Good morning from Paul. I prepared some more sections last night, so we hit the ground running today!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

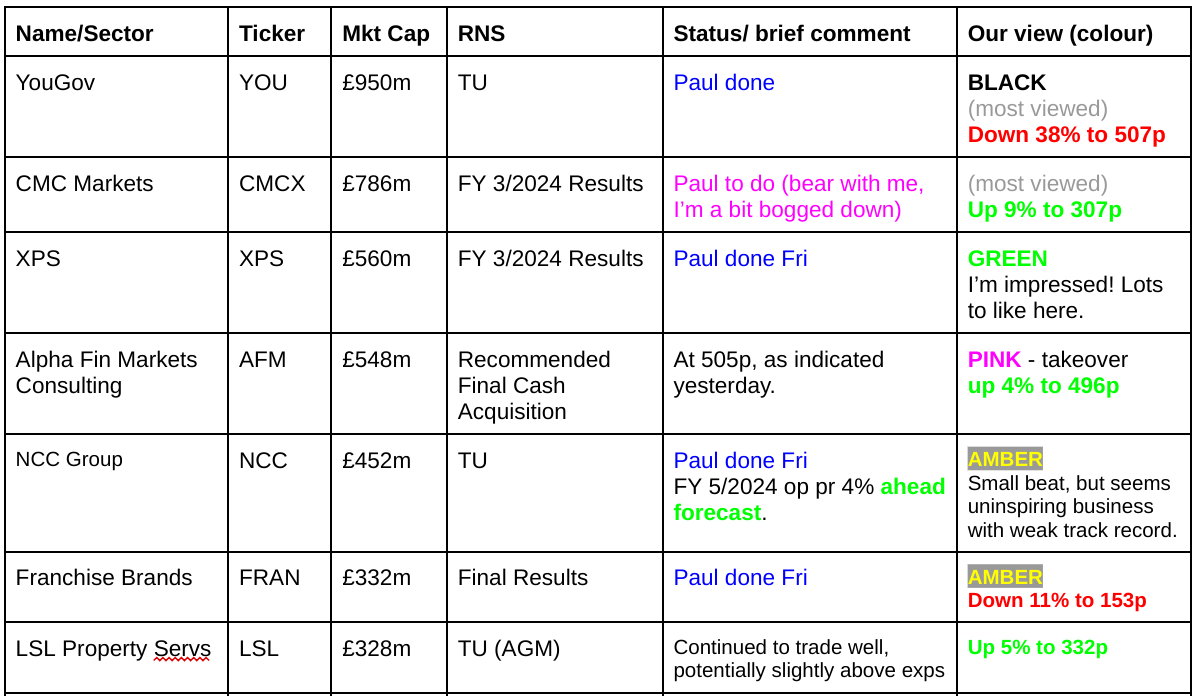

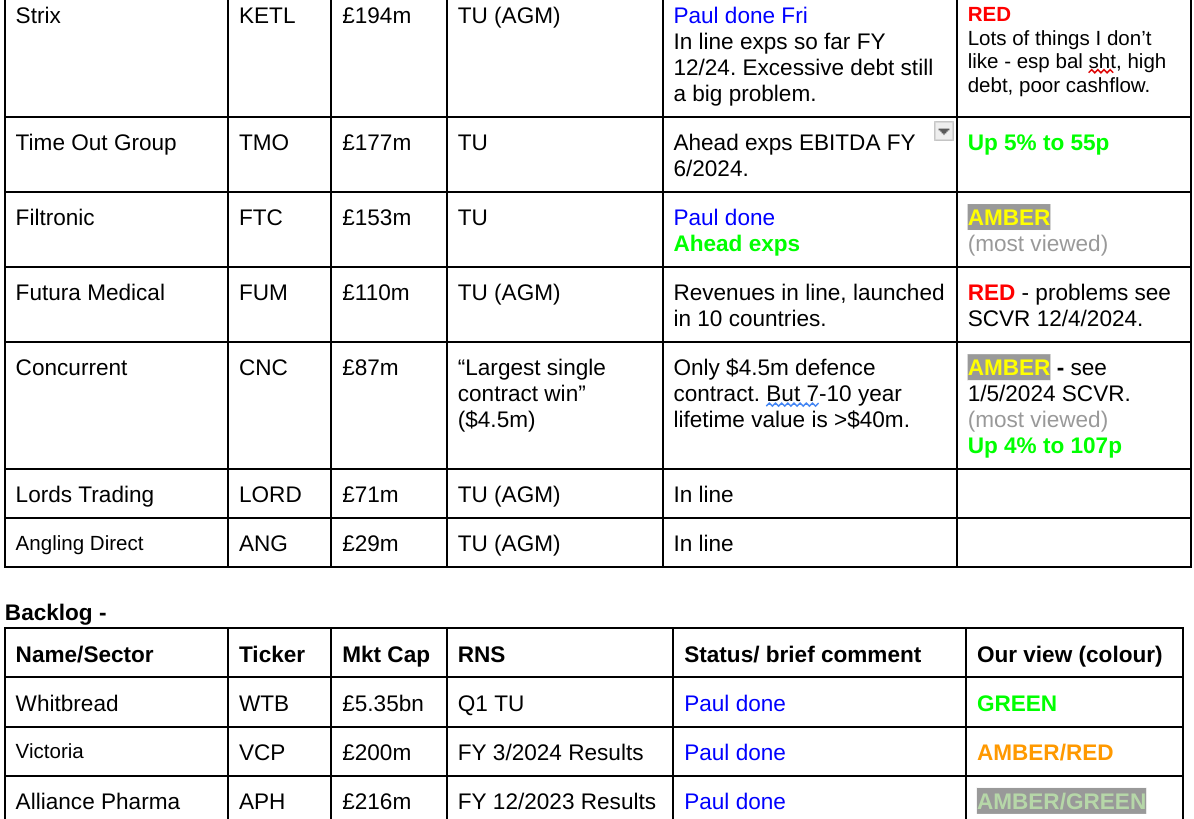

Companies Reporting

Summaries

Whitbread (LON:WTB) - 2,940p (£5.35bn) - Q1 Trading Update - Paul - GREEN

One of my favourite mid caps, so I've looked at yesterday's Q1 (Mar-May 2024) update. It seems a bit soft to me, glossed over by the PR. However, FY outlook is held (note brokers have edged down their forecasts in the last 3 months!), so nicely finessed. Bottom line, it's an excellent, well-funded and cash generative business in my view. I see shares as very attractive longer term, and explain why below.

Victoria (LON:VCP) - Up 2% to 176p (£200m) - FY 3/2024 Results - Paul - AMBER/RED

No recovery in trading yet, and an uncertain outlook. That's a big problem, because the clock is ticking on debt maturities beginning in 2026. Management horribly over-geared the business on cheap debt, and are now stuck in a corner. Equity could go either way, a zero, or multibagger, but at least mgt has 2 years to sort things out, if they can. Impossible to value, it's just for gamblers at the moment.

Alliance Pharma (LON:APH) - Up 13% y’day to 40p (£216m) - FY 12/2023 Results (delayed) - Paul - AMBER/GREEN

In an SCVR first (!), I've moved straight from red to AMBER/GREEN due to much more positive news. The delayed accounts, and other issues, turn out to be nowhere near as bad as feared, and I reckon this share might have put in a bottom. Worth a fresh look I think. Details below.

YouGov (LON:YOU) - down 39% to 501p (£580m) - Update on current trading (profit warning) - Paul - BLACK (AMBER/RED on fundamentals)

A frustrating profit warning that gives revised down profit guidance without telling us what it was previously (and I can't find anything in the H1 results, and no broker notes are available). So I'm in the dark until revised broker consensus forecasts filter through. I'm wary of the balance sheet weakness, after it took on too much debt to fund a large acquisition in Jan 2024. So for now, I'm wary at AMBER/RED until we have more information. Things like this usually recover from profit warnings though.

