Good morning from Paul & Graham! Up early today, to catch up on a straggler from yesterday.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

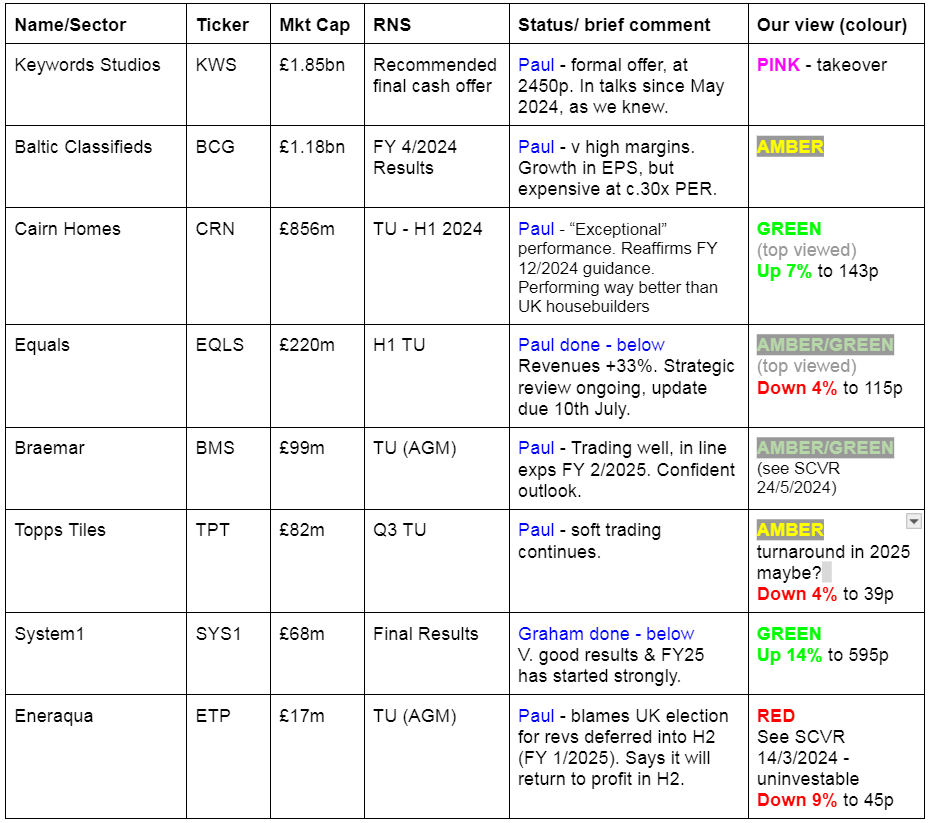

Companies Reporting

Summaries

CML Microsystems (LON:CML) - down 11% y’day to 300p (£48m) - FY 3/2024 Results - Paul - AMBER/GREEN

Profit is down, but in line with expectations. Valuation is supported by plenty of cash, and surplus property (now up for sale). I'm not sure what the future holds, as short-term outlook sounds quite weak. However with heavy R&D spend (20% of revenues), and upbeat medium-term comments, could this be the next Filtronic (LON:FTC) if it hits the jackpot with new products? I don't know, but it's an interesting potential upside case, and the cash/property protects against some of the downside risks.

Equals (LON:EQLS) - Down 4% to 115p (at 08:43) £215m - H1 Trading Update - Paul - AMBER/GREEN

Strong revenue growth has continued, although it doesn't say anything about profit vs market exps. This payments company is very popular with shrewd investors. A big rise in interest receipts on client cash, and "solutions" fee growth seem to be driving things. Graham and I have some reservations, so put it in the don't know tray, on amber previously. However, looking at it again with fresh eyes today, risk:reward does seem favourable, if you're prepared to take the risk of a sharp fall (est. to 80-90p I reckon?) if bid talks end (Madison Dearborn has already walked away).

