Good morning from Paul & Graham!

All done for today, see you tomorrow.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

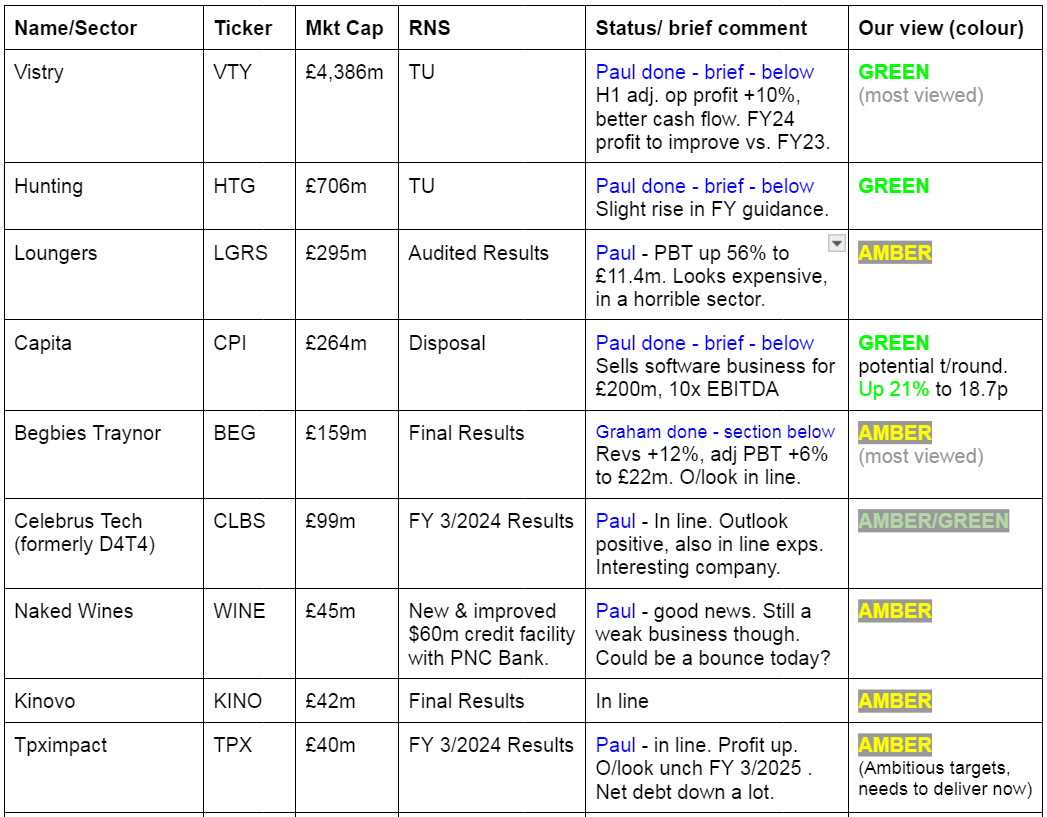

Companies Reporting

Other mid-morning movers (with news)

Indivior (LON:INDV) - down 32% to 780p (£1.04bn) - Profit warning - Paul - BLACK (no view on fundamentals)

This pharma more than 10-bagged from 2020 to early 2023 peak c.1975p. It’s since given up 60% of the peak price.

I won’t go into the detail here, but a profit warning today says it reduces profit guidance, due to various problems. Cutting costs. Reduces operating profit guidance to $285-320m range, previously $330-380m. Discontinuing sale of schizophrenia drug Perseris, as no longer financially viable. IMDV moved its primary listing to USA last month, since c.50% of its shareholders are American. Today’s 34% fall is much larger than brokers originally expecting 10% fall. One for bargain hunters to investigate maybe? No view from me, as I haven’t researched it, am just flagging up the large % fall today.

Pagegroup (LON:PAGE) - down 10% to 382p (£1.26bn) - Profit Warning - Paul - BLACK (AMBER on fundamentals)

International recruitment group, says Q2 trading soft in almost all regions. Candidate & client confidence low. More cautious FY 12/2024 guidance now operating profit c.£60m. Operating profit was £119m in FY 12/2023, and £196m in FY 12/2022.

