Good morning! Regulars here will know that I've been bullish on Portmeirion (LON:PMP) for a while now, having first flagged them up after their January trading statement in 2013, and then taking the plunge and buying some shares myself on 21 Mar 2013, explaining in that day's report how they looked good value on a PER of 11.1 and a dividend yield of 4.1%, with net cash of £7.5m. Although I bemoaned the 25p quoted spread between the 525p Bid price, and 550p Offer spread.

The shares have since risen about 31% to 700p Bid, 720p Offer, which is only really in line with the general market re-rating of smaller caps, as you can see from the chart below, where (as usual) the beige line is the FTSE Small Caps Index (excl. Inv. Trusts). In fact Portmeirion has lagged since Sept 2013, and would have risen to 800p per share if it had kept up with the Index.

Perhaps investors were concerned that their H1 results were not great, with EU anti-dumping tariffs on Chinese made products causing a temporary drop (of 38%) in H1 profitability for Portmeirion. As I reported at the time, they said that this would be corrected for the full year, and I'm pleased to report that they have been good to their word.

So we have a positive trading update today, indicating that profit before tax for the year ended 31 Dec 2013 will be in line with expectations, which is for 50.8p EPS. So at 720p Offer price, these shares are priced at a PER of 14.2 times 2013 earnings. Given the much more favourable economic outlook in its main markets (the UK, USA, and S.Korea), I think this is a reasonable price.

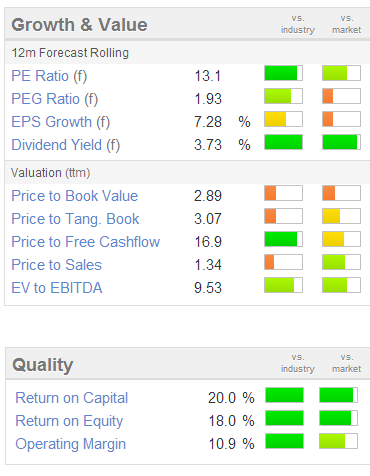

There is plenty of green (i.e. good) on the Stockopedia growth & value graphics, on the right here. The PER here is calculated on rolling forward earnings forecast, so that drops out at a lower PER of 13.1, and an attractive & growing dividend yield of 3.73% Note also the decent Quality measures, all solid green bars, indicating top ranking within its sector. This is a smashing business in my opinion, and one I'm very happy to hold pretty much forever.

There is plenty of green (i.e. good) on the Stockopedia growth & value graphics, on the right here. The PER here is calculated on rolling forward earnings forecast, so that drops out at a lower PER of 13.1, and an attractive & growing dividend yield of 3.73% Note also the decent Quality measures, all solid green bars, indicating top ranking within its sector. This is a smashing business in my opinion, and one I'm very happy to hold pretty much forever.

Bear in mind also that the company has net cash, sitting on a bulletproof Balance Sheet - how does £27.3m current assets against £6.0m current liabilities grab you?! There was a £4.7m pension deficit in long term liabilities, but given the strength of the working capital position, that's not a concern. It is a historic problem with the defined benefit scheme having been frozen in 1999, so the current £800k cash contributions being paid by the company into this scheme will eventually cease, so could be seen as a long term investing upside, since that money will be available for paying dividends instead of topping up the pension fund, at some point.

I must admit to being a bit rusty on pension fund accounting, so I've had a look at the 2012 Annual Report for PMP, and the position seems to be that the £800k p.a. cash payments to reduce the pension scheme deficit are not expensed through the P&L, but are instead accounted for in the Statement of Comprehensive Income, and the Cashflow statement. I'm not entirely sure why pension deficit payments by-pass the P&L, perhaps any actuarial expert could shed some light on this in the comments section below?

As a final point on Portmeirion, they indicate that net cash has dropped to £6m, or about 56p per share, but that was after spending £3.9m to buy the long leasehold to their Head Office in Stoke-on-trent, and thereby benefit from the elimination of rent payments. The outlook statement is too vague to be worth mentioning, but I shall certainly be expecting another year of steady growth, and nice dividends. Check out the historic performance here, and bear in mind this was achieved in a period of at best lacklustre economic times. So there should be good upside as Western economies recover.

My dedication to the investment cause has no end (!), hence as promised I spent a bit of time last night updating the end of Friday's report to include some brief comments on Brainjuicer (LON:BJU), Eclectic Bar (LON:BAR), Surgical Innovations (LON:SUN), and 24/7 Gaming Group (LON:247), so please click here to revisit that article.

Also a reminder that tonight is the latest Mello Beckenham investor evening, with two company presentations, including City of London Investment (LON:CLIG), and Sanderson (LON:SND), then a meal and drinks/networking. I am told by the organiser David Stredder that a record turn-out of about 80 people is expected. If you have booked a place, please do turn up, or let David know you can't make it a.s.a.p., as no-shows cause problems with the catering arrangements and put David in an awkward position with the restaurant, where he has even had to make good the food bill with his own money in the past, which clearly is not fair.