Polar Capital Holdings (LON:POLR) - 583p (£592m) - Results for FY March 2024 - Graham - GREEN

As requested by readers, I catch up on the 2024 results from Polar, one of my top picks for the year. While “core” (adjusted) operating profit is down, other measures of profit are higher. I remain comfortable with my positive stance even if this is one of the more expensive fund manager stocks.

Various Eateries (LON:VARE) - 18p (£32m) - H1 Results - Paul - AMBER/RED

It seems almost impossible for smaller hospitality groups to make profits at all in current conditions, and these numbers reinforce that view. A decent fundraise, and debt for equity swap was done in Dec 2023 at 25p, doubling the share count, so we can now buy a third cheaper at 18p. Hence I've moderated from red to AMBER/RED, but still don't see a viable business here. It could become viable in a future consumer boom though, who knows?

System1 (LON:SYS1) - up 17% to 610p (£77m) - Final Results - Graham - GREEN

Barnstorming results from SYS1 and they enjoy yet another earnings upgrade, their sixth in a row! We’ve been positive on this one since 370p when Paul wrote on their upgrade in January. Momentum remains excellent with hundreds of new clients and big opportunities seen at existing advertising clients.

Paul’s Section:

CML Microsystems (LON:CML)

Down 11% y’day to 300p (£48m) - FY 3/2024 Results - Paul - AMBER/GREEN

CML Microsystems Plc, which develops mixed-signal, RF and microwave semiconductors for global communications markets, announces its Full Year Results for the year ended 31 March 2024.

Revenue up 11% to £22.9m - however more than all the growth came from the acquisition of MWT, which contributed £3.3m in revenues for about half the year. Without that acquisition, revenue would have been down c.5%.

High gross margin of 71%, so lots of operational gearing if it can scale up revenues - that’s the problem though, as historically CML has not demonstrated growth, and remained a small (but profitable) niche company -

PBT was £2.52m (FY 3/2024), down x% from £3.16m last year (with a further £2.06m exceptional profit on top of that last year, from the sale of surplus land - and there’s more of that in the pipeline). Two brokers (Shore, and Progressive) adjust the PBT up by £0.6m to £3.1m.

EPS is reported by the company at 13.0p (down 33%, pre-exceptionals). However, Progressive adjusts it up to 14.5p. Personally I prefer it when companies report adjusted figures that are consistent with what the brokers report. Shore Capital adjusts the FY 3/2024 EPS up to 19.4p, so confusion reigns as to what EPS figure we should be using. To play it safe, maybe I should just value the shares using statutory EPS of 13.0p?

Earnings get a boost from the UK’s generous R&D tax credit scheme.

Outlook - not great in the short-term. There are two outlook sections, a short one from the Chairman, which claims revenue growth (but excluding the acquisition of MWT, revenue actually fell), going on to say -

“External factors, including current market conditions and the normalising of elevated customer inventory levels, make it difficult to achieve our profits growth objectives.

Despite the short-term outlook not being what I would like to see, I am confident that the Group is well placed against its more medium-term objectives. Exciting opportunities lay before us, we are addressing growing new markets which are supplementary to the more traditional sectors that have been a cornerstone of growth in recent years. The pipeline of opportunities has a strong upward trend, giving us confidence that we will achieve our strategy of sustainable long-term growth.”

Customer de-stocking has been mentioned before, so no surprises there. This is also mentioned by the CEO as an ongoing factor -

“the trading environment for the current year will continue to be influenced by the customer inventory overhang…”

Th Group MD’s more detailed outlook comments sound cautious, and uninspiring, at least in the short-term -

“The current full financial year is expected to show a further revenue advance, albeit not at the compounded rates seen across the prior four-year period. The full year inclusion of MwT's cost base along with necessary activities to unlock the full potential of the enlarged business will have an impact on operational profitability. However, these are essential and value-added strategic steps in the drive towards much higher medium-term gains.”

