Good morning!

I'm looking forward to the private investor lunch which is being organised by Staffline (LON:STAF) (in which I hold a long position) today, via Buchanan Communications. It's great to see more companies reach out to private investors. After all, it's us who create the liquidity in smaller cap shares, and our trades which predominantly determine the share price.

If there's anything interesting from the STAF investor lunch today, then I will report back. Although regular readers will know that this is currently one of my favourite shares - I think the share price just looks wrong at the moment (i.e. too low). In my view a price of 1200-1400p is justified by the recent good results & positive outlook. As always though, that's just my personal opinion, not a recommendation. I may have missed something, so it's vital that investors always DYOR, as I don't particularly want to be blamed in the instances when I do get it wrong! (my average win:lose ratio is about 60:40 currently, but am striving to improve on that).

In a similar vein, Dillistone (LON:DSG) has announced an interesting-sounding investor access event, at the Tower of London, on 26 Sep 2016. Details are here.

Companies routinely spend a day or two meeting & talking to Institutions & brokers after publishing results. So it really should become routine to include meeting(s) for private investors in that schedule too. Webinars are also an excellent initiative, as many investors can't make it into London, so appreciate a web presentation with Q&A.

So lots more of this stuff please, brokers/Nomads & PR people!

Waterman (LON:WTM)

Share price: 82.7p (up 10.2% today)

No. shares: 30.8m

Market cap: £27.1m

(I do not currently hold a position in this share)

Trading update - shares in this group of engineers, serving the infrastructure & commercial building sectors, got whacked heavily post-Brexit. The same was true for lots of construction-related shares, as the assumption seemed to be that activity would decline considerably.

For the year ended 30 Jun 2016, Waterman has traded well;

Waterman has experienced a successful trading period. The Board expects to report results which exceed its previously declared financial objective of tripling adjusted annual profit before tax to £3.3m over the three year period to 30th June 2016.

I wouldn't get too excited about this though, as it confirms what the company had already said on 11 May 2016, which I reported on here. Also the period concerned is (all bar 1 week) pre-Brexit. So it's the future which matters more than the year to 30 Jun 2016.

The cash position looks strong, although bear in mind Waterman has an unusual balance sheet, with large debtors & creditors - which could introduce risk in long-term contracts. Still, it looks as if the group is managing working capital well;

Our continuing emphasis on working capital management has resulted in a further significant improvement in the Group's net cash position. Notwithstanding the increased levels of activity, the Group expects to report net funds at 30th June 2016 of £5.4m, up from £3.8m at 30th June 2015 (£6.6m at 31st December 2015).

Now on to the all-important outlook comments;

Whilst the recent EU Referendum decision has generated a period of uncertainty for markets, it is too early to speculate what impact, if any, there will be on Waterman's future prospects.

In the five weeks since the Referendum we have continued to experience good levels of enquiries. We have been appointed for several new commissions across a wide range of development activities, some of which have been outlined in recent announcements.

That sounds reasonably alright to me. The worry was that activity would shudder to a halt, which clearly is not happening.

Valuation - Waterman looked good value before Brexit, and continues to do so. Although I do think considerably more caution needs to be exercised now, because we don't yet know whether big construction projects (sometimes funded by overseas investors) are going to carry on as normal, or be curtailed.

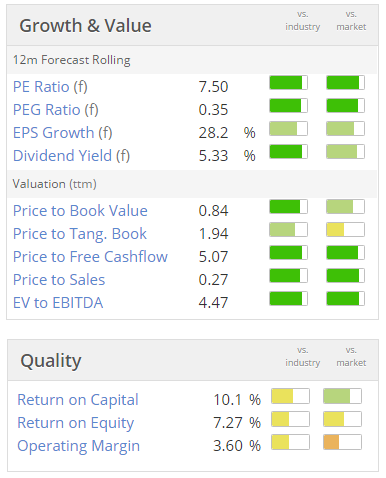

Loads of green on the above Stockopedia graphics, denoting positive scores. Also note that the StockRank of 93 is very good. This matters because, so far, the StockRank system has performed extremely well - a basket of high StockRank shares is statistically proven to be more likely to out-perform.