I shall be there, so do say hello if we've not met before. These really are excellent, and very friendly events, highly recommended.

Vislink (LON:VLK) announce today their admission to trading on AIM. They have taken the unusual, but logical step of moving from the main list to AIM, which makes sense for a small (£48m market cap), acquisitive technology company. However, this has caused some short term dislocation to the share price, as holders who are not able to (or don't want to) hold AIM shares have sold up.

I am expecting that process to reverse now, as new buyers who like the big tax advantages of AIM shares (e.g. 2-year IHT exemption) will become fresh buyers, and the forced sellers are likely to be drying up. So it will be interesting to see how this one pans out. To my mind, this is all background noise - in the long run all that matters is how the company's trading performance develops, not which market it is Listed on.

Promotional products group 4imprint (LON:FOUR) has issued a trading update, ahead of its results for the year ended 28 Dec 2013. Turnover rose 16% against 2012, to £211.7m. By far the bulk of turnover is generated by their North American operation - so they are up against the pressure of stronger sterling, which means US profits will translate into a lower sterling reported amount this year, if the pound remains strong.

Group underlying profit before tax will be "not less than £13.3m compared to the prior year at £10.0m", so that's a strong improvement in profits, and one assumes that in a recovering economy in the USA, 2014 should show further improvements. Although this statement does not comment on the outlook.

It finished the year with net cash up 45% to £15.5m.

My data sources are showing differing figures for profit forecasts, which can sometimes happen as some sources use adjusted profit figures, and others don't. However, the figures in today's announcement are higher than in either forecast, so I think this is a beat against profit expectations.

So I reckon that EPS is likely to come in around 35p for 2013, so at 690p the rating is a fairly lofty 19.7 times. That strikes me as a bit rich, as the share price has already priced-in further considerable growth in earnings. That may happen, but personally I don't like paying up-front for future profit growth, as it leaves me too vulnerable to a heavy loss on any setbacks in trading. This is a good company, but it's operating in a competitive sector, on a not particularly strong operating profit margin, and the share price already factors in another big increase in EPS.

As you can see from the two-year chart below, these shares have really out-performed even against the buoyant FTSE SMALL CAP INDEX XIT (FTSE:SMXX)

More evidence of the rude health of the UK car market has emerged with a trading update today from H.R. Owen (LON:HRO). In it they say that a robust close to the year will lead to results for 2013 being ahead of management expectations. Used car sales volumes are up by almost a third, which I find astonishing. That must reflect pent-up demand from the last few years of depressed conditions, and perhaps people deciding to buy a new car on credit whilst interest rates are still low?

As one would expect, these shares have risen 10.5% today to 166.7p, which values the company at just under £42m. Their shares have had a great run in the last year, rising about 157%, and the valuation looks to me like it's up with events. There seems to be quite a bit of debt too.

Strangely, the RNS lists a recommended takeover bid at 170p last autumn, but that seems to have gone quiet, so I'm not quite sure what the company's position is. So I've put out a phone call to the company's advisers & will report back once hopefully briefed by them.

Shares in franchised off licence convenience stores Conviviality Retail (LON:CVR) were Floated last summer by their former Private Equity owner. I make it a rule never to buy anything floated by PE, as you can be pretty sure that you're going to be on the losing side of the trade! All to often companies are polished up for sale, loaded up with debt, and then sold on to gullible investors in bull markets at an inflated price.

That said, Conviviality shares are still significantly up on their AIM Listing price, although today's trading update has not gone down well, with the price down 8% to 180p. I can see the logic for running off licences as franchises, as otherwise the staff & customer pilferage would be very difficult to control. So a franchisee owning their own stock is a far better arrangement in my view.

For the half year to 31 Oct 2013 they say that profit before tax was up 13.6% to £2.2m. It seems to be a heavily H2 weighted trading year, judging by the 2012/13 figures. Also, I take back my rude comments about Private Equity, as it reports being debt-free, and having net cash of £11.9m.

Their Christmas trading update only covers the two weeks to 5 Jan 2014, which doesn't give enough information. Sales are up for those two weeks, but they don't say anything about H2 sales to date, or profits, so this trading update really has too many holes in it to be taken seriously - you can't help thinking that they've perhaps cherry-picked the two weeks that showed a sales rise, whilst not mentioning the rest of the period's performance at all!

Other retailers have reported how Xmas sales were very late this year, so I would expect the two weeks to 5 Jan 2014 to be up. Stockopedia shows a forward PER of about 15, which given an uncertain trading update, does not interest me. The 4.17% forecast dividend yield looks quite attractive though.

I shall sign off now, and hope to see some of you at Mello tonight.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PMP, VLK, and has no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.