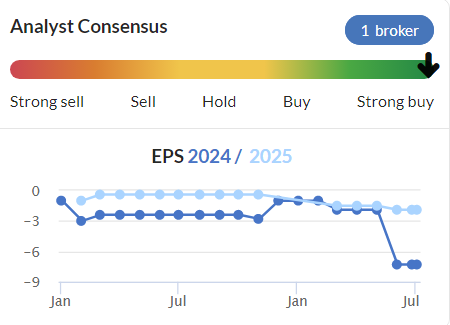

Broker forecasts - Shore seems to use a higher adj EPS calculation, and it sees 19.4p dropping to 10.7p from FY 3/2024 to FY 3/2025.

Progressive sees 12.8p in FY 3/2025, dropping from its different calculation of 14.5p in FY 3/2024.

We’ve then got a completely different, lower forecast of 7.4p in the Stockopedia broker consensus number, so I’ve no idea where that has come from.

What to do then? To keep things simple, I’m going to work on the 13.0p statutory EPS, which Progressive reckons will drop to 7.9p in FY 3/2025. Shore has a similar statutory EPS forecast of 7.4p for FY 3/2025, which ties in with the Stockopedia number.

Therefore at 300p share price, the PER is 40x which looks high.

However, remember part of the valuation at CML hinges on its strong balance sheet, with lots of cash and surplus property. Moving on to that -

Balance sheet - NAV is £51.1m, but that includes intangible assets (goodwill £14.4m, capitalised development spending £15.2m, and other of £3.4m), totalling £32.9m. Eliminating that gives us NTAV of £18.2m.

There could be upside on that number from further surplus property development & sales.

Cash looks very healthy at £18.2m, and no interest-bearing debt. However a key point is that the acquisition of MWT involved deferred consideration. I discovered this when I couldn’t find the £10.8m consideration paid on the cashflow statement. All is revealed in note 9, where it says net cash paid out was only £565k, with deferred payments in cash & shares as follows -

“ is payable over a three-year period, cash consideration £956,325 on 2 April 2024, cash consideration £2,171,783 and £475,807 (90,780 shares) on 2 October 2024, cash consideration of £1,557,331 and £475,807 (90,780 shares) on 2 October 2025 and £475,807 (90,779 shares) on 2 October 2026. “

I make that about £4.7m cash (or 10% of the market cap) outflows re MWT up to 2/10/2025 - which is about a quarter of CML’s current cash pile, plus a bit of dilution from the issue of new shares.

Hence it’s best to take a prudent view on cash, and adjust it down to £13.5m.

Although you could ignore this, and offset it against future land sales, which might be above book value, it’s not clear.

Cashflow statement - doesn’t impress me I’m afraid. All the £5m operating cashflow is used in capex (physical £1.5m [of which £1m is moving the car park, as part of the redevelopment of surplus land], and R&D development spend £3.5m). Shareholder returns were £1.75m buybacks, and £1.74m divis.

It warns -

“Cash flow will come under pressure for the year ahead for two main reasons; firstly, working capital to support the aforementioned strategic R&D initiative and secondly, as a result of further payments relating to the MwT acquisition, being $1.17m already paid on 2 April 2024 and a $2.65m payment due 2 October 2024.”

However, putting all that together, I think CML has ample cash & liquidity, so there’s not really anything to worry about. We just have to hope that its heavy product development (c.20% of revenues) delivers future benefits.

Dividends - total 11p for the year (unchanged), giving a decent enough yield of 3.7%.

Paul’s opinion - I hadn’t intended to go into this level of detail on the numbers, but CML has always intrigued me as a hybrid share with interesting growth potential (not showing in the numbers yet though), combined with strong asset backing to protect the downside and provide shareholder returns whilst you wait for something more exciting to happen with its future products. Plus it is still profitable, despite the lacklustre shorter term outlook.

Imagine if CML delivers a blockbuster product, as we saw this year from Filtronic (LON:FTC) ? For that reason I think CML might be an interesting share to add to our watchlists, so we get all the future RNSs, and keep our eyes peeled for anything that looks transformative in terms of order intake.

In the meantime, it’s very well financed, so no risk of seeing the upside snatched away with a horribly dilutive fundraise, as we all-too-often see elsewhere.