Filtronic (LON:FTC) - down 2% to 71.4p (£155m) - Trading Update - Paul - AMBER

Ends the financial year 5/2024 with a flourish, ahead of expectations, with Cavendish today raising forecast EBITDA by £0.3m to £4.8m. Real profit is forecast at £3.6m. Hence the £155m market cap is pricing in a continuation of very strong profit growth. It looks an exciting situation, but I have no idea how to value it, so will sit on the fence with AMBER. Well done to holders, who have enjoyed a stellar bull run.

Paul’s Section:

Whitbread (LON:WTB)

2,940p (£5.35bn) - Q1 Trading Update - Paul - GREEN

These days, Whitbread’s main business is hotel chain Premier Inns, mainly in the UK, but with a small but growing operation in Germany. It also has co-located food & beverage businesses - ie bar/restaurants attached to Premier Inns (some underperforming ones are being converted into more hotel rooms).

For reference, I reviewed WTB shares in some detail here on 21/1/2024, most of which is still relevant now. In particular I showed how the balance sheet is very strong, with tons of freehold properties. The net debt shown on the StockReport is a red herring because it includes hefty lease liabilities under IFRS 16. I have challenged this, and asked if the net debt could be changed to pre-IFRS 16, but the response from the data provider is that they provide data which complies with current accounting standards, including IFRS 16. Therefore we have to remember that, for any company which has multiple leased properties (ie almost all retailers, and hospitality companies), the net debt numbers will include leases, and hence need to be manually adjusted down to focus on actual debt. Annoying, but that’s the way it is I’m afraid.

WTB’s current financial year end is FY 2/2025, so this Q1 update covers Mar, Apr and May 2024.

Q1 Trading Update

Headline - has been PR’d a bit I’d say -

“Strengthening trading performance in the UK and continued progress in Germany”

This glosses over what I see as a rather lacklustre Q1 sales performance, as this table below demonstrates. The growth in Germany is much better, but it’s so small relative to WTB’s UK operation that it barely moves the dial. Germany is expected to reach breakeven during this calendar year - and hopefully then move into profits in future. That could be a catalyst for a re-rating, if it works.

Bear in mind that staff wages costs are about 30% of WTB’s revenues, and these have seen two years’ large increases from minimum wage, so LFL sales being down 1% in Q1 isn’t good enough. Set against that, I imagine that food and energy costs might be moving down somewhat, which is what we’re hearing from some other hospitality companies. The last results guided cost inflation at 3-4% overall this year, since efficiency savings have offset a lot of the wage inflation.

I’m struggling to reconcile the upbeat-sounding commentary and bullet points with the weak figures in the table above.

Share buybacks - you’ll see that “transaction in own shares” announcements dominate the list of RNSs from 1/5/2024 when the programme began -

“£150m share buy-back: on track with 3.2m shares purchased so far for a total consideration of £96m”

WTB passes my simple tests for share buybacks to be a good thing, namely -

Shares must be cheap on fundamentals, and

The company must have a strong balance sheet to be able to easily afford the buybacks.

The share count is heading down nicely now, over several years, thus enhancing EPS and DPS.

Outlook -

“Our UK trading results strengthened during the quarter and we continued to grow accommodation sales ahead of the market. “

“Confident in full year outlook, underpinned by our strong commercial programme and good progress on cost efficiencies”

As you can see below, the trend of broker forecasts has been up, although in recent months current year forecast FY 2/2025 has been trimmed from 230p to 210p. At 2940p, the current year PER is about 14x - I think that’s a reasonable price, given the upside potential from a cyclical economic recovery, more growth in Germany, and a reducing share count from the buybacks. Meanwhile shareholders also receive a useful dividend yield of about 3.4%

Balance sheet - as mentioned before, this is very strong indeed, full of freehold property, and has minimal net debt of only £303m, as you can see from this table in the FY 2/2024 results -

Pension schemes - this is the latest news, as of Feb 2024, which is a little confusing, but my conclusion is that we probably don’t have to worry about pension schemes being significant, given the size and profitability of the company - although the large size of the property held as security raises an eyebrow -

“There are currently no deficit reduction contributions being paid to the Pension Fund, however annual contributions continue to be paid to the Fund through the Scottish Partnership arrangements which amount to approximately £11m. The Trustee holds security over £532m of Whitbread's freehold property which will remain at this level until no further obligations are due under the Scottish Partnership arrangements, which is expected to be in 2025. Following that, the security held by the Trustee will be the lower of: £500m; and 120% of the buy-out deficit and will remain in place until there is no longer a buy-out deficit. The Pension Fund is currently in the process of conducting the triennial actuarial valuation of the Fund as at 31 March 2023.”

