Good morning, it's Paul here!

I'm back from a week's holiday on the west coast of America, which was interesting & enjoyable. If you think we've got a homelessness problem in the UK, then you should visit San Francisco - where the scale of the problem is unbelievably bad, and very sad to observe. All that wealth, yet thousands of people have just been abandoned, to live miserable & squalid lives on the streets.

Many thanks to Graham for doing a sterling job last week, which gave me a chance to have a rest from the markets.

It looks to be a quiet day today. So far I have the following on my list to review;

Air Partner (LON:AIR) - accounting issues

Renew Holdings (LON:RNWH) - trading update

Flybe (LON:FLYB) - trading update

Hornby (LON:HRN) - trading update

So I'll get cracking on those now.

IQE (LON:IQE) - I've just seen the tragic news that its Finance Director, Phillip Rasmussen, has died following a cycling accident abroad. He presented at a Mello evening a couple of years ago. His presentation was an absolute masterclass in how to explain complex subject matter with amazing clarity. Our condolences go to his family, friends & colleagues.

Air Partner (LON:AIR)

Share price: 113.25p (down 21.1% today, at 08:39)

No. shares: 52.2m

Market cap: £59.1m

Year end update (accounting problem)

A reader has asked me to try to explain today's announcement in plain English.

A problem has emerged during the audit of its figures for year ended 31 Jan 2018;

The Board of Air Partner has identified, during the course of its year-end review process, an issue predominantly relating to its accounting for receivables and deferred income.

Following preliminary investigations, the issue principally relates to the collection of receivables from customers and accounting for uncollected amounts since financial year 2010/11.

Certain uncollected receivables were inappropriately offset against deferred income rather than being expensed to the income statement in the appropriate financial year.

This is a non-cash item and has no bearing on the Company's cash balances.

This seems to be saying that bad debts (i.e. amounts which had been invoiced to customers, but were not paid by the customer) were not written off through the P&L. Instead they were offset against a balance sheet creditor (deferred income).

This appears to be indirectly saying that prior year profits were overstated. Although I cannot be sure about that, as it depends on the nature of the deferred income. If bad debts were dumped into the (very large) deferred income creditor account, with no specific reason, or matching of related items, then that just sounds like false accounting to me - very concerning. However, we cannot be sure of this, as today's announcement doesn't give enough detail. It also refers to preliminary investigations.

The size of the problem is fairly small, and spread over several years;

Whilst the investigation continues, the Board presently understands that the cumulative amount between financial year ended 31 July 2011 and the financial year ended 31 January 2018 is approximately £3.3 million and a significant proportion of this relates back to 2011.

My opinion - this is a tricky one, as we don't yet have full information.

If you are happy to give the company the benefit of the doubt, then it could be argued that a drop of about £15m in market cap today, for a £3.3m historic accounting issue, could be an over-reaction, and hence perhaps presents a buying opportunity?

However, following on so soon from the calamitous turn of events at Conviviality (in which I have [now worthless] long position, bought 1 day before the shares were suspended, as a falling knife purchase), the timing could hardly be worse.

Maybe this disclosure could be the thin end of the wedge? Who knows?

Looking at the last reported balance sheet, at the interims as at 31 July 2017, it looks OK to me, although not particularly strong. As with many travel companies, it relies heavily on customers paying up-front, in advance of using the service. Some key numbers;

NAV: £16.1m

NTAV: £7.4m

Current ratio: 1.1

The stand-out figure on the balance sheet, is £43.8m of deferred income - i.e. the opposite side of the double entry from cash received from customers. Total cash is £28.8m, so the whole business is financed by customer up-front payments. That's not unusual in this sector - airlines, and cruise ship operators typically finance operations in the same way.

Overall, my feeling is that share price drop of around 20% today looks about right. It's very concerning that the company appears to be admitting today to having falsely accounted for bad debts, and hence boosted cumulative reported profits by £3.3m.

There again, that's a relatively minor amount, and I don't see any signs that this issue alone would affect the viability of the business at all.