Offsetting that, the current trading sounds quite weak, and I do wonder if it might have another profit warning in it? De-stocking seems to have gone on for too long, that there might be more to it than just destocking, I’m wondering?

I’ve been green before, but think it’s probably sensible to moderate that to AMBER/GREEN for now, and await developments.

Equals (LON:EQLS)

Down 4% to 115p (at 08:43) £215m - H1 Trading Update - Paul - AMBER/GREEN

Consistent with prior years, Equals Group plc (AIM:EQLS), the fintech payments group focused on the Enterprise and SME marketplace, provides the following trading update for the six months ended 30 June 2024 ('H1-2024' or the 'Period').

Revenues have continued rising strongly -

“The Group is pleased to announce a strong period of trading in H1-2024 with revenues up £14.9 million compared with the same period last year to £60.0 million, an increase of 33% year-on-year (H1-2023: £45.0 million).”

I haven’t got access to any broker notes, but the StockReport shows forecast revenue growth of +20% in FY 12/2024. So H1 seems well ahead of that. Although I don’t know what the split of revenue growth between H1 and H2 was expected to be.

Graham’s notes are here on 16/4/2024, where he reviewed the impressive FY 12/2023 results, showing revenue up 37%, and an operationally geared increase in EBITDA of +70%

Previously we were told that YTD revenues up to 12 April 2024 were up 30%. So today’s news of H1 to 30 June 2024 seeing revenues up 33%, shows an improving trend from Q1 to Q2.

As the table below shows, most of the revenue growth is coming from “Solutions” -

Another table categorises income differently, and this shows strikingly large increases in both fees, and interest income (maybe one-off growth from interest rates normalising?)

Interesting snippets here -

“In keeping with the strong growth in our Solutions platform, fee-based revenues have grown both in comparison to prior year and quarter-on-quarter during H1-2024. Within Solutions, fee-based revenues are more recurring in nature as customers typically enter into longer-term contracts with agreed monthly minimum fees.

The Group also earns interest income which is primarily earned on safeguarded customer balances held off balance sheet, over three currencies (GBP, EUR and USD) and across four Tier-1 banks.

Interest, particularly in Solutions, is a key component of the pricing discussion with clients and is therefore assigned to the segment generating the underlying balances. Not only have balances grown but the Group has renegotiated better rates and margins with its Tier-1 partner banks. “

Cash - EQLS had £20.5m of its own cash at 30 June 2024. The last balance sheet showed only c.£12m NTAV, so there's nothing much in terms of asset backing to support the share price if trading were to deteriorate.

Strategic review - seems to be going on forever, the next update will be 10/7/2024.

What’s missing? - we’re not directly told whether or not EQLS has traded (ie profits) above, in line, or below expectations. That’s the main point of a trading update, surely? Although it is only 3/7/2024, so this is more of a flash figures update to 30/6/2024, I suppose.

Paul’s opinion - quite a few shrewd & successful small caps investors that I know have all bought into this share in a big way. That’s a very good starting point for research, following shrewdies, although they get things wrong sometimes too, but it’s good to know that people who pore over the detail and get more right than wrong, like it a lot.

The numbers look very good to me. The only reasons Graham and I have previously stuck at AMBER with this share are because we’re not sure if the profit growth is necessarily sustainable (in such a competitive space), and we’re mystified as to why management seem so determined to sell the company. That could work out great, if a bidder is prepared to pay a whacking great premium, so upside here is potentially good. Also, the numbers stack up well even if a bid falls through - the StockReport shows the forward PER as 17.6x.

EQLS seems to have developed some successful offerings for B2B services. Interest rates rising has been a major boost to profit too.

Where does it go from here? I just don’t know.

However, given that the valuation seems reasonable on a PER basis, and revenue growth is continuing to be strong, plus the potential upside from a bid (even if that seems to be less likely after such a long gestation period), means I think we ought to recognise the positives and shift up a bit to AMBER/GREEN. Downside risk in the short term seems to be a drop to maybe 80-90p (my guess) if the bid talks end?

