018. This was achieved in the year ended 31 May 2017, and these interim results indicate that this improved operating performance is being sustained.

Second, to create more than £35m of value from the Property & Energy portfolio by 2021. To date only £2.4m has been realised in cash from the Property portfolio and the work to realise further value continues.

The successful development of the Blindwells site will be a key demonstration that the Group possesses substantial latent value in the land portfolio.

A key element of the value creation in the Property and Energy portfolio is the separation and spin off of the Energy business into Brockwell Energy Limited. The process to secure funding for Brockwell is well advanced with discussions progressing with several credible financial institutions. The Brockwell management team and their advisers have indicated that they are confident of achieving financial close within the next few months.

Finally, to generate £60m of cash from the realisation of Legacy assets. To date, £27m has been recorded and the net book value of the remaining legacy assets is £33m, compared with £42m one year ago.

My opinion - after reading the above, I'm having to file this in the "too difficult" tray.

It's clear that to value this share, a sum of the parts calculation, would be most appropriate. I haven't got time to do that work.

Note that the balance sheet has NAV of £134.9m, which reduces to £122.8m NTAV, or 384p per share (compared with a share price of 346p. The thing is, that some items on the balance sheet (e.g. property) might be worth more than book value, whilst other assets might be worth less than book value. So I can only guess at what the shareholder returns would be. Disposals might attract tax charges on any profit over book value.

I think you also have to consider the opportunity cost, with an asset realisation type situation like this. It's all very well hoping to make x% return, but you might have to sit tight for several years, during which time your money could have been generating a faster return on something else.

There's not enough information to enable me to value this share, therefore I can only say that I'm neutral on it. I do recall several lunches with management going back a couple of years, and they struck me as pretty shrewd. The CEO has a big personal holding, so is certainly incentivised to squeeze every drop of value out of the assets

Onthemarket (LON:OTMP)

Share price: 143.5p (floated at 165p on 9 Feb 2018)

No. shares: 60.53m

Market cap: £86.9m

This is the UK's 3rd largest property website, after Rightmove (in which I have a short position) & Zoopla. It was originally formed in 2015, as Agents Mutual - set up by a group of estate agents who were fed up with paying hefty fees to Rightmove. It failed to de-throne Rightmove, and ended up being an also-ran.

Floating on AIM could be seen as a second attempt to make the concept work. The shares joined AIM last week, and has raised £27m net of fees in fresh funding. Plus existing funders have converted their loans into shares.

The huge problem facing any new entrants in the property portal space, is that Rightmove is so dominant. Estate agents have to use Rightmove, since about 90% of properties are listed there, hence Rightmove is where the customers go. This has enabled Rightmove to become enormously profitable, and become more-or-less a monopoly.

Can OTMP de-throne Rightmove on this second attempt? Probably not, is my view. However, if it does succeed, then the shares would be a serious multi-bagger - Rightmove's market cap is currently about £3.9bn, about 45x the market cap of OTMP. Therefore OTMP shares could be seen as an option - i.e. they'll probably not work out, but if they do, then the upside could be very big.

What is OTMP doing differently? Not very much, as far as I can see - its website looks like any other property portal. It's trying to persuade agents to give it exclusive property listings, and to list properties first on OTMP's portal, before putting them on Rightmove. These supposed advantages can then be used in its marketing, to persuade customers to switch from using Rightmove to using OnTheMarket instead. That seems a very tall order to me, but it has a new pot of money to do renewed marketing.

Another interesting development, is that now its shares are listed, OTMP can do deals with estate agents, and incentivise them with share options perhaps? I read some research on OTMP just before it listed, and it has plans afoot to double the number of estate agents that use it. So I wouldn't dismiss it just yet.

My opinion - I wasn't tempted to participate in the OTMP IPO. Usually, if I get access to an IPO, it probably means that there isn't much institutional interest, so it's instead offered to pond life like me!

I think a better way to play this might be to short Rightmove (LON:RMV) which I did some time ago. My rationale for doing this, is that RMV now faces a renewed competitive threat, coming from a different angle - i.e. OTMP is still mainly owned by estate agents, with a vested interest in it succeeding. So maybe the original disrupter, Rightmove, could now itself be disrupted?

The other thing is that RMV makes too much profit. Therefore, I think it is potentially vulnerable to some kind of different competition. For example, if Google, Apple, or Amazon decided to start offering a free, worldwide property portal, it would kill Rightmove stone dead. Also, Rightmove now has very little organic growth potential, as it already has near-100% market penetration.

It will be fascinating to see how this pans out.

(work in progress)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.