Paul’s opinion - recent performance looks a bit soft, confirmed by broker forecasts having been trimmed. The Q1 update seems a little over-PR’d to me, I prefer a more honest style of reporting which admits that recent trading has been challenging, but the outlook is fine, thanks to efficiency gains and continued self-funded expansion.

What you’re getting here is a superbly well funded business with a bulletproof balance sheet (which could well attract private equity bidders), that is a market leader with a strong brand in a fragmented hotels market, generating excellent profit margins, with cyclical recovery potential, Germany moving into profit, nice divis and buybacks, what more do you want?! All for a PER of 14x.

I remain of the view that recent share price weakness looks a good opportunity, and that this share should re-rate in the fullness of time. It’s GREEN from me.

Victoria (LON:VCP)

Up 2% to 176p (£200m) - FY 3/2024 Results - Paul - AMBER/RED

Revenue and earnings in line with market expectations

Cautious outlook for FY2025, but strong operational fundamentals in place as demand normalises

Poor results for FY 3/2024, with revenue down 14% to £1,257m - so it’s a substantial group, having been built rapidly from multiple acquisitions, funded by now excessive debt. Hence the no.1 issue here is whether it can recover from its deeply indebted position, or will equity be engulfed by debt and wiped out? You always have to remember that equity legally ranks behind all creditors.

Adj PBT has dropped 65% to only £27m. That is after the benefit of adjustments which once again are >£100m (mostly goodwill impairments). Statutory PBT was a £(108)m loss.

Balance sheet - for me this is the most important consideration. Liquidity actually sounds OK -

“The Group boasts a strong liquidity position with cash and undrawn credit lines in excess of £250 million.

Almost all debt financing takes the form of Senior Notes, which have no financial maintenance covenants. Although the earliest tranche is not due for repayment until August 2026, the Board has started working on refinancing options to allow adequate time to optimise the terms of the replacement funding and management remain focussed on reducing Group leverage ratio ahead of the refinancing.”

Overall though the balance sheet is an over-geared mess. NTAV is negative by a huge £(376)m. Management did an acquisition binge on borrowed money, when financing was cheap, and customer demand was strong.

There’s not just £673m of long-term debt, there’s also another £274m of preferred equity.

I cannot see how all that debt can possibly be refinanced sensibly, now that interest rates are so much higher. VCP management seem to have taken a gamble that interest rates would remain low forever, and they got it wrong.

The danger is obviously that future refinancing might involve heavy equity dilution, which could be a big problem for shareholders if the share price continues its downward trajectory. The worst case scenario is that if lenders don’t play ball when bond expiries come up, then equity could be wiped out, and lenders own the business. Hence there is a very wide range of potential outcomes at VCP, from multibagger upside, to a zero downside if it ends up insolvent.

As we’ve seen with many other financially stretched companies, once the market smells blood, it can exact a heavy price for additional support for companies that are trying to secure fresh funding (debt or equity) from a position of weakness.

That said, management at VCP are experienced, and have got out of tight corners before as the long-term share price demonstrates. You have to decide if the wheels have come off this time, or if Mr Wilding is just fixing another puncture before setting off again! I genuinely cannot decide or predict which it is, this share could go either way in my view, but the eventual up or down move is likely to be big.

Hyperinflation - this is interesting, and relates to accounting adjustments required in VCP’s two Turkish businesses, a country where economic mismanagement has caused hyperinflation. If I’m reading this right, the hyperinflation adjustments seem to have boosted PBT by £16.2m in the group accounts, but has I think been removed from the underlying results. See note 2 for more details.