So this StockRank system can either be used as an entirely standalone method for quickly picking shares. Or, for those of us who enjoy the DIY approach, it's a nice confirmation that our manual stock-picking is probably on the right lines.

Personally I like to overlay my balance sheet testing on top of it, to give additional downside protection. It will be interesting to see how the StockRanks cope with an economic downturn (if that happens, as seems likely). We will probably see the momentum scores fall first, as brokers downgrade forecasts. Although in my experience, brokers tend to be too slow to do this, so it's not a bad idea to try to get ahead of the crowd on that front, anticipating brokers reducing their forecasts - which you can often glean from cautious-sounding outlook comments. A good recent example of that would be Bonmarche Holdings (LON:BON) - where a dismal Q1 was accompanied with a scarcely believable assertion that the company hoped to meet full year expectations. I'd put the probability of another profit warning & broker downgrades there at 80-100%.

My opinion - going back to Waterman. I like the company, and it seems to have straightforward, and competent management - a big plus.

However, there's no doubt that it would suffer considerably in a downturn. This may not become apparent for a considerable length of time, due to the long-term nature of its contract work.

If you look back, the current level of profitability is about 3-times what it achieved for several previous years. This suggests to me that the group may be at or near the top of the cycle, and hence there's a risk that earnings could drop from here, looking say 2 years ahead. OR, things may continue in a positive vein, we don't know at this stage.

The outlook statement sounds alright for now, so it doesn't sound as if there are any immediate problems to worry about.

For me, it's a little too uncertain for me to want to revisit this share (I sold mine in the run-up to Brexit, as a general cull for anything where there was uncertainty).

Trinity Mirror (LON:TNI)

Share price: 79.7p (up 6.2% today)

No. shares: 283.5m

Market cap: £225,9m

Interim results - 27 weeks to 3 Jul 2016 - a fascinating set of accounts, as usual, from this newspaper publishing group.

With a forward PER of only 2.1, and a dividend yield of almost 8%, this share looks, superficially, like the bargain of the century. However, that view is missing two elephants in the room;

- Paid-for newspapers are in long-term structural decline - they probably won't exist (in mainstream form) in say 10 years' time. So this is a cigar butt share.

- TNI has gigantic pension fund liabilities, which are worsening due to low interest rates.

The fascinating thing about this group, is that despite being almost certainly on a downward spiral towards death, it's still extraordinarily profitable. In fact profit is growing, due to the acquisition of Local World, and ongoing cost-cutting.

I'm struggling to think of a similar situation - normally companies lose money and then go bust. This one is a cash machine, and generating an extremely high 21.4% operating profit margin.

Net debt has reduced to only £48.0m, so is not a worry at all.

Dividends & share buyback - a 2.1p interim divi has been declared. The forecast yield is c.7-8%. Also, a £10m share buyback is announced today.

Bear in mind that there are special factors here, in that the company has agreed with the pension fund trustees to link dividend payments to over-payments into the pension schemes - more details are given today in note 13 - here is an excerpt;

In addition, the Group agreed that in respect of dividend payments in 2015, 2016 and 2017 that additional contributions would be paid at 50% of the excess if dividends in 2015 were above 5 pence per share.

For 2016 and 2017 the threshold increases in line with the increase in dividends capped at 10% per annum.

In conjunction with the £10 million share buyback announced today the Group has agreed additional funding of up to £7.5 million (including a minimum payment of £5 million), representing 75% of the share buyback.

Pension deficit - is absolutely massive. The accounting deficit is up by £120m to £426m - so not far off twice the entire market cap.

Bear in mind also that actuarial deficits (on which funding requirements are based) use a more conservative method. so the actuarial deficit is likely to be considerably more than £426m.

So the big risk is that the next actuarial valuation could trigger larger cash payments from the company, which are already large;

As part of the agreement of the valuations, deficit funding contributions were agreed at £36.2 million for 2015, 2016 and 2017. Contributions remain at around £36 million from 2018 to 2023 and then reduce to around £21 million for 2024 and 2025 after which contributions are due to cease. The combined deficit was expected to be eradicated by 2027 by a combination of the contributions and asset returns.