Paul - I’m surprised that the soft recruitment markets are getting even softer. I would have expected signs of a recovery beginning, but that’s not the case. Even after today’s fall, PAGE shares don’t look obviously cheap, arguably they already factor in a strong recovery that hasn’t even started. Balance sheet is fine, so no solvency/dilution issues. Generous divis might have to be trimmed a bit? It should recover in due course though, but why would I want to pay up-front for a recovery? Read-across to smaller recruiters today, eg STEM down 4% - vulnerable to a PW also l I wonder? Tough sector still. Are there any more structural sector problems I wonder, eg disruption from online competition? Let me know if you’re a sector expert!

Summaries

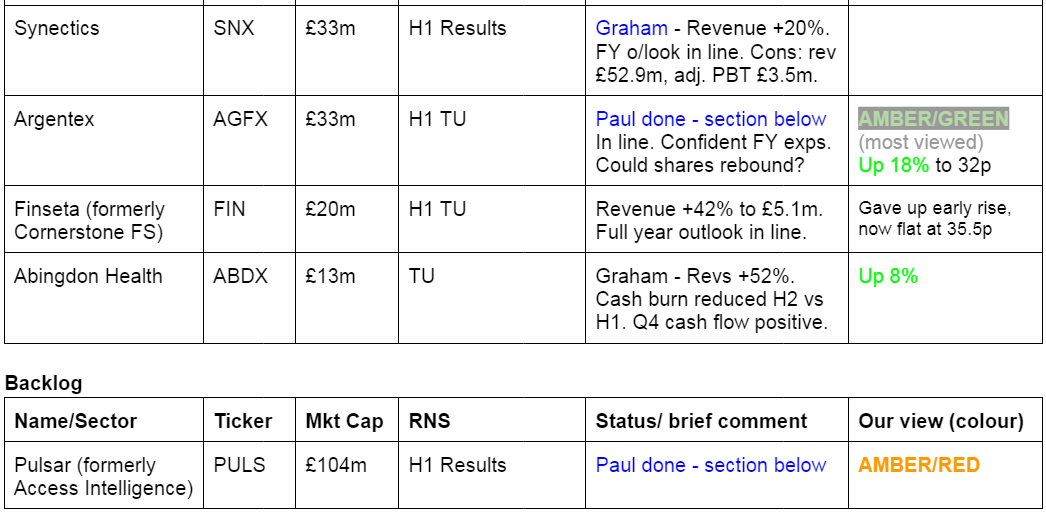

Pulsar (LON:PULS) - down 5% to 81.5p y’day (£104m) - H1 Results - Paul - AMBER/RED

This used to be called Access Intelligence, and we've not reviewed it for 18 months, so I wanted to get the archive up-to-date. Continued losses, poor cashflow, and a weak balance sheet put me off. But it promises better performance in H2.

Argentex (LON:AGFX) - up 7% to 29p (£35m) - H1 Trading Update - Paul - AMBER/GREEN

A catalogue of problems over the last year have crushed this payments/forex company's share price and profits. Could we be seeing the early signs of it stabilising today under new management? It looks that way to me, so I've pushed the boat out with a move up to a (speculative) amber/green.

Begbies Traynor (LON:BEG) - down 2% to 97p (£155m) - Final Results - Graham - AMBER

Solid results from Begbies with decent organic growth (6%) boosted as usual by some acquisitions. Insolvency work is plentiful but M&A/advisory remains slow, with a recovery anticipated later in the year. I remain neutral on this as the current market cap seems fair to me, given the sector in which this operates.

Vistry (LON:VTY) - unch. 1288p (£4.35bn) - H1 Trading Update - Paul - GREEN

[Brief section, no more detail below] - we’ve flagged before the good, differentiated (through partnerships eg with Local Authorities, Housing Associations, etc) and superior business model of this housebuilder, and have previously been amber/green on it. Today it says -

“The Group has delivered a strong performance in the first half which underpins the Board's confidence in its expectations for the full year. “

Broker consensus is for c.90p EPS, so that’s a PER of 14.3x, falling to 12.2x if next year’s 106p forecast is achieved.

Like all listed housebuilders, it’s nicely asset backed, although P/TBV is relatively high at 2.1x. It had net debt of £323m at 6/2024 - modest considering the asset backing & earnings. Excellent disclosure of average month end net debt, higher at £490m. Reckons it will be net cash by Dec 2024 year end. Dividend yield is a pleasant 4.6%, almost twice covered, plus share buybacks underway. It says that building materials have fallen in price this year vs last, that’s interesting - maybe not so good for the building supplies sector. Cost savings expected to continue in H2.