The company has more explaining to do, and perhaps a change of FD is now needed? Based on today's announcement, I don't see any reason to panic. It doesn't look like another Conviviality. Let's hope those are not famous last words on the matter.

Renew Holdings (LON:RNWH)

Share price: 386.5p (up 1.7% today, at 09:46)

No. shares: 62.59m

Market cap: £241.9m

Renew (AIM: RNWH), the Engineering Services Group supporting UK infrastructure, announces an update on trading in advance of the interim results for the half year ended 31 March 2018.

This all sounds reassuring;

The performance of the Group continues to be strong. Trading for the first half of the year is in line with the Board's expectations and we anticipate reporting an increased forward order book at the interim results.

This has been driven by Engineering Services where order flow across our Infrastructure and Environmental sectors has been good.

The Group expects to report a modest net debt position at the half year in line with expectations. Our year end net cash forecast remains unchanged.

What is less reassuring however, is (as I have flagged many times before), this group has a very weak balance sheet. To date, this doesn't seem to have caused any problems. However, it's a potential major risk, that investors need to be aware of.

Consider the following key figures, from the last reported balance sheet of 30 Sept 2017;

NAV: £28.1m

NTAV: -£32.6m - a significantly negative position. I don't normally invest in anything with negative NTAV.

Usually, this would indicate that a company was laden with debt. However, in this case, there's very little in interest-bearing debt. The elephant in the room is the enormous trade creditors debt of £173.2m. I looked into this before, and a lot of this non-interest-bearing debt is deferred income - i.e. the other side of the double entry to cash received up-front from customers.

So, coincidentally, in a similar way to my comments on Air Partner (LON:AIR) above, Renew Holdings (LON:RNWH) is also funded by its customers up-front cash payments. This is fine if the receipts keep flowing, however it could spell disaster if, for any reason, customers decide they don't want to pay up-front. In that scenario, RNWH would need to strengthen its balance sheet with an equity raise (I'm surprised they haven't already done this, given the fairly strong share price in recent years).

In a nutshell, RNWH's business model hinges on it being paid by its customers before it has to pay its sub-contractors & other suppliers.

The problem is, in this sector, a weak balance sheet means that a contractor is only one bad contract away from disaster. We've seen how numerous contracting businesses have run into contract problems - often terminal, as with Carillion.

Pension scheme - this needs more investigation. There is a £9.7m asset for pension schemes, within non-current assets. However the last cashflow statement shows a £5.3m cash outflow for contributions to defined benefit pensions. Therefore it looks like there might be a significant actuarial deficit, but an accounting surplus. I don't have time to look into that now, but am just flagging it as an issue which readers might wish to investigate if considering a purchase (or hold) here.

On the upside, Renew seems to be well-managed, and focused on niche projects, with improving margins (up to 4.6% at the last full year accounts).

Another positive point is that a loss-making subsidiary has been disposed of, which should boost group profits by £2.8m p.a..

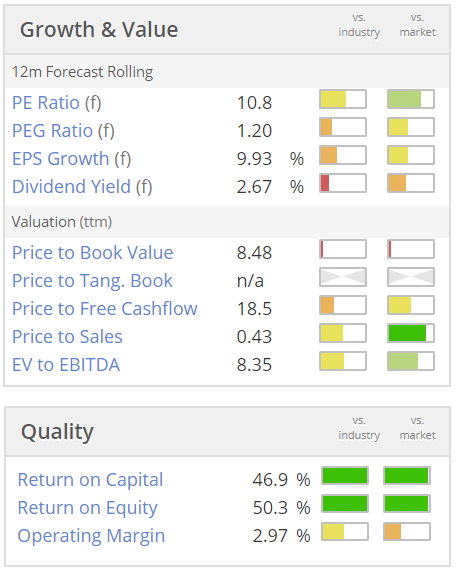

Valuation - seems reasonable, but wouldn't look this cheap if you adjust for the black hole in the balance sheet;

My opinion - the company has a good track record. However, this sector is fraught with risk, so I cannot understand why anyone would want to invest in this sector at all. Let alone in a company with a negative NTAV balance sheet.