Phone hacking - the company calls this "legal issues", and it sounds as if it's under control, with cases being settled from an existing provision.

Outlook - is described as volatile. July LFL revenues are down 9%.

Unless I missed it somewhere in the narrative, I couldn't see a direct reference to full year market expectations. That suggests to me that they could be running a bit behind expectations, but not enough to specifically warn on profit? That's just my interpretation though, so could be wrong.

The trading environment was volatile in the first half and this is expected to continue through the remainder of the year, in particular, driven by the macroeconomic uncertainty created by the outcome of the UK's referendum on EU membership. In July, Group revenue fell by 9% on a like for like basis.

Our strategic focus remains to grow digital audience and revenue whilst protecting print revenue and profit. Despite the challenging print environment and increased macroeconomic uncertainty arising from the outcome of the UK's referendum on EU membership, the Board remains confident that its strategy will enable continued progress and help support the Group's profit and cash flow.

My opinion - so this is very much a special situation, as it has been for years now. The share price has fallen a lot, reflecting the worsening pension deficit problem. Who would have imagined that, almost 8 years on from the GFC, we would still have rock-bottom interest rates? I wouldn't want to bet on that changing any time soon either, so the pension schemes here look very worrying.

That said, despite funding them, TNI is also now chucking out very nice dividends. So if you held the share for 3 years in a tax-free vehicle like a SIPP, then you'd get about a quarter of your money back through divis, which reduces overall risk considerably.

Overall, I reckon the business is likely to throw off enough cash to eliminate debt, service the pension fund, and pay some good divis. However, how long for, I don't know. Maybe 3-4 years? The trouble is, with the inevitable & continued decline in circulation & ad revenues, the golden goose has a limited life expectancy. They can't keep cutting costs forever - there comes a point when the content becomes so flimsy that it's not worth buying the paper at all.

So what that leaves us with is almost a call option on them managing to create something worthwhile in the digital space. So far, not much evidence of that happening, but who knows what the future holds? I note that a new NED (Steve Hatch) is a regional Director of Facebook UK & Ireland. That at least suggests TNI understands that the future is digital. Whether TNI will be part of the future, is the big question.

I don't see enough evidence of that to tempt me back into this share.

Avanti Communications (LON:AVN)

Share price: 26.5p (up 4.8% today)

No. shares: 147.4m

Market cap: £39.1m

Inmarsat statement - Inmarsat confirms that it has no intention of making an offer for Avanti.

Inmarsat confirms it has withdrawn from Avanti's announced process and it is not considering an offer for the shares of Avanti.

This looks like another nail in the coffin for this terrible share. As I've mentioned before, the equity is clearly worth nothing, because Avanti is saddled with ridiculous 10% junk bonds. Once its remaining cash has run out, Avanti clearly won't be able to service the interest, let alone repay the capital. So it's bust - the equity is worth nothing - this has been very obvious indeed for a considerable length of time.

The only hope for equity holders now is that a white knight with very expensive paper, comes along and bids for it. You never know, I suppose, strange things do happen - look at the ridiculous bid for InternetQ from Toscafund for an example of a company with deep pockets doing something totally irrational.

Or look at the utterly bonkers, I would say irresponsible, 116% premium paid by Institutions for the last Fastjet (LON:FJET) fundraising - who cheerfully overpaid more than double what they needed to, "to satisfy their internal ownership limits". Would those fund managers have cheerfully paid more than double a fair price with their own personal money? Of course not! Which is what makes this really quite scandalous.

I am not tempted to short Avanti at this stage, because it's now too risky & too small. The smart money has already been made on the shorts, in the big move down.

Even if there is only a 1 in 10 chance of a premium priced takeover bid happening (it's probably more like 1 in 100, if that), you never know. So if you keep betting on high risk:high reward situations, sooner or later one of them goes wrong & takes you to the cleaner.

Also, it gets messy when shares de-list after going bust, as I think Avanti almost certainly will. It can take a long time before short positions are paid out, and in the meantime the SB companies whack them onto 100% margin - which ties up a lot of cash, which comes with an opportunity cost. Much better to close out after the main shorting profits have been achieved, and walk away with capital to deploy elsewhere, in my opinion.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.