Paul’s opinion - I think Vistry has the best business model of the UK listed housebuilders, which is reflected in a higher valuation relative to NTAV. It also looks in pole position to benefit the most from the new Govt’s focus on increased affordable housebuilding. Although as with everything, we await firm details. Overall, even though this share has done well, I suspect it could have further upside over the medium term. Hence I think we should be GREEN. It might be a nice one to buy the dips?

My only worry is that a tax-hungry new Govt might well also be eyeing the massive profits the big housebuilders generate, and might find a way to grab a bigger slice for themselves? I think housebuilders already pay a 4% surcharge on their profits (RPDT), so what’s to stop the new Govt hiking that further?

Capita (LON:CPI) - up 20% to 18.5p (£315m) - Disposal - Paul - GREEN

This was another potential turnaround that Richard Staveley also mentioned in his recent interview with Paul Hill, with all sorts of insightful comments on Capita and others. Hence I had just put CPI on my list of share ideas to revisit, so today’s news is timely. I’ve liked the turnaround potential here in the past, but shares never seemed to reflect the significant progress that’s already been made in repairing its previously over-geared balance sheet. I flagged it as amber/green here on 14/12/2023 as a potential recovery share.

Today’s disposal is Capital One, a standalone software business, that has been sold for £200m, a 10x EBITDA multiple. This will hit short-term profits (as £19m pa PBT drops out of the group numbers in future), but

“Capita is maintaining its medium-term guidance for the continuing Group based on the benefits of the cost saving and technology initiatives previously outlined.”

Requires shareholder, and Govt approval.

Paul’s view - note that Capita only had £182m net financial debt (excl. leases) at Dec 2023. So assuming no big changes, this disposal wipes out all that net debt. Although its balance sheet overall is still weak, it does benefit from getting substantial up-front cash from customers - so a favourable working capital cycle means balance sheet weakness doesn't matter that much. It only becomes a big problem if Govt decides to become a slow payer.

I would argue that since the disposal is at a valuation multiple considerably greater than CPI’s own PER of 4.5x, then that would seem to make sense, and improve the overall position for CPI.

As Richard Staveley points out, if Capita achieves its target operating margin in future, similar to what it achieved in the past before everything seemed to go wrong, then the share price could end up substantially higher than it is now. That is a big “if” though! It wouldn’t surprise me if this share doubles from here, which would only take the PER up to about 8-9x. If it then out-performs against what seems modest forecasts, then maybe more upside? Overall I see positive risk:reward here, and there will be likely loads of investors who won’t even look at Capita shares, just assuming it’s still a basket-case. Hence an opportunity maybe? Time will tell, we can’t predict the future.

Hunting (LON:HTG) - unch 428p (£708m) - H1 Trading Update [ahead exps] - Paul - GREEN

“Hunting PLC (LSE:HTG), the global precision engineering group, today issues a trading update, ahead of its Half Year Results to be released on Thursday 29 August 2024.”

H1 trading is ahead of management expectations.

Order book is up, at $700m ($565m previously at 31/12/2023)

H1 EBITDA guided at $59-61m, ahead exps, and 22% up on H1 LY.

H1 EBITDA margin is 12%, with 12-13% guided for FY 12/2024.

(was 11% in 2023, and 7% in 2022)

Improved performance in H2 expected, due to cost-cutting.

Net debt negligible at June 2024 ($9-11m)

Outlook is positive for both FY 12/2024 and 12/2025, helped by (previously announced) big Kuwaiti orders.

Guidance -

FY 12/2024 EBITDA guidance raised to $134-138m (it said on 15/5/2024 that expecting towards top end of $125-135m range. So this update today is hardly any different)

Note that EBITDA was $103m in 2023, and $52m in 2022, so there’s been a very strong profit recovery here.

FY 12/2025 EBITDA guidance $160-175m (changed or unchanged???)

I wish companies would explicitly state the before, and after guidance, when they update the market.

Net cash of $30-40m expected at 31/12/2024.

Broker update - many thanks to Canaccord for sharing their work with us, available on Research Tree. They forecast US$0.42 adj & dil EPS for FY 12/2024, rising nicely to US$0.61 for FY 12/2025 - both figures very slightly edged up today.

