Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

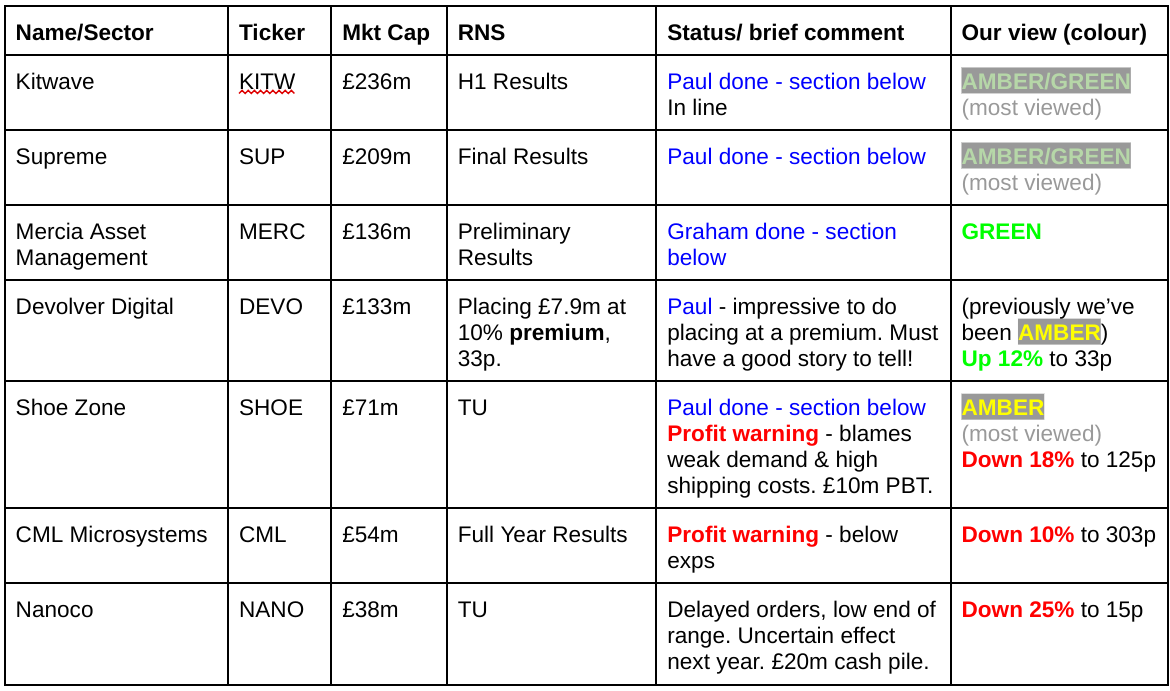

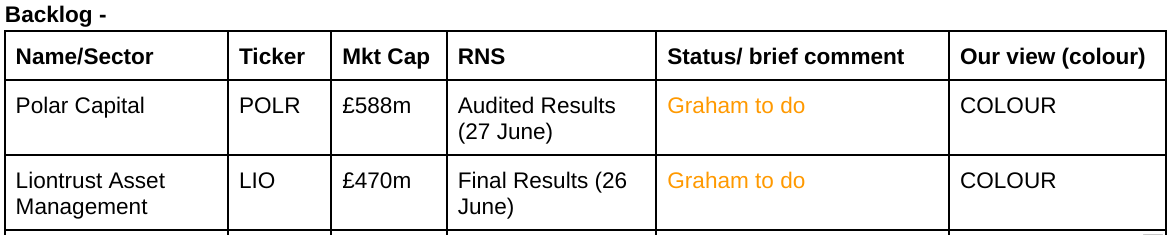

Companies Reporting

These are the things we've got so far. I'm going to rush out a section on SHOE before 8am, and Graham's pondering doing some fund manager shares as catchups.