Audit problems - this issue caused a lot of consternation some time ago, but according to VCP it now sounds resolved -

“Through the course of FY2024 Grant Thornton continued their work on addressing the concerns expressed in their FY2023 report in relation to Hanover Flooring Limited, a small subsidiary contributing 1.25% of Group revenue. These extensive additional procedures evidenced that there was no financial misconduct and all payments due to Victoria have been received, no money is unaccounted for, and Victoria has suffered no loss. Consequently, the auditors have confirmed in the FY2024 Audit Report that their concerns have been appropriately satisfied.”

Outlook - no immediate signs of recovery -

“Commenting on Victoria's Outlook, Geoff Wilding, Executive Chairman, said:

"Whilst we remain cautious about near-term trading conditions and cannot predict precisely when demand will normalise, we are (logically) continually moving closer to that point. As interest rates fall, housing transactions and deferred residential renovation, improvement and repair purchases will rebound, driving flooring demand. We expect the market outperformance and productivity improvements secured over the last 24 months to then be rapidly reflected in Victoria's earnings and cash flow. Until this occurs, we remain focussed on minimising controllable costs and driving market share gains."...

Alongside all other global flooring companies, Victoria has suffered from the large drop in flooring demand over the last 24 months. However, critically, the fall is not structural and, as the macro-economic factors that have contributed to the low demand abate, the fundamental need for flooring will result in volumes rebounding to the long-term mean - that is the very essence of cyclical industries.

In calendar 2023, flooring volume across Victoria's key markets was estimated to be some 20% below the levels of 2019 (which were broadly in line with the 25-year average growth rate). Simple reversion to the mean therefore suggests demand normalisation should deliver a volume uplift from 2023 levels of more than 25%. Whilst the Group's FY2025 financial outlook is largely based on current demand, it is interesting to note the potential impact normalising demand could have on the business as each 5% increase in volume is expected to drive a £25 million increase in Victoria's earnings.

Net debt - is way, way too high, at £632m, which is over 3x the market cap of £200m. There’s a footnote saying -

3 Net debt shown before right-of-use lease liabilities, preferred equity, bond issue premia and the deduction of prepaid finance costs.

Dividends - none, and I wouldn’t expect any for the foreseeable future.

Acquisitions - on hold, for the same reason - it has to get debt down as its main priority.

Cashflow statement - is not good. More than all the cashflow generated is used up by finance costs, capex, and lease payments. So there’s nothing available to reduce debt, which has actually gone up a little.

Make no mistake then, VCP is in a deep hole, and need a substantial uplift in trading just to survive, and will then have to somehow refinance its massive debt load.

Paul’s opinion - I’m mindful that in a recovering economy, highly indebted companies that also take self-help measures, can miraculously recover. The standout case in the last year has been McBride (LON:MCB) - for this reason, I’m reluctant to condemn VCP too much, as it could recover.

However, the extent of its balance sheet problems are far worse than MCB, and with poor cashflows, I’m struggling to see how VCP can recover enough to even make a small dent in its massive debt pile before refinancing is required in about two years.

Hence the equity needs to be seen as a high risk gamble.

The Frankfurt Bourse seems to be the only easy place to get bond prices, and this shows VCP’s 2028 3.75% coupon bond falling in value when interest rates rose in 2022 -

The 2026 VCP bond looks a healthier price, so it seems as if these particular bondholders are expecting to get their money back, taking into account the low coupon -

Although bondholders might be sitting reasonably comfortably because they expect equity dilution to occur, which of course helps them, whereas it hurts shareholders.

Sentiment could change rapidly with VCP shares, once the commentary becomes more bullish with a recovery in demand starting hopefully soon, maybe in 2025? With no immediate debt maturities to worry about, above all VCP seems to have a 2-year window to turn itself around enough to refinance.

I’m finding it impossible to value this share.

The terrible balance sheet, with vast, seemingly unpayable debt, which of course will get a lot more expensive once it is refinanced (if it can be refinanced at all) from 2026, means it has to be either red or amber/red. As last time, I’ll go with AMBER/RED again, since there’s no immediate liquidity issue. That buys 2 years for management to pull a rabbit out of the hat. Overall though, this one is really for gamblers only at this stage.

