Good morning, it's Paul here!

I'll be updating this article at a leisurely pace throughout this afternoon, so please update this page later for more sections.

Begbies Traynor (LON:BEG)

Share price: 66.1p (up 0.4% today)

No. shares: 137.6m

Market cap: £91.0m

(at the time of writing, I hold a long position in this share)

AGM trading update - this company is the only UK listed insolvency practitioner. It also has a property services division (e.g. valuation, auctioneers) which now accounts for 30% of revenues and profits.

The next year end is 30 Apr 2018, so today is an update for Q1 (May, Jun & Jul 2017).

Key points;

- Q1 trading is in line with management expectations

- Business recovery division is achieving year-on-year growth

- Property services division - performing in line

- Government statistics show that insolvencies have risen 2% in H1 of 2017 - the first rise since 2009

- Earnings should grow this year

- Looking for more acquisitions

My opinion - this is a good counter-cyclical share - so it does well in recessions. Although Government policy of ultra-low interest rates has suppressed the number of insolvencies - allowing zombie companies to trade their way out of problems that would normally have resulted in their insolvency. Is this a good or bad thing? You can argue it either way.

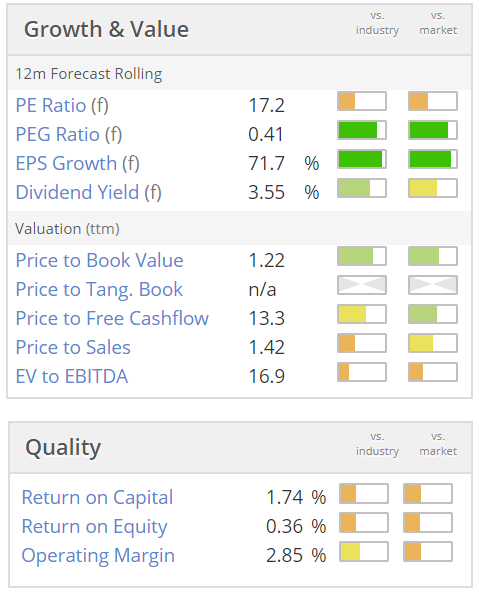

On a forward PER basis, this share is starting to look a bit pricey (see below), on a PER of 17.2. So clearly the market is anticipating that the actual earnings may exceed broker forecasts? With increasingly ominous signs of economic problems ahead, it makes sense that BEG shares will rise to anticipate increased workload & hence profits.

So much retailing is now moving online, that smaller retailers are struggling, and many are likely to go bust. The same is true of estate agents. Therefore capitalism's creative destruction is bound to take its toll in those areas, and others - e.g. hospitality, where there is over-capacity and profit warnings galore (all listed restaurant chains have now warned on profits).

For these reasons, it stands to reason that BEG should have more buoyant trading ahead.

The StockRank is strong, at 80.

Accsys Technologies (LON:AXS)

Share price: 82p (up 2.8% today)

No. shares: 111.1m

Market cap: £91.1m

AGM Statement (trading update) - this company makes specially treated wood, called Accoya, and Tricoya.

Accoya sales rose 20% to 22.5m (I presume they mean Euros, as that's the currency previous results have been reported in)

The big issue at this company is limited production capacity;

Demand continues to be strong, however as previously stated we are now operating at full capacity. Further growth will therefore be constrained until the third reactor is complete and we are working with our customers in order to minimise the impact of this temporary capacity limitation.

New capacity is coming on stream in about 6 months. This will enlarge capacity to 60,000 cubic metres, which is almost double last year's sales. Also, a Tricoya plant is being built in Hull, to come on stream in 2019.

My opinion - this company has always intrigued me, and it's a share I held briefly some time ago. The good thing is that the company makes a product which is in demand. The downside is that they can't make enough of it. However, capacity constraints are being dealt with. I don't like the capital-intensive nature of the business model, requiring expensive machinery & premises to make the product. Although the financial burden of the new Tricoya plant is being shared with a consortium - which obviously also means giving away some of the upside.

Looking 2 or 3 years ahead, this should become a profitable business. So it's tempting to buy some now, to tuck away for the long term. The trouble is, that has an opportunity cost, as there could be better options with other shares.

Overall then, I'm on the fence (haha!) about this one. Looking at the 2 year chart (below), it does look as if it wants to go higher.

Driver (LON:DRV)

Share price: 62p (up 21.6% today)

No. shares: 53.9m

Market cap: £33.4m

Trading update - this section is a reader request.

Driver Group, theglobal professional services consultancy to construction and engineering industries

Clearly the market likes this update a lot, as the share price is up 21.6% at the time of writing.

Last time I looked at this business, here on 17 Feb 2017, it looked a can of worms. Although the company talked about positive signs emerging, and it repaired its balance sheet with an equity fundraising.

Anyway, fair play to the company, it seems to be enjoying a convincing turnaround;

The Board is pleased to report that the Group has continued to benefit from careful management of overheads and improved utilisation rates during the second half of the financial year and, as a result, that it now expects to report underlying *PBT ahead of its previous expectations.

Stockopedia shows broker consensus forecast of 3.8p EPS for this year (ending 30 Sep 2017).

There's an update from N+1 Singer which is available on Research Tree. They have increased forecast EPS by 15% to 4.2p, so at 62p the PER is now 14.8, which looks about right to me.

Outlook - steps have been taken to improve performance, and it sounds as if further increases in earnings could be on the cards;

...expected to see a strong close to the year as a whole and the Group better placed for the future.