Flybe (LON:FLYB)

Share price: 34.25p (up 2.2% today, at 11:09)

No. shares: 216.7m

Market cap: £74.2m

This reads as a mixed update today, from this UK-based regional airline.

Load factor & revenue per seat in Q4 (Jan-Mar 2018) have improved;

Flybe's turnaround continues with a further improvement in load factors as we reduce capacity1. In Q4, load factors2 were up by 6.8 ppts to 73.5%, a strong performance for the winter season.

As a result, estimated passenger revenue4 per seat was up by 9.0% to £50.84. Passenger numbers3 rose by 3.7%, even though capacity was reduced by 6.0%.

On the negative side, the very poor weather this year has hurt profits, as you would expect;

We had to cancel 994 flights due to weather in Q4 compared to 372 in Q4 last year. As a result, we anticipate this to have an impact of around £4m from lost revenue and additional care and assistance costs on cancelled and delayed flights.

The company can't be blamed for that.

The legacy problem of excess leased aircraft seems to be drawing to a close, which is good news;

At 31 March 2018, Flybe has returned five of the planned six end-of-lease aircraft with the final one to be returned in early April. At the year end, Flybe will have a total fleet size of 80 aircraft (31 March 2017: 83) which will fall to 79 once the final handback is completed.

Net debt;

We expect net debt at 31 March 2018 to be broadly flat year on year.

Looking back at last year's results, net debt was £64.0m at 31 Mar 2017. Previously the company had a lot of net cash, but it used this to buy 10 Bombardier Q400 aircraft, which were previously on leases. This gives me a good excuse to put a picture of a plane below.

Early indications of summer trading;

Our strategy to reduce capacity to focus on profitable flying will continue into the new financial year. Very early indications of our summer trading are encouraging with an estimated 7.5% increase in passenger revenue per seat offsetting an expected 7.9% decrease in capacity.

So far, we have sold 21% of our H1 capacity, against 20% sold at the same time last year.

Outlook - sounds a bit mixed. Some positives, but also mentions cost headwinds;

"The Flybe strategy as set out in our business plan to reduce the fleet size is delivering higher load factors and revenue per seat. The drive to reduce costs is continuing, given added impetus by the rise in fuel prices and lower value of sterling.

Despite these headwinds, the foundations are being put in place to strengthen the business and we remain confident that our strategy will continue to improve performance as we go into the new financial year."

My opinion - I'm not the best person to judge, as I've been wrong about this share in the past. It has always seemed a good turnaround, if you believe broker forecasts. However, the company seems to repeatedly disappoint, missing forecasts.

That said, it's a lot of company for the money (just a £74m market cap). A bear might point out that the company isn't really viable - historically failing to put enough bums on seats to make its routes profitable overall. The company also seems to be tying up a huge amount of capital, to generate no return for shareholders. So what is the point in it existing at all, other than to provide employment for Directors and staff?

On the plus side, the company does seem to be gradually working through its historic problems. Maybe the much vaunted turnaround could be finally emerging?

I can't help wondering whether there might be value in FLYB to an acquirer? There was a recent flurry of announcements from Stobart (LON:STOB) and FLYB which seem to suggest that STOB made an offer for FLYB, which it declined. I can't find any mention of a mooted price for the possible bid.

Overall, I wonder if FLYB might make an interesting punt at the moment? There's a possibility its long-standing turnaround could begin to work. Also, the takeover potential looks interesting, particularly if an acquirer could somehow utilise its fleet in a more profitable way - maybe reducing passenger capacity, and increasing freight, on routes with low load factors?

FLYB looks financially stable, so it's not a completely ridiculous idea to look at it as a possible punt. It would be very interesting to find out what price Stobart were willing to pay for Flybe. Has anyone seen any detail on this? If so, please leave a comment below.