Convert into sterling, gives 32.8p and 47.7p, so at 428p/share the PERs are 13.0x and 9.0x - that seems attractive value, especially considering HTG has a superb balance sheet, with a P/TBV of only 1.19x. So you’re getting surplus capital in for free.

Paul’s opinion - we’ve been flagging HTG as a good value share for a while, and my recap of the numbers today confirms that remains the case, despite the shares having risen considerably already this year.

It all depends whether the boom in profits will continue or not. Obviously I have no idea about that, you have to assess that sort of thing, which is the next stage of research after our quick reviews here. Order lumpiness could be an issue if the large Kuwait orders turn out to be one-offs.

Based on the information as of today, it’s got to be GREEN.

Pulsar (LON:PULS)

Down 5% to 81.5p y’day (£104m) - H1 Results - Paul - AMBER/RED

Pulsar Group Plc (AIM: PULS), the technology innovator delivering Software-as-a-Service ("SaaS") solutions for the global marketing and communications industries, is pleased to announce its unaudited half year results for the six months ended 31 May 2024.

This is the new name for Access Intelligence. I last looked at it in Jan and Dec 2022, and wasn’t impressed - noting its continuing losses, weakish balance sheet, and wobbly outlook. I’ll take a look today with fresh eyes, let’s see if things have improved, as the share price has had a strong recent run up.

Nearly all (96%) of revenues are recurring.

H1 revenue £30.8m (up 1.3%)

Adj EBITDA £3.1m (up 55%) - but my previous notes point out that positive EBITDA turns into PBT losses, so it's a meaningless measure.

Outlook - trading in line, so we should be able to rely on this year’s forecast -

“the Group continues to trade in line with the Board's full year expectations.”...

“Overall, the Board remains confident in Pulsar Group's outlook for the second half of the year and beyond…"

“The ARR growth delivered by the Group during the first half is expected to contribute to higher revenue in the second half, whilst the Group's pipeline also continues to grow with a number of strategic opportunities expected to close during the second half.”

“the majority of expected non-recurring costs have been incurred in the first six months of the financial year are all expected to contribute to improved free cash flow conversion into the second half of the financial year. The Group's third quarter is usually a strong period for customer invoicing and we therefore expect to see the net debt position reduce over the coming months.”

You can see from this table below, there’s a gulf between adj EBITDA and PBT again, huge. However, if the heavy non-recurring costs really do not recur, then that would take the company quite close to breakeven in future, so more research is needed on the nature of these “non-recurring” costs -

I can tolerate short term losses, if the balance sheet is strong, so this is key.

Balance sheet - looks very weak to me. This company clearly needs an equity raise to strengthen its balance sheet.

Some numbers - NAV is £46.2m, less intangible assets of £69.3m, gives NTAV of £(23.1)m.

Working capital looks tight, with only £1.25m cash, but a current ratio of a very poor 0.32.

Note that new loan liabilities have appeared in H1, of £2.9m (current) and £1.5m (non-current), which were not on last year's balance sheet. So it’s moved from net cash of £2.7m May 2023, to net debt of £3.2m at May 2024 - a worrying deterioration. So the bank facilities are now crucial - it arranged a £3m loan, plus a £3m overdraft in H1, but reckons improved cashflow in H2 should address this.

Cashflow statement - looks poor to me. Positive cashflow last year was only generated thanks to favourable working capital movements (extending creditors). That’s slightly reversed in H1 this year, meaning there’s nothing in cash generation. Plus it then capitalises a lot of its payroll in development spending, at £3.4m in H1 (FY 5/2023: £8.6m).

Paul’s opinion - I’ve seen enough to make me want to give this share a wide berth.

It’s not yet demonstrated an ability to make proper profits. Growth is pedestrian. It’s cash hungry, and has a weak balance sheet, so an equity placing looks inevitable here - indeed they should do one, since the £104m market cap gives plenty of scope to repair the balance sheet with only (say) 10% dilution.

Upbeat outlook says H2 will be better - it needs to be!

Why pay £104m for something so lacklustre, and which has been around for many years too, delivering no dividends, and often giving back share price bull runs? The share count has tripled in the last 6 years, so it looks like they’ve bought in growth through acquisitions.

I’m happy to turn positive if it delivers some decent numbers, but it hasn’t done. Therefore I have to be cautious given the weak cashflow & balance sheet, it’s AMBER/RED.