Summaries

Shoe Zone (LON:SHOE) - down 16% to 127p (£60m) - Trading Update [profit warning] - Paul - BLACK (pw) - AMBER on fundamentals

Another profit warning, blamed on higher sea freight costs, and subdued demand (Apr-Jun). Still forecast to be profitable in FY 9/2024, but forecast reduced from £13.8m to £10.0m adj PBT. Balance sheet is OK, so no solvency worries. Expect a nasty drop today, obviously.

Supreme (LON:SUP) - down 6% to 169p (£196m) - FY 3/2024 Results - Paul - AMBER/GREEN

Excellent results, and a PER still modest at c.8x - but I think it deserves a discount due to vaping producing almost 3/4 of the profits. Shares have had a great run up, so I'm moderating from green to AMBER/GREEN.

Kitwave (LON:KITW) - down 6% to 316p (£221m) - H1 Results - Paul - AMBER/GREEN

H1 results are a tad lacklustre, but it's sticking with FY 10/2024 forecasts for now. So I see some potential risk of an H2 profit miss. Balance sheet has a bit too much debt for my liking. That said, I do like the strategy of consolidating a fragmented market, and valuation looks more reasonable after recent falls.

Mercia Asset Management (LON:MERC) - up 6% to 32.9p (£140m) - Preliminary Results - Graham - GREEN

Continued progress as Mercia transitions from a direct investor to a manager of 3rd-party funds. Large mandates were won in FY 2024 and an acquisition in 2022 has also helped to grow and diversify the group. I remain positive here given the deep value on offer and the positive trading momentum.

Paul’s Section:

Shoe Zone (LON:SHOE)

down 16% to 127p (£60m) - Trading Update [profit warning] - Paul - BLACK (pw) - AMBER on fundamentals

Oh dear, I’m sorry to report another profit warning from this cheap Chinese shoes retailer. This might be the third or fourth PW this year?

This time it blames higher costs of sea freight, combined with lower demand than expected in April- June - blamed on unseasonable weather, which I don’t personally accept. People are just buying their shoes elsewhere, is my view - which is something that had begun to concern me last year, with the rise of the Shein/Temu Chinese competition.

What’s the damage? - last time guidance was given as £13.8m adj PBT for FY 9/2024.

This time SHOE guides it down significantly, to £10.0m - quite a hefty miss.

Zeus helpfully updates its spreadsheet & shares it with us - FY 9/2024 EPS is now 16.2p (previously 22.4p).

Zeus expects little recovery in FY 9/2025.

Valuation - with a series of profit warnings, surely the market might now factor in the possibility of a further deterioration in trading? For that reason I don’t suppose SHOE justifies a forward PER much above mid single digits. If we say PER 6x, then it’s only 97p share price.

A bit more generous at 8x, gives us 130p.

I suspect today might see a significant lurch down somewhere into that 97-130p range (writing this at 07:33)

Cyber security incident - was announced on 27/6/2024, but the impact is not expected to be financially material, “at this stage”.

Balance sheet - looks adequate when last reported at 30/3/2024. Although one amber flag is the level of inventories seems quite high.

Paul’s opinion - every time we look at SHOE, we comment on how cheap it looks. But I took us down from green to amber/green last time on a recent profit warning, due to unease that SHOE has changed from constantly beating forecasts, to now constantly missing them. So it’s difficult to avoid the impression that something fundamental is deteriorating at this business, it’s possibly not just one-offs in my view.

That said in the past SHOE has been adept at recovering from shocks like the pandemic, so maybe it’s just having a sluggish year due to not getting its product & pricing right?

The sea freight issue is something we’re already aware of, so I’m now worrying how many more companies are going to be also issuing profit warnings over this? We probably need to be cautious.

Unfortunately, I haven’t got much option other than to move SHOE down again, to just AMBER this time.

All is not lost though, as Zeus is forecasting divis will continue to be paid, 6.5p for this year (previous forecast 9.0p).

Profit should be rising, as SHOE’s strategy has been to close smaller shops, and open larger, more efficient big box shops. So again, I’m puzzled as to why we’re seeing performance worsen, even allowing for some tough macro factors (living wage rises, sea freight, etc). That should all be mopped up by increased sales at a healthy business, so something’s going wrong here I suspect.