Hornby (LON:HRN)

Share price: 23p (down 6.1% today, at market close)

No. shares: 125.3m

Market cap: £28.8m

Hornby Plc, the international hobby products Group, provides an update to shareholders on the progress of the new strategy.

I'm a bit rusty on this share, so have been reading through the recent RNSs.

25 Jan 2018 - profit warning, due to a refusal to discount prices, and late deliveries. Underlying loss after tax (for y/e 03/2018) likely to be larger than expected.

Interim results to 30 Sept 2017 look very poor - a £4.5m pre-exceptional loss, on revenues of £17.0m. Bank debt rising, to £5.3m. Receivables & inventories look too high.

Placing - in Nov 2017 - relatively big, raising £12m gross, at 29.5p - should have more than wiped out all bank debt.

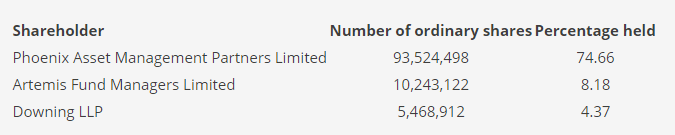

Key shareholder, Phoenix Asset Management Partners supported the fundraising, and had previously tried to buy all of Hornby, in a takeover offer in July 2017, which didn't complete. This is the current major shareholder list (taken from Hornby's website);

Clearly then, the big issue is what are the intentions of the major shareholder, Phoenix? Could another bid approach from them be forthcoming? I don't like overly dominant shareholdings like this, as minorities are at the mercy of whatever the big shareholder wants to do.

Today the trading update says;

As reported in the January update, the lack of discounting coupled with late deliveries of product has continued to affect our sales rate. There was an improvement in sales towards the end of the financial year as some of the European product started to arrive, but as expected, the Group sales and profits were lower than last year.

Clearly then, there's still some way to go, with this turnaround.

Lending update - this isn't as bad as it sounds, because the company had net cash of £4m at year end of 31 Mar 2018;

The Board has now refined its strategy to enable the business to return to profitability. The investment needed to support this strategy will require a larger facility than the one currently available to the Group.

Hornby is in the final stages of discussions regarding a new financing facility with new lenders and expects to have the facilities in place ahead of the Group's full year results, which are expected to be announced in mid-June 2018.

To support these discussions, the Board has engaged with Barclays and it has been agreed that they will support the Group with a covenant waiver in relation to the Group's EBITDA covenant in respect of the quarter to 31 March 2018, which is required due to the reduced sales volumes.

This covenant waiver sounds purely technical in nature, since the group was in a net cash position.

Outlook;

"As the dust settles on the changes to the strategy and we start to put together the line plans for 2019 and beyond, morale is starting to build in our hardworking staff and some trust is coming back with our retailers and customers; both in the UK and abroad.

Whilst we have managed to make a lot of progress in the first few months, there is still much more to do in terms of reducing costs, streamlining processes and adding routes to market."

My opinion - this is quite an interesting special situation. It seems obvious that the company would have gone bust, were it not for the deep & supportive pockets of its largest shareholder. Minority shareholders are really just along for the ride, and should be very grateful to Phoenix - as indeed should the staff & Directors.

I wish them all well with the turnaround, but it seems to be a company that is still heavily loss-making & cash-burning, with plenty more turnaround work needed to make it viable. The risk for small shareholders is that, if the turnaround works, then the upside could easily be whipped away by the majority shareholder taking it private.

Therefore, I don't see much upside potential on the current share price. Or rather, there's too much risk associated with any potential upside. It's not for me. It's difficult to see why this share is still listed. The only reason I can see to maintain the listing, is to provide Phoenix with an eventual exit, by placing its shares.

There haven't been any divis since 2012, and are not likely to be for some time to come. Note also that the share count has risen more than 3-fold in recent years, so the share price is unlikely to recover fully back to previous levels, unless there's a spectacularly good turnaround in trading.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.