As always, we don’t know what the future holds, so if it does deliver a stronger H2, then shares could go up. Also bear in mind that software companies are often highly attractive to bidders, who value them differently to our approach here of value/GARP. So it might appeal to a different type of investor who is prepared to value it on adj EBITDA and recurring revenues.

Ten-year chart is uninspiring - and quite low StockRank for most of this period too -

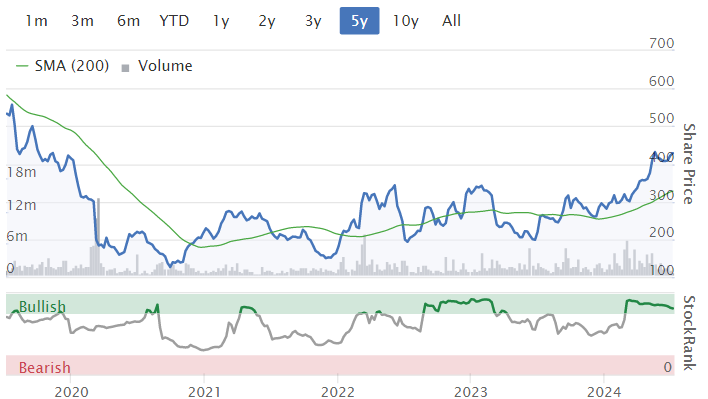

Argentex (LON:AGFX)

Up 7% to 29p (£35m) - H1 Trading Update - Paul - AMBER/GREEN

Argentex Group PLC (AIM: AGFX), the global specialist in currency risk management and alternative banking, today announces a trading update for the six months ended 30 June 2024.

I’ve just been looking through my previous notes, and had forgotten what a can of worms this share has been in the last year.

Very briefly, the CEO abruptly exited in Oct 2023, followed by the CFO a fortnight later. Then came several profit warnings. On 2/5/2024 it announced a £3.25m (before fees) fundraise at 45p, increasing the share count from 113m to now 120.4m. The original announcement had stated it hoped to issue 11.3m new shares (actual was 7.2m issued). It was a surprise to me that it needed a fundraise at all, given the cash already on its balance sheet.

The share price has been awful for investors in the last 5 years -

Previously it was profitable, but as you can see from the graphs below, EPS has just collapsed, down into losses now for 2024 & 2025. I still don’t understand what specifically went wrong at AGFX to cause this profits collapse? -

Today’s H1 update makes it sound as if things are stabilising, and not getting any worse, hence why I speculated in my pre-market open comment above that we might see a bounce today.

Here are the company’s headlines today -

Trading in line with expectations

Positive momentum against strategic objectives with key hires to accelerate move into Alternative Banking

Interim CFO has accepted a permanent role

(I like this, as it suggests that he’s not found a can of worms and hence is happy to stay put. So this reassures somewhat that the problems are probably not terminal)

Guidance - H1 revenues c.£23.9m (down 4.4% on H1 LY)

Signs of improvement? - yes, but vague and no figures -

“Although adverse market conditions experienced during 2023 in the core FX business continued into the first quarter of 2024, trading momentum in the second quarter has been encouraging. The Group continues to make good progress across the areas of strategic focus, particularly in regards to the acceleration in Alternative Banking and the geographic expansion overseas.”

Outlook - for FY 12/2024 -

“the Board remains confident in its full year expectations.”

Although a reminder that “in line” is not good, when broker forecast (thanks to Singers) is a PBT loss of £(4.9)m in FY 12/2024, and a £(4.0)m loss in FY 12/2025. So a very low bar, which we need to see AGFX thrashing in future, with ahead of exps updates, for it to regain market credibility I think. Hence this is very much a not getting any worse update, rather than a positive update.

Losses damage balance sheets remember, so it might need another small placing perhaps?

Overseas expansion - granted an Australian licence, ahead of schedule in application for a Dubai licence. I like the sound of this, as it possibly indicates a company on the front foot, not a declining business in firefighting mode.

Balance sheet - was last reported at 31/12/2023. It showed £38.3m NTAV, slightly above the present market cap of £35m. It had a clean going concern statement too at Dec 2023. I’m not at all expert in analysing financial services companies, but to me this balance sheet does not look stretched. Maybe the small fundraise earlier this year was to pre-empt any balance sheet erosion from expected trading losses in 2024 & 2025?