Note that over ¾ of the shares are held by just 4 major shareholders, dominated by the founders. De-listing risk a possibility?

Personally I won’t be bottom fishing here just yet. Let’s see where the dust settles.

The sliders have slipped off this year -

Supreme (LON:SUP)

Down 6% to 169p (£196m) - FY 3/2024 Results - Paul - AMBER/GREEN

This is the vaping & other consumer products group. It starts off this announcement with an impressive list of achievements -

Some superb figures in the highlights table too -

Adj EPS up 77% to 20.9p means at 169p SUP shares are on a PER of 8.1x - still cheap, despite a strong recent bull run.

Outlook - the main point says -

“Supreme forecasts FY25 to be another profitable and highly cash-generative year for the Group. Having made a positive start in Q1, the Group is trading comfortably in line with current market expectations5.”

5Analyst consensus immediately before this announcement for the year ending 31 March 2025 was revenue of £242 million and Adjusted EBITDA1 of £36.9 million

Annoying to see adj EBITDA quoted. As we can see from their highlights table, adj PBT was £7.4m (or 19%) lower than adj EBITDA.

Note also that the market expectations of £36.9m EBITDA for FY 3/2025 is below the actual £38.1m achieved in FY 3/2024, so this looks a soft target. Either that, or there’s no further growth expected from the large jump in profits in FY 3/2024.

This comment from management doesn’t suggest they’re planning for a flat, or declining year, so I imagine SUP is probably set to beat current forecasts (unless something unforeseen goes wrong) -

“FY24 has been a hugely successful period of growth for Supreme and I strongly believe that we remain firmly on track to maintain this impressive growth momentum in FY25 and beyond.”

How much profit comes from vaping? - this isn’t easy to work out, as note 4 (divisional analysis) only shows revenues and gross profits, which excludes overheads - as follows -

The above table shows that 58% of the group’s gross profit came from its vaping division in FY 3/2024.

However, what it calls “Branded distribution” is also vaping products! Combine those, and 72% of gross profit comes from vaping products. Hence the other products are a sideshow I would argue. Although to be fair, they’ve all shown nice growth.

I don’t know how overheads would be allocated to each division. It talks about being vertically integrated, so assuming it’s an even split, then operating profit for each division would be about half the gross profit numbers above.

I won’t go into all the detail about vaping, and the regulatory threats. SUP plays it all down, but I would want a hefty discount on this share valuation to allow for a potential bombshell on a future Govt say deciding that these products should only be sold on prescription as smoking cessation products, and not be on general sale to any adults. Or competitors seeing that it's a lucrative niche, and coming for some of SUP's market share.

The commentary also mentions Govt possibly imposing tax on vaping products, but I haven’t looked into that. Surely these things should be heavily taxed, to deter nicotine addiction?

We always get a heated debate when this company comes up, so I’ll leave that to readers - keep it clean please girls! ;-)

Balance sheet - is strong, £44m NTAV.

Cashflow statement - looks perfectly healthy to me, so there’s no doubt at all that SUP is a profitable & cash generative business.

Paul’s opinion - I can’t fault these numbers, they’re superb.

I suspect it might beat the FY 3/2025 forecasts too.

The crux with this share is how you view vaping, and the bumper profits SUP is making from it. FWIW my view is that I wouldn’t pay more than a PER of about 8x for a business that is so heavily dependent on one controversial product line.

If we assume c.20p EPS, with some potential upside on that maybe, then I think a share price c.160p sounds about right. That’s slightly below the current price of 169p, and given that SUP shares have had an excellent run up, I’m going to moderate from green to AMBER/GREEN.

Management seem shrewd at finding, and exploiting lucrative niches. So it will be interesting to see how the recent bottled water acquisition develops.