Alliance Pharma (LON:APH)

Up 13% y’day to 40p (£216m) - FY 12/2023 Results (delayed) - Paul - AMBER/GREEN

I last looked at this on 8/5/2024, concluding RED because of these issues - unspecified audit problems delayed the 2023 accounts twice. CEO stepped down. Very weak balance sheet with horribly negative NTAV, and way too much bank debt of c.£120m gross. So things looked pretty scary, hence I had to flag the risk with RED.

There was a 13% relief rally yesterday, so I’m happy to look at things with fresh eyes, to see if a positive corner has been turned. Getting the audited accounts out is in itself a positive thing, as another 10 days delay would have caused suspension.

The highlights table below looks fine, if you’re happy to use “underlying” profits, which are actually slightly up on prior year. Although note the statutory numbers are heavy losses in both years, due to impairments of intangible assets - ie writing down the value of drugs rights it acquired which are now assessed to be worth less than they paid for them (I'm assuming they're in the books at cost, not a revalued basis), including “valuation errors” in the restated 2022 accounts -

Net debt is high, although reduced by c.10%, and dividends have stopped. It says the leverage multiple has fallen from 2.69x EBITDA in June 2023 to 2.05x at Dec 2023, a much more comfortable level of gearing. This section on net debt reassures me, although note that finance costs almost doubled in 2023 to £10.5m due to higher interest rates, consuming a quarter of operating profit, so continued debt reduction is important, although not a crisis in my view.

Important points here about debt -

“Free cash flow (see note 15 for definition) for the year rose 35% to £21.3m (2022: £15.8m), due to the strong trading performance in H2. Cash generated from operations increased by 48% to £36.9m (2022: £24.9m).

This solid cash generation supported a reduction in net debt of £10.8m to £91.2m at 31 December 2023 (31 December 2022: £102.0m), with Group leverage (the ratio of net bank debt to EBITDA) decreasing to 2.05 times (31 December 2021: 2.57 times). Interest rate cover (the ratio of EBITDA to finance charges) decreased to 4.82 times (31 December 2022: 7.39 times) reflecting the increase in net interest cost on rising interest rates.

Net debt and Group leverage are both expected to fall further during 2024, particularly in the second half, with Group leverage expected to be below 2.0 times by the end of 2024.”

CMA (Competition & Markets Authority) - good news that a £7.9m provision for a potential fine has been released, given a successful appeal. This also seems to reflect positively on management integrity.

Outlook - here it is in full below, which suggests an unexciting outlook, but in line trading so far in 2024. No profit growth in 2024, but stabilising things is a pretty good outcome given how wobbly everything looked in the last update -

“Outlook for 2024

Alliance's clear focus on the core Consumer Healthcare business, in addition to our well-established, scalable platform, is expected to deliver continued modest revenue growth. Group performance in the five months to end May is in-line with the Board's expectation.

As we continue to refine our strategy we intend to move towards smaller, more regular order fulfilment, to create a more consistent revenue stream, reducing the stocking and destocking cycles we've experienced over the last two years as we've changed distributors, moved manufacturing and managed through the COVID environment.

In 2024 we will continue to increase investment in sales, marketing and innovation to maintain our brand leadership position in key categories.

The Board continues to anticipate that profits in FY 2024 will be in-line with FY 2023. As in previous years, performance is expected to be H2 weighted, particularly in Nizoral.

We remain confident in our ability to further capitalise on identified organic growth opportunities within the business and to deliver positive financial performance which will help drive the de-levering of our balance sheet.

Balance sheet - I’ve been critical of the weakness in NTAV, and too much debt in the past.

However, I’m taking a more lenient view now on seeing the latest numbers, because the intangible assets are mainly rights over drugs, which presumably do have resale value. Hence we shouldn’t be just writing them off as worthless. The problem is that APH seems to have been inaccurately valuing them, and well done to the auditors for spotting this, and forcing APH to write down values to a more robust basis. I like the humility of APH’s commentary on this, where it says valuable lessons have been learned. And to be fair, as a former CFO myself, you tend to be focused on running the business, and things like impairment reviews, leases, revenue recognition policies, etc, many of which have changed a lot recently, are generally left to the year end, and often even calculated by the auditors. So that does increase the risk that something big and nasty could emerge during the audit. It’s not ideal of course, but in this case I think APH mainly failed in its communications to the stock market. It should have been far more open with investors about what the precise issues were, instead of causing panic amongst investors with its opaqueness.