Debtors - the very high debtor balance was a previous worry of mine. Some progress has been made on this, but it is one of the things that puts me off investing in this company;

Control of working capital continues to be a key area of focus, as does monetising the Group's legacy debtor book and good progress has continued in the collection of aged debt in the Middle East, where, in Oman for instance, debt which stood at 4.6m at the end of March currently stands at 3.1m. Net debt for the group at the financial year end is expected to be in the region of 1m.

My opinion - when the facts change, then I change my mind. So I now regard this share positively. The company has effected a decent turnaround, and fixed its previously over-geared balance sheet, with an £8.5m (before costs) fundraising at 40p in Mar 2017.

This share isn't for me, as I rarely invest in consultancy businesses. However, it's great to see a company that was previously in trouble, manage to turn itself around.

Quixant (LON:QXT)

Share price: 410p (down 6.3% today)

No. shares: 65.9m

Market cap: £270.2m

Interim results - for the 6 months to 30 Jun 2017.

Quixant (AIM: QXT), a leading provider of specialised computing platforms and monitors for gaming and slot machine applications

Checking the archive to refresh my memory, I reported on strong results for y/e 31 Dec 2016 here. Then I reported here on 24 Jul 2017 on a strong H1 trading update & positive outlook. So this company certainly seems to be on a roll, which is reflected in a fairly high valuation.

A few numbers & my comments;

- H1 revenues up 38% to $56.9m - I think that is all organic growth too. The Densitron acquisition completed in Nov 2015, therefore will be fully included in the numbers for H1 2016 and H1 2017.

- Adjusted EBITDA up a very impressive 70% to $10.2m

- Adjusted pre-tax profit up 77% to $9.2m

- Net cash of $1.7m

- Seasonality - last year there was a strong bias for profitability in H2 (full year 2016 operating profit $12.0m, versus H1 2016 profit of $4.6m). However, note the comments below, which rather pours cold water on the strong H1 figures;

... Our core gaming platforms revenue was particularly strong with higher than expected orders from some of our key customers. This very strong demand was, we believe, out of the ordinary and hence we do not currently expect it to continue at this level for the full year.

Unlike previous years we therefore expect that the full year results will not be second half weighted, although we are clearly well placed to achieve market expectations for the full year. We therefore look forward to the remainder of the year and beyond with confidence."

Balance sheet - looks good.

NAV of $41.2m

NTAV is $27.1m

Working capital is solid, the current ratio being strong at 2.17 (I regard anything over about 1.5 as being strong, depending on the sector)

My opinion - I'm a bit concerned by the company's comments that its strong performance in H1 was down to "out of the ordinary" customer orders. The trouble with this, is that it's laying the ground for poor results next year in H1, when the company will be up against very strong comparatives. FinnCap say today that some H2 orders have been pulled forwards into H1.

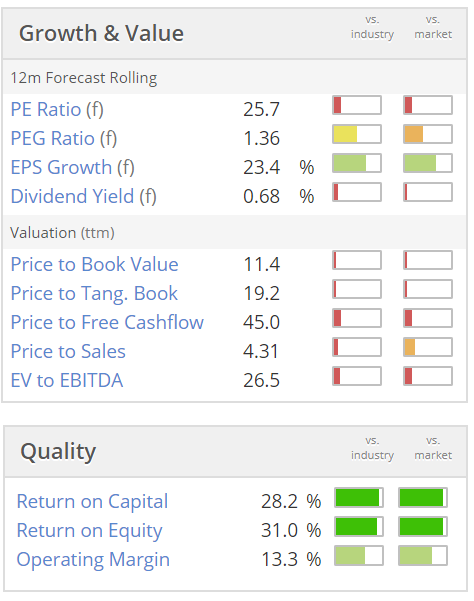

As you can see below, the valuation is quite rich, and for that reason it doesn't appeal to me.

Mission Marketing (LON:TMMG)

Share price: 44.75p (unchanged today)

No. shares: 84.4m

Market cap: £37.8m

(at the time of writing, I hold a long position in this share)

Interim results - for the 6 months to 30 Jun 2017

This is a;

marketing communications and advertising group

The point of difference, is that it operates outside of London. The group has grown through acquisitions.

Top marks for being shareholder-friendly - e.g. there are results presentation slides here, and a short video from the Chairman here. All companies should do this kind of thing, which is so useful for private investors who are not able to attend meetings in London.

A few numbers for H1;

- Headline profit before tax up 11% to £2.9m

- Headline diluted EPS also up 11% to 2.58p

- "Strong second half bias again predicted"

- Some big name contract wins (more detail in the commentary)

Outlook comments sound confident, which is a bit surprising, given that lots of other companies are talking about uncertainty, and difficult market conditions;

With our business becoming stronger, including good growth from our core business, we have a great platform from which to grow. We will continue to target further margin improvements, seek new opportunities, drive into new markets and upskill our offering.

Underpinned by our strong cash generation, we will continue to explore accretive acquisition opportunities, or establish start-ups, that enhance our overall offering that supports our Clients wherever and however they need us to without being myrmidons. We again expect a strong second half to the year and are confident that we will deliver another year of growth.

Valuation - the company reported 6.41p for headline diluted EPS in 2016. So from the above, I imagine we're probably looking at 7.0p+ for 2017. Stockopedia shows broker consensus of 7.3p EPS for 2017, and 8.3p for 2018.

I would expect a share like this to trade on a PER of maybe 10-12. So it looks strikingly cheap. Although you do have to factor in the bank debt, and deferred consideration re acquisitions.

I've run out of time & energy for today, but will circle back tomorrow to finish off a couple more sections, whilst Graham is writing Friday's report.

UPDATE: I'll cover a couple more companies from this day, but in a new report dated 22 Sep 2017 (Part 2) - link to follow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.