Since listing -

Various Eateries (LON:VARE)

18p (£32m) - H1 Results - Paul - AMBER/RED

Graham last looked at this upmarket bars and restaurants group majority owned (62%) by Hugh Osmond here on 1/11/2023, at 27.5p/share, concluding with RED due to poor performance, and being financially stretched. Graham also flagged de-listing risk.

VARE’s two brands are Coppa Club (trendy lounge/bar/eateries), and Noci (Italian style food with a twist).

Numbers for H1 (26 weeks to 31/3/2024) are poor -

Revenues £22.7m (up 10% due to new site openings. LFL revenues “slightly down”)

Adj EBITDA loss of £(1.2)m, improved a bit from £(1.9)m LY H1, but still terrible.

Loss before tax in H1 £(3.86)m, a bit improved from £(4.3)m H1 LY.

Outlook - vague, but sounds weak -

So far it has 20 sites, some of them quite swanky, looking through its website. However, central costs look far too high for a business of this small size, running at about £3.4m pa.

Balance sheet - this is the most significant change, and it’s positive. An equity fundraise in Dec 2023 raised £9.7m net of fees through 40.4m new shares being issued (24m to management) at 25p per share. Plus a debt-for-equity swap resulting in another c.45m shares also being issued to management. Overall, the share count has more than doubled from 82m to 175m. However, at least the finances now look on a sounder footing, and it’s very encouraging to see management (mostly Hugh Osmond) backing the company to the hilt. Although I still think de-listing risk remains high, because he might just decide the stock market isn’t attributing a proper valuation to the shares, and take it private on any terms he likes.

NAV is now £28.7m, of which £11.1m is intangible assets, so £17.6m NTAV.

Note it only has £2.1m in freehold property, the rest are leased. Also the NBV of fixtures, fittings & lease improvements are £21m, which is the sunk cost of fitting out all these swanky sites - the problem being they don’t generate an overall profit after all the central costs, so arguably these should be written down to nil.

Paul’s opinion - I’m increasingly coming round to the view that it’s almost impossible to make a profit from smaller groups of pub/restaurant/bars. Why? Because their costs are too high, after 2 years’ c.10% living wage increases, and wages are typically 30-40% of revenues. Combine that with a consumer spending squeeze, and people reluctant to pay ludicrous prices (everywhere apart from ‘spoons) for drinks.

Have any readers mystery shopped Coppa Club or Noci? I see there’s a Noci in Islington Green, where I often hang out (usually at Chilango, owned by Tortilla Mexican Grill (LON:MEX) after work, when I’m in London. I’ve literally never noticed Noci, despite walking past almost every day. Noci does a £15 lunch deal, so I’ll definitely mystery dine that next time I’m in London, and will report back here. Although the pictures on the website look like it’s one of those fancy places where you eat a meal, but need to stop off for a kebab on the way home, to properly satisfy your hunger.

There’s no sign of a viable business here yet. Note broker forecasts were slashed deeper into the red a month ago. It’s fair that VARE says poor weather this year will have hampered performance, as it has some big outside areas that add a lot of extra trade when it’s nice weather. That’s true. As consumer confidence improves, and inflation recedes, then maybe performance could improve.

However, with more new sites planned, I can’t help feeling they’re rolling out a couple of formats that have not yet proven they’re viable. You have to decide whether it’s rich and stubborn founders ploughing more money into a failing business, or whether there’s an opportunity to achieve economies of scale here?

I would also add that VARE has spent a lot of money on its swanky site fit-outs. So these should be the boom times when those fancy new sites generate a good return on investment. That doesn’t seem to be the case. So imagine the millions that will be needed every few years to revamp the sites, to keep trendy crowds wanting to visit.

The main hope here is that we enter a consumer boom. The geared effect of c.75% gross margins in the hospitality sector could then prove lucrative for the survivors.

I suspect VARE could need another fundraise in future, which combined with de-listing risk, means I remain negative. Although the strengthened balance sheet means I’m happy to move up from red to AMBER/RED.