As you can see below, these drugs rights are reduced by about a quarter, but it’s still a big asset value -

Paul’s opinion - I don’t recall ever jumping from RED straight to AMBER/GREEN, but I’m going to do that here.

The various audit delays, combined with worryingly high gearing, and abrupt CEO departure, clearly spooked a lot of people (including me) earlier this year, understandably.

Yet the 2023 figures actually look OK to me, and I can forgive the sloppy procedures for placing notional values on its drug rights assets - I don’t see that as a commercial or cashflow issue, and there are still substantial assets, measured on a more prudent basis now.

Cash generation is good, and with dividends stopped, I reckon APH has the capacity to reduce net debt by about £20m pa. That’s important because finance costs are currently consuming about a quarter of operating profit, and almost a third of cashflow. Hence there should be scope to refinance at lower rates, and for a smaller amount, in say 1-2 years.

I imagine a small divi might return in future, but for now debt reduction is more important.

I’ll stick my neck out here, and say that I suspect APH shares might have now put in a bottom, and this seems an interesting-looking value situation for you to do some deeper research on. Let me know what you think, once you’ve delved a bit deeper!

Shares have almost done a round-trip over the last 10 years - not very good, particularly when you adjust for inflation -

YouGov (LON:YOU)

Down 39% to 501p (£580m) - Update on current trading (profit warning) - Paul - BLACK (AMBER/RED on fundamentals)

A savage 39% drop in share price this morning for this “international research and data analytics group”.

The peak share price was 1,600p at end 2021, so this is now down by more than two thirds. Is it a buying opportunity, a disaster, or somewhere in between?

YOU is not a share we cover much here, due to its size (not a problem any more). My notes show we last looked at YOU on 12/10/2023 concluding AMBER, noting superb FY 7/2023 results and long-term track record, but that a large acquisition pending was about to gear up the balance sheet. I also flagged concern over some accounting adjustments.

On to today’s bombshell, a profit warning for FY 7/2024.

What’s gone wrong? Sales are lower than expected, now guided at £324-327m. It had increased costs in anticipation of higher sales in H2. Revised adj operating profit guidance is now £41-44m. Maddeningly, it doesn’t put this in context by saying what the previous guidance was! How ridiculous is that.

The big acquisition in Jan 2024 (part of GfK I seem to recall) is integrating well, although “slight” shift of revenues into next year due to aligning its accounting policies with YOU’s.

What are they doing about it? Trying to drum up more sales, and cost-cutting, is my interpretation of this -

“As we move into FY25, we will focus on optimising our cost base and prioritising investment in key growth areas such as upgrading our Data Products, continuing to build out our AI capabilities and enhancing our sales organisation to further capitalise on YouGov's unique asset: its high-quality global panel and proprietary dataset.”

Broker updates - nothing for the plebs. So I’ll have to try and work it out for myself.

H1 results (to Jan 2024) showed adj operating profit of £27.9m. So the guidance today of FY 7/2024 adj operating profit of £41-44m suggests H2 will be between £13.1m, and £16.1m, significantly below H1.

I’m not happy with adj operating profit because the adjustments are too aggressive at YOU in my view, and also it geared up with loads of bank debt in Jan 2024 to make a very large acquisition. Hence there will be substantial finance charges on the bank debt in H2, that obviously doesn’t appear in operating profit because it’s the next line down. Hence we need to know what PBT guidance is, not operating profit.

The H1 figures say that leverage was 1.6x EBITDA. Now we’ve had a profit warning, presumably the leverage multiple will have worsened. Investors therefore need to check what the bank covenants are, as there could be a risk of the balance sheet needing repair from an equity fundraise.

Balance sheet - this is a concern now. At H1, the NAV of £189m included a huge £416m in intangible assets (mainly goodwill), leaving NTAV badly negative at £(227)m. I did raise concerns last year over the wisdom of taking on so much debt to finance a large acquisition in Jan 2024, so there couldn’t be a worse time to encounter softer trading and issue a profit warning, just after taking on a ton of debt.