Paul’s opinion - the excellent Richard Staveley of Rockwood Strategic mentioned AGFX in his recent interview with Paul Hill, which I highly recommend, it’s full of fascinating stock specific insights from start to finish. I won’t put words into his mouth, oh well maybe just a little, he was saying AGFX could be a good turnaround. Although I would temper that by noting that Harwood reduced its stake in AGFX in April! So it can’t be their no.1 pick, and they might be stale bulls wanting to exit, who knows?

I think there might be tentative signs here of a turnaround beginning to take shape perhaps? Together with a decent enough balance sheet, and a bombed out share price, I’m minded to push the boat out a bit, with AMBER/GREEN. OK that’s not supported by any profits or divis, so it won’t appeal to value investors. We can’t just sit on the fence with everything though. So please bear in mind that this is a more speculative thing than our usual amber/greens.

Generally I’m not keen on the business models of these alternative payments/forex type companies. As we saw with the recent update from Equals (LON:EQLS) , a lot of the growth recently has come from higher interest rates meaning it picks up the interest receivable, running into millions. That’s fine, but it’s exaggerated profit growth in the last 1-2 years in my view.

Graham’s Section:

Begbies Traynor (LON:BEG)

Down 2% to 97p (£155m) - Final Results - Graham - AMBER

This is an old favourite at the SCVR: Begbies Traynor, a professional services consultancy that is traditionally known as an insolvency practitioner.

“Business recovery” remains its largest service line, accounting for 60% of revenues.

Today we have full year results for FY April 2024: there is progress against the prior year by most measures, but not by PBT and EPS.

EPS is affected by the higher corporate tax rate:

Organic growth is 6%, total growth 12%. Four acquisitions contributed £5m to revenue.

Comment by Ric Traynor:

I am pleased to report on another successful year of strong financial performance, which now represents a decade of profitable growth… We have delivered value to shareholders across the cycle having tripled the size of the business with a six-fold increase in profit since 2014.

We have started the new year confident of a further year of growth, in line with market expectations…

Outlook - “encouraging activity levels in all service lines with positive momentum”. Organic growth is anticipated to remain at similar levels for the new year.

Insolvency: activity remains at elevated levels, due to higher interest rates. There were 25,400 insolvencies during the year (previous year: 22,600). Begbies is ranked #1 nationally for insolvencies, and within this is ranked #2 for administrations. Sectors under particular pressure now are construction, real estate, financial services and support services.

Advisory and corporate finance: should improve as M&A is anticipated to recover later in the year.

Property advisory: “well-placed to build on its recent strong track record”.

Financials

The non-underlying items at Begbies tend to be a hot topic here, as they are so large:

As the table above shows, even before the impact of the higher corporate tax rate, Begbies was already posting a slightly lower pre-tax profit in 2024 vs. 2023. This is due to the impact of higher non-underlying items.

All non-underlying items relate to how the company must account for its acquisitions.

Therefore, if you’re happy to write off all acquisition-related costs, you can use adj. PBT figure and not concern yourself with the statutory number.

This is how the non-underlying items break down for FY 2024:

The major difference is that Begbies didn’t benefit so much from negative goodwill (this is what happens when you buy a company for less than the fair value of its assets).

There is £11m of acquisition consideration that is tied up with the continuing participation of key employees (the sellers of the companies bought by Begbies).

There is also £5.6m of amortisation of intangible assets: these assets primarily consist of customer relationships, brands and order books.

Balance sheet: net assets are £78m but these are nearly all intangible assets. The balance sheet includes £45m of “unbilled income” within receivables, up from £37m last year.

Graham’s view

We last discussed Begbies in February, when I took a neutral stance. I do generally have a positive impression of the business and I admire the stewardship of Ric Traynor who remains the largest shareholder (17%).

When it comes to valuation, I try to take a middle ground between allowing some of the non-underlying items, while at the same time accepting the logic behind the accounting rules. There is a £16m gulf between adj. PBT and statutory PBT, and I think the truth lies somewhere in the middle.

It’s interesting that despite the continued high levels of insolvency activity, the BEG share price has been so soft:

At a market cap of £155m, lower than it was the last time I analysed this share, I’m inclined to again think that this could be worth studying for value. However, given the sector (professional services/accountancy) and the highly adjusted accounts, I can’t bring myself to upgrade my stance from neutral.

It seems that the StockRanks agree with my human assessment.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.