Graham’s Section:

Polar Capital Holdings (LON:POLR)

583p (£592m) - Results for FY March 2024 - Graham - GREEN

It’s time for a catch-up report on Polar Capital, another stock from my 2024 best ideas list.

Polar issued results for FY March 2024 while I was away.

Here are the key points:

Year-end AuM up 14% to £21.9 billion, despite net outflows of £1.6 billion.

Average AuM during the year flat at £19.6 billion.

Core operating profit down 6% to £44.8m, actual PBT up 21% to £54.7m (we’ll explain this in a few moments).

Full-year dividend: unchanged at 46p.

Snippets from the CEO comments:

"During the financial year, Polar Capital benefited from its differentiated funds range of thematic and sector focused strategies, particularly those with exposure to technology and its related sectors.

...AuM has risen further to £22.8bn as at 14 June 2024… "The positive net inflows of £56m as previously reported in the March 2024 quarter have continued in the current quarter with net inflows of £197m in the period 1 April to 14 June 2024…

The outlook is more constructive for risk assets such as equities with a continuing reduction in global inflation, interest rates peaking and central banks poised to ease monetary policy. Polar Capital has active, specialist and differentiated thematic, sector and regionally focused fund strategies with compelling long term performance track records and significant remaining capacity. While there remains geopolitical risk and a significant portion of the developed world population facing elections this year, our performance-led culture, strong balance sheet and improving sentiment for equities positions us well to continue performing for our clients and shareholders."

I’ve highlighted the standout pieces of information here: AuM has continued rising in the new financial year, there have been net inflows in Q1 so far, and Polar are positive on the macro outlook for reasons with which I’m sure many fund managers would agree.

AuM breakdown

Investment trusts are now 23% of AuM (last year: 20%), giving Polar marginally more protection against open-ended fund outflows.

In terms of fund strategy, Technology-focused funds have grown in size and are now 45% of AuM (last year: 38%).

Performance: strong numbers posted against peers and against benchmark (e.g. 72% of total AUM in the top two quartiles against peers over one year).

Explanation of the profit numbers: I think it’s worth understanding why “core” profit is down even though what I call the “actual” PBT was up strongly. Here’s the relevant table:

Core profit excludes the items listed here, with the main ones being performance fees and exceptional items.

We can see that in 2023, Polar had much lower performance fees and much higher (negative) exceptional items, both of which dragged on the relative performance of PBT.

So in 2024, actual PBT rose 21% despite falling “core” profits. As we often say here, “profits” are a matter of opinion!

Graham’s view

Regular readers will know that I’ve been bullish on most fund manager stocks for some time now, and Polar has been one of my top picks within the sector.

The Polar share price has shown some life this year, up 28%:

Today’s results show that even in a challenging year, with the company experiencing outflows, they remained highly profitable. They did need the help of higher performance fees and lower exceptional items to boost PBT, but that’s ok with me.

The fact that Polar is showing net inflows again in the new financial year is also highly relevant, although I must try not to get too excited about flows over one or two quarters.

The net flows number is the difference between two large numbers (gross inflows and gross outflows): it can be easy to forget this and how volatile the resulting “net” figure can be.

Polar had gross inflows of £4.4 billion in FY March 2024, implying that it had gross outflows of £6 billion.

That’s nearly a third of Polar’s total AuM that was churned by fund investors during the year. Fund investors do tend to churn their portfolios (in the same way that many stock investors do!) and the result is that fund management companies with open-ended funds are always vulnerable to short-term sentiment - whether that’s broad macro sentiment or sentiment relating to the fund management company itself.

Fortunately, I think Polar has maintained its high-quality reputation among fund investors in FY March 2024. Fund performance has been good and the company maintains its traditional strength in technology and healthcare.

The stock remains highly rated compared to its peers, e.g. the AuM multiplier is £38.50 (you get c. £38.50 of AuM for every £1 invested in POLR shares at the current share price).

Unlike its peers, it also has a double-digit PE ratio:

Even at this more expensive valuation, I’m comfortable maintaining my positive stance on POLR. It has an unblemished reputation in the sector, fund performance is good, and it’s experiencing net inflows again (although that could easily be reversed in any given quarter). I’m hoping for another good performance in FY March 2025.