Some profit taking tends to happen in this market, after such a rise -

Kitwave (LON:KITW)

Down 6% to 316p (£221m) - H1 Results - Paul - AMBER/GREEN

Gosh, quite a volatile share this one. It’s surprising how many small caps soared from autumn 2023 to April 2024, but have since given a lot of that move back. This market definitely feels like profit-taking is a sensible move after big rises, as a lot of them are not sticking.

Time for me to don my smart-ass hat, as checking back I see we suggested on 2/5/2024 that the rise to 407p was likely to turn into profit-taking after a 60% rise, hence a shift down here from green to AMBER/GREEN. With shares now down 22% from that recent peak, I’m wondering if this could be time for us to be buying a bargain thrown at us by someone else’s stop loss kicking in?! KITW is certainly a business that we like here at the SCVR, and we were previously green on it going back to July 2023, when Directors banked £3.3m-worth of shares, as a reminder.

On to today’s H1 results -

“Kitwave Group plc (AIM: KITW), the delivered wholesale business, is pleased to announce its unaudited interim results for the six months ended 30 April 2024 ("the period" or "H1 2024").”

Not great is the quick version on these H1 results. As you can see below from this P&L excerpt, the increased revenue & gross profit wasn’t enough to absorb a larger increase in overheads, particularly administration costs -

Although in mitigation it does comment -

“Investment in the business has continued ahead of future potential growth opportunities, with operational and financial benefits being realised from H2 2024 onwards.”

Finance expenses are up, at a hefty £2.4m, thus eating up c. a quarter of operating profit to arrive at PBT of £6.9m, down 17% on H1 LY.

Seasonality - there was a heavy H2 weighting to profits last year, with H1 being about a third of FY 10/2023 PBT. I seem to recall this might be due to summer sales of drinks & ice creams being important, which fall into H2.

Balance sheet - is weakish, with only c.£7m NTAV, due to this being an acquisitive group (a good strategy, but it does cause the balance sheet to fill up with goodwill at the top, and rather more debt than I would like in the middle and bottom).

No cause for alarm, but personally I would like to see a brake on further acquisitions, and maybe reconsideration of the dividend policy.

Outlook - I’m starting to lean towards giving KITW the benefit of the doubt over these lacklustre H1 numbers -

"As noted in the pre-close trading update, operating profit for H1 2024 is slightly behind the prior year due to investment and lower levels of demand in the Group's Foodservice hospitality customer base. This, alongside the benefits of the increased investment in infrastructure and the inclusion of trade from Total Foodservice in H2 2024 will lead to the Company's annual financial performance having an increased second-half weighting.

"Despite the slight shortfall in operating profit in H1 2024 and the continued wet weather in May and early June, we expect to be in line with market expectations for the full year ending 31 October 2024."

Broker note - good old Canaccord update us helpfully. It's leaving FY 10/2024 forecast unchanged, at 29.9p adj EPS. That means a PER of 10.6x, although there could be some doubt over its ability to deliver the necessary large H2 weighting. Also, a low margin distributor is not likely to ever achieve or sustain a high rating.

Paul’s opinion - I’m much more comfortable with this share now the froth has come off from over 400p to not much above 300p, it’s more sensibly-priced now. Taking into account the debt, and the need for an H2 weighting to hit targets, it’s probably priced about right. That said, I like the strategy of using cashflows to buy up smaller competitors, thus consolidating a fragmented market. Lots of deals have been done over the years, so you hope they won't make any bad mistakes.

Overall, worth considering for deeper research I’d say, but I can’t see KITW as a compelling opportunity.

Even after the recent correction, it's still been an unusually successful float -

Graham’s Section:

Mercia Asset Management (LON:MERC)

Up 6% to 32.9p (£140m) - Preliminary Results - Graham - GREEN

Mercia Asset Management PLC (AIM: MERC), the proactive regionally focused, specialist alternative asset manager with c.£1.8billion of assets under management ("AuM"), is pleased to announce its preliminary results for the year ended 31 March 2024.