Paul’s opinion - I need more information to properly judge this, in particular what the previous guidance was, as I can’t find anything in the H1 results. In this situation I would usually go amber. However, my balance sheet concern means it has to be AMBER/RED for the time being, whilst information on revised forecasts takes time to filter down to us plankton.

I should say though, that former mid caps like this do usually recover from profit warnings, and YOU has a strong historical track record. Although my main concern is that it’s possibly bitten off too much with the 315m Euro acquisition of CPS, mostly funded with debt.

Overall, I think this share could go either way, sorry I can’t give a more helpful view on it!

Shares have more than halved so far in 2024 -

Filtronic (LON:FTC)

Down 2% to 71.4p (£155m) - Trading Update - Paul - AMBER

Filtronic plc (AIM: FTC), the designer and manufacturer of products for the aerospace, defence, telecoms infrastructure and low earth orbit ("LEO") space markets, is pleased to provide the following trading update for the financial year ended 31 May 2024 ("FY2024").

Says it’s performed ahead of expectations, yet the share price has fallen slightly this morning (after a fabulous bull run though) -

“Revenue and earnings before interest, taxation, depreciation and amortisation ("adjusted EBITDA") has been delivered ahead of market expectations as trading momentum continues to build, in what has been a transformational year for the business, after entering into a Strategic Partnership with SpaceX as we previously announced on 24 April 2024.”

Useful guidance is provided, showing a large year-on-year increase in profit (although bear in mind the market cap has soared to £155m, so the numbers need to be good) -

“Trading has been strong in H2 of the financial year and the Board, subject to audit, expects to deliver FY2024 revenue of approximately £25.4m (FY2023: £16.3m) and adjusted EBITDA of no less than £4.8m (FY2023: £1.3m).

Cash at bank on 31 May 2024 was £7.2m (30 November 2023: £4.1m). Net cash (net of all lease obligations except right of use property leases) at 31 May 2024 was £5.2m (30 November 2023: £2.4m).”

Broker update - Cavendish helpfully updates us, raising adj EBITDA from £4.5m to £4.8m, a useful but not huge beat.

What about real profit? Adj PBT is forecast at £3.6m, a large uplift from breakeven in the previous year.

Adj EPS is 1.4p, so the PER is a whopping 51x, hence the market is pricing in roughly a tripling of future profits to a steady state of c.£10m, the way I look at it.

FY 5/2025 forecast (unchanged today) is another big rise to adj PBT of £6.4m, or 2.7p EPS, taking the PER down to a still quite punchy 26.4x.

Outlook sounds exciting -

“Nat Edington, Chief Executive Officer, said: "The space market continues to present significant growth potential for Filtronic. The recent Strategic Partnership we entered with SpaceX is exciting for all of our stakeholders. It gives a platform to develop the business and puts us in a stronger position to capitalise on the plentiful opportunities in the core markets we serve. We enter the new financial year with a very strong order book, a growing list of customers, including key strategic targets that we have secured in the year, and an opportunity pipeline that continues to grow and mature."

Paul’s opinion - doesn’t really matter, as this share is all about anticipating further growth, and trying to work out how to value the shares on unknown future results. Hence there’s a fair bit of guesswork involved, and well beyond the scope of my reviews of the numbers here.

Profitability has transformed upwards in FY 5/2024, which has been reflected in a large increase in the share price & market cap. There’s a lot more growth already priced-in.

I don’t have any idea how to value this share, so will go with AMBER. Well done to investors who spotted the opportunity. It’s very impressive that a small UK company, with a lacklustre track record over many years of boom & bust products, seems to have hit a rich vein of new business. How high can it go? How long will this boom last? No idea! If I held this share, I’d probably top slice some of the profits for safety’s sake, then let the rest run, and keep some cash back to buy the dips, providing the newsflow remains good.

I see one of the biggest shareholders (a couple, surname Newlands) are thinking along the same lines, having top-sliced from 12.2% to 11.3% two days ago, announced today.

What a glorious chart here - a reminder that multibaggers can come from the most unlikely sources sometimes - but also a warning that previous glories faded away -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.