The StockRanks tend to agree with my assessment:

System1 (LON:SYS1)

Up 17% to 610p (£77m) - Final Results - Graham - GREEN

System1 Group the marketing decision-making platform www.system1group.com announces its results for the twelve months ended 31 March 2024 ("FY24").

Paul switched us to GREEN on this one in January, following a second profit upgrade (share price at the time: 370p).

Fortunately, there was still plenty of upside from that point on. Here’s the year-to-date chart::

I was neutral on SYS1 in September (212p) and in December (218p).

It’s easy to say in hindsight after the share price has soared, but I agree that after the second upgrade, it made sense to change stance, as the business was clearly enjoying fabulous momentum.

Re-reading my December report today, I think my reasons to stay neutral were valid: the company had posted an excellent H1 adjusted PBT of £1.9m, but that number excluded over £1m of bonuses and commissions. Actual after-tax profits were only £0.6m. And while H1 revenue growth was excellent (27%), forecasts at that time suggested that growth in 2025 would only be 10%. Given the company’s many years of failure to generate material profits, I think I might still be able to justify my scepticism at that time!

Today, however, the company has turned up with truly excellent numbers for FY March 2024:

We finally have after-tax profits (of £2m) that I would consider material for a small-cap listed company - and it’s the best result for SYS1 in many years.

The company explains the profit growth as “owing to the flow through of far higher sales volumes and improved margins, more than offsetting a 24% increase in operating costs”.

Key performance indicators are no less exciting than the profit growth: the number of clients is up 44% to 428, free cash flow is £4m, and net cash has grown to nearly £10m (last year: £6m).

Dividend - 5p per share is proposed, a little less than a third of EPS (16p). The policy is to distribute 30-40% of average (“through the cycle”) earnings

CEO comment includes news relating to the new financial year:

"Our success last year was underpinned by 260 new client wins and our scalable growth model. In the coming year we will step up investment in attracting, winning and retaining customers in order to continue our growth trajectory. The new financial year has started strongly, particularly in the US, and we anticipate an increase of 50% in Q1 total revenue with platform revenue up 70% versus Q1 FY24. As a result we continue to expect strong double-digit revenue growth for the financial year as a whole."

The Outlook section provides more detail. I’ll put it in bullet points:

Bespoke consultancy revenue will fall as long-term contracts end. This “should not significantly affect overall group revenue or profit growth”.

1st big opportunity: US market. A new Chief Commercial Officer is US-based.

2nd opportunity: “Test Your Innovation” product suite relaunched.

3rd opportunity: growing revenues from large advertisers who are already customers of SYS1.

Graham’s view

I’m happy to maintain the positive stance on this one, as in general it’s wrong to stand in the way of momentum, whether that is business momentum or share price momentum - and SYS1 currently enjoys both.

The enterprise value is £67m once you deduct the cash balance from today’s market cap. Canaccord are estimating adj. PBT of £4.4m in the current year (FY March 2025) and £6m the following year, implying some reasonable cash-adjusted (pre-tax) PE multiples (15x this year, 11x next year).

I note also that it’s another upgrade from Canaccord this morning; they previously estimated adj. PBT of £4m for the current year. They say they have now made six consecutive upgrades!

Checking the cash flow statement briefly, I note that the results were not boosted in any significant way by capitalising software development costs.

For those considering an investment here, the management bonus schemes here should also be worth a look.

The company’s 2021 LTIP has granted options equivalent to 9% of the existing share count, but the conditions for them to “vest” aren’t being fulfilled. Therefore, the company has created an “STIP” (short-term incentive plan), something I’ve never come across before!

Overall, it seems that SYS1 is finally performing as well as it threatened to for so many years: its sales efforts are working, and its reformulated product set is working. It would be churlish of me not to be GREEN in these circumstances.

Value ratios will need to be updated soon, e.g. for the dividend:

And yet another EPS upgrade will be on this chart:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.