This was on my top ideas list for 2024 having already been on it for 2023 (sadly it did not contribute much in terms of share price performance in 2023).

Let’s see how it summarises its progress in FY March 2024.

The official numbers:

Revenue +17% to £30.4m

Pre-tax loss £8m after taking a £17m hit to the fair value of its direct investments.

Cash £47m, net assets £189m (I calculate tangible net assets as £153m).

Most importantly from the point of view of the growing fund management business, assets under management grew to £1.8 billion, up from £1.4 billion a year ago.

This includes both the company’s own capital and third-party funds. Third-party funds grew by 32% to £1.6 billion. Large mandates were received from the British Business Bank.

Underlying profitability: adjusted operating profit is £9.7m (last year: £7.6m). This excludes profits and losses on direct investments and it also excludes £1m of share-based bonuses for management, along with a range of other items.

My personal inclination would be to include share-based payments in my calculations of the company’s profitability, as these payments are just another form of remuneration. I would therefore be inclined to use a figure of c. £8.7m as my measure of the company’s “underlying” profitability. But there are many different ways to calculate this.

Direct investment portfolio: this is no longer of great relevance to the investment case here. But it does still have a balance sheet fair value of £117m (split across 22 investments). The loss that hit the income statement this year related to an impairment at one particular investee company.

Emphasising the lower importance now attached to MERC’s own direct investment portfolio, the company is seeking to be reclassified as a trading company rather than an investing company under AIM rules. This could have (positive) inheritance tax implications for MERC’s shareholders.

The company will not make any new direct investments, but it will continue to support existing investee companies.

Buyback and dividends: a £5m buyback has been completed, and the company is proposing a slightly larger final dividend (0.55p) than last year (0.53p). The dividend yield is c. 3%.

CEO comment:

"The year to 31 March 2024 was characterised by market volatility, high inflation and high interest rates driving up the costs of doing business, alongside geopolitical uncertainty and a thankfully short-lived recession. It is therefore pleasing to have come through these universal headwinds with record organic growth in our assets under management, driven by Mercia's diversified and differentiated approach to making a positive impact for our investors and investees.

"Over the next three years as Mercia continues its natural evolution, and subject to shareholders approving our proposed new investment approach, we will seek to drive AuM to in excess of £3.0billion whilst doubling EBITDA, focused on building value for shareholders and our other key stakeholders as a growing and sustainable, specialist alternative asset manager."

Outlook: nothing specific is given for the year ahead, but the CEO highlights that the goal over the next three years is to become “a leading UK specialist alternative asset manager”.

Estimates: Equity Development have initiated on MERC today with a valuation of 51p, based on a sum-of-parts analysis (fund management business 13p, cash on balance sheet 11p, direct investments 27p). It’s a detailed report (36 pages long) and it provides me with a great deal of confirmation bias, as I’ve been arguing for a few years now that MERC is too big for its market cap.

Analyst Paul Bryant estimates we could see adj. EBITDA of £6.2m next year (2024: £5.5m). (GN note: this figure is lower than adj. operating profit because it excludes net finance income).

Graham’s view

The MERC investment thesis isn’t a simple one. The business model is changing, and it’s currently between two stools, with a large direct investment portfolio on the one hand and a growing (but still small) fund management business on the other.

Partly because of this, the stock can’t be valued on the basis of earnings/EPS/PE ratio. The correct approach, as done by Equity Development, is to look at each of its features in turn and to value them separately. This isn’t easy and while one-off events such as impairments can hit the income statement, we don’t have straightforward financial statements to analyse.

From my point of view, nothing has changed: the company is executing its plan and I maintain my positive stance. In the fullness of time, the direct investments will be realised and the profits at the fund management business will become the main event here.

I continue to believe that the company is just too big for its market cap, both from the point of view of its balance sheet (tangible net assets £153m, which seems more likely than not to be a conservative measure of fair value) and from the point of view that a growing fund management business is thrown in “for free”. So I remain content that this is on my best ideas list for the year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.